by Calculated Risk on 8/21/2006 07:27:00 PM

Monday, August 21, 2006

"Jingle Mail" and More

Phrase of the day from Fleck: Jingle Mail.

Jingle Mail: where homeowners have mailed in the keys because they can't make the payments and no longer have any equity in their homes.However, with the new bankruptcy law, some homeowners will still owe money on their homes even after they mail in the keys.

That phrase was a prominent feature of the S&L bust and ensuing real-estate debacle in 1990-1991 -- and something we'll be hearing lots more about in the future.

From Roubini: Recent Macro Indicators Strongly Reinforce My Recession Call...

The macroeconomic indicators published in the last week or so have strongly reinforced my out-of-consensus view that the US economy will fall into a recession by early 2007: quite simply most of them are headed sharply south, consistent with a sharp deceleration in growth in H2 that will lead to a recession by 2007.And a much more positive view on housing from two Fed economists - The great turn-of-the-century housing boom, Jonas D. M. Fisher and Saad Quayyum. Here are their conclusions:

This article has attempted to explain two features of the turn of the twenty-first century U.S. economy: high levels of residential investment and homeownership rates. Our main findings are as follows. First, it appears that the housing boom has not been driven by unusually loose monetary policy. This is not to say the monetary policy has not been unusually loose, but that to the extent it has been loose, this is not what has been driving spending on housing. Second, the current levels of spending on new housing are largely explained by technology-driven wealth creation over the previousI'm amazed by their conclusion. The authors clearly understood that the surge in residential investment was related to new mortgage products, but I believe they missed that excessive leverage can be considered speculation.

decade. Third, changes in the demographic, income, educational, and regional structure of the population account for about one-half of the increase in homeownership. That is, without any other developments, the homeownership rate is likely to have gone up anyway, but not by as much as it has done. The last finding is that substitution away from rental housing made possible by developments in the mortgage market, such as subprime lending, could account for a significant fraction of the increase in residential investment and homeownership.

We view our findings as supporting the view that the current housing boom may be a temporary transition toward an era with higher homeownership rates in which spending is temporarily higher than historical norms but will eventually return to such norms. While we have so far mostly avoided discussing housing prices, our findings do suggest that to the extent that house prices have grown considerably in recent years, this is not due to unusually excessive speculation in the housing market, such as would occur in a bubble. Instead, our findings point toward the high prices being driven by fundamentals.

"... substitution away from rental housing made possible by developments in the mortgage market, such as subprime lending, could account for a significant fraction of the increase in residential investment and homeownership."This type of leveraged activity pulls demand from future periods.

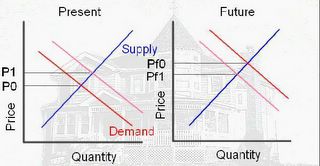

Starting with the first diagram on the left, these leveraged financing programs shift the demand curve to the right (light red) and increase the price from P0 to P1. In the future, the demand will be shifted to the left and the future price will be Pf1.

If Pf1 is less than P1, and the homeowner cannot make the mortgage payment, then the homeowner might resort to "jingle mail", and the supply will increase further - and depress prices even more.