by Calculated Risk on 4/07/2020 01:05:00 PM

Tuesday, April 07, 2020

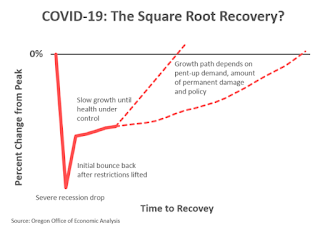

The "Square Root Recovery"

This is an interesting way to look at the eventual recovery, from Josh Lehner at the Oregon Office of Economic Analysis: COVID-19: The Square Root Recovery?

The thinking is as follows.

The sudden stop of the economy sends us into a severe recession overnight. Once the health situation improves some, the curve flattens and caseloads peak, the restrictions begin to be lifted. This results in some initial bounce back in economic activity, although far from 100%. We may be able to got out to eat, or get a haircut again, or the like. These firms will staff back up to meet this demand, but is the rebound 1/3 of the losses? 1/2 the losses? We don’t know that answer today. ...

This initial bounce back likely takes the economy from near-depression level readings up to something resembling a severe or bad recession. From there the economy sees slow or moderate rates of growth until the health situation is under control.

Click on graph for larger image.

Click on graph for larger image.This graph is from Josh Lehner.

Finally, just to be clear, none of this is designed to be pitting the economy against public health. Research shows they are clearly connected and in past episodes, the economy is stronger in places that improve public health the most. As Bill Conerly said the other week, if you tell me the health outcomes, I can tell you the path of the economy. That remains true today.