by Calculated Risk on 3/02/2011 07:38:00 AM

Wednesday, March 02, 2011

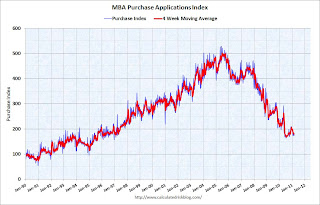

MBA: Mortgage Purchase Application activity decreases

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6.5 percent from the previous week. The seasonally adjusted Purchase Index decreased 6.1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.84 percent from 5.00 percent, with points increasing to 1.30 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is at 1997 levels - however there are have been a large percentage of cash buyers recently and cash buyers do not apply for a mortgage - still this suggests weak home sales through the first few months of 2011.

Tuesday, March 01, 2011

ISM Manufacturing Index and Employment

by Calculated Risk on 3/01/2011 10:33:00 PM

It is time for a scatter graph ...

Earlier today, I noted that the ISM manufacturing employment index was the highest level since January 1973 at 64.5, but the impact on overall employment would be less than in '73. This is because manufacturing employment is a much smaller percentage of overall U.S. employment now. In 1973, almost 30% of private payroll employment was manufacturing (18.3 million), today it is less than 11% (at 11.6 million). So the same ISM manufacturing employment reading today suggests a much smaller impact on overall U.S. employment than in 1973.

It is still good news, and the ISM survey suggests manufacturing employment grew at around 60,000 in February.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the relationship between the ISM manufacturing employment index and the change in BLS manufacturing employment (as a percent of the previous month employment).

The two yellow dots are for January 2011 (61.7 ISM and 49,000 jobs), and a forecast for February based on the ISM employment reading of 64.5.

There was a time when a 64.5 might mean a couple hundred thousand payroll jobs, but now it suggests around 60,000 jobs (with plenty of noise). Still helpful, but not the same overall impact as in the '50s, '60s or even '70s.

Earlier:

• ISM Manufacturing Index increases in February

• Private Construction Spending decreases in January

• U.S. Light Vehicle Sales 13.44 million SAAR in February

• Graphs: ISM manufacturing, Construction Spending, Vehicle Sales

Fannie Mae and Freddie Mac Delinquency Rates decline slightly

by Calculated Risk on 3/01/2011 07:27:00 PM

Earlier:

• ISM Manufacturing Index increases in February

• Private Construction Spending decreases in January

• U.S. Light Vehicle Sales 13.44 million SAAR in February

• Graphs: ISM manufacturing, Construction Spending, Vehicle Sales

Fannie Mae reported that the serious delinquency rate decreased to 4.48% in December from 4.50% in November. This is down from 5.38% a year ago.

Freddie Mac reported that the serious delinquency rate decreased to 3.82% in January from 3.84% in December. (Note: Fannie reports a month behind Freddie). This is down from 4.15% in January 2010.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The slowdown in the decline was probably related to the new foreclosure moratoriums last year. Going forward, a key question is if falling house prices will lead to an increase in serious delinquent loans.

U.S. Light Vehicle Sales 13.44 million SAAR in February

by Calculated Risk on 3/01/2011 03:55:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.44 million SAAR in February. That is up 28% from February 2010, and up 6.8% from the sales rate last month (Jan 2011).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 13.44 million SAAR from Autodata Corp).

This is the highest sales rate since August 2008, excluding Cash-for-clunkers in August 2009.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is finally off the bottom of the '90/'91 recession - and there were fewer registered drivers and a smaller population back then.

This was well above the consensus estimate of 12.7 million SAAR. But, with rising oil prices, the automakers might be under pressure in March.

A few comments on the ISM Manufacturing Report

by Calculated Risk on 3/01/2011 03:29:00 PM

I've been sent some poor commentary today regarding the ISM manufacturing index. I won't embarrass the author, but I'd like to make a few points:

• The ISM reports several diffusion indexes. The indexes are calculated by adding the percent of positive responses plus one-half of those responding unchanged. Then the index is seasonally adjusted. As an example, for employment in February: 35% of companies surveyed said employment increased and 56% said employment was unchanged. So the ISM adds 35 plus 28 (half of 56) giving 63. Then the seasonal factor pushed this up to 64.5.

This is constructed so that any reading above 50 suggests expansion. This is based on companies, not number of employees, but the ISM employment index does track changes in BLS reported manufacturing employment pretty well over time.

• The ISM employment index can be strong - the 64.5 reported today was the highest since January 1973 - even though the overall employment situation is grim. This just means more companies are hiring today and says nothing about the current overall employment situation.

• Although this was the highest employment index reading since 1973, manufacturing employment is a much smaller percentage of overall U.S. employment now. In 1973, almost 30% of private payroll employment was manufacturing, today it is less than 11%. So the same reading today will have a much smaller impact on the overall U.S. employment.

• The ISM manufacturing index is from a private organization, the Institute for Supply Management. It is not a department of the U.S. government.

Prices were a clear concern in the ISM report - both with the prices index at 82, and from the comments. But for manufacturing production, orders and employment, this was a very strong report.

Private Construction Spending decreases in January

by Calculated Risk on 3/01/2011 12:45:00 PM

Catching up ... the Census Bureau reported this morning that overall construction spending decreased in January compared to December (seasonally adjusted).

[C]onstruction spending during January 2011 was estimated at a seasonally adjusted annual rate of $791.8 billion, 0.7 percent (±1.4%)* below the revised December estimate of $797.6 billion.Private construction spending also decreased in January:

Spending on private construction was at a seasonally adjusted annual rate of $490.0 billion, 1.2 percent (±1.1%) below the revised December estimate of $495.9 billion. Residential construction was at a seasonally adjusted annual rate of $245.6 billion in January, 5.3 percent (±1.3%) above the revised December estimate of $233.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $244.4 billion in January, 6.9 percent (±1.1%) below the revised December estimate of $262.7 billion.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 64% below the peak in early 2006, and non-residential spending is 41% below the peak in January 2008.

This is the first time since December 2007 that private residential construction spending has been higher than non-residential spending. Not by much, but that is something I've been expecting.

We will probably see a sluggish recovery in residential spending in 2011 (mostly multi-family), and for residential investment to make a positive contribution to GDP and employment growth this year for the first time since 2005. And that is one of the reasons I think growth (both GDP and employment) will be better in 2011 than in 2010.

General Motors: February U.S. sales increase 22% year-over-year

by Calculated Risk on 3/01/2011 11:33:00 AM

Note: The real key is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers. But this is a strong increase for GM ...

From MarketWatch: GM U.S. February auto sales surge 45.8% to 207,028

[GM] said January U.S. sales in February surged 45.8% to 207,028 vehicles from 141,951 in February 2010.Once all the reports are released, I'll post a graph of the estimated total February light vehicle sales (SAAR) - usually around 4 PM ET. Most estimates are for an increase to 12.7 million SAAR in February from the 12.6 million SAAR in January. Sales in January 2010 were at a 10.74 million SAAR.

I'll add reports from the other major auto companies as updates to this post.

From MarketWatch: Ford U.S. February auto sales up 13.8% to 156,626

From MarketWatch: Chrysler sales rise 13% in Feb

From MarketWatch: Toyota U.S. February sales soar 41.8% to 141,846

ISM Manufacturing Index increases in February

by Calculated Risk on 3/01/2011 10:16:00 AM

PMI at 61.% in February, up from 60.8% in January, matching the level in May 2004 - the highest since 1983.

From the Institute for Supply Management: January 2011 Manufacturing ISM Report On Business®

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "February's report from the manufacturing sector indicates continuing strong performance as the PMI registered 61.4 percent, a level last achieved in May 2004. New orders and production, driven by strength in exports in particular, continue to drive the composite index (PMI). New orders are growing significantly faster than inventories, and the Customers' Inventories Index indicates supply chain inventories will require continuing replenishment. The Employment Index is above 60 percent for only the third time in the last decade. While there are many positive indicators, there is also concern as industries related to housing continue to struggle and the Prices Index indicates significant inflation of raw material costs across many commodities."The price index was at 82 with "66 percent of respondents reported paying higher prices and 2 percent reported paying lower prices, 32 percent of supply executives reported paying the same prices as in January".

...

ISM's New Orders Index registered 68 percent in February, which is an increase of 0.2 percentage point when compared to the 67.8 percent reported in January. This is the 20th consecutive month of growth in the New Orders Index.

...

ISM's Employment Index registered 64.5 percent in February, which is 2.8 percentage points higher than the 61.7 percent reported in January. This is the 17th consecutive month of growth in manufacturing employment.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

This was a strong report and above expectations. The new orders and employment indexes were especially strong.

Bernanke Senate Testimony: Semiannual Monetary Policy Report

by Calculated Risk on 3/01/2011 10:00:00 AM

Here is the CSpan feed

Prepared testimony from Fed Chairman Ben Bernanke: Semiannual Monetary Policy Report to the Congress

Housing: Governors are not immune to the housing bust

by Calculated Risk on 3/01/2011 09:03:00 AM

Note: At 10 AM, the ISM Manufacturing Index for February and Construction Spending for January will be released. Also Fed Chairman Bernanke provides the Semiannual Monetary Policy Report to the Congress (Senate testimony).

From Ted Nesi at wpri.com: Governor Chafee has a house he’d like to sell you

[Gov. Lincoln Chafee] and his wife, Stephanie, listed their seven-bedroom, three-and-a-half-bathroom house on Providence’s East Side last week for $889,000.So he is asking $50,000 less than he paid. Case-Shiller doesn't track Providence, but house prices have fallen about 15% in Boston and 22% in New York - and prices have probably fallen at least 10% in Providence. So I wouldn't be surprised to see a price reduction.

The Chafees purchased the house for $939,000 in 2006 ...