by Calculated Risk on 3/31/2024 06:11:00 PM

Sunday, March 31, 2024

Monday: ISM Mfg, Construction Spending

Weekend:

• Schedule for Week of March 31, 2024

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for March. The consensus is for the ISM to be at 48.5, up from 47.8 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for 0.5% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8 and DOW futures are up 67 (fair value).

Oil prices were up over the last week with WTI futures at $83.17 per barrel and Brent at $87.00 per barrel. A year ago, WTI was at $76, and Brent was at $79 - so WTI oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.51 per gallon. A year ago, prices were at $3.49 per gallon, so gasoline prices are up $0.02 year-over-year.

Las Vegas February 2024: Visitor Traffic Up 9.5% YoY; Convention Traffic Up 15%

by Calculated Risk on 3/31/2024 08:21:00 AM

From the Las Vegas Visitor Authority: February 2024 Las Vegas Visitor Statistics

With an extra day from the leap year, a notable YoY increase in available rooms, a strong group segment and of course, a Super Bowl, the destination saw a robust YoY increase in visitors and record‐breaking room rates. Visitation for the month saw a 9.5% increase to reach 3.37M visitors, or roughly 300,000 more visitors than last February.

With the recurring NAHB Int'l Builders' Show and Kitchen & Bath Industry Show, along with the rotational returns of National Auto Dealers Association (24k attendees) and Int’l Roofing Expo (13k attendees) and several mid‐sized shows at properties across the destination, estimated convention attendance reached nearly 765k, +15.3% vs. last Feb.

Despite the larger room inventory vs. last year, overall hotel occupancy for the month surpassed last February by 1.7 pts to reach 83.9% as Weekend occupancy reached 90.3%, up 1.0 pts YoY, and Midweek occupancy came in at 81%, up 2.2 pts YoY.

Driven by dramatically strong rates during Super Bowl, ADR for the month exceeded $248 while RevPAR hit a record $208, +43.5% YoY

emphasis added

Click on graph for larger image.

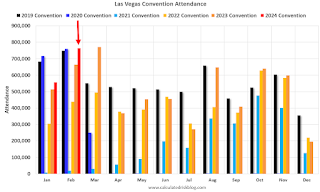

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (dark blue), 2021 (light blue), 2022 (light orange), 2023 (dark orange) and 2024 (red).

Visitor traffic was up 9.5% compared to last February. Visitor traffic was up 5.8% compared to the same month in 2019.

Saturday, March 30, 2024

Real Estate Newsletter Articles this Week: House Price Index Up 6.0% year-over-year

by Calculated Risk on 3/30/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 6.0% year-over-year in January

• New Home Sales at 662,000 Annual Rate in February

• Inflation Adjusted House Prices 2.4% Below Peak

• FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

• Fannie and Freddie: Single Family Serious Delinquency Rate Decreased, Multi-family Decreased in February

• Final Look at Local Housing Markets in February

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 31, 2024

by Calculated Risk on 3/30/2024 08:11:00 AM

The key report scheduled for this week is the March employment report on Friday.

Other key reports include the February Trade Deficit and March Auto Sales.

For manufacturing, the March ISM Manufacturing survey will be released.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 48.5, up from 47.8 in February.

10:00 AM: Construction Spending for February. The consensus is for 0.5% increase in construction spending.

8:00 AM: Corelogic House Price index for February.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased slightly in January to 8.86 million from 8.89 million in December.

The number of job openings (black) were down 15% year-over-year. Quits were down 13% year-over-year.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 15.9 million SAAR in March, up from 15.8 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 15.9 million SAAR in March, up from 15.8 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in March, up from 140,000 added in February.

10:00 AM: the ISM Services Index for March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 210 thousand last week.

8:30 AM: Trade Balance report for February from the Census Bureau.

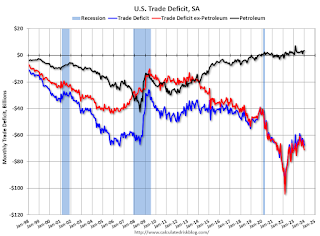

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $66.5 billion. The U.S. trade deficit was at $67.4 billion in January.

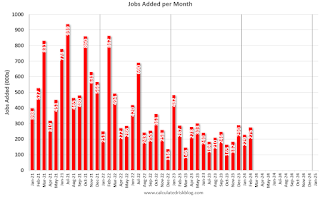

8:30 AM: Employment Report for March. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

8:30 AM: Employment Report for March. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.There were 275,000 jobs added in February, and the unemployment rate was at 3.9%.

This graph shows the jobs added per month since January 2021.

Friday, March 29, 2024

March 29th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 3/29/2024 07:17:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 8,584 | 10,326 | ≤3,0001 | |

| Deaths per Week2 | 1,164 | 1,234 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

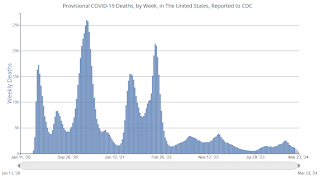

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

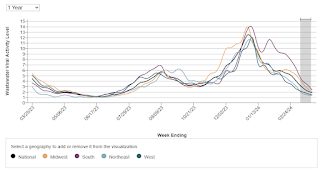

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

by Calculated Risk on 3/29/2024 02:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

A brief excerpt:

Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q4 2023 (released this morning).There is much more in the article.

...

Here is some data showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q4 2023.

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.3% (now at 58.1%), and the percent under 5% peaked at 85.6% (now at 77.0%). These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This is a key reason existing home inventory levels are so low. See: "The Lock-In Effect of Rising Mortgage Rates"

The percent of loans over 6% bottomed in Q2 2022 at 7.2% and has increased to 13.4% in Q4 2023.

Q1 GDP Tracking: Just Over 2%

by Calculated Risk on 3/29/2024 11:47:00 AM

From BofA:

1Q GDP tracking remained at 2.2% q/q saar largely due to downward revisions to core capital goods orders and shipments and lower than expected core capital goods shipments being offset by higher than expected manufacturing inventories in the February durable goods print [Mar 28th estimate]From Goldman:

emphasis added

After incorporating this morning’s data and yesterday’s GDP release, we have increased our Q1 GDP tracking estimate by 0.3pp to +2.1% (qoq ar), reflecting stronger consumption growth and a larger contribution from inventory accumulation that more than offset a slightly wider trade deficit. Our Q1 domestic final sales forecast now stands at +2.9% (qoq ar). [Mar 29th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.3 percent on March 29, up from 2.1 percent on March 26. After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, the nowcast of first-quarter real personal consumption expenditures growth increased from 1.9 percent to 2.6 percent, while the nowcast of the contribution of the change in real net exports to first-quarter real GDP growth decreased from -0.16 percentage points to -0.47 percentage points. [March 29th estimate]

PCE Measure of Shelter Slows to 5.8% YoY in February

by Calculated Risk on 3/29/2024 08:56:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through February 2024.

Since asking rents are mostly flat year-over-year, these measures will continue to slow over the next year.

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 6 months (annualized):

Key measures are slightly above the Fed's target on a 6-month basis.

Key measures are slightly above the Fed's target on a 6-month basis.PCE Price Index: 2.5%

Core PCE Prices: 2.9%

Core minus Housing: 2.3%

Personal Income increased 0.3% in February; Spending increased 0.8%

by Calculated Risk on 3/29/2024 08:30:00 AM

From the BEA: Personal Income and Outlays for February:

Personal income increased $66.5 billion (0.3 percent at a monthly rate) in February, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $50.3 billion (0.2 percent) and personal consumption expenditures (PCE) increased $145.5 billion (0.8 percent).The February PCE price index increased 2.5 percent year-over-year (YoY), up from 2.4 percent YoY in January, and down from the peak of 7.1 percent in June 2022.

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Real DPI decreased 0.1 percent in February and real PCE increased 0.4 percent; goods increased 0.1 percent and services increased 0.6 percent .

emphasis added

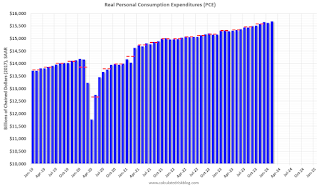

The following graph shows real Personal Consumption Expenditures (PCE) through January 2024 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations and PCE was at expectations.

Using the two-month method to estimate Q1 real PCE growth, real PCE was increasing at a 2.7% annual rate in Q1 2024. (Using the mid-month method, real PCE was increasing at 2.7%). This suggests solid PCE growth in Q1.

Thursday, March 28, 2024

Friday: Personal Income and Outlays, PCE Prices, Fed Chair Powell

by Calculated Risk on 3/28/2024 07:50:00 PM

All US markets will be closed in observance of Good Friday.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.8% YoY.

• At 11:30 AM, Discussion, Fed Chair Jerome Powell, Moderated Discussion with Kai Ryssdal, At the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference, San Francisco, Calif

Realtor.com Reports Active Inventory UP 25.5% YoY; New Listings up 14.9% YoY

by Calculated Risk on 3/28/2024 02:43:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For February, Realtor.com reported inventory was up 14.8% YoY, but still down almost 40% compared to February 2019.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending March 23, 2024

• Active inventory increased, with for-sale homes 25.5% above year ago levels.

For an 20th straight week, active listings registered above prior year level, which means that today’s home shoppers are able to consider more options for existing homes for sale. However, the number of homes on the market is still down nearly 40% compared to what was typical in 2017 to 2019 and the gain in inventory, particularly in the more affordable under $350,000 price category, was primarily focused in the South last month. Nonetheless, in the first few weeks of March, inventory growth has also accelerated in the Midwest and West, while inventory in the Northeast remains similar to the previous year.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 14.9% from one year ago.

For the 22nd consecutive week, newly listed homes have surpassed levels from a year ago. While the annual growth rate was slower than the 17.8% recorded a week earlier, it remains among the fastest increase rates in new listings since June 2021. This indicates a surge in fresh options for buyers as we approach the spring homebuying season. However, it’s worth noting that the inventory base for this growth remains relatively small.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 20th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Final Look at Local Housing Markets in February

by Calculated Risk on 3/28/2024 11:35:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in February

A brief excerpt:

Note: Most analysts were surprised by the increase in sales in February. Not housing economist Tom Lawler, or any readers of this newsletter. The local data clearly showed that sales - as reported by the NAR - would be up solidly in February. This is one of the reasons I track local markets. It is also useful to track inventory, both new and active.There is much more in the article.

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in February.

I’ve added a comparison of active listings, new listings, and closings to the same month in 2019 (for markets with available data). This gives us a sense of the current low level of sales and inventory, and also shows some significant regional differences.

The big stories for February were that existing home sales increased to 4.38 million on a seasonally adjusted annual rate basis (SAAR), and new listings were up YoY for the 5th consecutive month!

...

And here is a table for new listings in February (some areas don’t report new listings). For these areas, new listings were up 21.8% year-over-year.

Last month, new listings in these markets were up 8.6% year-over-year.

New listings are now up solidly year-over-year, but still at historically low levels. New listings in most of these areas are down compared to January 2019 activity.

...

More local data coming in April for activity in March!

NAR: Pending Home Sales Increase 1.6% in February; Down 7.0% Year-over-year

by Calculated Risk on 3/28/2024 10:00:00 AM

From the NAR: Pending Home Sales Rose 1.6% in February

Pending home sales in January grew 1.6%, according to the National Association of REALTORS®. The Midwest and South posted monthly gains in transactions while the Northeast and West recorded losses. All four U.S. regions registered year-over-year decreases.This was slightly above expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 75.6 in February. Year over year, pending transactions were down 7.0%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI decreased 0.3% from last month to 63.4, a decline of 9.0% from February 2023. The Midwest index soared 10.6% to 81.6 in February, down 2.5% from one year ago.

The South PHSI rose 1.1% to 89.5 in February, falling 8.5% from the prior year. The West index fell 6.5% in February to 57.1, down 7.9% from February 2023.

emphasis added

Weekly Initial Unemployment Claims Decrease to 210,000

by Calculated Risk on 3/28/2024 08:35:00 AM

The DOL reported:

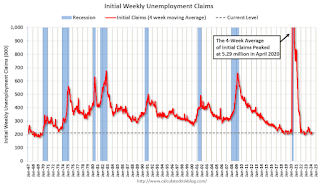

In the week ending March 23, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 210,000 to 212,000. The 4-week moving average was 211,000, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 211,250 to 211,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 211,000.

The previous week was revised up.

Weekly claims were close to the consensus forecast.

Q4 GDP Growth Revised Up to 3.4% Annual Rate

by Calculated Risk on 3/28/2024 08:30:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2023 (Third Estimate), GDP by Industry, and Corporate Profits

Real gross domestic product (GDP) increased at an annual rate of 3.4 percent in the fourth quarter of 2023, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 4.9 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 3.2 percent. The update primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment.

emphasis added

Wednesday, March 27, 2024

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 3/27/2024 07:41:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 4th Quarter and Year 2023 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 3.2% annualized in Q4, unchanged from the second estimate.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 210 thousand last week.

• At 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 43.0, down from 44.0 in February.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 2.0% increase in the index.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 76.5.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March. This is the last of the regional surveys for March.

Fannie and Freddie: Single Family Serious Delinquency Rate Decreased, Multi-family Decreased in February

by Calculated Risk on 3/27/2024 04:59:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rate Decreased, Multi-family Decreased in February

Brief excerpt:

Single-family serious delinquencies decreased in February, and multi-family serious delinquencies decreased after the huge surge in January.

...

Freddie Mac reports that the multi-family delinquencies rate declined to 0.35% in February, and down from 0.44% in January.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth has slowed, vacancy rates have increased, and borrowing rates have increased sharply. The rate surged higher in January but declined in February but is still at a high level. This will be something to watch as more apartments come on the market.

Philly Fed: State Coincident Indexes Increased in 49 States in January (3-Month Basis)

by Calculated Risk on 3/27/2024 01:12:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2024. Over the past three months, the indexes increased in 49 states and decreased in one state, for a three-month diffusion index of 96. Additionally, in the past month, the indexes increased in 39 states, decreased in seven states, and remained stable in four, for a one-month diffusion index of 64. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 0.6 percent over the past three months and 0.2 percent in January.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is almost all positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In January, 41 states had increasing activity including minor increases.

Inflation Adjusted House Prices 2.4% Below Peak; Price-to-rent index is 7.5% below 2022 peak

by Calculated Risk on 3/27/2024 09:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.4% Below Peak

Excerpt:

It has been over 17 years since the bubble peak. In the January Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 71% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $427,000 today adjusted for inflation (42% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.4% below the recent peak, and the Composite 20 index is 3.3% below the recent peak in 2022. Both indexes were mostly flat in January in real terms.

In real terms, national house prices are 10.2% above the bubble peak levels. There is an upward slope to real house prices, and it has been over 17 years since the previous peak, but real prices are historically high.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 3/27/2024 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 22, 2024.

The Market Composite Index, a measure of mortgage loan application volume, decreased 0.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 0.4 percent compared with the previous week. The Refinance Index decreased 2 percent from the previous week and was 9 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index increased 0.2 percent compared with the previous week and was 16 percent lower than the same week one year ago.

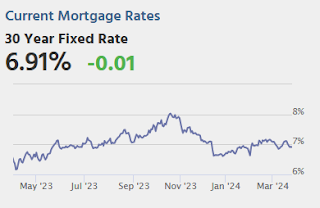

“Mortgage application activity was muted last week despite slightly lower mortgage rates. The 30-year fixed rate edged lower to 6.93 percent, but that was not enough to stimulate borrower demand,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications were essentially unchanged, as homebuyers continue to hold out for lower mortgage rates and for more listings to hit the market. Lower rates should help to free up additional inventory as the lock-in effect is reduced, but we expect that will only take place gradually, as we forecast that rates will move toward 6-percent by the end of the year. Similarly, with rates remaining elevated, there is very little incentive right now for rate/term refinances.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.93 percent from 6.97 percent, with points decreasing to 0.60 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.

Tuesday, March 26, 2024

Wednesday: Mortgage Applications

by Calculated Risk on 3/26/2024 07:42:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 3/26/2024 01:00:00 PM

Two key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through January 2024). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Comments on January House Prices, FHFA: House Prices Declined Slightly in January

by Calculated Risk on 3/26/2024 09:51:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 6.0% year-over-year in January; FHFA: House Prices Declined Slightly in January, up 6.3% YoY

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January closing prices). January closing prices include some contracts signed in September, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.36%. This was the twelfth consecutive MoM increase, and a larger MoM increase than the previous two months.

On a seasonally adjusted basis, prices increased month-to-month in 13 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 8.4% from the recent peak, Seattle is down 7.1% from the peak, Portland down 4.8%, and Phoenix is down 3.6%.

Case-Shiller: National House Price Index Up 6.0% year-over-year in January

by Calculated Risk on 3/26/2024 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in January 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.0% annual gain in January, up from a 5.6% rise in the previous month. The 10- City Composite showed an increase of 7.4%, up from a 7.0% increase in the previous month. The 20- City Composite posted a year-over-year increase of 6.6%, up from a 6.2% increase in the previous month. San Diego again reported the highest year-over-year gain among the 20 cities with an 11.2% increase in January, followed by Los Angeles, with an increase of 8.6%. Portland, though holding the lowest rank after reporting the smallest year-over-year growth, retained an upward trend with a 0.9% increase this month.

...

The U.S. National Index and the 20-City Composite showed a continued decrease of 0.1%, and 10-City Composite remained unchanged in January.

After seasonal adjustment, the U.S. National Index, the 20-City Composite, and the 10-City Composite all posted month-over-month increases of 0.4%, 0.1%, and 0.2% respectively.

“U.S. home prices continued their drive higher,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “Our National Composite rose by 6% in January, the fastest annual rate since 2022. Stronger gains came from our 10- and 20-City Composite indices, rising 7.4% and 6.6%, respectively. For the second consecutive month, all cities reported increases in annual prices, with San Diego surging 11.2%. On a seasonal adjusted basis, home prices have continued to break through previous all-time highs set last year”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.2% in January (SA). The Composite 20 index is up 0.1% (SA) in January.

The National index is up 0.4% (SA) in January.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 7.4% year-over-year. The Composite 20 SA is up 6.6% year-over-year.

The National index SA is up 6.0% year-over-year.

Annual price changes were at expectations. I'll have more later.

Monday, March 25, 2024

Tuesday: Case-Shiller House Prices, Durable Goods, Richmond and Dallas Fed Mfg

by Calculated Risk on 3/25/2024 07:37:00 PM

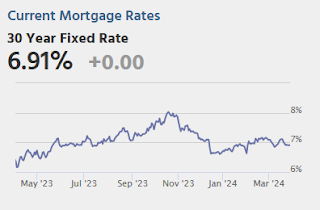

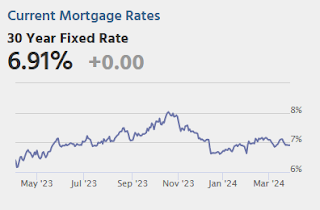

Mortgage rates enjoyed a decently strong week last week, with the average top tier conventional 30yr fixed rate moving down to 6.91% by Friday from 7.09% on the previous Friday. To put today's "unchanged" headline in perspective, that same number is up to 6.92% this afternoon. [30 year fixed 6.92%]Tuesday:

emphasis added

• At 8:30 AM ET, Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for January. The consensus is for a 5.8% year-over-year increase in the National index for January, up from 5.5% YoY in December.

• Also at 9:00 AM, FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for March.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March.

March Vehicle Sales Forecast: 15.6 million SAAR, Up 5% YoY

by Calculated Risk on 3/25/2024 01:47:00 PM

From WardsAuto: March U.S. Light-Vehicle Sales Tracking a Steady Course with Potential Upside (pay content). Brief excerpt:

If the March forecast holds firm, the first quarter will total a 15.5 million-unit seasonally adjusted annual rate, down from Q4-2023’s 15.7 million but up from like-2023’s 15.0 million. However, the forecasted steady climb in inventory should put sales in good stead to rise above 16-million-unit annualized rates for most of the remainder of 2024.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for March (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.6 million SAAR, would be down 1% from last month, and up 5% from a year ago.

New Home Sales at 662,000 Annual Rate in February; Median New Home Price is Down 19% from the Peak

by Calculated Risk on 3/25/2024 10:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales at 662,000 Annual Rate in February

Brief excerpt:

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 662 thousand. The previous three months were revised up slightly.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in February 2024 were up 5.9% from February 2023.

...

Note that the median and average price are down due to the mix of homes sold, not because of large price declines. Homebuilders are building less expensive homes to keep up volumes.

New Home Sales at 662,000 Annual Rate in February

by Calculated Risk on 3/25/2024 10:00:00 AM

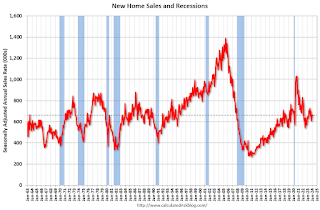

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 662 thousand.

The previous three months were revised up slightly.

Sales of new single‐family houses in February 2024 were at a seasonally adjusted annual rate of 662,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.3 percent below the revised January rate of 664,000, but is 5.9 percent above the February 2023 estimate of 625,000.

emphasis added

Click on graph for larger image.

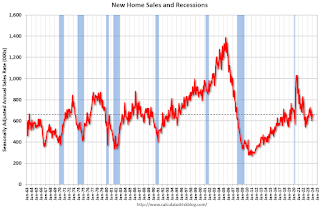

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

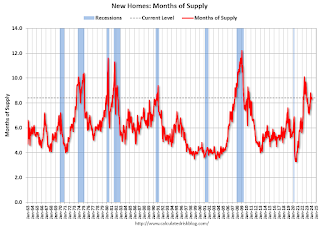

The second graph shows New Home Months of Supply.

The months of supply increased in February to 8.4 months from 8.3 months in January.

The months of supply increased in February to 8.4 months from 8.3 months in January. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of February was 463,000. This represents a supply of 8.4 months at the current sales rate."Sales were below expectations of 673 thousand SAAR, however, sales for the three previous months were revised up slightly. I'll have more later today.

Housing March 25th Weekly Update: Inventory Up 1.1% Week-over-week, Up 23.9% Year-over-year

by Calculated Risk on 3/25/2024 08:16:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, March 24, 2024

Monday: New Home Sales

by Calculated Risk on 3/24/2024 07:24:00 PM

Weekend:

• Schedule for Week of March 24, 2024

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for 673 thousand SAAR, up from 661 thousand in January.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 4 and DOW futures are down 47 (fair value).

Oil prices were down over the last week with WTI futures at $80.63 per barrel and Brent at $85.43 per barrel. A year ago, WTI was at $69, and Brent was at $74 - so WTI oil prices are up 17% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.53 per gallon. A year ago, prices were at $3.41 per gallon, so gasoline prices are up $0.12 year-over-year.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 3/24/2024 08:21:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 14 years. He has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales. Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.38 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | 4.72 |

| Jul-20 | 5.39 | 5.85 | 5.86 |

| Aug-20 | 6.00 | 5.92 | 6.00 |

| Sep-20 | 6.25 | 6.38 | 6.54 |

| Oct-20 | 6.45 | 6.63 | 6.85 |

| Nov-20 | 6.70 | 6.50 | 6.69 |

| Dec-20 | 6.55 | 6.62 | 6.76 |

| Jan-21 | 6.60 | 6.48 | 6.69 |

| Feb-21 | 6.51 | 6.29 | 6.22 |

| Mar-21 | 6.17 | 6.02 | 6.01 |

| Apr-21 | 6.09 | 5.96 | 5.85 |

| May-21 | 5.74 | 5.78 | 5.80 |

| Jun-21 | 5.90 | 5.79 | 5.86 |

| Jul-21 | 5.84 | 5.86 | 5.99 |

| Aug-21 | 5.88 | 5.90 | 5.88 |

| Sep-21 | 6.06 | 6.20 | 6.29 |

| Oct-21 | 6.20 | 6.34 | 6.34 |

| Nov-21 | 6.20 | 6.45 | 6.46 |

| Dec-21 | 6.45 | 6.33 | 6.18 |

| Jan-22 | 6.12 | 6.36 | 6.50 |

| Feb-22 | 6.16 | 5.97 | 6.02 |

| Mar-22 | 5.80 | 5.74 | 5.77 |

| Apr-22 | 5.62 | 5.57 | 5.61 |

| May-22 | 5.41 | 5.35 | 5.41 |

| Jun-22 | 5.40 | 5.12 | 5.12 |

| Jul-22 | 4.88 | 4.90 | 4.81 |

| Aug-22 | 4.70 | 4.84 | 4.80 |

| Sep-22 | 4.69 | 4.82 | 4.71 |

| Oct-22 | 4.39 | 4.49 | 4.43 |

| Nov-22 | 4.20 | 4.16 | 4.09 |

| Dec-22 | 3.95 | 3.96 | 4.02 |

| Jan-23 | 4.10 | 4.18 | 4.00 |

| Feb-23 | 4.18 | 4.51 | 4.58 |

| Mar-23 | 4.50 | 4.51 | 4.44 |

| Apr-23 | 4.30 | 4.33 | 4.28 |

| May-23 | 4.24 | 4.25 | 4.30 |

| Jun-23 | 4.23 | 4.26 | 4.16 |

| Jul-23 | 4.15 | 4.06 | 4.07 |

| Aug-23 | 4.10 | 4.07 | 4.04 |

| Sep-23 | 3.94 | 4.00 | 3.96 |

| Oct-23 | 3.93 | 3.94 | 3.79 |

| Nov-23 | 3.78 | 3.87 | 3.82 |

| Dec-23 | 3.84 | 3.84 | 3.78 |

| Jan-24 | 3.97 | 4.02 | 4.00 |

| Feb-24 | 3.94 | 4.40 | 4.38 |

| 1NAR initially reported before revisions. | |||

Saturday, March 23, 2024

Real Estate Newsletter Articles this Week: Single Family Starts Up 35% Year-over-year in February

by Calculated Risk on 3/23/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Increased to 4.38 million SAAR in February

• Single Family Starts Up 35% Year-over-year in February; Multi-Family Starts Down Sharply

• "The Lock-In Effect of Rising Mortgage Rates"

• California February Existing Home Sales increase 1.3% YoY, Prices up 9.7% YoY

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 24, 2024

by Calculated Risk on 3/23/2024 08:11:00 AM

The key reports scheduled for this week include February New Home sales, the 3rd estimate of Q4 GDP, February Personal Income & Outlays, and January Case-Shiller house prices.

For manufacturing, the March Dallas, Richmond and Kansas City Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 673 thousand SAAR, up from 661 thousand in January.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the National index for January, up from 5.5% YoY in December.

9:00 AM: FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM, Gross Domestic Product, 4th Quarter and Year 2023 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 3.2% annualized in Q4, unchanged from the second estimate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 210 thousand last week.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 43.0, down from 44.0 in February.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 2.0% increase in the index.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 76.5.

11:00 AM: the Kansas City Fed manufacturing survey for March. This is the last of the regional surveys for March.

All US markets will be closed in observance of Good Friday.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.8% YoY.

11:30 AM: Discussion, Fed Chair Jerome Powell, Moderated Discussion with Kai Ryssdal, At the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference, San Francisco, Calif