by Calculated Risk on 2/01/2021 04:00:00 PM

Monday, February 01, 2021

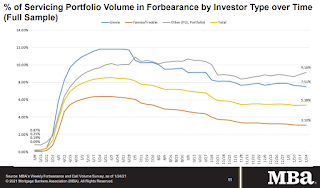

MBA Survey: "Share of Mortgage Loans in Forbearance Remains Unchanged at 5.38%"

Note: This is as of January 24th.

From the MBA: Share of Mortgage Loans in Forbearance Remains Unchanged at 5.38%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance remained unchanged relative to the prior week at 5.38% of servicers’ portfolio volume as of January 24, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“The share of loans in forbearance was unchanged in the prior week, with a gain in the portfolio/PLS loan segment offset by declines in the Ginnie Mae and GSE investor loan categories. When servicers buy out delinquent loans from Ginnie Mae pools, they are reclassified as portfolio loans, which can lead to a decrease in the Ginnie Mae forbearance share and an increase in the portfolio/PLS share,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While new forbearance requests dropped slightly, the rate of exits from forbearance was at the slowest pace since MBA began tracking exit data last summer.”

Fratantoni added, “Overall, the forbearance numbers have been little changed over the past few months. Homeowners still in forbearance are likely facing ongoing challenges with lost jobs, lost income, and other impacts from the pandemic.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, then trended down - and has mostly moved sideways recently.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.07% to 0.06%."