by Calculated Risk on 2/28/2011 10:17:00 PM

Monday, February 28, 2011

Home Sales: Record Percentage of Cash Buyers in California

From Lauren Beale at the LA Times: Cash-only home sales rise in California

All-cash buyers grabbed a record 30.9% share of the Golden State's houses and condos in January ... Cash activity has been brisk for months in foreclosure-ridden areas such as Riverside and San Bernardino. But now, the cash buyer has become a major player in Southern California's most expensive communities, where cash deals account for as much as two-thirds of home sales.At the low end it is probably mostly investors. The high end has always had a fairly high percentage of cash buyers, but this is very high. The good news is these buyers will never have negative equity (unless they take out a mortgage).

...

In the Southland's $1-million-and-up market, 29.2% of buyers paid cash last year — the highest percentage since 1994, DataQuick statistics show. For homes selling for $5 million and up, 62.2% paid cash.

The large percentage of cash buyers is part of the reason that the MBA purchase index has not been tracking home sales very closely (it also appears that the NAR has been overstating sales).

Libya Updates

by Calculated Risk on 2/28/2011 05:23:00 PM

By request ...

• From the NY Times: Libya Wages Counterattack Against Rebels on 3 Fronts

Colonel Muammar el-Qaddafi’s forces struck back on three fronts on Monday, using fighter jets, special forces units and regular army troops in an escalation of hostilities that brought Libya closer to civil war.• From the NY Times: U.S. Readies Military Options on Libya

The attacks by the colonel’s troops on an oil refinery in central Libya and on cities on either side of the country ... showed that despite defections by the military, the government still possessed powerful assets, including fighter pilots willing to bomb Libyan cities.

• From the Telegraph: West ready to use force against Col Gaddafi amid chemical weapon fears

The Prime Minister disclosed that he would not rule out “the use of military assets” as Britain “must not tolerate this regime using military forces against its own people”. Britain and America are also thought to be considering arming rebel forces in Libya.• From al Jazeera: Live Blog - Libya March 1

...

Mr Cameron told MPs that Britain and its allies were considering using fighter jets to impose a no-fly zone over Libya

Restaurant Performance Index declines in January

by Calculated Risk on 2/28/2011 02:08:00 PM

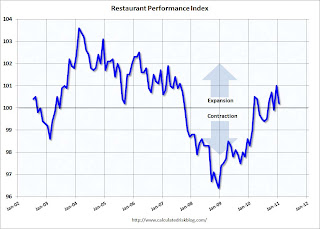

This is one of several industry specific indexes I track each month.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The index declined to 100.2 in January, barely indicating expansion.

More "Blame it on the snow!"

Unfortunately the data for this index only goes back to 2002.

From the National Restaurant Association: Restaurant Performance Index Declined in January Amid Weather-Dampened Sales and Traffic Levels

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.2 in January, down 0.8 percent from its December level. Despite the decline, January marked the fourth time in the last five months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

Due in large part to extreme weather conditions in some parts of the country, sales levels were dampened in January. Thirty-nine percent of restaurant operators reported a same-store sales gain between January 2010 and January 2011, down from 48 percent of operators who reported higher same-store sales in December.

...

Restaurant operators also reported a net decline in customer traffic levels in January.

...

For the fourth consecutive month, restaurant operators reported a positive outlook for staffing gains in the months ahead.

Dallas Fed: Texas Manufacturing Activity Picks Up

by Calculated Risk on 2/28/2011 11:31:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity increased in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose to 10 following a reading near zero in January.This is the last of the regional Fed surveys for February. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

...

Labor market indicators continued to reflect more hiring, a longer workweek and rising labor costs. The employment index came in at a reading of 11, up from 9 last month. The hours worked index was unchanged at 4, while the wages and benefits index fell from 15 to 9.

...

Prices continued to climb in February. The raw materials price index edged up from 62 to 63, with 64 percent of firms noting an increase in input costs compared with only 1 percent noting a decrease.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through February), and averaged five Fed surveys (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

The ISM index for February will released tomorrow, Mar 1st. The consensus is for a slight decrease to 60.5 from the strong 60.8 in January.

The regional surveys suggest the ISM manufacturing index will be around 60 (strong expansion). The 60.8 reading in January was the highest level since May 2004, and any reading above 61.4 would be the highest since 1983.

Chicago PMI Strong in February, Pending Home Sales decline in January

by Calculated Risk on 2/28/2011 10:00:00 AM

• From the Chicago Business Barometer™ Grew: The overall index increased to 71.2 from 68.8 in January. This was above consensus expectations of 68.0. Note: any number above 50 shows expansion.

"EMPLOYMENT continued to show expansion;". The employment index decreased to a still strong 59.8 from 64.1.

"NEW ORDERS nudged upward, still at the highest level since December 1983;". The new orders index increased to 75.9 from 75.7.

This was another strong report.

• From the NAR: Pending Home Sales Decline in January

The Pending Home Sales Index,* a forward-looking indicator, declined 2.8 percent to 88.9 based on contracts signed in January from a downwardly revised 91.5 in December [revised down sharply from 93.7]. The index is 1.5 percent below the 90.3 level in January 2010 when a tax credit stimulus was in place. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests existing home sales in February and March will be somewhat lower than in January.

Personal Income and Outlays Report for January

by Calculated Risk on 2/28/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $133.2 billion, or 1.0 percent ... Personal consumption expenditures (PCE) increased $23.7 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in January, in contrast to an increase of 0.3 percent in December.

...

The January change in disposable personal income (DPI) was affected by two large special factors. Reduced employee contributions for government social insurance ... boosted personal income in January by reducing the employee social security contribution rates ... The January change in DPI was affected by the expiration of the Making Work Pay provisions of the American Recovery and Reinvestment Act of 2009, which boosted personal current taxes and reduced DPI ... Excluding these two special factors ... DPI increased $11.4 billion, or 0.1 percent, in January

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Real PCE declined in January after increasing sharply in Q4. Note: The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter - so this still shows growth over Q4.

Also personal income less transfer payments increased again in January. This increased to $9,427 billion (SAAR, 2005 dollars) from $9,325 billion in December.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover, but has improved recently - and is still 3.2% below the previous peak.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover, but has improved recently - and is still 3.2% below the previous peak.The personal saving rate increased to 5.8% in January.

Personal saving as a percentage of disposable personal income was 5.8 percent in January, compared with 5.4 percent in December.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report. When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess. It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened.

The 1.0% increase in personal income was well above expectations of 0.4%, although spending only increased 0.2% (compared to expectations of 0.4%). The core price index for PCE increased 0.1 percent in January - slightly below expectations.

Overall this is a decent report. Even with the decline in real PCE, the 1.0% increase in income, the increase in the saving rate - and sharp increase in personal income less transfer payments - all were good news.

Weekend on U.S. economy:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

Sunday, February 27, 2011

Ireland to try to renegotiate bail-out terms

by Calculated Risk on 2/27/2011 08:24:00 PM

Earlier on U.S. economy:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

• From the Telegraph: Enda Kenny to call for bail-out to be renegotiated

Ireland's new leader [Enda Kenny] travels to Helsinki on Friday for a meeting ... with the German chancellor and French president over the EU and International Monetary Fund austerity programme.Watch the yield on Ireland's Ten Year bond today.

He will plead with the EU for reduced interest rates .... [and] will also ask that investors, often other European financial institutions, take on some of an £85 billion debt burden of Irish banks, currently carried by taxpayers.

• After the Friday meeting in Helsinki on March 4th, there will be a special eurozone debt crisis summit on March 11th.

• Here are the Ten Year yields for Portugal, Spain, Greece, and Belgium (ht Nemo)

Jobs, Jobs, Jobs

by Calculated Risk on 2/27/2011 03:38:00 PM

As a reminder, the weak payroll report for January was blamed on the snow. Usually I don't buy the weather excuses, but it did appear weather played a role this time. When the report was released, I wrote:

The 36,000 payroll jobs added was far below expectations of 150,000 jobs, however this was probably impacted by bad weather during the survey reference period. If so, there should be a strong bounce back in the February report.That is a key reason the consensus is so high for February. Bloomberg has the consensus at 180,000, MarketWatch has 200,000, Goldman's forecast is 200,000, and I heard ISI is at 230,000).

It will be useful to average the two months to estimate the current pace of payroll growth - especially if weather played a role in January and there is a strong bounce back in February.

And we have to remember the numbers are grim:

• There are 7.7 million fewer payroll jobs now than before the recession started in December 2007.

• Almost 14 million Americans are unemployed.

• Of those unemployed, 6.2 million have been unemployed for six months or more.

• Another 8.4 million are working part time for economic reasons,

• About 4 million more have left the labor force since the start of the recession (we can see this in the dramatic drop in the labor force participation rate),

• of those who have left the labor force, about 1 million are available for work, but are discouraged and have given up.

A simple calculation: If the economy is adding 125,000 jobs per month (average over two months), it would take over 5 years to add back the 7.7 million lost payroll jobs - and that doesn't even include population growth. Grim is an understatement.

Earlier:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

Schedule for Week of February 27th

by Calculated Risk on 2/27/2011 08:29:00 AM

Earlier: Summary for Week ending February 25th

The key report for this week will be the February employment report to be released on Friday, March 4th.

Other key reports include the Personal Income and Outlays report on Monday, the ISM manufacturing index on Tuesday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Thursday. Also Fed Chairman Ben Bernanke will deliver the Semiannual Monetary Policy Report to the Congress on Tuesday (Senate) and Wednesday (House).

8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.4% increase in personal income and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

8:30 AM: New York Fed President William Dudley speaks on the economic outlook

8:45 AM: Boston Fed President Eric Rosengren, panel discussion, "Lessons Learned from the Global Meltdown."

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a slight decrease to a still very strong 68.0 (down from 68.8 in January).

10:00 AM: Pending Home Sales for January. The consensus is for a slight decline in pending sales (a leading indicator for existing home sales).

10:30 AM: Dallas Fed Manufacturing Survey for February. The Texas production index was down sharply last month to 0.2 (from 15.3 in December), but is expected to show improvement in February.

10:00 AM: ISM Manufacturing Index for February.

The consensus is for a decrease to 60.5 from the strong 60.8 in January. All of the regional manufacturing surveys showed strong improvement in February.

The consensus is for a decrease to 60.5 from the strong 60.8 in January. All of the regional manufacturing surveys showed strong improvement in February.The PMI was at 60.8% in January, the highest level since May 2004. Some forecasts are as high as 63, and any reading above 61.4 would be the highest since 1983.

10:00 AM: Construction Spending for January. The consensus is for a 0.4% decrease in construction spending.

10:00 AM: Fed Chairman Ben Bernanke testimony, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

All day: Light vehicle sales for February. Light vehicle sales are expected to increase to 12.7 million (Seasonally Adjusted Annual Rate), from 12.6 million in January.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate. Edmunds is forecasting: "Edmunds.com analysts predict that February's Seasonally Adjusted Annualized Rate (SAAR) will be 12.64 million, up from 12.54 in January 2011."

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has declined over the last few weeks suggesting weak home sales through the first few months of 2011.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for +180,000 payroll jobs in February, down slightly from the 187,000 reported in January.

10:00 AM: Fed Chairman Ben Bernanke testimony, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: Fed Beige Book, Informal review by the Federal Reserve Banks of current economic conditions in their Districts

2:15 PM: Atlanta Fed President Dennis Lockhart speaks on economic outlook

8:00 PM: Fed Chairman Ben Bernanke, "Challenges for State and Local Governments", At the Citizens Budget Commission Annual Dinner in New York

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims had been trending down over the last couple of months. The consensus is for a slight increase to 396,000 from 391,000 last week.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a slight increase to 59.5 from 59.4 in January.

11:00 AM: Minneapolis Fed President Narayana Kocherlakota speaks on labor markets and monetary policy

2:15 PM: Atlanta Fed President Dennis Lockhart speaks on the economy and labor

8:30 AM: Employment Report for February.

The consensus is for an increase of 179,000 non-farm payroll jobs in February, after the disappointing 36,000 jobs added in January.

The consensus is for an increase of 179,000 non-farm payroll jobs in February, after the disappointing 36,000 jobs added in January. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for February is in blue.

The consensus is for the unemployment rate to increase to 9.1% from 9.0% in January.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.This shows the severe job losses during the recent recession - there are currently 7.7 million fewer jobs in the U.S. than when the recession started.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for January. The consensus is for a 2.2% increase in orders.

10:00 AM: Fed Vice Chair Janet Yellen, Panel Discussion, Improving the International Monetary and Financial System, At the International Symposium of the Banque de France, Paris, France

Best Wishes to All!

Saturday, February 26, 2011

Libya Updates: Obama calls for Gaddafi to step down, U.N. meets tomorrow

by Calculated Risk on 2/26/2011 08:06:00 PM

Earlier on U.S. economy: Summary for Week ending February 25th

UPDATE: from the WSJ: U.N. Imposes Sanctions on Gadhafi

The United Nations Security Council Saturday night unanimously imposed an arms embargo on Libya, referred its leaders to the International Criminal Court and slapped financial and trade sanctions on Col. Moammar Gadhafi and his inner circle in an effort to stop them from killing more Libyan civilians.• From the WaPo: Obama calls for Gaddafi to step down as leader of Libya

"Widespread and systematic attacks currently taking place in Libya against the civilian population may amount to crimes against humanity" and "those responsible for the attacks" must be held accountable, the resolution said.

In a statement, the White House said Obama told Merkel that "when a leader's only means of staying in power is to use mass violence against his own people, he has lost the legitimacy to rule and needs to do what is right for his country by leaving now." Secretary of State Hillary Rodham Clinton issued a statement Saturday also demanding that Gaddafi step down.• The Telegraph blog that is updated frequently: Libya protests: live

23.53 Our New York correspondent Jon swaine has been at the UN, where Libya's ambassador defected earlier today. Read his full report here.• From al Jazeera: Live Blog - Libya Feb 27

23:42 The full UN Security Council is due to meet tomorrow at 4pm GMT (11am in NYC) to discuss possible sanctions against Gaddafi.

2:38am Al Jazeera understands the UN Security Council resolution will freeze the assets of six members of the Gaddafi family, including the Libyan leader - while 16 members of his administration will be slapped with a travel ban. Waiting on news of the vote...• From the WSJ: Pro-Rebel Officers Vow Defense of Eastern Libya

• From the NY Times: Long Bread Lines and Barricades in Libya’s Capital