by Calculated Risk on 3/17/2012 04:25:00 PM

Saturday, March 17, 2012

Unofficial Problem Bank list declines to 952 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 16, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, the OCC release its actions through mid-February 2012 this week, which contributed to several changes to the Unofficial Problem Bank List.

In all, there were six removals and two additions, which leaves the list with 952 institutions with assets of $379.1 billion. Among the removals are one unassisted merger -- Mainline National Bank, Portage, PA ($235 million). The other removals are for action terminations including City National Bank of Florida, Miami, FL ($3.97 billion); Edgewater Bank, Saint Joseph, MI ($137 million); Bank of the Rio Grande, National Association, Las Cruces, NM ($102 million); First National Bank in Mahnomen, Mahnomen, MN ($72 million); and The First National Bank of Wayne, Wayne, NE ($35 million). The two additions this week were Lee County Bank & Trust, National Association, Fort Madison, IA ($163 million) and Mutual Federal Bank, Chicago, IL ($83 million).

Click on graph for larger image.

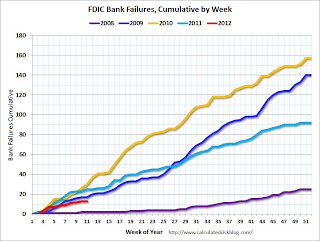

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 427 bank failures since the beginning of 2008, and so far closings this year are running at about half the rate of 2010 and 2011.

Earlier:

• Summary for Week ending March 16th

• Schedule for Week of March 18th