by Calculated Risk on 2/04/2021 11:08:00 AM

Thursday, February 04, 2021

January Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for 50 thousand jobs added, and for the unemployment rate to be unchanged at 6.7%.

• ADP Report: The ADP employment report showed a gain of 174,000 private sector jobs, well above the consensus estimate of 45 thousand jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be stronger than expected.

• ISM Surveys: The ISM manufacturing employment index increased in January to 52.6%, up from 51.7% last month. This would suggest essentially approximately 5,000 manufacturing jobs lost in January. ADP showed 1,000 manufacturing jobs added.

The ISM Services employment index increased in January to 55.2%, from 48.7% in December. This would suggest around 215,000 service jobs added in January. Combined, the ISM surveys suggest around 210,000 private sector jobs added in January. The ISM surveys haven't been as useful as usual during the pandemic, but this does suggest the report could be stronger than expected.

• Unemployment Claims: The weekly claims report showed a high number of total continuing unemployment claims during the reference week, although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession! In general, weekly claims have been lower than expected, and this suggests the employment report could be stronger than expected.

• Weather: Weather is a wildcard every year during the winter. A mild winter can lead to a stronger jobs report, and it appears January 2021 was mild, suggesting a stronger than expected jobs report. After the report is released, the SF Fed will update their Weather-Adjusted Employment Change

• Seasonal Factor: The pandemic has caused problems with the seasonal factor, and the January report might be impacted significantly. Every January, the economy loses about 2.9 million jobs (NSA), and the seasonal factor accounts for those expected job losses. However, it seems likely that fewer jobs were lost (NSA) this January, and that would boost the headline number (seasonally adjusted). This is something to watch.

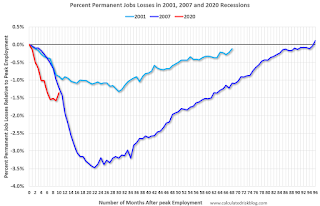

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been increasing, but declined in December.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been increasing, but declined in December.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. In December, the number of permanent job losers decreased to 3.370 million from 3.718 million in November. This is good news.

• Conclusion: Most of the indicators suggest a stronger report in January. My guess is the report will be higher than the consensus.