by Calculated Risk on 11/01/2019 10:05:00 AM

Friday, November 01, 2019

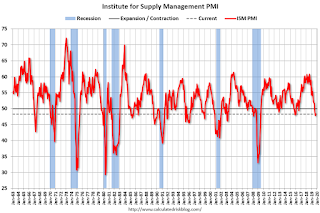

ISM Manufacturing index at 48.3 in October

The ISM manufacturing index indicated contraction in October. The PMI was at 48.3% in October, up from 47.8% in September. The employment index was at 47.7%, up from 46.3% last month, and the new orders index was at 49.1%, up from 47.3%.

From the Institute for Supply Management: October 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in October, and the overall economy grew for the 126th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The October PMI® registered 48.3 percent, an increase of 0.5 percentage point from the September reading of 47.8 percent. The New Orders Index registered 49.1 percent, an increase of 1.8 percentage points from the September reading of 47.3 percent. The Production Index registered 46.2 percent, down 1.1 percentage points compared to the September reading of 47.3 percent. The Backlog of Orders Index registered 44.1 percent, down 1 percentage point compared to the September reading of 45.1 percent. The Employment Index registered 47.7 percent, a 1.4-percentage point increase from the September reading of 46.3 percent. The Supplier Deliveries Index registered 49.5 percent, a 1.6-percentage point decrease from the September reading of 51.1 percent. The Inventories Index registered 48.9 percent, an increase of 2 percentage points from the September reading of 46.9 percent. The Prices Index registered 45.5 percent, a 4.2-percentage point decrease from the September reading of 49.7 percent. The New Export Orders Index registered 50.4 percent, a 9.4-percentage point increase from the September reading of 41 percent. The Imports Index registered 45.3 percent, a 2.8-percentage point decrease from the September reading of 48.1 percent.

“Comments from the panel reflect an improvement from the prior month, but sentiment remains more cautious than optimistic. October was the third consecutive month of PMI® contraction, at a slower rate compared to September. Demand contracted, with the New Orders Index contracting marginally, the Customers’ Inventories Index moving into ‘about right’ territory and the Backlog of Orders Index contracting for the sixth straight month (and at a faster rate). The New Export Orders Index surged into expansion territory, likely contributing to the slowing contraction of the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted, due primarily to lack of demand, but contributed positively (a combined +0.3-percentage point increase) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in October, due primarily to supplier delivery contraction offset by improvements in inventories. This resulted in a combined 0.4-percentage point net improvement in the Supplier Deliveries and Inventories indexes. Imports contraction quickened. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are more confident that materials received will be consumed in a reasonable time period. Prices decreased for the fifth consecutive month, at a faster rate.”

“Global trade remains the most significant cross-industry issue. Food, Beverage & Tobacco Products remains the strongest industry sector and Transportation Equipment the weakest sector. Overall, sentiment this month remains cautious regarding near-term growth,” says Fiore.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations of 49.0%, and suggests manufacturing contracted further in October.