by Calculated Risk on 12/07/2020 06:26:00 PM

Monday, December 07, 2020

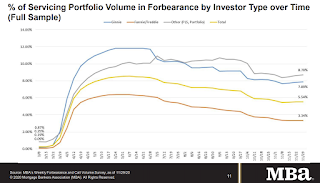

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 5.54%"

Note: This is as of November 29th.

From the MBA: Share of Mortgage Loans in Forbearance Remains Flat at 5.54%

he Mortgage Bankers Association's (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance remained unchanged relative to the prior week at 5.54% as of November 29, 2020. According to MBA's estimate, 2.8 million homeowners are in forbearance plans.

...

"After two weeks of increases, the share of loans in forbearance was unchanged for the week that included Thanksgiving. A small decline in forbearances for GSE loans was offset by increases for Ginnie Mae and portfolio loans," said Mike Fratantoni, MBA's Senior Vice President and Chief Economist. "While new forbearance requests declined for the week, exits slowed to a new low for the series."

Added Fratantoni, "The job market data for November showed an economic recovery that was slowing in response to the latest surge in COVID-19 cases. It is not surprising to see the rate of forbearance exits slow, as households that needed forbearance assistance in October may be in even greater need now."

...

By stage, 19.81% of total loans in forbearance are in the initial forbearance plan stage, while 77.90% are in a forbearance extension. The remaining 2.29% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.08%."