by Calculated Risk on 9/15/2017 12:25:00 PM

Friday, September 15, 2017

Q3 GDP Forecasts: Moving Down

From Merrill Lynch:

The data [today] sliced 0.8pp from 3Q GDP tracking, down to 1.7%.From the Altanta Fed: GDPNow

emphasis added

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2017 is 2.2 percent on September 15, down from 3.0 percent on September 8. The forecasts of real consumer spending growth and real private fixed investment growth fell from 2.7 percent and 2.6 percent, respectively, to 2.0 percent and 1.4 percent, respectively, after this morning's retail sales release from the U.S. Census Bureau and this morning's report on industrial production and capacity utilization from the Federal Reserve Board of Governors.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.3% for 2017:Q3 and 1.8% for 2017:Q4.CR Note: Looks like weak real GDP growth in Q3, some due to the impact of the hurricanes.

BLS: Unemployment Rates Unchanged in 41 states in August, Tennessee at New Series Low

by Calculated Risk on 9/15/2017 10:28:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in August in 8 states, lower in 1 state, and stable in 41 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-one states had jobless rate decreases from a year earlier, 1 state had an increase, and 28 states and the District had little or no change. The national unemployment rate, 4.4 percent, was little changed from July but was 0.5 percentage point lower than in August 2016.

...

North Dakota and Colorado had the lowest unemployment rates in August, 2.3 percent and 2.4 percent, respectively. The rate in Tennessee (3.3 percent) set a new series low. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Eleven states have reached new all time lows since the end of the 2007 recession. These eleven states are: Arkansas, California, Colorado, Idaho, Maine, Mississippi, North Dakota, Oregon, Tennessee, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.2%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.2%) and New Mexico (6.3%). D.C. is at 6.4%.

Industrial Production Decreased 0.9% in August

by Calculated Risk on 9/15/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.9 percent in August following six consecutive monthly gains. Hurricane Harvey, which hit the Gulf Coast of Texas in late August, is estimated to have reduced the rate of change in total output by roughly 3/4 percentage point. The index for manufacturing decreased 0.3 percent; storm-related effects appear to have reduced the rate of change in factory output in August about 3/4 percentage point. The manufacturing industries with the largest estimated storm-related effects were petroleum refining, organic chemicals, and plastics materials and resins.

The output of mining fell 0.8 percent in August, as Hurricane Harvey temporarily curtailed drilling, servicing, and extraction activity for oil and natural gas. The output of utilities dropped 5.5 percent, as unseasonably mild temperatures, particularly on the East Coast, reduced the demand for air conditioning.

At 104.7 percent of its 2012 average, total industrial production in August was 1.5 percent above its year-earlier level. Capacity utilization for the industrial sector decreased 0.8 percentage point in August to 76.1 percent, a rate that is 3.8 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

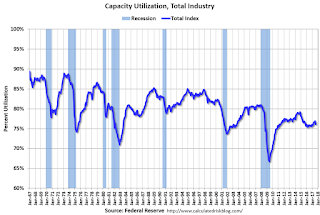

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.1% is 3.8% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in August to 104.7. This is 20.2% above the recession low, and close to the pre-recession peak.

The decrease was below expectations, largely due to Hurricane Harvey.

Retail Sales decreased 0.2% in August

by Calculated Risk on 9/15/2017 09:08:00 AM

On a monthly basis, retail sales decreased 0.2 percent from July to August (seasonally adjusted), and sales were up 3.2 percent from August 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $474.8 billion, a decrease of 0.2 percent from the previous month, and 3.2 percent above August 2016. ... The June 2017 to July 2017 percent change was revised from up 0.6 percent to up 0.3 percent.

Click on graph for larger image.

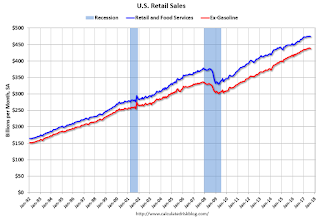

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.4% in August.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.1% on a YoY basis.The increase in August was below expectations, and sales in June and July were revised down.

Note: Hurricane Harvey impacted sales in August.

Thursday, September 14, 2017

Friday: Retail Sales, Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 9/14/2017 09:07:00 PM

From housing economist Tom Lawler:

Hurricane Harvey Hit Houston in the latter part of August, but that was enough to have a significant impact on home sales stats in the metro region. According to the Houston Association of Realtors, single family home sales by realtors this August were down 25.4% from last August (to 5,917 from 7,927), while condo/townhome sales were down 31.4% from a year ago to 443. September sales should be impacted even more.Friday:

• At 8:30 AM ET, Retail sales for August be released. The consensus is for a 0.1% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 19.0, down from 25.2.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.2% increase in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 96.0, down from 96.8 in August.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for August 2017

Phoenix Real Estate in August: Sales up slightly, Inventory down 7% YoY

by Calculated Risk on 9/14/2017 04:41:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in August were up 0.4% year-over-year.

2) Active inventory is now down 7.4% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the tenth consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (2.8% through June or 5.7% annual rate).

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Aug-08 | 5,660 | --- | 1,004 | 17.7% | 53,5691 | --- |

| Aug-09 | 8,008 | 41.5% | 2,849 | 35.6% | 38,085 | -28.9% |

| Aug-10 | 7,358 | -8.1% | 3,129 | 42.5% | 44,307 | 16.3% |

| Aug-11 | 8,712 | 18.4% | 3,953 | 45.4% | 26,983 | -39.1% |

| Aug-12 | 7,574 | -13.1% | 3,382 | 44.7% | 20,934 | -22.4% |

| Aug-13 | 7,055 | -6.9% | 2,409 | 34.1% | 21,444 | 2.4% |

| Aug-14 | 6,431 | -8.8% | 1,621 | 25.2% | 26,138 | 21.9% |

| Aug-15 | 7,023 | 9.2% | 1,588 | 22.6% | 22,554 | -13.7% |

| Aug-16 | 7,975 | 13.6% | 1,616 | 20.3% | 23,318 | 3.4% |

| Aug-17 | 8,010 | 0.4% | 1,541 | 19.2% | 21,590 | -7.4% |

| 1 August 2008 probably includes pending listings | ||||||

Key Measures Show Inflation mostly below 2% in August

by Calculated Risk on 9/14/2017 01:18:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (3.0% annualized rate) in August. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for August here. Motor fuel increased 107% in August, annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.9% annualized rate) in August. The CPI less food and energy rose 0.2% (3.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for July and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 3.0% annualized, trimmed-mean CPI was at 2.3% annualized, and core CPI was at 3.0% annualized.

Using these measures, inflation was soft year-over-year again in August (although inflation picked up month-to-month). Overall these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

Early Look at 2018 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/14/2017 11:01:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.9 percent over the last 12 months to an index level of 239.448 (1982-84=100). For the month, the index increased 0.3 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2016, the Q3 average of CPI-W was 235.057.

The 2016 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year. (Sometimes we have to look back two years).

For July and August 2017, the average is 239.0325 - or a 1.7% increase over the Q3 average last year. Inflation probably picked up a little in September due to the increase in gasoline prices following Hurricane Harvey, so COLA will probably be close to 2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.9% year-over-year in August, and although this is early - we still need the data for September - it appears COLA will be positive this year, and inflation probably picked up in September due to Hurricane Harvey and gasoline prices - so COLA will probably be close to 2% this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA (seems likely this year), the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2016 yet, but wages probably increased again in 2016. If wages increased the same as last year, then the contribution base next year will increase to around $131,500 from the current $127,200.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. We still need the data for September, but it appears COLA will be close to 2%, and the contribution base will increase next year.

Weekly Initial Unemployment Claims decrease to 284,000

by Calculated Risk on 9/14/2017 08:37:00 AM

The DOL reported:

In the week ending September 9, the advance figure for seasonally adjusted initial claims was 284,000, a decrease of 14,000 from the previous week's unrevised level of 298,000. The 4-week moving average was 263,250, an increase of 13,000 from the previous week's unrevised average of 250,250. This is the highest level for this average since August 13, 2016 when it was 263,250.The previous week was unrevised.

Hurricanes Harvey and Irma impacted this week's initial claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 263,250.

This was below the consensus forecast.

The report next week will include the reference period (includes the 12th of the month) for the September employment report - and will provide a hint on the impact of the hurricanes on employment in September.

Wednesday, September 13, 2017

Thursday: Unemployment Claims, CPI

by Calculated Risk on 9/13/2017 06:26:00 PM

Goldman economists on inflation:

The next piece of inflation news is the August CPI report, to be released on Thursday. We expect a 0.20% increase on the core and a 0.36% increase on the headline. Two special factors—a rebound in hotel prices and a price increase by Verizon—account for about 0.05pp of our core forecast.Thursday:

Looking further ahead with our bottom-up forecasting model, we expect core PCE to round to 1.5% by October, the last core PCE report before the December FOMC meeting, and to reach 1.6% by end-2017 and 1.9% by end-2018. The acceleration in our forecast is driven by (1) pass-through from energy prices and the dollar; (2) declining slack; and (3) the dropping out of earlier idiosyncratic declines that appear unlikely to be repeated next year.

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 300 thousand initial claims, up from 298 thousand the previous week.

• Also at 8:30 AM, The Consumer Price Index for August from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.2% increase in core CPI.