by Calculated Risk on 11/22/2012 07:30:00 PM

Thursday, November 22, 2012

Irwin: "Five economic trends to be thankful for"

From Neil Irwin at the WaPo looked for a few positives: Five economic trends to be thankful for. Some excerpts a few comments:

Household debt is way down. ... The good news is that in the past three years, Americans have made remarkable progress cleaning up their balance sheets and paying down those debts. After peaking at nearly 98 percent of economic output at the start of 2009, the household debt was down to 83 percent of GDP in the spring of 2012. ...CR Note: This level is still fairly high, but households have made progress. We will have more data next week when the NY Fed releases their Q3 Report on Household Debt and Credit.

Click on graph for larger image.

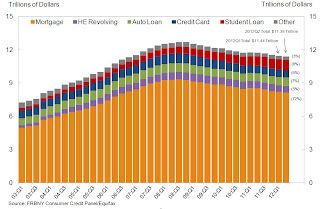

Click on graph for larger image.This graph is from the Q2 NY Fed Report on Household Debt and Credit and shows that aggregate consumer debt has been decreasing.

From the NY Fed: "Household indebtedness declined to $11.38 trillion [in Q2], a $53 billion decline from the first quarter of 2012. Outstanding household debt has decreased $1.3 trillion since its peak in Q3 2008."

Note: Irwin uses a different starting point, and also looks at household debt as percent of GDP (a good way to look at debt), and clearly household is debt is down significantly.

Irwin:

The cost of servicing that debt is way, way down. ... In late 2007, debt service payments added up to a whopping 14 percent of disposable personal income. Now it’s down to 10.7 percent, about the same as in the early 1990s. ..CR Note: Here is the data source: Household Debt Service and Financial Obligations Ratios.

Irwin:

Electricity and natural gas prices are falling. ... The retail price for consumers’ gas service piped into their homes is down 8.4 percent in the year ended in October. The lower wholesale price of natural gas is also pulling down electricity prices; they are off 1.2 percent over the past year. ...CR Note: I track the JOLTS data every month, and, as Irwin notes, layoffs and discharges are down.

Businesses aren’t firing people. ... While businesses aren’t adding new workers at a pace that would put the hordes of unemployed back on the job very rapidly, they also aren’t slashing jobs at a very rapid clip. Private employers laid off or discharged 1.62 million people in September, according to the Labor Department’s Job Openings and Labor Turnover data. ...

Irwin:

Housing is dramatically more affordable. ... In the spring of 2006, ... typical American home buyer would have faced a monthly mortgage payment of $1,247 a month ... home prices have fallen, so have mortgage rates ... Add it all up, and in the spring of 2012 that median American house would require a mortgage payment of only $889 a month ...CR Note: I'm not sure of all the numbers Irwin is using, but according to Case-Shiller, the Composite 20 house price index declined 31% from the peak (some areas more, some much less). Factor in low mortgage rates, and the payment would have fallen even further. There are definitely positive trends.

Happy Thanksgiving!