by Calculated Risk on 8/06/2009 12:59:00 PM

Thursday, August 06, 2009

Foreclosures: One Giant Wave, Still Building

Note: Graph is for Orange County only.

From Matt Padilla at the O.C. Register: Foreclosure wave gathers momentum

“To say there is a second wave implies the (current) wave has receded,” [Sam Khater, senior economist, First American CoreLogic] “I don’t see that the wave has receded.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is from Matt based on data from American CoreLogic.

Khater said ... federal and state efforts have mostly delayed foreclosures, preventing few. ... So to tune out the noise, just look at the 90-day rate. In Khater’s view it shows “one giant wave.”UPDATE: Matt provided me with the definitions:

90 day delinquency rate: "everything 3 months late or more. Likely includes most all Foreclosures in Process. The categories are not separate."

Foreclosure Rate is actual foreclosures in process: "Everything with NOD and Trustee's Sale filing."

REO Rate: "Everything foreclosed but still held by bank or servicer. This category is separate from other two."

Thursday, July 30, 2009

Hope Now: Mortgage Loss Mitigation Statistics

by Calculated Risk on 7/30/2009 03:26:00 PM

Hope Now released the Q2 Mortgage Loss Mitigation Statistics today.

Most of the data concerns modifications, but here are couple of graphs on delinquencies and foreclosures. Click on graph for larger image in new window.

Click on graph for larger image in new window.

There are now more than 3 million mortgage loans 60+ delinquent based on the Hope Now statistics. This covers approximately 85% of the total industry.

There are far more prime loans delinquent than subprime, although a much higher percentage of subprime (18.4%) vs prime (4.24%). The second graph shows foreclosure starts and completions.

The second graph shows foreclosure starts and completions.

Foreclosure starts are above 250 thousand per month, and completions close to 100 thousand per month. There is a lag between start and completion, and a number of loans cure or are modified - but it does appear completions will increase in the 2nd half of 2009 based on the surge in starts at the beginning of the year.

Just some data for everyone ...

Tuesday, July 07, 2009

More Evidence of the "Foreclosure Backlog"

by Calculated Risk on 7/07/2009 09:00:00 PM

From Peter Hong at the LA Times: L.A. County's May default rate double last year

May's 9.5% [seriously] delinquency rate [more than 90 days] for L.A. County was up from 5% of mortgages ... in May 2008 [First American CoreLogic reported today].Ramsey Su (REO broker in San Diego) sent me some data today. He wrote:

... the final foreclosure stage -- has shrunk. In May, the L.A. County repossession rate was down to 1% of mortgages, from 1.1% a year ago. This discrepancy is the "foreclosure backlog" now looming over the housing market. ...

Nationally, First American reported 6.5% of mortgages were in default in May, up from 4% in May 2008. The national repossession rate was 0.7% in May, up from 0.6% in May 2007.

[Pent Up Foreclosures - a stat Ramsey follows] measures the difference between foreclosures completed versus defaults. This gap is widening as a result of government intervention. ... If they do not ACCELERATE the foreclosure process and release some of the pressure now, the consequences will be disastrous.The foreclosures are coming. The foreclosures are coming!

ABA: Record Home-Equity Loan Delinquencies

by Calculated Risk on 7/07/2009 09:25:00 AM

From Bloomberg: U.S. Home-Equity Loan Delinquencies Set Record in First Quarter (ht Bob_in_MA)

Late payments on home-equity loans rose to a record in the first quarter ...Update: headline corrected, ABA, not MBA.

Delinquencies on home-equity loans climbed to 3.52 percent of all accounts in the quarter from 3.03 percent in the fourth and late payments on home-equity lines of credit climbed to a record 1.89 percent, the group said. ...

“The number one driver of delinquencies is job loss,” James Chessen, the group’s chief economist, said in an e-mailed statement. “Delinquencies won’t improve until companies start hiring again and we see a significant economic turnaround.”

Tuesday, June 30, 2009

OCC and OTS: Prime Delinquencies Surge in Q1

by Calculated Risk on 6/30/2009 11:21:00 AM

From the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for First Quarter 2009

This OCC and OTS Mortgage Metrics Report for the first quarter of 2009 provides performance data on first lien residential mortgages serviced by national banks and federally regulated thrifts. The report provides a comprehensive picture of mortgage servicing activities of most of the industry’s largest mortgage servicers, covering approximately 64 percent of all mortgages outstanding in the United States and incorporating information on all types of mortgages serviced, including subprime mortgages. The report covers more than 34 million loans totaling more than $6 trillion in principal balances and provides information on their performance from the beginning of 2008 through the end of the first quarter of 2009.Much of the report focuses on modifications and recidivism, but this report also shows far more seriously delinquent prime loans than subprime loans (by number, not percentage).

Negative trends continued for mortgage data for the first quarter of 2009, but with some hopeful signs on the modification front. Continued economic pressures, including rising levels of unemployment and a continuing decline in property values, resulted in an increased number of seriously delinquent mortgages and newly initiated foreclosure actions. The first quarter data also showed a relatively greater increase in seriously delinquent prime mortgages compared with other risk categories and a higher number of foreclosures in process across all risk categories as a variety of moratoria on foreclosures expired during the first quarter of 2009.

Click on graph for larger image.

Click on graph for larger image.We're all subprime now!

Note: "Approximately 14 percent of loans in the data were not accompanied by credit scores and are classified as “other.” This group includes a mix of prime, Alt-A, and subprime. In large part, the loans were result of acquisitions of loan portfolios from third parties where borrower credit scores at the origination of the loans were not available."

This report covers about two-thirds of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now significantly more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

The second graph shows foreclosure activity.

Newly initiated foreclosures picked up in Q1.

Completed foreclosures declined (because of the foreclosure moratorium), and foreclosures in process surged to 844 thousand.

Note that short sales are essentially irrelevant.

Saturday, June 27, 2009

Freddie Mac Delinquencies and Unemployment Rate

by Calculated Risk on 6/27/2009 09:37:00 PM

Yesterday I posted a graph of the Freddie Mac delinquency rate by month since 2005. I was asked if I could add the unemployment rate ... so by request ... Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate and the unemployment rate since 2005.

Note that the unemployment rate y-axis starts at 4% to match up the curves.

Here is the Freddie Mac portfolio data.

There are many reasons for the rising delinquency rate. Earlier today we discussed some new research suggesting a number of homeowners with negative equity are walking away from their homes ("ruthless default"). There are also negative events that can lead to delinquencies - like death, disease, and divorce - but one of the main drivers is probably loss of income.

Friday, June 26, 2009

Freddie Mac: Portfolio Shrinks, Delinquencies Rise

by Calculated Risk on 6/26/2009 02:02:00 PM

Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate since January 2005.

Here is the Freddie Mac portfolio data.

From Reuters: Freddie Mac May portfolio shrank annualized 9.9 pct (ht Ron)

Freddie Mac ... said its mortgage investment portfolio shrank by an annualized 9.9 percent rate in May, while delinquencies on loans it guarantees accelerated.

The portfolio decreased to $823.4 billion, for an annualized 5.6 percent increase year to date, the McLean, Virginia-based company said in its monthly volume summary.

In May 2008, the portfolio was $770.4 billion.

Delinquencies ... jumped to 2.62 percent of its book of business in May from 2.44 percent in April and 0.86 percent in May 2008.

...

Freddie Mac said refinance-loan purchase volume was $40.3 billion in May, down from April's $43.3 billion. March's $52 billion was its largest refinance month since 2003.

Thursday, May 28, 2009

MBA: Mortgage Delinquencies, Foreclosures Hit Records

by Calculated Risk on 5/28/2009 10:21:00 AM

From Bloomberg: Mortgage Delinquencies, Foreclosures Hit Records on Job Cuts

... The U.S. delinquency rate jumped to a seasonally adjusted 9.12 percent and the share of loans entering foreclosure rose to 1.37 percent, the Mortgage Bankers Association said today. Both figures are the highest in records going back to 1972.We're all subprime now!

...

The inventory of new and old defaults rose to 3.85 percent, the MBA in Washington said. Prime fixed-rate mortgages given to the most creditworthy borrowers accounted for the biggest share of new foreclosures at 29 percent, and prime adjustable-rate mortgages were 24 percent, Brinkmann said. It shows the mortgage problem has shifted from a subprime issue to a job-loss problem, he said.

emphasis added

UPDATE: From MarketWatch: Foreclosures break another record in first quarter

Total foreclosure inventory was also up, with 3.85% of all mortgages somewhere in the foreclosure process at the end of the first quarter, compared with 3.3% in the fourth quarter -- also a record jump.Note: I haven't seen a copy of the MBA report yet.

...

While subprime, option ARM and Alt-A loans were a focus of the foreclosure problem initially, the foreclosure rate on prime fixed-rate loans has doubled in the last year.

"For the first time since the rapid growth of subprime lending, prime fixed-rate loans now represent the largest share of new foreclosures," Brinkmann said -- evidence, he added, of the impact that the recession and drops in employment are having on the foreclosure numbers.

Monday, May 18, 2009

Fed: Delinquency Rates Surged in Q1 2009

by Calculated Risk on 5/18/2009 05:07:00 PM

The Federal Reserve reports that delinquency rates rose sharply in Q1 in all categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the delinquency rates at the commercial banks for residential real estate, commercial real estate and consumer credit cards.

Commercial real estate delinquencies (6.4%) are rising rapidly, and are at the highest rate since the early '90s (as delinquency rates declined following the S&L crisis).

Residential real estate (7.91%) and consumer credit card (6.5%) delinquencies are at the highest levels since the Fed started tracking the data (since Q1 '91).

Although there is credit deterioration everywhere, the rise in these three categories is especially significant. There was also a significant increase in C&I delinquencies (commerical & industrial).

Note: The Fed defines commercial as "construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate", and many of the problems are probably in the C&D loans. These are the loans that will probably lead to the closure of many regional banks.

Also check out the charge-off rates. The charge-off rate for residential real estate increased from 1.58% to 1.8, and for consumer credit cards from 6.33% to 7.49%.

Just more evidence of severe credit problems at the commercial banks.

Wednesday, April 22, 2009

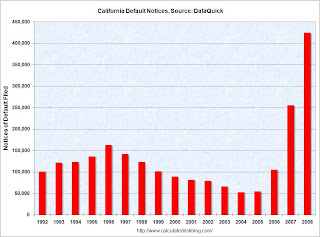

DataQuick: Mortgage Defaults Hit Record in California

by Calculated Risk on 4/22/2009 01:38:00 PM

From DataQuick: Golden State Mortgage Defaults Jump to Record High

Lenders filed a record number of mortgage default notices against California homeowners during the first three months of this year, the result of the recession and of lenders playing catch-up after a temporary lull in foreclosure activity ...There is a lot of interesting data in this report. A few key points:

A total of 135,431 default notices were sent out during the January- to-March period. That was up 80.0 percent from 75,230 for the prior quarter and up 19.0 percent from 113,809 in first quarter 2008, according to MDA DataQuick.

Last quarter's total was an all-time high for any quarter in DataQuick's statistics, which for defaults go back to 1992. There were 121,673 default notices filed in second quarter 2008 and 94,240 in third quarter 2008, during which a new state law took effect requiring lenders to take added steps aimed at keeping troubled borrowers in their homes.

"The nastiest batch of California home loans appears to have been made in mid to late 2006 and the foreclosure process is working its way through those. Back then different risk factors were getting piled on top of each other. Adjustable-rate mortgages can be good loans. So can low- down-payment loans, interest-only loans, stated-income loans, etcetera. But if you combine these elements into one loan, it's toxic," said John Walsh, DataQuick president.

The median origination month for last quarter's defaulted loans was July 2006. That's only four months later than the median origination month for defaulted loans a year ago, in first quarter 2008. That suggests a period where underwriting criteria were particularly lax.

Of the 3.7 million home loans made in 2004, less than 1 percent have since resulted in a lender filing a default notice. Of the 3.7 million loans originated in 2005, 4.9 percent have triggered a default notice so far. Of the 3 million in 2006, 8.5 percent have so far resulted in default. A particularly toxic period appears to have been August through November 2006 which had more than a 9 percent default rate. Of the 2.1 million loans made in 2007, it's 4.6 percent - a percentage that's likely to rise significantly during the rest of this year.

The lending institutions with the highest default rates for loans originated in August to November 2006 include ResMAE Mortgage (69.9 percent of loans resulting in a default notice), Master Financial (64.6 percent) and Ownit Mortgage Solutions (63.6 percent). Of the major lenders, IndyMac has a default rate on those loans of 18.9 percent, World Savings 8.0 percent, Countrywide 7.7 percent, Washington Mutual 6.3 percent and Wells Fargo 3.4 percent. Less than 1 percent of the home loans originated in late 2006 by Citibank and Bank of America have since gone into default.

...

While most first quarter 2009 foreclosure activity was still concentrated in affordable inland communities, there are signs that the problem is slowly migrating into other areas. The affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for more than 52.0 percent of all default activity in 2008. Last quarter it fell to 47.5 percent.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 2008 in California from DataQuick.

With 135,431 default notices filed in Q1 2009 (even with the lenders playing catch-up), 2009 is clearly on pace to break the 2008 record of 424 thousand NODs.

Tuesday, April 21, 2009

Capital One: Expect Charge-Off Rates Greater than 10%

by Calculated Risk on 4/21/2009 06:45:00 PM

Conference call notes (ht Brian):

Economic deterioration continued at a rapid pace during the first quarter driving increasing delinquency and charge off rates across most of our lending businesses. U.S. card charge off rate increased to 8.4% for the first quarter, above the 8.1% charge off rate expectation we articulated a quarter ago. Expected seasonal increases in bankruptcies and declining loan balances resulted in higher charge off rates compared to the fourth quarter of 2008. The increase in charge off rates beyond our expectations resulted from several factors related to the pace of economic deterioration in the quarter. Bankruptcies were higher than expected, increasing charge-offs directly without impacting delinquency rates. Recoveries on already charged off debt were lower than expected. We also observed an acceleration of later stage delinquency balances slowing to charge off in the quarter. For context recall that when we articulated our expectations last January the unemployment rate was 7.2% and we assumed it would increase to about 8.7% by the ends of 2009. The unemployment rate has already deteriorated to 8.5% and is expected to move beyond 8.7% well before year end. Even though our U.S. card charge off rate was higher than the expectation we had last quarter delinquencies and charge-offs were a bit better than we would have expected given the actual economic worsening we've seen in the quarter. ...The expected 'greater than 10% charge-off rate' is probably worse than the expected credit card loss rates for the "more adverse" scenario. I'll be curious if the Federal Reserve white paper, to be released on Friday, will mention the expected loss rates by category.

Credit Loss outlook

We expect further increases in U.S. card charge off rate through 2009 as the economy continues to weaken. It is likely that will our U.S. card charge off rate will increase at a faster pace than the broader economy as a result of the denominator effect and our implementation of OCC minimum payment requirements ... We expect monthly U.S. card charge off rates to cross 10% in the next couple of months.

Economic Outlook

I'll update our economic outlook. Unemployment and home prices have been and continue to be the economic variables with the greatest impact on our credit results. We now expect unemployment rate to increase to around 9.6% by the ends of 2009. Our prior assumption for home prices was for the Case Shiller 20 city index to fall by around 37% peak to trough. We now expect a modestly worse peak to trough decline of around 39%. ...

Fannie, Freddie Report Surge in Prime Delinquencies

by Calculated Risk on 4/21/2009 05:16:00 PM

Here is a letter from the FHFA to Chairman Dodd that was released today (ht James, Tim, Brian)

Update: here is the news release from FHFA: FHFA Expands Reporting on Homeowner Assistance

The tables show that the number of prime 60 days+ delinquent rose to 743,686 in January, from 497,131 in December. This is an increase from 1.93% in December to 2.89% in January.

The number of non-prime 60 day+ delinquent loans increased too; from 428,705 in December to 485,365 in January. But the foreclosure problem is now mostly a prime problem!

Or as Tanta used to say: "We're all subprime now!"

Friday, April 03, 2009

OCC: More Seriously Delinquent Prime Loans than Subprime

by Calculated Risk on 4/03/2009 12:37:00 PM

From the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Fourth Quarter 2008

The Office of the Comptroller of the Currency and the Office of Thrift Supervision today jointly released their quarterly report on first lien mortgage performance for the fourth quarter of 2008. The report covers mortgages serviced by nine large banks and four thrifts, constituting approximately two-thirds of all outstanding mortgages in the United States.Much of the report focuses on modifications and recidivism (see Housing Wire). But this report also shows - for the first time - more seriously delinquent prime loans than subprime loans (by number, not percentage).

The report showed that credit quality continued to decline in the fourth quarter of 2008. At the end of the year, just under 90 percent of mortgages were performing, compared with 93 percent at the end of September 2008. This decline in credit quality was evident in all loan risk categories, with subprime mortgages showing the highest level of serious delinquencies. However, the biggest percentage jump was in prime mortgages, the lowest loan risk category and one that accounts for nearly two-thirds of all mortgages serviced by the reporting institutions. At the end of the fourth quarter, 2.4 percent of prime mortgages were seriously delinquent, more than double the 1.1 percent recorded at the end of March 2008.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Note: "Approximately 14 percent of loans in the data were not accompanied by credit scores and are classified as “other.” This group includes a mix of prime, Alt-A, and subprime. In large part, the loans were result of acquisitions of loan portfolios from third parties where borrower credit scores at the origination of the loans were not available."

This report covers about two-thirds of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

We're all subprime now!

Thursday, March 12, 2009

S&P: Delinquencies Surge for HELOCs and Jumbo Prime Loans

by Calculated Risk on 3/12/2009 03:01:00 PM

From Dow Jones: S&P: Home-Loan Delinquencies Grow In January

Standard & Poor's said delinquencies of home-related loans climbed in January, with the rate surging in particular from December for home-equity lines of credit and prime-rated jumbo mortgages.Subprime delinquency rates are still much higher than other categories, but HELOCs and Jumbo primes delinquencies are increasing at a faster rate. The delinquencies are moving up the value chain - we're all subprime now!

...

S&P said the smallest month-to-month increase as of the January distribution date was subprime mortgages ... The delinquency rates, though, still range from 42% of current total pool balances for 2005 to 49% for 2007.

emphasis added

Thursday, March 05, 2009

More on MBA National Delinquency Survey

by Calculated Risk on 3/05/2009 01:05:00 PM

Here is the press release from the Mortgage Bankers Association (MBA): Delinquencies Continue to Climb in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 7.88 percent of all loans outstanding as of the end of the fourth quarter of 2008, up 89 basis points from the third quarter of 2008, and up 206 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.The initial resets are behind us for the 2-28 subprime ARMs, but still ahead of us for the 5/1 ARMs (fixed for 5 years and then adjust monthly). I do agree the impact of the resets is overstated (especially now since the various indices used for ARMs are very low), but there will still be a significant impact when certain NegAm loans recast (like Option ARMs). For the difference between "reset" and "recast" see Tanta's: Reset Vs. Recast, Or Why Charts Don't Match

The delinquency rate breaks the record set last quarter and the quarter-to-quarter jump is the also the largest. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 3.30 percent, an increase of 33 basis points from the third quarter of 2008 and 126 basis points from one year ago. The combined percent of loans in foreclosure and at least one payment past due was 11.18 percent on a seasonally adjusted basis and 11.93 percent on a non-seasonally adjusted basis. Both of these numbers are the highest ever recorded in the MBA delinquency survey.

...

“Subprime ARM loans and prime ARM loans, which include Alt-A and pay option ARMs, continue to dominate the delinquency numbers. Nationwide, 48 percent of subprime ARMs were at least one payment past due and in Florida over 60 percent of subprime ARMs were at least one payment past due.

“We will continue to see, however, a shift away from delinquencies tied to the structure and underwriting quality of loans to mortgage delinquencies caused by job and income losses. For example, the 30-day delinquency rate for subprime ARMs continues to fall and is at its lowest point since the first quarter of 2007. Absent a sudden increase in short-term rates, this trend should continue because the last 2-28 subprime ARMs (fixed payment for two years and adjustable for the next 28 years) were written in the first half of 2007. The problem with initial resets is largely behind us, although the impact of the resets was generally overstated.

emphasis added

"Reset" refers to a rate change. "Recast" refers to a payment change.

Report: Record 5.4 Million U.S. Homeowners Delinquent or in Foreclosure

by Calculated Risk on 3/05/2009 10:58:00 AM

From the WSJ: Delinquent Mortgages Hit Record Level

A record 5.4 million U.S. homeowners with a mortgage, or nearly 12%, were either behind on payments or in foreclosure at the end of last year, according to [the Mortgage Bankers Association] ...I haven't seen the actual report yet, and I'm especially interested in increases by loan category.

The percentage of loans at least 30 days past due rose to a record 7.88%, up from 6.99% in the third quarter and 5.82% a year earlier -- the biggest quarterly jump for delinquencies since the survey began in 1972.

The percentage of loans somewhere in the foreclosure process was 3.30% in the fourth quarter, up from 2.97% in the third quarter ...

The sharpest increases in loans 90-days past due were in Louisiana, New York, Georgia, Texas and Mississippi ...

Tuesday, February 24, 2009

Fed: Delinquency Rates Increased Sharply in Q4

by Calculated Risk on 2/24/2009 12:15:00 PM

UPDATE: Also check out the charge-off rates. The charge-off rate almost doubled for commercial real estate (CRE) from 1.16% in Q3 to 2.04% in Q4. The commercial banks are starting to recognize their CRE losses!

The Federal Reserve reports that delinquency rates rose sharply in Q4 in all categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the delinquency rates at the commercial banks for residential real estate, commercial real estate and consumer credit cards.

Commercial real estate delinquencies are rising rapidly, and are at the highest rate since Q2 '94 (as delinquency rates declined following the S&L crisis).

Residential real estate delinquencies are at the highest level since the Fed started tracking the data (since Q1 '91).

Credit card delinquency rates are now above the previous high in 1991 (the Fed started tracking data in '91).

Although there is credit deterioration everywhere, the rise in these three categories is especially significant. Residential delinquency rates jumped by over 1% from 5.22% to 6.29% - in just Q4! Credit card delinquencies rose from 4.83% to 5.56%, the fastest increase since the Fed started keeping records.

And commercial real estate delinquencies rose from 4.74% to 5.36%. The Fed defines commercial as "construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate", and many of the problems are probably in the C&D loans. These are the loans that will probably lead to the closure of many regional banks.

Just more evidence of severe credit problems at the commercial banks.

Monday, December 08, 2008

Dugan: High Re-Default Rates

by Calculated Risk on 12/08/2008 11:34:00 AM

Comptroller of the Currency John C. Dugan spoke today about the high re-default rates on modified loans. From the press release:

Comptroller of the Currency John C. Dugan said today that new data shows that more than half of loans modified in the first quarter of 2008 fell delinquent within six months.

“After three months, nearly 36 percent of the borrowers had re-defaulted by being more than 30 days past due. After six months, the rate was nearly 53 percent, and after eight months, 58 percent,” the Comptroller said in remarks at the Office of Thrift Supervision’s National Housing Forum today.

...

A key question, Mr. Dugan said, is why is the number of re-defaults so high? “Is it because the modifications did not reduce monthly payments enough to be truly affordable to the borrowers? Is it because consumers replaced lower mortgage payments with increased credit card debt? Is it because the mortgages were so badly underwritten that the borrowers simply could not afford them, even with reduced monthly payments? Or is it a combination of these and other factors?”

Click on photo for larger image in a new window.

Click on photo for larger image in a new window.This graph shows the re-default rate by month for loans modified in Q1 and Q2 2008.

For loans modified in Q2 2008, over half are already in default.

Here is Dugan's speech.

In general, the third quarter report will show many of the same disturbing trends as other recent mortgage reports. Credit quality continued to decline across the board, with delinquencies increasing for subprime, alt-A, and prime mortgages – and the greatest increase in percentage terms was in prime mortgages. Similarly, total foreclosures in process increased, as did foreclosure sales, just as they had done in the previous quarter.The only good news is foreclosure starts are down (as reported by the MBA too), but the reason is modifications have increased - and a very large percentage of modified loans re-default very quickly. Also note the comment on prime loans - we're all subprime now!

Not all the news is bad, however. Foreclosure starts actually decreased in the third quarter, by 2.6 percent. And not coincidentally, mortgage modifications increased: the total in the third quarter was nearly double what it was in the first quarter.

Of course, it stands to reason that the more mortgages that are modified, the fewer should result in foreclosure starts. But how true is that statement? In an attempt to shed light on this question, we collected a new data element in our Mortgage Metrics for the third quarter. Specifically, we asked our servicers to track the extent to which mortgage modifications earlier in the year were successful, in this sense: what percentage of borrowers re-defaulted on their mortgages after the modification was completed, and how quickly did they do so?

The results, I confess, were somewhat surprising, and not in a good way. Take the loans that were modified in the first quarter of this year. After three months, nearly 36 percent of the borrowers had re-defaulted by being more than 30 days past due. After six months, the rate was nearly 53 percent, and after eight months, 58 percent. The data is similar for mortgages modified in the second quarter: the re-default rate after three months was 39 percent, and after six months, 51 percent.

emphasis added

Friday, December 05, 2008

More on Delinquencies and Foreclosures

by Calculated Risk on 12/05/2008 02:34:00 PM

First a graph, always a graph ... Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly delinquency rate as reported by the MBA since 1979.

This shows that a fairly high percentage of mortgages were delinquent even in the best of times. As an example, in Q3 2005, at the height of the bubble, the MBA reported:

The third-quarter 2005 National Delinquency Survey (NDS), released today by the Mortgage Bankers Association (MBA), shows that the seasonally adjusted delinquency rate for mortgage loans on single-family residential properties stood at 4.44 percent at the end of the third quarter, down 10 basis points from the third quarter of 2004 but up 10 basis points from the second quarter of 2005.So even though the Q3 2008 delinquency rate of 6.99% is a record level for the MBA series, it is important to realize that 4% to 5% of mortgages are considered delinquent even during the good times.

This is why the MBA also reports on seriously delinquent mortgages. In 2005, 1.82% of loans were seriously delinquent, now, prime loans alone are at 2.87%, and subprime loans at 19.56%.

And how does this compare to the Great Depression? Glad you asked.

From David Wheelock at the St. Louis Fed: The Federal Response to Home Mortgage Distress: Lessons from the Great Depression

Comprehensive data on mortgage delinquency rates do not exist for the 1930s. However, a study of 22 cities by the Department of Commerce found that, as of January 1, 1934, 43.8 percent of urban, owner-occupied homes on which there was a first mortgage were in default. The study also found that among delinquent loans, the averagetime that they had been delinquent was 15 months. Among homes with a second or third mortgage, 54.4 percent were in default and the average time of delinquency was 18 months. Thus, at the beginning of 1934, approximately one-half of urban houses with an outstanding mortgage were in default (Bridewell, 1938, p. 172).So the delinquency rate was far higher during the Depression. Note that Wheelock is using the 90 delinquency number for comparison (as opposed to the 30 day number in the chart above).

For comparison, in the fourth quarter of 2007, 3.6 percent of all U.S. residential mortgages and 20.4 percent of adjustable-rate subprime mortgages had been delinquent for at least 90 days.

Here is some more interesting data from Wheelock:

This graph shows the foreclosure rate during the Great Depression. At the peak, there were almost 14 foreclosures per thousand mortgages per year during the Depression.

This graph shows the foreclosure rate during the Great Depression. At the peak, there were almost 14 foreclosures per thousand mortgages per year during the Depression. In 2008, according to the MBA, there will be about 2.2 million foreclosures started (not completed), and according to the Census Bureau 2007 estimate there are 51.6 million households with mortgages, or over 4% of households with mortgages entered foreclosure in 2008. The MBA reports that 2.97% of households with mortgages are currently in the foreclosure process.

So even though the current delinquency rate is much lower than during the Depression, it appears the foreclosure rate is higher. Wheelock also notes:

The rate of foreclosures would likely have been far higher were it not for the moratoria on (and other impediments to) foreclosure imposed by several states (Poteat, 1938), as well as the actions of the federal government to refinance delinquent mortgages ...And once again the government is stepping in to slow foreclosures.

I think it is important to note that mortgages were very different in the Depression era. It was typical for a buyer to put 50% down, and obtain a short duration loan (like 5 years) with a balloon payment. When you lost your home to foreclosure, it was a tragedy. Today many of the foreclosures are for buyers that put little or no money down (or extracted significant equity with 2nds or HELOCs), so these foreclosures are not wiping out a life time of savings like foreclosures during the Depression. Still a tragedy for some, but not quite the same impact for many others.

MBA: Almost 10% of Homeowners with Mortgages Delinquent or in Foreclosure Process

by Calculated Risk on 12/05/2008 10:15:00 AM

Update: 10% of Homeowners with mortgages. Approximately 31% of homeowners have no mortgage.

From the Mortgage Bankers Association (MBA): Delinquencies Increase, Foreclosure Starts Flat in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties stood at 6.99 percent of all loans outstanding at the end of the third quarter of 2008, up 58 basis points from the second quarter of 2008, and up 140 basis points from one year ago on a seasonally adjusted basis, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.All new records. There is more detail in the press release:

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure.

...

The seasonally adjusted total delinquency rate continues to be the highest recorded in the MBA survey.

...

The percentage of loans in the foreclosure process at the end of the third quarter was 2.97 percent, an increase of 22 basis points from the second quarter of 2008 and 128 basis points from one year ago. The percentage of loans in the process of foreclosure set a new record this quarter.

emphasis added

The seasonally adjusted delinquency rate increased 41 basis points to 4.34 percent for prime loans, increased 136 basis points to 20.03 percent for subprime loans ... The seriously delinquent rate, the non-seasonally adjusted percentage of loans that are 90 days or more delinquent, or in the process of foreclosure, was up from both last quarter and from last year. ... Compared with last quarter, the seriously delinquent rate increased for all loan types. The rate increased 52 basis points for prime loans to 2.87 percent, increased 171 basis points for subprime loans to 19.56 percent ...Most concerning is the surge in the prime delinquency rate. The prime problem appears to be concentrated in a few states (California and Florida lead the way), and is mostly due to prime ARM loans.