by Calculated Risk on 2/03/2010 05:56:00 PM

Wednesday, February 03, 2010

LPS: Mortgage Delinquencies Reach 10%

From Jon Prior at HousingWire: Mortgage Delinquencies Pass 10%: LPS

Home-loan delinquency rates in the US reached 10% in December, up from the record-high 9.97% in November, according to Lender Processing Services ... which provides data on mortgage performance.More foreclosures and short sales coming!

Accounting for foreclosures in the pipeline, the total non-current rate stands at 13.3% .... When extrapolated for the entire mortgage industry, 7.2m mortgage loans are behind on their payments.

Note: the MBA reported the delinquency rate in Q3 was 9.64%; the MBA Q4 delinquency data will be released soon.

Thursday, January 28, 2010

Fannie Mae: Delinquencies Increase Sharply in November

by Calculated Risk on 1/28/2010 04:41:00 PM

Earlier I posted the Freddie Mac delinquency graph.

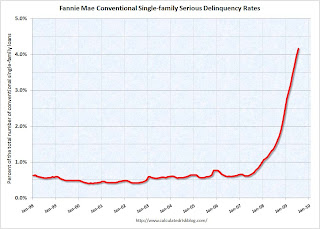

And here is the monthly Fannie Mae hockey stick graph ... (note that Fannie releases delinquency data with a one month lag to Freddie). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

Once again it is important to note these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.

Freddie Mac: Delinquencies Increase Sharply in December

by Calculated Risk on 1/28/2010 11:04:00 AM

Here is the monthly Freddie Mac hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 3.87% in December 2009, up from 3.72% in November - and up from 1.72% in December 2008.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

Just more evidence of the growing delinquency problem, although some of these loans may be in the trial modification programs and are still included as delinquent until they become permanent.

Fannie Mae should report soon ...

Monday, December 21, 2009

OCC and OTS: Foreclosures, Delinquencies increase in Q3

by Calculated Risk on 12/21/2009 10:40:00 AM

From Jim Puzzanghera at the LA Times: Foreclosures for major sector of bank industry topped 1 million in third quarter, report says

The number of home foreclosures for a major sector of the banking industry topped 1 million for the first time in the third quarter of the year as struggles spread to homeowners with prime loans and modified mortgage payments, according to new data released today by ... the Office of the Comptroller of the Currency and the Office of Thrift Supervision.Here is the press release and report.

...

The report highlighted some troubling trends as ... Difficulties increased for holders of prime mortgages, with the percentage of those loans that were 60 days or more delinquent increasing to 3.2%, up almost 20% from the second quarter and more than double the rate of a year ago.

In addition, holders of mortgages whose payments had been lowered through government or private modification plans re-defaulted at high rates. More than half of all homeowners with modified loans fell 60 days or more behind in their payments within six months of the modification taking place.

Much of the report focuses on modifications and recidivism, but this report also shows how the foreclosure problem has moved to prime loans.

Click on graph for larger image.

Click on graph for larger image.This report covers about 65% of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now significantly more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

Overall, mortgage performance continued to decline as a result of continuing adverse economic conditions including rising unemployment and loss in home values. The percentage of current and performing mortgages fell to 87.2 percent of the servicing portfolio. Seriously delinquent mortgages loans 60 or more days past due and loans to delinquent bankrupt borrowers—rose to 6.2 percent of the servicing portfolio. Foreclosures in process increased to 3.2 percent, while new foreclosure actions remained steady for the third consecutive quarter at 369,209. Of particular note, delinquencies among prime mortgages, the largest category of mortgages, continued to climb. The percentage of prime mortgages that were seriously delinquent in the third quarter was 3.6 percent, up 19.6 percent from the second quarter and more than double the percentage of a year ago.

emphasis added

The second graph shows foreclosure activity.

Notice that foreclosure in process are increasing sharply, but completed foreclosures were only up slightly.

The next wave of completed foreclosures is about to break, but the size of the wave depends on the modification programs.

There was some good news on redefaults:

The percentage of modified loans 60 or more days delinquent or in process of foreclosure increased steadily in the months subsequent to modification (see Table 2 [see below]). Modifications made after the third quarter of 2008 appeared to perform relatively better than older vintages. The most recent modifications made in the second quarter of 2009 had the lowest percentage of mortgages (18.7 percent) that were 60 or more days delinquent three months subsequent to modification. This lower three-month re-default rate may be an early indicator of sustainability for loan modifications that reduce monthly payments.

For earlier modifications, the redefault rates was around 60% after 12 months, but the little bit of good news is "only" 18.7% of recent modifications have redefaulted with 3 months (this is lower than the previous modifications). I expect a large percentage of the homeowners to redefault eventually because the modification efforts still leave the homeowners with significant negative equity (they are more renters than owners).

For earlier modifications, the redefault rates was around 60% after 12 months, but the little bit of good news is "only" 18.7% of recent modifications have redefaulted with 3 months (this is lower than the previous modifications). I expect a large percentage of the homeowners to redefault eventually because the modification efforts still leave the homeowners with significant negative equity (they are more renters than owners).

Thursday, November 19, 2009

States: Seriously Delinquent Mortgages vs. Unemployment Rate

by Calculated Risk on 11/19/2009 06:45:00 PM

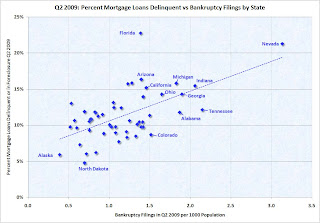

Here is a scatter graph comparing the seriously delinquency rate for mortgage loans vs. unemployment rate for all states. The seriously delinquent rate include 90+ days delinquent loans, and loans in the foreclosure process for Q3 2009 (Source: MBA). Click on graph for larger image in new window.

Click on graph for larger image in new window.

There is a relationship between delinquency rates and the unemployment rate.

Florida really stands out because of state specific foreclosure laws. Arizona and Nevada also have higher than expected foreclosure rates - possibly because of high investor activity during the housing bubble.

As the unemployment rate continues to rise, the mortgage delinquency rate will increase too.

For more on the MBA National Delinquency Survey, see:

Mortgage Delinquencies and Foreclosures by Period Past Due

by Calculated Risk on 11/19/2009 03:49:00 PM

Click on graph for larger image in new window.

First, on the market ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Reader Yuri asked me if the number of 30 day delinquencies is decreasing. He was curious if the overall number of delinquencies is increasing because of the loan modifications and other actions that are limiting the outflow - but that that overall increase might be masking some improvement for the inflow of new delinquencies. This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

The percentage of 30 and 60 day delinquencies have decreased slightly. However the rates are still near record levels.

For the 30 day bucket, there were 3.57% percent delinquent - not much lower than the high in Q1 of 3.77%. For 60 days, the rate was 1.67% - also below the high in Q1.

Clearly most of the increase was in the 90 day and in foreclosure buckets. And that is why the modification programs are so important. The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

Since prime fixed rate mortgages account for about 2/3s of the mortgage market, a large portion of future foreclosures will probably be from these loans.

MBA Forecasts Foreclosures to Peak in 2011

by Calculated Risk on 11/19/2009 11:08:00 AM

On the MBA conference call concerning the "Q3 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: Many more questions this time!

A few graphs ...

Click on graph for larger image in new window.

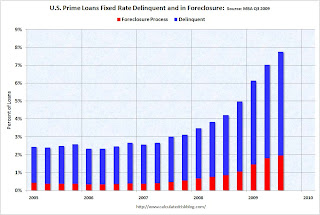

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for about 76% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about two-thirds of all loans).

The second graph shows just fixed rate prime loans (about two-thirds of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

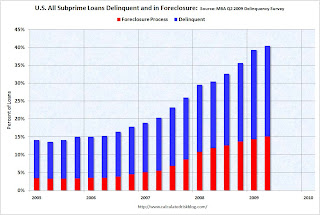

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 14.4 Percent of Mortgage Loans in Foreclosure or Delinquent in Q3

by Calculated Risk on 11/19/2009 10:00:00 AM

The MBA reports a record 14.4 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2009. This is an increase from 13.2% in Q2 2009.

From the MBA: Delinquencies Continue to Climb in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.64 percent of all loans outstanding as of the end of the third quarter of 2009, up 40 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 108 basis points from 8.86 percent in the second quarter of 2009 to 9.94 percent this quarter.

Top Line Results

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47 percent, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.41 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 1.42 percent, up six basis points from last quarter and up 35 basis points from one year ago.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

Increases Driven by Prime and FHA Loans

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies and foreclosures because mortgages are paid with paychecks, not percentage point increases in GDP. Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans and increasing the rate of new foreclosures from 1.07 percent to 1.42 percent,” said Jay Brinkmann, MBA’s Chief Economist.

“Prime fixed-rate loans continue to represent the largest share of foreclosures started and the biggest driver of the increase in foreclosures. 33 percent of foreclosures started in the third quarter were on prime fixed-rate and loans and those loans were 44 percent of the quarterly increase in foreclosures. The foreclosure numbers for prime fixed-rate loans will get worse because those loans represented 54 percent of the quarterly increase in loans 90 days or more past due but not yet in foreclosure.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.

“The foreclosure rate on FHA loans also increased, despite having a large increase in the number of FHA-insured loans outstanding. The number of FHA loans outstanding has increased by about 1.1 million over the last year. This increase in the denominator depresses the delinquency and foreclosure percentages. If we assume these newly-originated loans are not the ones defaulting and remove the big denominator increase from the calculation results, the foreclosure rate would be1.76 percent rather than 1.31 percent reported.

....

“The outlook is that delinquency rates and foreclosure rates will continue to worsen before they improve. First, it is unlikely the employment picture will get better until sometime next year and even then jobs will increase at a very slow pace. Perhaps more importantly, there is no reason to expect that when the economy begins to add more jobs, those jobs will be in areas with the biggest excess housing inventory and the highest delinquency rates. Second, the number of loans 90 days or more past due or in foreclosure is now a little over 4 million as compared with 3.9 million new and previously occupied homes currently for sale, although there is likely some overlap between the two numbers. The ultimate resolution of these seriously delinquent loans will put added pressure on the hardest hit sections of the country.”

Tuesday, November 17, 2009

Report: Record Mortgage Loan Delinquency Rates in Q3

by Calculated Risk on 11/17/2009 08:29:00 AM

TransUnion reports that the 60 day mortgage delinquency rate increased to a record 6.25% in Q3, from 5.81% in Q2.

From TransUnion: Mortgage Loan Delinquency Rates on Course to Hit Record in 2009

Mortgage loan delinquency (the ratio of borrowers 60 or more days past due) increased for the 11th straight quarter, hitting an all-time national average high of 6.25 percent for the third quarter of 2009. This statistic is traditionally seen as a precursor to foreclosure and increased 7.57 percent from the previous quarter's 5.81 percent average. While still increasing, this quarter marks the third consecutive period the delinquency rate increase has decelerated. For comparison purposes, the delinquency rate from the fourth quarter 2008 to first quarter 2009 saw an increase of almost 14 percent, and the percent change from first quarter to second quarter 2009 increased by 11.3 percent. Year-over-year, mortgage borrower delinquency is up approximately 58 percent (from 3.96 percent).The MBA will release delinquency data on Thursday.

Mortgage borrower delinquency rates in the third quarter of 2009 continued to be highest in Nevada (14.5 percent) and Florida (13.3 percent), while the lowest mortgage delinquency rates were found in North Dakota (1.7 percent), South Dakota (2.3 percent) and Vermont (2.6 percent). Areas showing the greatest percentage growth in delinquency from the previous quarter were Wyoming (+17.9 percent), Kansas (+17.4 percent) and North Dakota (+16 percent). Bright spots for the quarter included the District of Columbia, showing a decline in mortgage delinquency rates, down 0.19 percent from the previous quarter.

Sunday, November 08, 2009

First American CoreLogic Economist: Decline in Distressed Inventory a "Mirage"

by Calculated Risk on 11/08/2009 09:16:00 AM

Matt Padilla has an interesting chart on REOs and delinquent loans in Orange County, California: Banks hold few foreclosures.

The chart shows the number of REOs (bank owned real estate) has dropped sharply while 90+ day delinquencies continue to increase. Although this chart is for Orange County, we are seeing the same dynamics in many areas across the county (declining REOs, rising delinquency rates).

Sam Khater, senior economist with First American CoreLogic gave Matt his view of why this is happening:

The reason REOs have declined is that flow of distressed properties into REO has been artificially restricted due to local, state and GSE foreclosure moratoria, loan modifications and servicer backlogs. This has led to a drop in the supply of REO properties, while at the same time sales (including REO sales) increased due to the artificially low rates and first-time homebuyer tax credits, which further depleted the supply of REOs. This dynamic has led to the rapid improvement in home prices over the last six to eight months.We have to be careful with the 90+ day delinquency data because that includes loans in the trial modification process. If many of these trial modifications are successful - and become permanent - the delinquency rate could drop sharply without a large increase in foreclosures. We should know much more in Q1 when many of the trial modifications end.

However, the mortgage distress is high and rising as is evident by the 90+ day category, which means the pending supply is building up due to high levels of negative equity and rising unemployment. So we have a situation where at the back end (ie REOs) it appears as if it’s getting better, but it’s really a mirage as we know that the pending supply pipeline default (ie 90+ day DQs) is looming larger.

emphasis added

Friday, October 23, 2009

Freddie Mac: Delinquency Rate Rises to 3.33 Percent

by Calculated Risk on 10/23/2009 11:59:00 AM

NOTE: I'll have some more thoughts on existing home sales soon. Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate since January 2005.

Here is the Freddie Mac portfolio data.

From Reuters: Freddie Mac Sept portfolio up, delinquencies jump (ht Ron at WallStreetPit)

Delinquencies ... jumped to 3.33 percent of its book of business in September from 3.13 percent in August and 1.22 percent in September 2008.

The multifamily delinquency rate accelerated slightly in September to 0.11 percent from 0.10 percent in August. A year earlier it was 0.01 percent..

Tuesday, September 29, 2009

Fannie Mae Serious Delinquency Rate increases Sharply

by Calculated Risk on 9/29/2009 10:33:00 AM

Here is a hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported that the serious delinquency rate for conventional loans in its single-family guarantee business increased to 4.17 percent in July, up from 3.94 percent in June - and up from 1.45% in July 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans. These rates are based on conventional single-family mortgage loans and exclude reverse mortgages and non-Fannie Mae mortgage securities held in our portfolio."

Just more evidence of some shadow inventory and the next wave of foreclosures.

Update: These stats include Home Affordable Modification Program (HAMP) loans in trial modifications.

Monday, September 21, 2009

Report: Mortgage Delinquencies increase in August

by Calculated Risk on 9/21/2009 11:09:00 AM

From Reuters: Mortgage Delinquencies Rise Alongside Unemployment (ht Ron Wallstreetpit)

Reuters reports that a record 7.58% of U.S. homeowners with mortgages were 30+ days delinquent in August, up from 7.32% in July ... and up from 4.89% in August 2008.

Reuters also notes that delinquencies are rising at "an accelerating pace".

This is one part of the coming "triple whammy" at the end of this year that Tom Lawler mentioned this morning: rising foreclosures, end of the Fed buying MBS, and the end of the housing tax credit.

We have to be a little careful with the delinquency numbers because they include homeowners in the trial period for modifications.

Note: This uses a different approach than the MBA. The MBA reported 9.24% of all loans outstanding were delinquent at the end of the 2nd quarter. Another 4.3% of loans were in the foreclosure process.

Sunday, August 30, 2009

Bankruptcy Filings and Mortgage Delinquencies by State

by Calculated Risk on 8/30/2009 10:47:00 AM

Here is a graph of bankruptcy filings vs. mortgage delinquencies (including homes in foreclosure process) by state for Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The bankruptcy filings data is from the American Bankruptcy Institute.

The mortgage delinquency data is from the Mortgage Bankers Association.

No surprise - there is a clear correlation, although each state has different bankruptcy laws that can impact the relationship (see Florida).

Here is a sortable table to find the data for each state (use scroll bar to see all data).

Thursday, August 27, 2009

Report: Mortgage Delinquencies increase in July

by Calculated Risk on 8/27/2009 12:16:00 AM

From Reuters: U.S. mortgage delinquencies up in July: Equifax

Among U.S. homeowners with mortgages, a record 7.32 percent were at least 30 days late on payments in July, up from about 4.5 percent a year earlier and 7.23 percent in June, according to monthly data from the Equifax credit bureau.There numbers aren't directly comparable to the MBA quarterly numbers, but this shows that delinquencies are still rising.

Monday, August 24, 2009

Fitch: "Dramatic" Decrease in Cure Rates for Delinquent Mortgage Loans

by Calculated Risk on 8/24/2009 12:04:00 PM

These are very important numbers ...

Press Release from Fitch: Fitch: Delinquency Cure Rates Worsening for U.S. Prime RMBS (ht BURN, Ron Wallstreetpit)

While the number of U.S. prime RMBS loans rolling into a delinquency status has recently slowed, this improvement is being overwhelmed by the dramatic decrease in delinquency cure rates that has occurred since 2006, according to Fitch Ratings. An increasing number of borrowers who are 'underwater' on their mortgages appear to be driving this trend, as Fitch has also observed.This really puts the recent rise in delinquencies in perspective. Look at this graph from MBA Forecasts Foreclosures to Peak at End of 2010

Delinquency cure rates refer to the percentage of delinquent loans returning to a current payment status each month. Cure rates have declined from an average of 45% during 2000-2006 to the currently level of 6.6%. ...

'Recent stability of loans becoming delinquent do not take into account the drastic decrease in delinquency cure rates experienced in the prime sector since the peak of the housing market,' said [Managing Director Roelof Slump]. 'While prime has shown the most precipitous decline, rates have dropped in other sectors as well.'

In addition to prime cure rates dropping to 6.6%, Alt-A cure rates have dropped to 4.3%, from an average of 30.2%, and subprime is down to 5.3% from an average of 19.4%. 'Whereas prime had previously been distinct for its relatively high level of delinquency recoveries, by this measure prime is no longer significantly outperforming other sectors,' said Slump.

... Furthermore, up to 25% of loans counted as cures are modified loans, which have been shown to have an increased propensity to re-default.

... 'As income and employment stress has spread, weaker prime borrowers become more likely to become delinquent in their loan payments and are less likely to become current again,' said Slump.

Regardless of aggregate roll-to-delinquent behavior, it will be difficult to argue that the market has stabilized or that performance has improved, until there is a concurrent increase in cure rates. This is especially true in the prime sector, which remains performing many times worse than historic averages. Prime 60+ delinquencies have more than tripled in the past year, from $9.5 billion to $28 billion total, or roughly $1.6 billion a month.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for all 78% of all loans.

Back in the 2000 to 2006 period, 45% of those delinquencies cured. Now, according to Fitch, only 6.6% cure - and a large percentage of those "cures" are modifications - and there is a large redefault rate on those loans.

Thursday, August 20, 2009

U.S. Mortgage Market and Seriously Delinquent Loans by Type

by Calculated Risk on 8/20/2009 04:12:00 PM

A little more information from the MBA Q2 delinquency report (and market graph below): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the U.S. mortgage market by type. There are about 45 million loans included in the MBA survey, and that is about 85% of the U.S. market.

This is a general breakdown, and apparently Alt-A is included in Prime (it would be helpful to break that out). The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

Clearly subprime is disproportionately represented (much higher delinquency rate), but now over half the loans in this category are Prime - and the delinquency rate is growing faster for Prime. This is now a Prime foreclosure crisis.

For more, please see earlier posts:

MBA Forecasts Foreclosures to Peak at End of 2010 (several graphs)

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2 Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

MBA Forecasts Foreclosures to Peak at End of 2010

by Calculated Risk on 8/20/2009 11:21:00 AM

On the MBA conference call concerning the "Q2 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: The MBA data shows about 5.8 million loans delinquent or in the foreclosure process nationwide. I believe the MBA surveys covers close to 90% of the mortgage market. Many of these loans will cure, but the foreclosure pipeline is still building.

A few graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for all 78% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about 65.5% of all loans).

The second graph shows just fixed rate prime loans (about 65.5% of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

The fourth graph shows the delinquency and foreclosure rates by state (add: and D.C. and Puerto Rico!).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).Although most of the delinquencies are in a few states - because of a combination of high delinquency rates and large populations - the crisis is widespread.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2

by Calculated Risk on 8/20/2009 10:08:00 AM

From the Mortgage Bankers Association (MBA): Delinquencies Continue to Climb, Foreclosures Flat in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.24 percent of all loans outstanding as of the end of the second quarter of 2009, up 12 basis points from the first quarter of 2009, and up 283 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.We're all subprime now!

...

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 4.30 percent, an increase of 45 basis points from the first quarter of 2009 and 155 basis points from one year ago. The combined percentage of loans in foreclosure and at least one payment past due was 13.16 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

...

“While the rate of new foreclosures started was essentially unchanged from last quarter’s record high, there was a major drop in foreclosures on subprime ARM loans. The drop, however, was offset by increases in the foreclosure rates on the other types of loans, with prime fixed-rate loans having the biggest increase. As a sign that mortgage performance is once again being driven by unemployment, prime fixed-rate loans now account for one in three foreclosure starts. A year ago they accounted for one in five....” said Jay Brinkmann, MBA’s Chief Economist.

emphasis added

More to come ...

Monday, August 17, 2009

Fed: Delinquency Rates Surged in Q2 2009

by Calculated Risk on 8/17/2009 02:42:00 PM

The Federal Reserve reports that delinquency rates rose in Q2 in all categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the delinquency rates at the commercial banks for residential real estate, commercial real estate and consumer credit cards.

Commercial real estate delinquencies (7.91%) are rising rapidly, and are at the highest rate since the early '90s (as delinquency rates declined following the S&L crisis).

Residential real estate (8.84%) and consumer credit card (6.7%) delinquencies are at the highest levels since the Fed started tracking the data (since Q1 '91).

Although there is credit deterioration everywhere, the rise in these three categories is especially significant. There was also a significant increase in C&I delinquencies (commerical & industrial) and Agricultural loans.

Note: The Fed defines commercial as "construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate", and many of the problems are probably in the C&D loans. These are the loans that will lead to the closure of many more regional banks.

Also check out the charge-off rates. The charge-off rate for residential real estate increased from 1.81% to 2.34%, and for consumer credit cards from 7.64% to 9.55%!

Ouch!!!