by Calculated Risk on 12/10/2020 01:25:00 PM

Thursday, December 10, 2020

Fed's Flow of Funds: Household Net Worth Increased $3.8 Trillion in Q3

The Federal Reserve released the Q3 2020 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $123.5 trillion in the third quarter of 2020. The value of directly and indirectly held corporate equities increased $2.8 trillion and the value of real estate increased $0.4 trillion.

Household debt increased 5.6 percent at an annual rate in the third quarter of 2020. Consumer credit grew at an annual rate of 1.9 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 5.6 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

With the sharp decline in GDP in Q2, net worth as a percent of GDP increased sharply. This reversed somewhat in Q3 as GDP bounced back (even as net worth increased)

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

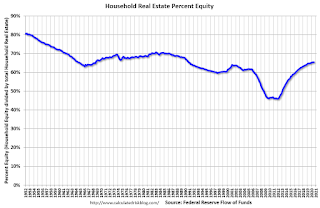

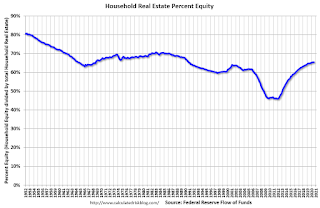

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2020, household percent equity (of household real estate) was at 65.5% - unchanged from Q2.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 65.5% equity - and about 1.6 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.

Mortgage debt increased by $158 billion in Q3.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 51.0% - down from Q2 - and down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, decreased in Q3 as GDP bounced back, and is above the average of the last 30 years.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2020, household percent equity (of household real estate) was at 65.5% - unchanged from Q2.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 65.5% equity - and about 1.6 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.Mortgage debt increased by $158 billion in Q3.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 51.0% - down from Q2 - and down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, decreased in Q3 as GDP bounced back, and is above the average of the last 30 years.