by Calculated Risk on 9/13/2020 09:47:00 AM

Sunday, September 13, 2020

FOMC Preview

Expectations are there will be no change to policy when the FOMC meets this week.

Here are some comments from Goldman Sachs economist David Mericle:

The Fed concluded its framework review between meetings with the adoption of a new flexible average inflation targeting strategy in August. We expect the FOMC to modify its post-meeting statement to recognize the new approach by replacing the current reference to its “symmetric 2 percent inflation objective” with a reference to “inflation that averages 2% over time.”For review, here are the June FOMC projections. Projections will be updated at this meeting and there will be substantial changes to GDP, the unemployment rate, and inflation projections.

The Summary of Economic Projections is likely to show large upgrades to the growth and unemployment forecasts in recognition of the surprisingly strong data over the last few months. But we expect that the median projection will still show an unemployment rate modestly above the longer-run rate and inflation just below 2% even at the end of the forecast horizon in 2023, a bit short of the conditions that we expect to eventually trigger liftoff.

Note that GDP decreased at a 5.0% annual rate in Q1, and decreased at a 31.7% annual rate in Q2.

Most forecasts are for GDP to increase at a 25% to 35% annual rate in Q3.

It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

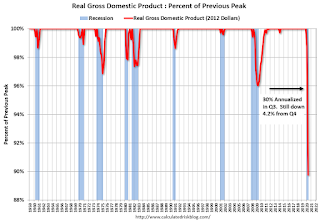

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Merrill Lynch is projecting:

We revise up our 3Q GDP forecast to 27% qoq saar from 15% previously, but take down 4Q to 3.0% qoq saar from 5.0%. 2Q GDP is tracking -31.6% qoq saar.Based on Merrill's projections, GDP would decline 4.0% in Q4 2020 compared to Q4 2019.

This suggests the FOMC will revise up their GDP projections for 2020, and possibly revise down their projections for the following years.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | -7.6 to -5.5 | 4.5 to 6.0 | 3.0 to 4.5 | |

The unemployment rate was at 8.4% in August. The unemployment rate declined faster than most expectations.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there almost 14 million people unemployed, close to 4 million people have left the labor force since January. And millions more are being supported by various provisions for the CARES Act - that hasn't been renewed

The unemployment rate will be revised down for all three years.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 9.0 to 10.0 | 5.9 to 7.5 | 4.8 to 6.1 | |

As of July 2020, PCE inflation was up 1.0% from July 2019. The projections for inflation will be revised up this month.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.6 to 1.0 | 1.4 to 1.7 | 1.6 to 1.8 | |

PCE core inflation was up 1.3% in July year-over-year. Projections for core inflation will be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.9 to 1.1 | 1.4 to 1.7 | 1.6 to 1.8 | |

Projections will change significantly this month, with GDP being revised up for 2020, and the unemployment rate revised down. Inflation will also be revised up.