by Calculated Risk on 2/16/2017 03:11:00 PM

Thursday, February 16, 2017

Comments on January Housing Starts

Earlier: Housing Starts at 1.246 Million Annual Rate in January

The housing starts report released this morning showed starts were down in January compared to December 2016, however starts in December (and November) were revised up sharply. Starts in January were actually somewhat above consensus - and above the preliminary release for December.

Note that multi-family is frequently volatile month-to-month, and has seen especially wild swings over the last five months. Single family starts were solid in January.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 10.5% in January 2017 compared to January 2016.

My guess is starts will increase around 3% to 7% in 2017.

This is a solid start to 2017.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has started to decline. Completions (red line) have lagged behind - but completions have been generally catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect a few years of increasing single family starts and completions.

NY Fed: Household Debt Increases Substantially, Approaching Previous Peak

by Calculated Risk on 2/16/2017 11:22:00 AM

The Q4 report was released today: Household Debt and Credit Report.

From the NY Fed: Household Debt Increases Substantially, Approaching Previous Peak

he Federal Reserve Bank of New York today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt increased substantially by $226 billion (a 1.8% increase) to $12.58 trillion during the fourth quarter of 2016. This marked the largest quarterly increase in total household debt since the fourth quarter of 2013, and debt today is now just 0.8% below its peak of $12.68 trillion reached in the third quarter of 2008. Every type of debt increased since the previous quarter, with a 1.6% increase in mortgage debt, 1.9% increase in auto loan balances, a 4.3% increase in credit card balances, and a 2.4% percent increase in student loan balances. This boost in balances was in part driven by new extensions of credit, with a large increase in the volume of mortgage originations and a continuation in the strong recent trend in auto loan originations. This report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

...

Mortgage balances increased and mortgage originations reached the highest level seen since the beginning of the Great Recession.

Mortgage delinquencies remained mostly unchanged and the delinquency transition rates for current mortgage accounts improved slightly.

New foreclosure notations reached another new low for the 18-year history of this series.

...

Overall delinquency rates were roughly stable this quarter.

This quarter saw the lowest number of bankruptcy notations in the 18-year history of this series, continuing an overall downward trend since the financial crisis.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt increased in Q4, from the NY Fed:

Mortgage balances, the largest component of household debt, increased during the fourth quarter. Mortgage balances shown on consumer credit reports on December 31 stood at $8.48 trillion, an increase of $130 billion from the third quarter of 2016.

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate was mostly unchanged in Q4. From the NY Fed:

Delinquency rates were roughly stable in the last quarter of 2016, with a small uptick in severely derogatory balances offset by a modest improvement in 30 days delinquent balances. As of December 31st, 4.8% of outstanding debt was in some stage of delinquency. Of the $607 billion of debt that is delinquent, $412 billion is seriously delinquent (at least 90 days late or “severely derogatory”).

Philly Fed: Manufacturing Conditions Continued to Improve in February

by Calculated Risk on 2/16/2017 10:15:00 AM

Earlier from the Philly Fed: Manufacturing Conditions Continued to Improve in February

Results from the February Manufacturing Business Outlook Survey suggest that growth in regional manufacturing is broadening. The diffusion indexes for general activity, new orders, and shipments were all positive this month and increased notably from their readings last month. The surveyed firms continued to report growth in employment and work hours. Although they moderated from last month, the future indexes for growth over the next six months continued to reflect a high degree of optimism.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The index for current manufacturing activity in the region increased from a reading of 23.6 in January to 43.3 this month and has remained positive for seven consecutive months. ...

...

Firms continued to report overall increases in manufacturing employment this month. ... The current employment index fell 2 points but has now registered its third consecutive positive reading. Firms reported an increase in work hours this month: The average workweek index increased 7 points and has now been positive for four consecutive months.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

It seems likely the ISM manufacturing index will show faster expansion again in February.

Weekly Initial Unemployment Claims increase to 239,000

by Calculated Risk on 2/16/2017 09:02:00 AM

The DOL reported:

In the week ending February 11, the advance figure for seasonally adjusted initial claims was 239,000, an increase of 5,000 from the previous week's unrevised level of 234,000. The 4-week moving average was 245,250, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 244,250 to 244,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 245,250.

This was below the consensus forecast.

The low level of claims suggests relatively few layoffs.

Housing Starts at 1.246 Million Annual Rate in January

by Calculated Risk on 2/16/2017 08:36:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,246,000. This is 2.6 percent below the revised December estimate of 1,279,000, but is 10.5 percent above the January 2016 rate of 1,128,000. Single-family housing starts in January were at a rate of 823,000; this is 1.9 percent above the revised December figure of 808,000. The January rate for units in buildings with five units or more was 421,000.

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,285,000. This is 4.6 percent above the revised December rate of 1,228,000 and is 8.2 percent above the January 2016 rate of 1,188,000. Single-family authorizations in January were at a rate of 808,000; this is 2.7 percent below the revised December figure of 830,000. Authorizations of units in buildings with five units or more were at a rate of 446,000 in January.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in January compared to December. Multi-family starts are up year-over-year.

Multi-family is volatile, and the swings have been huge over the last five months.

Single-family starts (blue) increased in January, and are up 6% year-over-year.

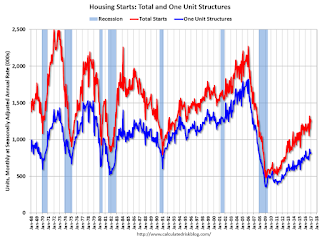

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in January were above expectations. Also November and December were revised up sharply. Another solid report. I'll have more later ...

Wednesday, February 15, 2017

Thursday: Housing Starts, Philly Fed Mfg, Q4 Household Debt and Credit

by Calculated Risk on 2/15/2017 08:27:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Approach 3-Week Highs

Mortgage rates rose for the 5th day in a row following a higher reading in this morning's inflation data and an upbeat Retail Sales report. ... Today's increase brings mortgage rates close to their highest level in 3 weeks. You'd have to go back to January 25th to see worse. That said, "worse" is a relative term. Both then and now, a top tier scenario would result in a conventional 30yr fixed rate of 4.25%. Today's upfront costs would be just slightly lower. Only a few lenders remain at 4.125% on comparable scenarios and several have moved up to 4.375%.Thursday:

emphasis added

• At 8:30 AM, 8:30 AM: Housing Starts for January. The consensus is for 1.232 million, up from the December rate of 1.226 million.

• Also at 8:30 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of 23.6, up from 19.3.

• At 11:00 AM, The New York Fed will release their Q4 2016 Household Debt and Credit Report

MBA: Mortgage Delinquencies Increased in Q4, Foreclosures Decreased

by Calculated Risk on 2/15/2017 02:56:00 PM

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.80 percent of all loans outstanding at the end of the fourth quarter of 2016. The delinquency rate was up 28 basis points from the previous quarter, and was three basis points higher than one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 0.28 percent, a decrease of two basis points from the previous quarter, and eight basis points lower than one year ago. This is the lowest rate of new foreclosures started since the fourth quarter of 1988.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 1.53 percent, down two basis points from the third quarter and 24 basis points lower than one year ago. This was the lowest foreclosure inventory rate since the second quarter of 2007.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 3.13 percent, an increase of 17 basis points from last quarter, and a decrease of 31 basis points from last year.

Marina Walsh, MBA's Vice President of Industry Analysis, offered the following commentary on the survey: "We saw a mixed set of results in the most recent survey. Mortgage delinquencies increased in the fourth quarter for the first time since 2013, while both new foreclosure starts and the percentage of loans in foreclosure continued to decline.

"The overall delinquency rate in the fourth quarter increased across all loan types - FHA, VA and conventional - as compared to the third quarter. However, it should be noted that last quarter's overall delinquency rate was at its lowest level since 2006. It is not unexpected that delinquencies could eventually increase off such a low base. We continue to see strong fundamentals in the overall economy, such as rising home values and increased employment, which bodes well for the future performance of FHA, VA and conventional loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Note that the total percent delinquencies and foreclosures is below the 2002 level.

The percent of loans 30 and 60 days delinquent increased in Q4, but is below the normal historical level.

The 90 day bucket increased in Q4, and remains a little elevated.

The percent of loans in the foreclosure process continues to decline, but is still above the historical average.

The 90 day bucket and foreclosure inventory are still elevated, but should be close to normal in 2017. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Key Measures Show Inflation close to 2% in January

by Calculated Risk on 2/15/2017 12:22:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.3% annualized rate) in January. The 16% trimmed-mean Consumer Price Index also rose 0.3% (3.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for January here. Motor fuel was up 149% annualized in January!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.6% (6.8% annualized rate) in January. The CPI less food and energy rose 0.3% (3.8% annualized rate) on a seasonally adjusted basis.

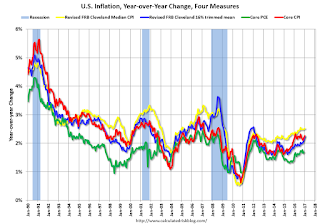

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.3%. Core PCE is for December and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 3.3% annualized, trimmed-mean CPI was at 3.7% annualized, and core CPI was at 3.8% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are above the Fed's 2% target (Core PCE is still below).

NAHB: Builder Confidence decreased to 65 in February

by Calculated Risk on 2/15/2017 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 65 in February, down from 67 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Continues to Settle Back to Sustainable Levels in February

Builder confidence in the market for newly-built single-family homes declined two points in February to a level of 65 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

...

“With much of the decline this month resulting from a decrease in buyer traffic, builders continue to struggle to minimize costs while dealing with supply side challenges such as a lack of developed lots and labor shortages,” said NAHB Chief Economist Robert Dietz. “Despite these constraints, the overall housing market fundamentals remain strong and we expect to see continued growth this year as some of these concerns are addressed.”

All three HMI components fell in February. The component gauging current sales conditions dipped one point to 71, and the index charting sales expectations in the next six months registered a three-point decline to 73. The component measuring buyer traffic dropped five points to 46.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell two points to 50 and the Midwest rose one point to 65. The South dipped one point to 67 and the West held steady at 79 for the third month in a row.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 68, but still another solid reading.

Industrial Production decreased 0.3% in January

by Calculated Risk on 2/15/2017 09:22:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.3 percent in January following a 0.6 percent increase in December. In January, manufacturing output moved up 0.2 percent, and mining output jumped 2.8 percent. The index for utilities fell 5.7 percent, largely because unseasonably warm weather reduced the demand for heating. At 104.6 percent of its 2012 average, total industrial production in January was at about the same level as it was a year earlier. Capacity utilization for the industrial sector fell 0.3 percentage point in January to 75.3 percent, a rate that is 4.6 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.3% is 4.6% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in January to 104.6. This is 19.7% above the recession low, and is close to the pre-recession peak.

This was below expectations of no change, but December was revised up.