by Calculated Risk on 12/06/2016 04:44:00 PM

Tuesday, December 06, 2016

Phoenix Real Estate in November: Sales up 30%, Inventory down 2%

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was down 2% year-over-year in October. This followed eight consecutive months with a YoY increase in inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in November were up 30.2% year-over-year.

2) Cash Sales (frequently investors) were down to 23.4% of total sales.

3) Active inventory is now down 1.8% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

This slight decrease in inventory followed eight monthly YoY increases. This might be a change in trend - something to watch.

| November Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Nov-08 | 4,417 | --- | 1,217 | 27.6% | 56,2271 | --- |

| Nov-09 | 7,494 | 69.7% | 2,572 | 34.3% | 40,372 | -28.2% |

| Nov-10 | 6,789 | -9.4% | 2,966 | 43.7% | 45,353 | 12.3% |

| Nov-11 | 7,147 | 5.3% | 3,245 | 45.4% | 26,798 | -40.9% |

| Nov-12 | 6,810 | -4.7% | 2,945 | 43.2% | 23,232 | -13.3% |

| Nov-13 | 5,181 | -23.9% | 1,761 | 34.0% | 26,762 | 15.2% |

| Nov-14 | 4,986 | -3.8% | 1,396 | 28.0% | 27,426 | 2.5% |

| Nov-15 | 5,308 | 6.5% | 1,542 | 29.1% | 25,022 | -8.8% |

| Nov-16 | 6,911 | 30.2% | 1,618 | 23.4% | 24,582 | -1.8% |

| 1 November 2008 probably includes pending listings | ||||||

EIA: "Retail gasoline prices are forecast to average $2.30/gal in 2017"

by Calculated Risk on 12/06/2016 01:43:00 PM

The EIA released the Short-Term Energy Outlook today. From the STEO:

• U.S. crude oil production averaged 9.4 million barrels per day (b/d) in 2015, and it is forecast to average 8.9 million b/d in 2016 and 8.8 million b/d in 2017.WTI is currently at $50.69 per barrel, and Brent at $53.86 per barrel. So the EIA isn't expecting any further increase in 2017 (on average).

• EIA forecasts Brent crude oil prices to average $43 per barrel (b) in 2016 and $52/b in 2017. West Texas Intermediate (WTI) crude oil prices are forecast to average about $1/b less than Brent prices in 2017. The values of futures and options contracts indicate significant uncertainty in the price outlook. The NYMEX contract values for March 2017 delivery traded during the five-day period ending December 1 suggest that a range from $34/b to $71/b encompasses the market expectation of WTI prices in March 2017 at the 95% confidence level.

• Lower crude oil prices contributed to U.S. average retail regular gasoline prices in November averaging $2.18 per gallon (gal), a decline of 7 cents/gal from the October level. EIA expects gasoline prices to fall to an average of $2.10/gal in January. Retail gasoline prices are forecast to average $2.14/gal in 2016 and $2.30/gal in 2017.

• Global oil inventory builds are forecast to average 0.7 million b/d in 2016 and 0.4 million b/d in 2017.

emphasis added

CoreLogic: House Prices up 6.7% Year-over-year in October

by Calculated Risk on 12/06/2016 10:30:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6.7 Percent in October 2016

Home prices nationwide, including distressed sales, increased year over year by 6.7 percent in October 2016 compared with October 2015 and increased month over month by 1.1 percent in October 2016 compared with September 2016, according to the CoreLogic HPI.

...

“While national home prices increased 6.7 percent, only nine states had home price growth at the same rate of growth or higher than the national average because the largest states, such as Texas, Florida and California, are experiencing high rates of home price appreciation,” said Dr. Frank Nothaft, chief economist for CoreLogic.

“Home prices are continuing to soar across much of the U.S. led by major metro areas such as Boston, Los Angeles, Miami and Denver. Prices are being fueled by a potent cocktail of high demand, low inventories and historically low interest rates,” said Anand Nallathambi, president and CEO of CoreLogic. “Looking forward to next year, nationwide home prices are expected to climb another 5 percent in many parts of the country to levels approaching the pre-recession peak.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in October (NSA), and is up 6.7% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 4.6% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty seven consecutive months since turning positive year-over-year in February 2012.

Trade Deficit at $42.6 Billion in October

by Calculated Risk on 12/06/2016 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $42.6 billion in October, up $6.4 billion from $36.2 billion in September, revised. October exports were $186.4 billion, $3.4 billion less than September exports. October imports were $229.0 billion, $3.0 billion more than September imports.The trade deficit was close to the consensus forecast.

The first graph shows the monthly U.S. exports and imports in dollars through October 2016.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in October.

Exports are 13% above the pre-recession peak and up slightly compared to October 2015; imports are up 1% compared to October 2015.

It appears trade might be picking up a little.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $40.01 in October, up from $39.02 in September, and down from $40.12 in October 2015. The petroleum deficit has generally been declining (but has increased recently with the decline in oil prices) and is the major reason the overall deficit has declined a little since early 2012.

The trade deficit with China decreased to $31.1 billion in October, from $32.9 billion in October 2015. The deficit with China is a substantial portion of the overall deficit, but the deficit with China has been declining.

Monday, December 05, 2016

Tuesday: Trade Deficit

by Calculated Risk on 12/05/2016 07:19:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Begin Week Higher

Mortgage rates were slightly higher today relative to last Friday's levels, leaving them near the 2-year highs seen last Thursday. Volatility continues to run much higher than normal, with lots of intraday reprices (lenders changing rates in the middle of the business day) over the past 2 weeks, and generally big changes from day to day.Tuesday:

...

Most lenders are quoting conventional 30yr fixed rates between 4.125 and 4.25% on top tier scenarios.

emphasis added

• At 8:30 AM ET, Trade Balance report for October from the Census Bureau. The consensus is for the U.S. trade deficit to be at $42.0 billion in October from $36.4 billion in September.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is a 2.7% increase in orders.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/05/2016 04:11:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

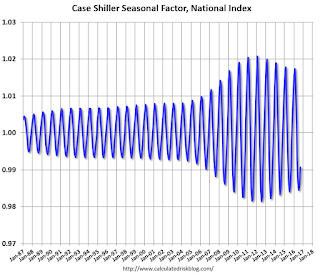

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

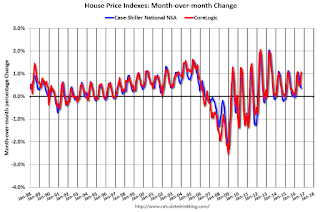

This graph shows the month-to-month change in the CoreLogic (through September 2016) and NSA Case-Shiller National index since 1987 (through September 2016). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

2017 Housing Forecasts

by Calculated Risk on 12/05/2016 12:59:00 PM

Towards the end of each year I collect some housing forecasts for the following year. It looks like analysts are optimistic on New Home sales for 2017.

First a review of the previous four years ...

Here is a summary of forecasts for 2016. In 2016, new home sales will probably be around 565 thousand, and total housing starts will be around 1.175 million. Fannie Mae and Merrill Lynch were very close on New Home sales, and MetroStudy was close on starts.

Here is a summary of forecasts for 2015. In 2015, new home sales were 501 thousand, and total housing starts were 1.112 million. Zillow, CoreLogic, and the MBA were right on with New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all correct on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2017:

From Fannie Mae: Housing Forecast: November 2016

From Freddie Mac: Interest Rates Headed Higher. What that Means for Housing

From NAHB: NAHB’s housing and economic forecast

From Wells Fargo: Monthly Economic Outlook

From NAR: U.S. Economic Outlook: November 2016

Note: For comparison, new home sales in 2016 will probably be around 565 thousand, and total housing starts around 1.175 million.

| Housing Forecasts for 2017 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Bloomberg | 1,250 | |||

| Blue Chip | 1,260 | |||

| CoreLogic | 4.7% | |||

| Fannie Mae | 671 | 883 | 1,308 | 4.8%2 |

| Freddie Mac | 1,260 | 4.7%2 | ||

| Goldman Sachs | 648 | 893 | 1,333 | 3.7% |

| HomeAdvisor5 | 614 | 893 | 1,236 | 3.5% |

| Merrill Lynch | 625 | 825 | 1,225 | 3.2% |

| MBA | 860 | 1,268 | ||

| NAHB | 647 | 873 | 1,258 | |

| NAR | 623 | 838 | 1,221 | 4.2%3 |

| Wells Fargo | 600 | 830 | 1,170 | 4.4% |

| Zillow | 3.6%4 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices 4Zillow Home Prices 5Brad Hunter, chief economist, formerly of MetroStudy |

||||

ISM Non-Manufacturing Index increased to 57.2% in November

by Calculated Risk on 12/05/2016 10:06:00 AM

The November ISM Non-manufacturing index was at 57.2%, up from 54.8% in October. The employment index increased in November to 58.1%, from 53.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:November 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 82nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 57.2 percent in November, 2.4 percentage points higher than the October reading of 54.8 percent. This represents continued growth in the non-manufacturing sector at a faster rate. This is the 12-month high, and the highest reading since the 58.3 registered in October of 2015. The Non-Manufacturing Business Activity Index increased to 61.7 percent, 4 percentage points higher than the October reading of 57.7 percent, reflecting growth for the 88th consecutive month, at a faster rate in November. The New Orders Index registered 57 percent, 0.7 percentage point lower than the reading of 57.7 percent in October. The Employment Index increased 5.1 percentage points in November to 58.2 percent from the October reading of 53.1 percent. The Prices Index decreased 0.3 percentage point from the October reading of 56.6 percent to 56.3 percent, indicating prices increased in November for the eighth consecutive month at a slightly slower rate. According to the NMI®, 14 non-manufacturing industries reported growth in November. The Non-Manufacturing sector rebounded after a slight cooling-off in October. The majority of respondents' comments are positive about business conditions and the direction of the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.5, and suggests faster expansion in November than in October. A strong report.

Black Knight October Mortgage Monitor

by Calculated Risk on 12/05/2016 07:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for October today. According to BKFS, 4.35% of mortgages were delinquent in October, down from 4.77% in October 2015. BKFS also reported that 0.99% of mortgages were in the foreclosure process, down from 1.43% a year ago.

This gives a total of 5.34% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Post-Election Rate Jumps Eliminate 4.3 Million from Refinanceable Population, Push Home Affordability to Post-Recession Low

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of October 2016. In the immediate aftermath of the U.S. presidential election, 30-year mortgage rates have spiked by 49 basis points (BPS) in just a few short weeks. This month, Black Knight examines the impact of these jumps on the population of borrowers who could both likely qualify for and have incentive to refinance as well as the wider matter of home affordability. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the effects have been dramatic, but must still be seen in the proper historical context.

“The results of the U.S. presidential election triggered a treasury bond selloff, resulting in a corresponding rise in both 10-year Treasury and 30-year mortgage interest rates,” said Graboske. “As mortgage rates jumped 49 BPS in the weeks following the election, we saw the population of refinanceable borrowers cut by more than half. From the 8.3 million borrowers who could both likely qualify for and had interest rate incentive to refinance immediately prior to the election, we’re now looking at a population of just 4 million total, matching a 24-month low set back in July 2015. While there are still two million borrowers who could save $200 or more per month by refinancing and a cumulative $1 billion per month in potential savings, this is less than half of the $2.1 billion per month that was available just four short weeks ago. These changes will likely have an impact on refinance origination volumes moving forward. And, since higher interest rates tend to reduce the refinance share of the market – specifically in higher credit segments – which typically outperform their purchase mortgage counterparts, they may potentially impact overall mortgage performance as well.

emphasis added

Click on graph for larger image.

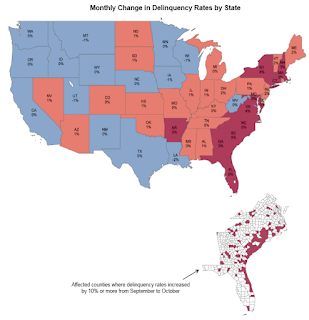

Click on graph for larger image.This map from Black Knight shows the monthly change in delinquency rate - and the impact of Hurricane Matthew on mortgage delinquencies.

From Black Knight:

• While most of the country saw minimal increases or even declines in delinquencies, those areas of the country impacted by Hurricane Matthew saw significant increases in delinquency rates in October

• South Carolina’s delinquency rate jumped nine percent, (from 5.1 to 5.6 percent) while Florida’s climbed six percent (from 4.5 to 4.8 percent)

• The hardest hit areas were along the coast, and correspondingly higher increases in delinquencies were observed in these areas as well

• In some of the hardest hit areas of South Carolina, delinquency rates rose by more than 20 percent from September to October

• Since the worst of the storm hit the southeast on October 7th and 8th, after the majority of borrowers would have made their mortgage payments, we could yet see further impact in November’s mortgage performance data

This graph from Black Knight shows the number of 90 day defaults. This is back to normal.

This graph from Black Knight shows the number of 90 day defaults. This is back to normal.From Black Knight:

• The inflow of new troubled loans has now returned to pre-recession levels; on average, over the past six months default volumes have been four percent below historic (2000-2006) normsThat last sentence is amazing.

• However, the share of mortgages becoming 90-days delinquent each month has actually averaged 13 percent below historic norms over the same period, due to the larger number of active mortgages today than in the early 2000s

• Despite making up only 25 percent of all active mortgages, pre-recession vintages (2007 and prior) still account for 60 percent of all new defaults, even though these mortgages now have nine or more years of seasoning

There is much more in the mortgage monitor.

Sunday, December 04, 2016

Sunday Night Futures

by Calculated Risk on 12/04/2016 07:17:00 PM

Weekend:

• Schedule for Week of Dec 4, 2016

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• Also at 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for the index to increase to 55.5 from 54.8 in October.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 8, and DOW futures are down 40 (fair value).

Oil prices were up sharply over the last week with WTI futures at $51.68 per barrel and Brent at $54.46 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so oil prices are up 25% to 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon - a year ago prices were at $2.04 per gallon - so gasoline prices are up more than 10 cents per gallon year-over-year.

This graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY. Oil prices are volatile!

WTI oil prices are currently up 27% year-over-year.