by Calculated Risk on 1/28/2022 11:01:00 AM

Friday, January 28, 2022

NMHC: January Apartment Market Survey shows "Strong Demand, Record-High Occupancy, Double Digit Rent Growth"

From the National Multifamily Housing Council (NMHC): January Apartment Market Conditions Show Improvement

Apartment market conditions generally improved according to the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for January 2022. The Market Tightness (69), Sales Volume (59), and Equity Financing (67) indexes all came in above the breakeven level (50) for the fourth quarter in a row, though many respondents indicated conditions remained unchanged across the indexes. The Debt Financing (36) index indicated weaker conditions for the second consecutive quarter.

“We are continuing to witness strong demand for apartments across the entire U.S., but most notably in the Sun Belt, where most markets have seen double-digit rent growth that has more than made up for the pandemic slowdown,” noted NMHC’s Chief Economist, Mark Obrinsky. “And even as construction continues to rebound from the lows of 2020, absorptions have more than kept pace, such that apartment occupancy remains at record-highs.”

Click on graph for larger image.

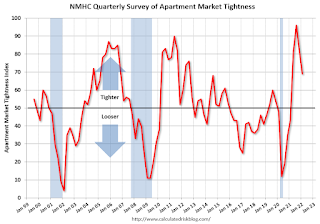

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Even though the index declined in January, this indicates market conditions tightened further in January for the fourth consecutive quarter, after being especially weak during the early months of the pandemic.