by Calculated Risk on 8/25/2013 04:46:00 PM

Sunday, August 25, 2013

The Future is still Bright!

For new readers: I was very bearish on the economy when I started this blog in 2005 - back then I wrote mostly about housing (see: LA Times article and more here for comments about the blog). I started looking for the sun in early 2009, and now I'm even more optimistic looking out over the next few years.

Early this year I wrote The Future's so Bright .... In that post I outlined why I was becoming more optimistic, even though there might be too much deficit reduction in 2013. As I noted, "ex-austerity, we'd probably be looking at a decent year" in 2013. And of course - looking forward - Congress remains the key downside risk to the U.S. economy.

It still appears economic growth will pickup over the next few years. With a combination of growth in the key housing sector, a significant amount of household deleveraging behind us, the end of the drag from state and local government layoffs (four years of austerity mostly over), some loosening of household credit, and the Fed staying accommodative (even if the Fed starts to taper, the Fed will remain accommodative).

Here are some updates to the graphs I posted in January:

Click on graph for larger image.

Click on graph for larger image.

This graph shows total and single family housing starts. Even after the 28.1% in 2012, the 780 thousand housing starts in 2012 were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959. Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

Residential investment and housing starts are usually the best leading indicator for economy, so this suggests the economy will continue to grow over the next couple of years.

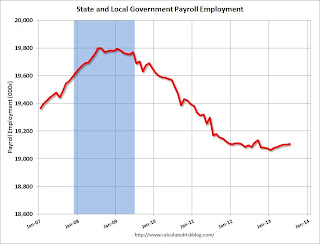

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

In 2012, state and local government employment declined by 26,000 jobs.

In 2013, state and local employment is up 31 thousand so far. So it appears that most of the state and local government layoffs are over and the drag on the economy is over.

And here is a key graph on the US deficit. This graph, based on the CBO's May projections, shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

And here is a key graph on the US deficit. This graph, based on the CBO's May projections, shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to under 3% in 2015 before starting to increase again. Of course many people (and many politicians) have been surprised by the rapid decline in the deficit (it was obvious to those of us paying attention).

Note: With 7.4% unemployment, there is a strong argument for less deficit reduction in the short term, but that view doesn't seem to be gaining any traction.

This graph from the the NY Fed shows aggregate consumer debt decreased further in Q2 2013. This was mostly due to a decline in mortgage debt.

From the NY Fed: "In Q2 2013 total household indebtedness fell to $11.15 trillion; 0.7 percent lower than the previous quarter and 12 percent below the peak of $12.68 trillion in Q3 2008. Mortgages, the largest component of household debt, fell $91 billion from the first quarter."

There will probably more deleveraging ahead (mostly from foreclosures and distressed sales), but this suggests some improvement in household balance sheets.

This graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

This graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages and consumer debt. The overall Debt Service Ratio increased slightly in Q1, and is just above the record low set in Q4 2012 thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt also increased slightly in Q1, and is back to levels last seen in early 1995.

The blue line is the homeowner's financial obligation ratio for mortgages (blue). This ratio increased rapidly during the housing bubble, and continued to increase until 2008. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined to 1998 (and 1981) levels.

Overall it appears the economy is poised for more growth over the next few years.

And in the longer term, I remain very optimistic too. I mentioned a few long term risks in my January post, but I also mentioned that I wasn't as concerned as many others about the aging of the population. By 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts are the youngest 11 cohorts. The renewing of America was one of the key points I made when I posted the following animation of the U.S population by age, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Last year, I said that looking forward I was the most optimistic since the '90s. And things are only getting better. The future's so bright, I gotta wear shades.

Yes, the song was about nuclear holocaust ... but it was originally intended the way I'm using it.