by Calculated Risk on 3/07/2014 09:50:00 AM

Friday, March 07, 2014

Comments on Employment Report

First, a milestone for next month: Private payroll employment increased 162 thousand in February and private employment is now just 129 thousand below the previous peak (total employment is still 666 thousand below the peak in January 2008). It seems very likely that private employment will be at a new high in March.

Total non-farm employment will probably be at a new high this summer (all the government layoff have held back total employment).

This was a better employment report than the previous two months with 175,000 jobs added in February (and 25,000 in upward revisions to prior months). Hopefully job growth will be averaging over 200,000 jobs per month again soon (I expect stronger employment growth in 2014 than in 2013 even with the poor start to this year).

Employment-Population Ratio, 25 to 54 years old

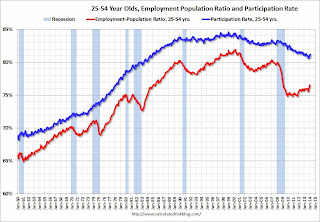

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in February to 81.2% from 81.1%, and the 25 to 54 employment population ratio was unchanged at 76.5%. As the recovery continues, I expect the participation rate for this group to increase.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels mid-year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 7.2 million in February. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.This is the lowest level for part time workers since October 2008.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 12.6% in February. This is the lowest level for U-6 since November 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.849 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 3.646 in January. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In February 2014, state and local governments added 19,000 jobs.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.

All things considered, this was a decent report. Hopefully the severe weather is behind us, and the pace of employment growth will pick up.