by Calculated Risk on 12/10/2005 12:39:00 AM

Saturday, December 10, 2005

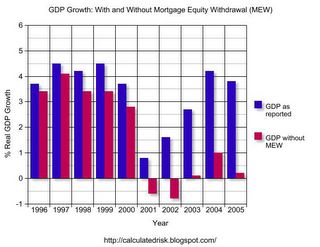

GDP Growth: With and Without Mortgage Extraction

The recent Flow of Funds report showed that household mortgages increased a record $289.5 Billion in Q3 2005. Using a simple formulation for Mortgage Equity Withdrawal (MEW), MEW was $171 Billion in Q3. Note: to calculate MEW, I simply subtracted new single family construction spending from the increase in household mortgages. This is close to other methods.

Click on graph for larger image.

Using Goldman's estimate of about 2/3 of MEW flowing through to personal consumption expenditures, it is possible to estimate the impact of MEW on GDP. Note: Some estimates are only about 50% of MEW flows through to consumption.

The graph clearly shows the importance of MEW over the last few years. For 2005, I used YTD compared to 2004.

Many observers estimate that MEW will fall significantly in the next few years. If so, this will be a drag on GDP as the growth of personal consumption expenditures slows.

The two most direct impacts of a housing slowdown are:

1) the loss of housing related employment.

2) lower MEW and the impact on personal consumption expenditures.

Earlier I posted two articles on the loss of housing related employment:

LA Times: Mortgage Industry Job Losses May Rise With Interest Rates

CNN: There go 800,000 jobs out the door

A significant drop in MEW will lead to the loss of retail related employment too.