by Calculated Risk on 2/01/2021 05:39:00 PM

Monday, February 01, 2021

Black Knight Mortgage Monitor for December

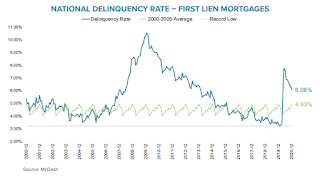

Black Knight released their Mortgage Monitor report for December today. According to Black Knight, 6.08% of mortgages were delinquent in December, down from 6.33% of mortgages in November, and up from 3.40% in December 2019. Black Knight also reported that 0.33% of mortgages were in the foreclosure process, down from 0.46% a year ago.

This gives a total of 6.54% delinquent or in foreclosure.

Press Release: Black Knight: 24% of Active Forbearance Plans Scheduled to End in March, When More than 600,000 Homeowners Face 12-Month Expirations

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI) released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. As the final, 12-month expiration point for many forbearance plans quickly approaches, this month’s report looks at how the slowdown in improvement in recent months may present new challenges to recovery for seriously delinquent homeowners. According to Black Knight Data & Analytics President Ben Graboske, the end of March 2021 is shaping up to be an inflection point for the industry.

“For the roughly 6.7 million Americans who have been in COVID-19 related mortgage forbearance at some point since the onset of the pandemic, the programs have represented an essential lifeline,” said Graboske. “The vast majority of plans have a 12-month cap on payment forbearance, though. And the various moratoriums which have kept foreclosure actions at bay over the past 10 months may be lulling us into a false sense of security about the scope of the post-forbearance problem we will need to confront come the end of March. Last year saw the largest number of homeowners – nearly 3.6 million – become 90 or more days past due since 2009, and as of the end of December, 2.1 million remained so.

“When nearly a quarter of all forbearance plans come to an end on March 31, at the current rate of improvement there would still be approximately 1.5 million more such serious delinquencies than before the pandemic. With that rate of improvement slowing in recent weeks, current trends suggest more than 2.5 million homeowners would still in forbearance at that point. While early in the pandemic roughly half of homeowners in forbearance continued to make their monthly mortgage payments, that number has steadily declined. Today, it’s about 12%, which suggests the people who are taking the full forbearance period afforded to them may well be experiencing prolonged financial distress, and face extended challenges as they return to making payments.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows Black Knight's estimate of inventory over the last several years.

From Black Knight:

• Severe inventory shortages persist across the country, with the number of homes listed for sale down 40% from last year, representing a 450K decline in the number of homes available for sale compared to the same time last year

• Even factoring in a slight downward trend in new listings in recent years, volumes for 2020 suggest that more than 750K homeowners chose to forego listing their homes for sale in 2020 because of the pandemic (a 16% decline year-over-year)

• Nearly 2/3 of the shortage of listings came in Q2 2020 alone, which was down more than 470K new listings from the year prior

• By December, new listings were flat year-over-year, suggesting that volumes may be normalizing to some degree; even so, a return to the status quo would still leave us at a significant deficit should buyer demand remain strong

And on delinquencies from Black Knight:

And on delinquencies from Black Knight: • December saw another modest improvement in mortgage delinquencies, with the national mortgage delinquency rate falling by 3.9% for the month to 6.08%There is much more in the mortgage monitor.

• Serious delinquencies (90+ days) also improved in December, falling to 3.43M from 3.56M the month prior

• Nearly 40% of the pandemic-related rise in overall delinquencies has now been reversed, but only 11% of the rise in serious delinquencies, providing a more accurate representation of the true recovery to date