by Calculated Risk on 12/09/2012 10:15:00 AM

Sunday, December 09, 2012

FOMC Projections Preview

There are two key topics for the FOMC meeting this week: 1) What action to take when Operation Twist concludes at the end of year, and 2) whether or not to adopt a threshold rule for the Feds Fund Rate based on inflation and unemployment, and remove the forward guidance sentence from the statement.

My expectation is the FOMC will announce additional security purchases starting in January after the conclusion of Operation Twist. This will probably be announced this week and will be funded with reserve creation that will expand the Fed balance sheet. Note: Operation Twist didn't increase the Fed's balance sheet, but changed the composition of their securities holdings by selling short-term Treasury securities and buying longer-term Treasury securities.

The key questions are: the size of the additional purchases (some FOMC members have argued for $45 billion per month), the composition and maturity of the assets (Treasuries and MBS), and how long the purchases will continue (along with QE3). Goldman Sachs estimates:

"Looking further ahead, based on our economic forecasts the Fed may purchase up to $2 trillion in Treasury securities and MBS under QE3, before the first fed funds rate hike in early 2016."On thresholds: Currently the Fed has been including projections of when participants think the first rate increase will happen, and the FOMC statement includes the sentence: "[the FOMC] currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015". The could be replaced with general rules based on the unemployment rate and inflation.

Here are a couple of excerpts from the FOMC minutes for the October meeting:

Participants generally favored the use of economic variables, in place of or in conjunction with a calendar date, in the Committee's forward guidance, but they offered different views on whether quantitative or qualitative thresholds would be most effective. Many participants were of the view that adopting quantitative thresholds could, under the right conditions, help the Committee more clearly communicate its thinking about how the likely timing of an eventual increase in the federal funds rate would shift in response to unanticipated changes in economic conditions and the outlook.So the FOMC is leaning towards changing to thresholds, but it appears there is more work to do. This communication change could happen at the meeting this week, but my feeling is the FOMC will wait until early 2013.

...

Participants generally agreed that the Committee would need to resolve a number of practical issues before deciding whether to adopt quantitative thresholds to communicate its thinking about the timing of the initial increase in the federal funds rate. These issues included whether to specify such thresholds in terms of realized or projected values of inflation and the unemployment rate and, in either case, what values for those thresholds would best balance the Committee's objectives of promoting maximum employment and price stability. Another open question was whether to supplement thresholds expressed in terms of the unemployment rate and inflation with additional indicators of economic and financial conditions that might signal a need either to raise the federal funds rate before a threshold is crossed or to delay until well afterward.

emphasis added

In advance of the meeting, here is a look back at the previous projections from the September meeting.

Click on graph for larger image.

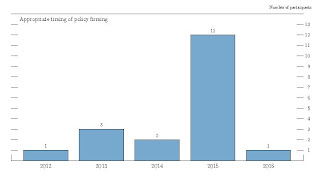

Click on graph for larger image.The first two charts are when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

If the FOMC moves to thresholds, this graph might be removed. However I expect the FOMC to wait until next year for thresholds, and the key will be to see if the views have shifted for when the first rate hike will occur.

"The dots represent individual policymakers’ projections of the appropriate federal funds rate target at the end of each of the next several years and in the longer run. Each dot in that chart represents one policymaker’s projection."

"The dots represent individual policymakers’ projections of the appropriate federal funds rate target at the end of each of the next several years and in the longer run. Each dot in that chart represents one policymaker’s projection."Most participants still think the Fed Funds rate will be in the current range through 2014.

On the projections, it looks like GDP and inflation will be close to the September FOMC projections. However the unemployment rate will be lower than projected. The key will be to look for changes in the 2013 and 2014 forecasts.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 |

Fiscal policy uncertainty makes it even more difficult to forecast GDP for 2013, but I expect the FOMC will revise down their 2013 forecasts.

The unemployment rate was at 7.9% in October and 7.7% in November (average of 7.8%). This is below the September projections, and suggests the unemployment rate projections for 2013 and 2014 will be revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 |

Both measures of inflation will be close to the September projections, and I expect the forecasts for inflation will show the FOMC is still not concerned about inflation going forward.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.8 | 1.6 to 2.0 | 1.6 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.9 | 1.7 to 2.0 | 1.8 to 2.0 |

Conclusion: I expect the FOMC to announce additional asset purchases at the meeting this week (to start at the conclusion of Operation Twist). It seems the FOMC will move to thresholds, but probably not until next year. On projections, I expect GDP to be revised down for 2013, and the unemployment rate to be revised lower for 2013 and 2014.