by Calculated Risk on 7/14/2010 07:46:00 AM

Wednesday, July 14, 2010

MBA: Mortgage Purchase Applications lowest since December 1996

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2.9 percent from the previous week and the seasonally adjusted Purchase Index decreased 3.1 percent from one week earlier. This was the lowest Purchase Index observed in the survey since December 1996.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.69 percent from 4.68 percent, with points increasing to 0.96 from 0.86 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

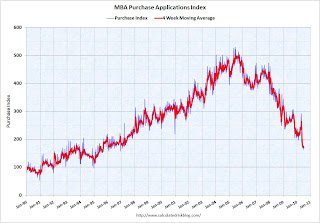

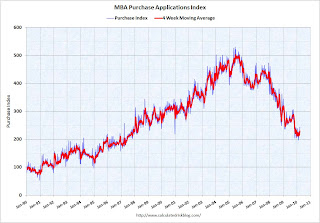

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Mortgage applications have fallen off a cliff. The weekly applications index is at the lowest level since December 1996, and and the four week average is at the lowest level since September 1995 - almost 15 years ago. The four week average is off 35% since the mini-peak in April (the weekly index is off 44% since the end of April).

This collapse in the mortgage application index has already shown up as a decline in new home sales, and will show up in the July existing home sales report (counted at close of escrow).

Wednesday, July 07, 2010

MBA: Mortgage Purchase Applications Decrease, Refis increase

by Calculated Risk on 7/07/2010 07:21:00 AM

The MBA reports: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 9.2 percent from the previous week and is the highest Refinance Index observed in the survey since the week ending May 15, 2009. The seasonally adjusted Purchase Index decreased 2.0 percent from one week earlier. The Purchase Index has decreased eight of the last nine weeks.

...

“Mortgage rates remained near record lows last week, as incoming data on the job and housing markets were weaker than anticipated. As more homeowners locked in to these low rates, the level of refinance applications increased to a new 13-month high,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “For the month of June, purchase applications declined almost 15 percent relative to the prior month, and were down more than 30 percent compared to April, the last month in which buyers were eligible for the tax credit.”

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.68 percent from 4.67 percent, with points decreasing to 0.86 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

There has been a mini-refi boom because of the low mortgage rates, but the purchase index has fallen sharply to the levels of 1996.

Wednesday, June 30, 2010

MBA: Mortgage Refinance Applications increase, Purchase Applications near 13 Year Low

by Calculated Risk on 6/30/2010 07:18:00 AM

The MBA reports: Mortgage Refinance Applications Increase as Rates Continue to Drop in Latest MBA Weekly Survey

The Refinance Index increased 12.6 percent from the previous week and is the highest Refinance Index observed in the survey since the week ending May 22, 2009. The seasonally adjusted Purchase Index decreased 3.3 percent from one week earlier.

...

“Amid continuing financial market volatility, mortgage rates dropped again last week, with rates on 15-year loans reaching a record low for the MBA survey. Refinance applications jumped in response, but remain at about half the level seen in the spring of 2009,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Purchase applications declined for the seventh time in the last eight weeks, keeping the purchase index near 13-year lows.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.67 percent from 4.75 percent, with points decreasing to 0.96 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year contract rate recorded in the survey since the week ending April 24, 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has collapsed following the expiration of the tax credit suggesting home sales will fall sharply too. This is the lowest level for 4-week average of the purchase index since 1996.

Wednesday, June 23, 2010

MBA: Mortgage Purchase Applications Decrease in Weekly Survey

by Calculated Risk on 6/23/2010 07:55:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 7.3 percent from the previous week and the seasonally adjusted Purchase Index decreased 1.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.75 percent from 4.82 percent, with points increasing to 1.07 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year contract rate observed in the survey since the week ending May 15, 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has collapsed following the expiration of the tax credit suggesting home sales will fall sharply too. This is the lowest level for 4-week average of the purchase index since February 1997.

Wednesday, June 16, 2010

MBA: Mortgage Purchase Applications increase slightly, near 13 Year Low

by Calculated Risk on 6/16/2010 07:11:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 21.1 percent from the previous week. This is the highest Refinance Index recorded in the survey since May 2009. The seasonally adjusted Purchase Index increased 7.3 percent from one week earlier, which is the first increase in six weeks.

...

“Mortgage applications for home purchases increased last week, the first increase in over a month. Refinance applications also picked up significantly over the week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “While it is clear that purchase applications in May dropped sharply as a result of the tax credit induced increase in applications in April, it is unclear whether we are seeing the beginnings of a rebound now.”

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.82 percent from 4.81 percent, with points decreasing to 0.89 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has collapsed following the expiration of the tax credit suggesting home sales will fall sharply too. This is the lowest level for 4-week average of the purchase index since February 1997.

Wednesday, June 09, 2010

MBA: Mortgage Purchase Applications decline 35% over last four weeks

by Calculated Risk on 6/09/2010 07:33:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 14.3 percent from the previous week and the seasonally adjusted Purchase Index decreased 5.7 percent from one week earlier.

...

“Purchase and refinance applications dropped this week, even after an adjustment for the Memorial Day holiday. Purchase applications are now 35 percent below their level of four weeks ago, as homebuyers have not yet returned to the market following the expiration of the homebuyer tax credit at the end of April,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remained essentially flat, refinance applications dropped this past week for the first time in a month. Despite the historically low rates, many homeowners have already refinanced recently, remain underwater on their mortgages, have uncertain job situations, or have damaged credit following this downturn, and therefore may not qualify to refinance.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.81 percent from 4.83 percent, with points decreasing to 1.02 from 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has collapsed following the expiration of the tax credit suggesting home sales will fall sharply too. This is the lowest level for the purchase index since February 1997.

Wednesday, June 02, 2010

MBA: Mortgage Purchase Applications lowest level since April 1997

by Calculated Risk on 6/02/2010 07:06:00 AM

The MBA reports: Mortgage Refinance Applications Increase Slightly, Purchase Applications Decline Further

The Refinance Index increased 2.4 percent from the previous week. This was a smaller increase than in previous weeks, but was still the fourth consecutive weekly increase for the Refinance Index and it remains at its highest level since October 2009. The seasonally adjusted Purchase Index decreased 4.1 percent from one week earlier. The Purchase Index decreased for the fourth consecutive week and is currently at the lowest level since April 1997.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.83 percent from 4.80 percent, with points decreasing to 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has declined sharply following the tax credit related buying, suggesting home sales will fall sharply too. Pending home sales for April will be announced today and a large increase is expected, however May pending home sales will be much lower.

As the Michael Fratantoni, MBA’s Vice President of Research and Economics noted two weeks ago: "The data continue to suggest that the tax credit pulled sales into April at the expense of the remainder of the spring buying season."

Wednesday, May 26, 2010

MBA: Mortgage Purchase Applications at 13 Year Low

by Calculated Risk on 5/26/2010 08:07:00 AM

The MBA reports: Mortgage Refinance Applications Continue to Increase, Purchase Applications Decline Further

The Market Composite Index, a measure of mortgage loan application volume, increased 11.3 percent on a seasonally adjusted basis from one week earlier ...

The Refinance Index increased 17.0 percent from the previous week. This third consecutive increase marks the highest Refinance Index recorded in the survey since October 2009. The seasonally adjusted Purchase Index decreased 3.3 percent from one week earlier and is the lowest Purchase Index observed in the survey since April 1997.

...

“Refinance application volume jumped last week as continuing financial market turmoil related to the budget crises in Europe extended the opportunity for homeowners to lock in at historically low mortgage rates,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “In contrast, purchase applications fell further this week, following last week’s sharp decline, keeping the purchase index at 13-year lows.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.80 percent from 4.83 percent, with points remaining constant at 1.08 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed-rate recorded in the survey since the week ending November 27, 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

There was a spike in purchase applications in April, followed by a decline to a 13 year low last week. As Fratantoni noted last week: "The data continue to suggest that the tax credit pulled sales into April at the expense of the remainder of the spring buying season."

Wednesday, May 19, 2010

Mortgage Delinquencies by Period and by State

by Calculated Risk on 5/19/2010 04:01:00 PM

Much was made last quarter about the decline in the 30 day delinquency "bucket" (percent of loans between 30 and 60 days delinquent). Unfortunately the seasonally adjusted 30 day delinquency rate increased in Q1 2010.

Note: there are some questions about the seasonal adjustment, especially for the 90 day bucket since we've never seen numbers this high before, but the adjustment for the 30 and 60 day periods are probably reasonable. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loans 30 days delinquent increased to 3.45%, about the same level as in Q4 2008.

Delinquent loans in the 60 day bucket increased too, and are also close to the Q4 2008 level. This suggests that the pipeline is still filling up at a high rate, but slightly below the rates of early 2009.

The 90+ day and 'in foreclosure' rates are at record levels. Obviously the lenders have been slow to start foreclosure proceedings - and the 90+ day delinquent bucket is very full. Also lenders have been slow to actually foreclose - and the 'in foreclosure' bucket is at record levels.

These seriously delinquent loans are the 4.3 million loans MBA Chief Economist Jay Brinkmann referred to as the "shadow inventory" on the conference call this morning. Not all are really "shadow inventory" since some of these loans will be modified, some will be cured (probably very few), and some are probably already listed as short sales. But it does suggest a significant number of distressed sales coming.  The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

This highlights a couple more points that Brinkmann made this morning: 1) the largest category of delinquent loans are fixed rate prime loans, and 2) this is not just a "sand state" problem. Brinkmann argued the foreclosure crisis is now being driven by economic problems as opposed to the bursting of the housing price bubble - and this is showing up in prime loans and all states. Although Florida and Nevada are very high, notice that the blue bar (new delinquencies) are higher in many other states.

Thirty four states and the District of Columbia have total delinquency rates over 10%. This is a widespread problem.

MBA Q1 National Delinquency Survey Conference Call

by Calculated Risk on 5/19/2010 11:06:00 AM

On the MBA conference call concerning the "Q1 2010 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the delinquency and foreclosure rates for all prime loans.

This is a new record rate of prime loans in delinquency and foreclosure.

Prime loans account for over 75% of all loans.

"We're all subprime now!"

NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

I'll have more later today ...

MBA Q1 2010: Record 14.69% of Mortgage Loans Delinquent or in Foreclosure

by Calculated Risk on 5/19/2010 10:00:00 AM

The MBA reports a record 14.69 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2010 (seasonally adjusted).

From the MBA: Delinquencies, Foreclosure Starts Fall in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unitAlthough this is a new record, Jay Brinkmann, MBA’s chief economist added a caution on the seasonal adjustment (see press release).

residential properties increased to a seasonally adjusted rate of 10.06 percent of all loans outstanding as of the end of the first quarter of 2010, an increase of 59 basis points from the fourth quarter of 2009, and up 94 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased 106 basis points from 10.44 percent in the fourth quarter of 2009 to 9.38 percent this quarter.

The percentage of loans on which foreclosure actions were started during the first quarter was 1.23 percent, up three basis points from last quarter but down 14 basis points from one year ago.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 4.63 percent, an increase of five basis points from the fourth quarter of 2009 and 78 basis points from one year ago. This represents another record high.

The combined percentage of loans in foreclosure or at least one payment past due was 14.01 percent on a non-seasonally adjusted basis, a decline from 15.02 percent last quarter.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 9.54 percent, a decrease of 13 basis points from last quarter, but an increase of 230 basis points from the first quarter of last year.

I'll have notes from the conference call and graphs soon.

MBA: Mortgage Purchase Applications 'Plummet' to 13 Year Low

by Calculated Risk on 5/19/2010 07:31:00 AM

The MBA reports: Mortgage Purchase Applications Plummet While Refinance Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.5 percent on a seasonally adjusted basis from one week earlier....

The Refinance Index increased 14.5 percent from the previous week and the seasonally adjusted Purchase Index decreased 27.1 percent from one week earlier. This is the lowest Purchase Index observed in the survey since May of 1997. ...

“Purchase applications plummeted 27 percent last week and have declined almost 20 percent over the past month, despite relatively low interest rates. The data continue to suggest that the tax credit pulled sales into April at the expense of the remainder of the spring buying season. In fact, this drop occurred even as rates on 30-year fixed-rate mortgages continued to fall, and at 4.83 percent are at their lowest level since November 2009,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “However, refinance borrowers did react to these lower rates, with refi applications up almost 15 percent, hitting their highest level in nine weeks.”

... The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.83 percent from 4.96 percent, with points increasing to 1.08 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

There was a spike in purchase applications in April, followed by a decline to a 13 year low last week. As Fratantoni noted: "The data continue to suggest that the tax credit pulled sales into April at the expense of the remainder of the spring buying season."

Wednesday, May 12, 2010

MBA: Mortgage Purchase Applications Decrease

by Calculated Risk on 5/12/2010 07:21:00 AM

The MBA reports: Refinance Applications Surge, Purchase Applications Drop in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 3.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 14.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 9.5 percent from one week earlier. ...

“The recent plunge in rates on US Treasury securities, due to a flight to quality as investors worldwide sought shelter from the Greek debt crisis, benefitted US mortgage borrowers last week. Rates on 30-year mortgages dropped to their lowest level since mid-March. As a result, refinance applications for conventional loans jumped, hitting their highest level in six weeks,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “In contrast, purchase applications fell almost 10 percent in the first week following the expiration of the homebuyer tax credit, as the tax credit likely pulled some sales into April that would otherwise have occurred in May or later.”

... The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.96 percent from 5.02 percent, with points decreasing to 0.91 from 0.92 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

We expected the Purchase Index to increase in April - and then turn down in May since the tax credit expired at the end of April (buyers need to close by June 30th). The tax credit related peak in purchase activity is probably behind us.

As Fratantoni noted, the decline in mortgage rates (below 5% again on a 30 year fixed) resulted in a surge in refinance applications last week.

Wednesday, May 05, 2010

MBA: Mortgage Purchase Applications Highest Since October

by Calculated Risk on 5/05/2010 07:00:00 AM

The MBA reports: Purchase Applications Continue to Increase, Refinance Activity Declines in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 4.0 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 2.1 percent from the previous week and the seasonally adjusted Purchase Index increased 13.0 percent from one week earlier. This is the third consecutive weekly increase in purchase applications and the highest Purchase Index recorded in the survey since the week ending October 2, 2009. ...

"Purchase application activity continued to increase in the last week of the homebuyer tax credit program," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Purchase applications were up 13 percent over the previous week and almost 24 percent over the last month, driven by significant increases in both conventional and government purchase applications. We also saw the Government share of applications for purchasing a home increase to over 50 percent of all purchase applications last week, which is the highest in two decades."

... The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.02 percent from 5.08 percent, with points increasing to 0.92 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

This is the highest level for the purchase index since last October. The index will probably turn down in the next week or two since the tax credit expired last Friday (buyers need to close by June 30th).

Wednesday, April 28, 2010

MBA: Mortgage Purchase Applications Increase

by Calculated Risk on 4/28/2010 08:19:00 AM

The MBA reports: Purchase Applications Increase, Refinance Applications Decline in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume decreased 2.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 8.8 percent from the previous week, while the seasonally adjusted Purchase Index increased 7.4 percent from one week earlier and reached its highest level since October 2009. The increase in the purchase index was driven largely by the government purchase index, which increased 11.9 percent ...

“Purchase activity continues to increase as we approach the end of the homebuyer tax credit program,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “Purchase applications were up almost 9 percent from a month ago, with a disproportionate share of the increase due to government purchase applications. Government applications for purchasing a home accounted for almost 49 percent of all purchase applications last week.”

The refinance share of mortgage activity decreased to 55.7 percent of total applications from 60.0 percent the previous week. The refinance share is at its lowest since August 2009 ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.08 percent from 5.04 percent, with points decreasing to 0.91 from 0.98 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

This is the highest level for the purchase index since last October.

Wednesday, April 21, 2010

MBA: Mortgage Purchase Applications Increase "Modestly"

by Calculated Risk on 4/21/2010 08:07:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 13.6 percent on a seasonally adjusted basis from one week earlier. ...

“Treasury rates fell last week causing a decline in mortgage rates. As a result, refinance applications picked up over the week, as some borrowers took advantage of this recent rate volatility to lock in a low fixed-rate loan,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Purchase applications continued to increase coming out of the Easter holiday, as we approach the end of the homebuyer tax credit, and are up modestly over last month.”

The Refinance Index increased 15.8 percent from the previous week and the seasonally adjusted Purchase Index increased 10.1 percent from one week earlier. ...

The refinance share of mortgage activity increased to 60.0 percent of total applications from 58.9 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.04 percent from 5.17 percent, with points increasing to 0.98 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

So far the increase in activity because of the expiration of the tax credit has been "modest". I expect any increase this year to be less than the increase last year ...

Wednesday, April 07, 2010

MBA: Mortgage Refinance Actvity Declines as Rates Rise

by Calculated Risk on 4/07/2010 08:52:00 AM

The MBA reports: Mortgage Refinance Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 11.0 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 16.9 percent from the previous week and the seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. ...

The refinance share of mortgage activity decreased to 58.7 percent of total applications from 63.2 percent the previous week, marking the lowest share observed in the survey since the week ending August 28, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.31 percent from 5.04 percent, with points decreasing to 0.64 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year rate recorded in the survey since the first week of August 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Although purchase activity was flat week-to-week, the four week average is moving up due to buyers trying to beat the expiration of the tax credit. I expect any increase in activity this year to be less than the increase last year when buyers rushed to beat the expiration of the initial tax credit.

Wednesday, March 31, 2010

MBA: Mortgage Applications Increase

by Calculated Risk on 3/31/2010 08:55:00 AM

The MBA reports: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 1.3 percent on a seasonally adjusted basis from one week earlier. ...

“Purchase applications have increased over the past month, and are now at their highest level since last October when many homebuyers were rushing to get loans closed before the expected expiration of the homebuyer tax credit,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “We may be seeing a similar pattern now, as the extended version of the tax credit ends next month.”

The Refinance Index decreased 1.3 percent from the previous week and the seasonally adjusted Purchase Index increased 6.8 percent from one week earlier. This is the highest Purchase Index since the week ending October 30, 2009. ...

The refinance share of mortgage activity decreased to 63.2 percent of total applications from 65.0 percent the previous week. This is the lowest refinance share recorded in the survey since the week ending October 23, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.04 percent from 5.01 percent, with points increasing to 1.07 from 0.76 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The recent uptick in purchase applications is probably related to buyers trying to beat the expiration of the tax credit.

I've heard from some real estate agents that activity seems to have picked up, more than the normal seasonal increase, and the MBA data would seem to suggest this is happening. However I expect any increase in activity this year to be less than the increase last year.

Wednesday, March 24, 2010

MBA: Mortgage Applications Decrease, Rates Rise

by Calculated Risk on 3/24/2010 08:52:00 AM

The MBA reports: Mortgage Refinance Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.2 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 7.1 percent from the previous week and the seasonally adjusted Purchase Index increased 2.7 percent from one week earlier. ...

The refinance share of mortgage activity decreased to 65.0 percent of total applications from 67.3 percent the previous week. This is the lowest refinance share observed in the survey since the week ending October 30, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.01 percent from 4.91 percent, with points decreasing to 0.76 from 1.30 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

There was a slight increase in purchase applications last week, but the 4-week average is still near the levels of 1997 - after falling sharply at the end of last year. This index shows no indication yet of the expected increase in home sales due to the expiration of the home buyer tax credit.

Wednesday, March 17, 2010

MBA: Mortgage Applications Decrease, Mortgage Rates Fall

by Calculated Risk on 3/17/2010 08:03:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.7 percent from the previous week and the seasonally adjusted Purchase Index decreased 2.3 percent from one week earlier. ...

The refinance share of mortgage activity increased to 67.3 percent of total applications from 67.2 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.91 percent from 5.01 percent, with points increasing to 1.30 from 0.82 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed-rate observed in the survey since mid-December of 2009, yet the effective rate was unchanged from last week due to the significant increase in points.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with mortgage rates below 5%, the 4 week average of the purchase index is still at the levels of 1997.