by Calculated Risk on 6/23/2017 11:59:00 AM

Friday, June 23, 2017

A few Comments on May New Home Sales

New home sales for May were reported at 610,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, and the three previous months combined were revised up. Overall this was a solid report.

Sales were up 8.9% year-over-year in May.

Earlier: New Home Sales increase to 610,000 Annual Rate in May.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 8.9% year-over-year in May.

For the first five months of 2017, new home sales are up 12.2% compared to the same period in 2016.

This was a strong year-over-year increase through May, however sales were weak in Q1 last year, so this was a somewhat easy comparison.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 610,000 Annual Rate in May

by Calculated Risk on 6/23/2017 10:15:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 610 thousand.

The previous three months combined were revised up.

"Sales of new single-family houses in May 2017 were at a seasonally adjusted annual rate of 610,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.9 percent above the revised April rate of 593,000 and is 8.9 percent above the May 2016 estimate of 560,000."

emphasis added

Click on graph for larger image.

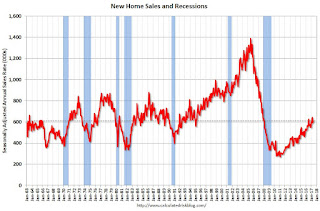

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in May at 5.3 months.

The months of supply was unchanged in May at 5.3 months. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of May was 268,000. This represents a supply of 5.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2017 (red column), 58 thousand new homes were sold (NSA). Last year, 53 thousand homes were sold in May.

The all time high for May was 120 thousand in 2005, and the all time low for May was 26 thousand in 2010.

This was above expectations of 590,000 sales SAAR, and the previous months were revised up. A solid report. I'll have more later today.

Thursday, June 22, 2017

Friday: New Home Sales

by Calculated Risk on 6/22/2017 06:50:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Lower

Mortgage rates have been so little-changed in recent days that yesterday's coverage wouldn't need to be changed in order to apply perfectly today.Friday:

...

The absence of change continues to be a good thing given that rates remain very close to their lowest levels in more than 8 months. Only a handful of recent days have been any better. 4.0% is the most prevalently-quoted conventional 30yr fixed rate on top tier scenarios, though a few of the aggressive lenders remain at 3.875%.

• At 8:30 AM ET: New Home Sales for May from the Census Bureau. The consensus is for an increase in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 569 thousand in April.

U.S. Demographics: The Millennials Take Over

by Calculated Risk on 6/22/2017 02:29:00 PM

From the Census Bureau The Nation’s Older Population Is Still Growing, Census Bureau Reports

New detailed estimates show the nation’s median age — the age where half of the population is younger and the other half older — rose from 35.3 years on April 1, 2000, to 37.9 years on July 1, 2016.

“The baby-boom generation is largely responsible for this trend,” said Peter Borsella, a demographer in the Population Division. “Baby boomers began turning 65 in 2011 and will continue to do so for many years to come.”

Residents age 65 and over grew from 35.0 million in 2000, to 49.2 million in 2016, accounting for 12.4 percent and 15.2 percent of the total population, respectively.

Click on graph for larger image.

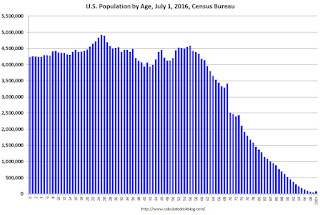

Click on graph for larger image.This graph uses the data in the July 1, 2016 estimate released today.

Using the Census data, here is a table showing the ten most common ages in 2010 and 2016.

Note the younger baby boom generation dominated in 2010. By 2016 the millennials have taken over. The six largest groups, by age, are in their 20s - and eight of the top ten are in their 20s.

My view is this is positive for both housing and the economy.

| Population: Most Common Ages by Year | ||

|---|---|---|

| 2010 | 2016 | |

| 1 | 50 | 25 |

| 2 | 49 | 26 |

| 3 | 20 | 24 |

| 4 | 19 | 23 |

| 5 | 47 | 27 |

| 6 | 46 | 22 |

| 7 | 48 | 55 |

| 8 | 51 | 28 |

| 9 | 18 | 21 |

| 10 | 52 | 55 |

Kansas City Fed: Regional Manufacturing Activity "Expanded Further" in June

by Calculated Risk on 6/22/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded further with strong expectations for future activity.The Kansas City region was hit hard by the sharp decline in oil prices, but activity has been expanding as oil prices increased. It is too early to tell if the recent decline in oil prices will impact the Kansas City region again.

“Firms reported faster growth in June than earlier in the second quarter,” said Wilkerson. “The share of factories planning to add workers over the next six months also rose solidly.”

...

The month-over-month composite index was 11 in June, up from 8 in May and 7 in April. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ...

emphasis added

Black Knight: Mortgage Delinquencies Decreased in May, Foreclosures at 10-Year Lows

by Calculated Risk on 6/22/2017 09:30:00 AM

From Black Knight: Prepayments (historically a good indicator of refinance activity) jumped 23 percent month-over-month, reaching their highest point so far in 2017

• Prepayments (historically a good indicator of refinance activity) jumped 23 percent month-over-month, reaching their highest point so far in 2017According to Black Knight's First Look report for May, the percent of loans delinquent decreased 7.1% in May compared to April, and declined 10.8% year-over-year.

• Delinquencies reversed course after calendar driven increase in April, falling 7.13 percent month-over-month

• April’s delinquency rate increase was primarily calendar-driven (due to both the month ending on a Sunday and March being the typical calendar-year low) and largely isolated to early-stage delinquencies

• Inventory of loans either seriously delinquent (90 or more days past due) or in active foreclosure continues to improve, with both hitting 10-year lows in May

The percent of loans in the foreclosure process declined 3.0% in May and were down 26.9% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.79% in May, down from 4.08% in April.

The percent of loans in the foreclosure process declined in May to 0.83%.

The number of delinquent properties, but not in foreclosure, is down 226,000 properties year-over-year, and the number of properties in the foreclosure process is down 153,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2017 | Apr 2017 | May 2016 | May 2015 | |

| Delinquent | 3.79% | 4.08% | 4.25% | 4.91% |

| In Foreclosure | 0.83% | 0.85% | 1.13% | 1.59% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,927,000 | 2,072,000 | 2,153,000 | 2,478,000 |

| Number of properties in foreclosure pre-sale inventory: | 421,000 | 433,000 | 574,000 | 803,000 |

| Total Properties | 2,348,000 | 2,505,000 | 2,727,000 | 3,280,000 |

Weekly Initial Unemployment Claims increase to 241,000

by Calculated Risk on 6/22/2017 08:34:00 AM

The DOL reported:

In the week ending June 17, the advance figure for seasonally adjusted initial claims was 241,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 237,000 to 238,000. The 4-week moving average was 244,750, an increase of 1,500 from the previous week's revised average. The previous week's average was revised up by 250 from 243,000 to 243,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 244,750.

This was close to the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, June 21, 2017

Thursday: Unemployment Claims

by Calculated Risk on 6/21/2017 08:58:00 PM

Thursday:

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 237 thousand the previous week.

• At 9:00 AM, FHFA House Price Index for April 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for June.

Philly Fed: State Coincident Indexes increased in 36 states in May

by Calculated Risk on 6/21/2017 03:55:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2017. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78. In the past month, the indexes increased in 36 states, decreased in seven, and remained stable in seven, for a one-month diffusion index of 58.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In May, 43 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices. The reason for the recent decrease in the number of states with increasing activity is unclear - and might be revised away.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

A Few Comments on May Existing Home Sales

by Calculated Risk on 6/21/2017 12:42:00 PM

Earlier: NAR: "Existing-Home Sales Rise 1.1 Percent in May"

Two key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. The NAR reported sales of 5.62 million SAAR, Lawler projected 5.65 million SAAR, and the consensus was 5.55 million SAAR. See: Lawler: Early Read on Existing Home Sales in May

"I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.65 million in May, up 1.4% from April’s preliminary pace and up 3.3% from last May’s seasonally adjusted pace."2) Inventory is still very low and falling year-over-year (down 8.4% year-over-year in May).

I started the year expecting inventory would be increasing year-over-year by the end of 2017. That now seems unlikely, but still possible.

More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in May (red column) were above May2016. (NSA) - and the highest for May since 2006.

Note that sales NSA are now in the seasonally strong period (March through September).