by Calculated Risk on 10/24/2010 11:03:00 PM

Sunday, October 24, 2010

Short Sales vs. Foreclosures

Posted earlier:

Michael Powell at the NY Times looks at short sales and foreclosures: Owners Seek to Sell at a Loss, but Bankers Push Foreclosure

The article offers two explanations for why lenders seem to prefer foreclosures: 1) short sale fraud, and 2) some incentives might favor foreclosure.

From Powell:

[F]inancial incentives can push toward a foreclosure rather than a short sale. Servicers can reap high fees from foreclosures. And lenders can try to collect on private mortgage insurance.In a more normal environment, servicers can "reap high fees" from foreclosures, but in the current environment there is a less of an incentive (since investors are reviewing all expenses closely). And mortgage insurance is a definite stumbling block to some short sales. But there is little evidence of the banks sitting on REOs to avoid taking losses (there just aren't that many REOs on their balance sheets) - so I think that point is incorrect.

Some advocates and real estate agents also point to an April 2009 regulatory change in an obscure federal accounting law. The change, in effect, allowed banks to foreclose on a home without having to write down a loss until that home was sold. By contrast, if a bank agrees to a short sale, it must mark the loss immediately.

When I've spoken to lenders / servicers, short sale fraud is always the first thing they mention. There are all kinds of possible frauds - from non-arms length transactions (selling to friends or relatives), off the record kickbacks to the owner, and "flopping", where the agent presents an offer to the bank from a partner - even though the agents has received higher offers, and then the partner flips the house after the short sale splitting the profits with the agent.

Even with all these problems, and the long waits for buyers, short sales have increased significantly this year.

Monday, July 12, 2010

Distressed Sales: Sacramento as an Example, June 2010

by Calculated Risk on 7/12/2010 04:08:00 PM

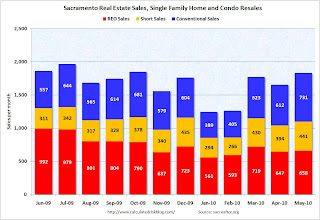

The Sacramento Association of REALTORS® has been breaking out short sales for over a year now. They report monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the June data.

Total June sales were up from May, and up from June 2009. Of course June was the scheduled closing deadline to qualify for the Federal homebuyer tax credit (closing date since extended), and also the California tax credit played a role. Sales should collapse in July.

The year-over-year (YoY) increase in June sales break a 12 month streak of declining YoY sales. But that was because of the tax credit, and sales will be off YoY in July.

Short sales were up 66% YoY (Year of the Short Sale!), and REO sales were down by 30%.

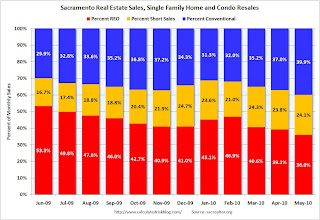

Note: This data is not seasonally adjusted. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is now at a high for this brief series.

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is now at a high for this brief series.

In June, 62.4% of all resales (single family homes and condos) were distressed sales.

The percent of REOs has been generally declining (seasonally there are a larger percentage of REOs in the winter). Also there appears to be a higher percentage of conventional sales associated with the tax credit.

On financing, 54.6% percent were either all cash (21.3%) or FHA loans (33.3%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

With the tax credit (mostly) over, I expect total sales to decline and the percent of distressed sales (Short and REO) to increase.

Friday, June 25, 2010

Year of the Short Sale, and Deed in lieu

by Calculated Risk on 6/25/2010 09:45:00 PM

From Kenneth Harney in the WaPo: Foreclosure alternative gaining favor (ht ghostfaceinvestah)

There are two programs in Home Affordable Foreclosure Alternatives (HAFA), short sales and deed in lieu of foreclosure.

Harney writes:

Some of the largest mortgage servicers and lenders in the country are gearing up campaigns to reach out to carefully targeted borrowers with cash incentives that sometimes range into five figures, plus a simple message: Let's bypass the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home, and we'll call it a deal. ...The deal can be quick, and the first lender will agree not to pursue a deficiency judgment. However 2nds are a problem, and "deed in lieu" transactions still hit the borrower's credit history.

Borrowers with 2nds considering a "deed in lieu" transaction should contact the 2nd lien holders. HAFA offers a payout to 2nd lien holders in deed in lieu transactions who agree to release borrowers from debt (see point 4 here for payouts under deed in lieu).

Under the HAFA deed in lieu program, the borrower needs to be proactive with 2nd lien holders.

The deed in lieu program is gaining in popularity, from Harney:

Bank of America, has mailed 100,000 deed-in-lieu solicitations to customers in the past 60 days, and its volume of completed transactions is breaking company records, according to officials. ... To sweeten the pot, Bank of America is offering cash incentives that range from $3,000 to $15,000 ... [Matt Vernon, Bank of America's top short sale and deed-in-lieu executive] said.On the credit impact, from Carolyn Said at the San Francisco Chronicle:

[Craig Watts, a spokesman for FICO] said it is a "widespread myth" that short sales and deeds in lieu of foreclosure have less impact on credit scores than do foreclosures.And a video from HAMP / HAFA: "Your Graceful Exit"

"Generally speaking, when you can't pay your mortgage, in the eyes of the FICO score what matters is that you were not able to fill your obligation as you originally agreed and that failure is highly predictive of future risk," he said.

Tuesday, June 15, 2010

Short Sale: Agent "takes advantage" of Bank of America?

by Calculated Risk on 6/15/2010 09:28:00 PM

Jim the Realtor thinks Bank of America was taken on this deal. This 4,374 sq ft house, on two acres, is in a great location in Rancho Santa Fe (upscale San Diego). The loan was $3.2 million, and the short sale was for $1.575 million.

This was another "5 second" listing. Some agents list short sales for less than a minute to show the bank the listing ... and then keep the entire process secret. I've heard stories of sales to relatives, friends, or the listing agent just wanting both sides of the deal. If this was listed on the open market, Jim thinks it would have sold for substantially more.

Monday, June 07, 2010

Distressed Sales: Sacramento as an Example, May 2010

by Calculated Risk on 6/07/2010 06:42:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the May data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009 - so we now have one year of data.

In May, 60.1% of all resales (single family homes and condos) were distressed sales. This is the lowest level over the last year.

Note: This data is not seasonally adjusted. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The percent of REOs has been generally declining (seasonally there are a larger percentage of REOs in the winter). Also there appears to be a higher percentage of conventional sales associated with the tax credit.

Also total sales in May were off 1.8% compared to May 2009; the 12th month in a row with declining YoY sales - even with the tax credit buying this year!

On financing, 57 percent were either all cash (23.3%) or FHA loans (33.6%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Starting in June we can do some year-over-year comparisons. It appears short sales will be up substantially YoY and REOs down, and it will be interesting to see the level of total distressed sales once the tax credit buying is behind us (July).

Tuesday, June 01, 2010

Distressed House Sales: Movin' on up!

by Calculated Risk on 6/01/2010 12:58:00 PM

From Carolyn Said at the San Francisco Chronicle: Foreclosures shifting to affluent ZIP codes

Foreclosures are going upscale across the Bay Area. ... Even more striking is the growth of mortgage defaults - the first step in the foreclosure process - in affluent ZIP codes.Option ARMs were very popular in the mid-to-high end bubble areas.

While the high-end numbers are far shy of the massive wave of lower-priced foreclosures, the growth reflects a significant shift in the foreclosure landscape ... Mortgage distress has moved upstream in part because of economic conditions ... Also in play [are] option ARM (adjustable rate mortgage) that's just beginning to cause problems.

Previous Chronicle analyses have found that option ARMs were heavily used in the Bay Area, accounting for 20 percent of all homes bought or refinanced here from 2004 to 2008. They were used for homes averaging about $823,000 in value.Although many of these loans already recast - or were refinanced - there are still quite a few that will recast over the next couple of years. Since Option ARMs were frequently used as "affordability products", many homeowners will not be able to afford the higher payments when the loans recast.

Carolyn Said also notes that banks prefer short sales to foreclosures in the mid-to-high end areas. So just tracking foreclosures doesn't tell the entire story. I'm seeing more and more high end homes listed as short sales ... and this means there are more distressed sales coming in certain mid-to-high end bubble areas and also more price declines.

Tuesday, May 11, 2010

Distressed Sales: Sacramento as an Example, April Update

by Calculated Risk on 5/11/2010 05:17:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the April data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009 - so we almost have one year of data.

In April, 63% of all resales (single family homes and condos) were distressed sales.

Note: This data is not seasonally adjusted, although the decrease in sales in April is a little surprising because of the tax credit. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The percent of REOs has been generally declining (seasonally there are a larger percentage of REOs in the winter).

Also total sales in April were off 9.1% compared to April 2009; the eleventh month in a row with declining YoY sales - even with the tax credit buying this year!

On financing, over 58 percent were either all cash (27.2%) or FHA loans (30.9%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Wednesday, April 21, 2010

Distressed Sales: Sacramento as an Example, March Update

by Calculated Risk on 4/21/2010 12:13:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.

Starting last month First American Corelogic has started releasing a distressed sales report - and that shows the trend in short sales and REOs nationally. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the March data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 65% of all resales (single family homes and condos) were distressed sales in March.

Note: This data is not seasonally adjusted, although the increase in sales in March is slightly above normal because of the tax credit. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December. This will probably continue to increase this year (2010 is the year of the short sale!).

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December. This will probably continue to increase this year (2010 is the year of the short sale!).

Also total sales in March were off 3.4% compared to March 2009; the tenth month in a row with declining YoY sales - even with a surge from tax credit buying this year!

On financing, nearly 60 percent were either all cash (27.1%) or FHA loans (31.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Thursday, April 08, 2010

Report: Distressed Home Sales Increasing

by Calculated Risk on 4/08/2010 02:33:00 PM

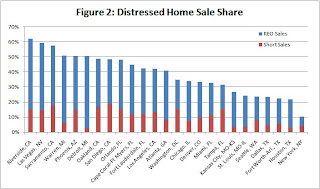

First American Corelogic released their first distressed sales report this morning: Distressed Sales Again on the Rise, Reaching 29% in January

First American CoreLogic today released its first monthly report on distressed sales activity. The report below indicates that distressed home sales – such as short sales and real estate owned (REO) sales – accounted for 29 percent of all sales in the U.S. in January: the highest level since April 2009. The peak occurred in January 2009 when distressed sales accounted for 32 percent of all sales transactions (Figure 1). After the peak in early 2009, the distressed sale share fell to 23 percent in July, before rising again in late 2009 and continuing into 2010.Here are a couple of graphs from the report:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Credit: First American Corelogic.

This graph shows the total percent of distressed sales broken down by REO and Short Sales. Notice that the percent short sales has increased significantly over the last year - that trend will probably continue.

The second graph shows the breakdown by certain metropolitan areas.

The second graph shows the breakdown by certain metropolitan areas. Among the largest 25 markets, Riverside, CA, had the largest percentage of distressed sales in January (62 percent), followed closely by Las Vegas (59 percent) and Sacramento (58 percent) (Figure 2). The top REO market was Detroit where the REO share was 48 percent, followed closely by Riverside (47 percent) and Las Vegas (45 percent). San Diego’s short sale share was 19 percent in January, making it the highest ranked short sale market, followed by Sacramento (18 percent) and Oakland (16 percent). Although the top 10 markets for foreclosures are all located in Florida, only two Florida markets, Orlando and Cape Coral, made the top 10 distressed sale list. The most likely reason: Florida is a judicial state where foreclosures process through the courts and take quite a bit longer than in California, Arizona or Nevada, where non‐judicial foreclosures are the norm.I've been following the Sacramento market as an example of a distressed market - and the Sacramento Association of REALTORS® reported that almost 69% of sales were distressed in January, with 24% short sales, and 45% REOs. The FACL data shows about 58% as distressed. The difference is probably in the methodology.

The exact numbers probably aren't as important as the trend - and this will be an interesting trend to follow in 2010.

Wednesday, March 31, 2010

Jim the Realtor on Short Sales: "Rampant Fraud and Deceit"

by Calculated Risk on 3/31/2010 10:40:00 PM

First: the buyer should find out if it is a HAFA short sale (starts April 5th). If so, the "negotiator fee" must be disclosed and be part of the agent's fee (total agent fee not to exceed 6%). From HAFA:

The amount of the real estate commission that may be paid, not to exceed 6% of the contract sales price, and notification if any portion of the commission must be paid to a contractor of the servicer that has been retained to assist the listing broker with the transaction.As an aside, if the homeowner or buyer is an agent, they are not eligible for any commission.

Any commission that would otherwise be paid to you or the buyer must be reduced from the commission due on sale.Second: as part of a HAFA short sale, the lender(s) must agree not to pursue a deficiency. If the lender balks on a short sale - I'd ask them about HAFA.

Third: Where are the regulators? Jim the Realtor is talking about rampant fraud in San Diego. Hello? Is anybody listening?

"There is rampant fraud and deceit being imposed by Realtors throughout the county. It's embarrassing."

Thursday, March 25, 2010

Servicer: "You HAFA to be kidding"

by Calculated Risk on 3/25/2010 01:28:00 PM

IMPORTANT note from CR: The following is from long time reader Shnaps (the views are his). Shnaps has been working in the mortgage industry in various capacities "since people were extending the antennas on their mobile phones". Shnaps currently serves in a key role related to HAMP at one of the largest non-prime mortgage servicers in the Nation.

Shnaps offered to write a couple of posts from the viewpoint of a servicer.

Several readers reacted negatively to Shnaps previous post. Shnaps writes: "Most HAMP applicants ARE hurting, no doubt. But that shouldn't justfy a free pass for the minority of applicants who are just trying to take advantage. That was the point of the post."

One might suppose that after the abject failure that HAMP has proven to be at modifying mortgages for ’millions’ of struggling homeowners, the US Treasury might have learned something before rolling out ‘HAFA’. This scheme was briefly known, in its conceptual stage, as FAP(!) - short for ‘Foreclosure Avoidance Program’. It eventually was redubbed HAFA - which is short for ‘Home Affordable Foreclosure Alternatives’. Whatever they call it, the program’s purported goal is to help (millions?) of Americans avoid the horror of foreclosure via the slightly-less -awful ‘deed-in-lieu’ alternative.

For those just tuning in and asking “What is a ‘deed-in-lieu’?” - allow me to explain. This term is used to describe a situation in which a mortgagor voluntarily turns over the deed to the mortgaged property to the mortgagee ‘in lieu’ of a foreclosure. It’s different than the mortgagee taking ownership via foreclosure in two key ways: first, in the sense that it is ‘voluntary’, and also in that a deed transferred in this manner would come subject to any other liens. So for this to happen, realistically – there better not be any other liens. The other option HAFA incentivizes is similar – the so-called ‘short-sale’, which basically amounts to the borrower doing the bank’s customary post-foreclosure task of liquidating the collateral for them. In exchange, the borrower may receive $1500 “walkin’ around money”, forgiveness of any deficiency balance remaining, and a less-severe hit to their credit record as the cherry on top.

Sound like a good deal for the borrower? Eh, maybe. In most cases, the biggest incentive for them is that by going the HAFA route they might get back in the credit game a couple years earlier than they would by doing nothing (and being foreclosed upon).

Now if you think the borrowers have a rather minimal incentive to participate in HAFA, get a load of the, uh, not so tasty treat that HAFA wishes to serve up to second-lien holders. In a foreclosure, people seem to be fond of pointing out that such subordinate liens ‘get nothing’ insofar as their lien interest in the property is extinguished. However, that party’s claim to the money that they are owed is not otherwise diminished. For some reason, the HAFA scheme thinks that second lien holders should not only release their lien, but also waive their right to collect on the money they are owed. In exchange, they may receive as much as $3000, which might cover their administrative cost of participating in the program - provided they do enough of these deals. Hello!? This is the reason the entire program is a non-starter – virtually all of the borrowers who might be interested in this program have huge second liens.

Not that it matters, but for those wondering ‘How about the party servicing the first mortgage? What’s in it for them?’ In short: A thousand bucks, a potentially shortened timeline to liquidation, and perhaps diminished risk that the property will end up trashed. That’s not bad – except that with short-sales come tremendous opportunities for fraud in the form of collusion, and non-arms-length transactions, leading to such unwanted outcomes such as ‘flopping’.

I really don’t ‘get’ HAFA at all. I have to assume it is just being rolled out to make HAMP look like a relative success.

CR Note: This was from Shnaps who works for one of the largest non-prime mortgage servicers in the U.S. My view is HAFA will help with the process, but as I noted before, the 2nd liens are a huge stumbling block.

Thursday, March 18, 2010

C.A.R. Outlines Possible Criminal Penalties for Undisclosed 2nd Lien Payments

by Calculated Risk on 3/18/2010 07:59:00 PM

In a recent email to agents on March 16th, the California Association of Realtors (C.A.R.) points out that making undisclosed 2nd lien payments in a short sale transaction could be a crime and punishable by up to 30 years in prison.

The email points out that undisclosed payments might violate HUD's RESPA (Real Estate Settlement Procedures Act) and laws against loan fraud.

In addition any agent participating in the scheme might be subject to disciplinary action and could have their license revoked.

Apparently the requests by 2nd lien holders are common. The C.A.R. reported: "Short sale agents have increasingly reported to C.A.R. about requests for agents and their clients to pay junior lienholders and others, often times outside of escrow."

Although the email doesn't address possible criminal activity of 2nd lienholders, it would appear the junior lienholders are soliciting a crime if they ask for a payments and suggest that the payment not be disclosed on the settlement documents. Properly disclosed payments to junior lienholders are perfectly fine and legal.

I doubt law enforcement will pursue individual homeowners, so probably the best way to end this practice is to report the requests for payments outside of escrow by 2nd lien holders (name of person and company holding the junior lien) to either HUD or the FBI.

This possible fraud was first reported by Eric Wolff at the North County Times: Wrinkle raises questions in home short sales, and by Diana Olick at CNBC: Big Banks Accused of Short Sale Fraud

Perhaps this version of short sale fraud is finally getting the attention it deserves ...

Tuesday, March 16, 2010

Distressed Sales: Sacramento as an Example, February Update

by Calculated Risk on 3/16/2010 06:49:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area. It will be especially interesting to track this after the Home Affordable Foreclosure Alternatives (HAFA) starts on April 5th. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the February data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 68% of all resales (single family homes and condos) were distressed sales in February.

Note: This data is not seasonally adjusted, and the decline in sales from the end of last year is about normal. The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

The second graph shows the percent of REO, short sales and conventional sales. The percent of REOs has been increasing again, and the percent of short sales has declined slightly over the last couple of months. The percent of conventional sales peaked last November, and has declined to 32% in February.

Now that many HAMP trial modifications have been cancelled, I expect REO sales to increase. Also, I expect the percentage of short sales to be higher in 2010 than in 2009 - but probably not as high as foreclosures (it will be interesting to watch).

Also total sales in February were off 24.3% compared to February 2009; the ninth month in a row with declining YoY sales.

On financing, over 60 percent were either all cash (30.7%) or FHA loans (30.2%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Monday, March 15, 2010

2010: REOs or Short Sales?

by Calculated Risk on 3/15/2010 11:20:00 PM

Paul Jackson has a great post at HousingWire: Housing Recovery is Spelled R-E-O

[U]sing LPS data, for all loans more than 90 days in arrears, the average days delinquent is now at 272 days—up from 204 days in early 2008. For loans in foreclosure, the aging numbers are even more staggering: loans in this bucket average 410 days delinquent, up from 260 days delinquent in early 2008.Ahhh ... the "Squatter Stimulus Plan" - live mortgage free (but not worry free).

Ponder those numbers for just a second. On average, severely delinquent borrowers have gone more than 9 months without making a mortgage payment—and yet foreclosure has not yet started for them. For those borrowers who are in the foreclosure process, it’s been an average of 13.6 months—more than one full year—since they last made any payment on their mortgage.

But Paul thinks foreclosures (REOs) will be the answer, not short sales:

For some, short sales will be an important solution—but don’t kid yourself: the hype currently surrounding short sales and the HAFA program will prove to be short-lived ...He gives two main reasons for foreclosures over short sales: 1) 2nd liens, and 2) that HAFA has the same qualifications as HAMP. I agree that 2nd liens pose a serious problem, but on the qualifications, Paul writes:

The HAFA program, going into effect on April 5, is getting plenty of attention—and the program’s heart is in the right place. But most are forgetting that it’s an extension of HAMP, the government’s loan modification program that has seen tepid success at best thus far. A loan must first be HAMP-eligible in order for anyone (borrower, servicer, or investor) to qualify for the program’s various incentive payments for short sale or deed-in-lieu.But lets review the qualifications for HAFA:

Which means any of the guidelines applicable to the HAMP program—loan in default or default imminent, within UPB [CR: unpaid principal balance] guidelines, owner-occupied, and originated prior to 2009—still apply.

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) for permanent mods was 45%, and the back end DTI was an astounding 76.4%! And these are the borrowers who made it to permanent status!The property is the borrower’s principal residence; The mortgage loan is a first lien mortgage originated on or before January 1, 2009; The mortgage is delinquent or default is reasonably foreseeable; The current unpaid principal balance is equal to or less than $729,7501; and The borrower’s total monthly mortgage payment (as defined in Supplemental Directive

09-01) exceeds 31 percent of the borrower’s gross income.

Many borrowers who meet the HAMP qualifications never even get a trial program because their DTI ratios are so high there is just no way they will make it to a permanent mod. The servicers turn them down on the spot. These are the borrowers eligible for the HAFA program right away - and looking at the HAMP DTI stats I suspect this is a much larger group of borrowers than will ever get a permanent mod. So, although I think REOs will play a key role, I think short sales will also be very important.

More on Short Sales at HousingWire:

As 2010 gears up to be the ‘Year of the Short Sale,’ Lenders Processing Service (LPS), the integrated technology provider, is jumping on opportunities such a situation offers by launching its own short sale service to clients.

In a report that may be considered numerical ammunition to the argument that short sales are heating up faster than modifications, Equator announced that it ushered along more than 125,000 short sale transactions, from November to February, since launching an automated short sale platform.Note: Yes, I predicted that 2010 would be the year of the short sale, although I think economist Tom Lawler was first.

Afternoon Reading: Taxes on Short Sales, More Delinquencies, TARP Fraud

by Calculated Risk on 3/15/2010 05:02:00 PM

California legislators last week passed a bill that ... mirrors a federal law that excludes "forgiven debt" on a principal residence from being considered taxable income. It covers short sales, foreclosures, deeds in lieu of foreclosure and loan modifications that reduce the principal due.It is important to remember the Federal exemption only applies to "money used to purchase, build or fix up a home". That exemption makes sense - and California will probably fix the current tax law.

However, Gov. Arnold Schwarzenegger, who has until March 23 to sign the bill, indicated that he is likely to veto it based on an unrelated provision regarding tax fraud.

...

When the foreclosure crisis started, Congress passed the Mortgage Forgiveness Debt Relief Act of 2007 so foreclosed homeowners would not be liable for their canceled debt. It is in force through 2012. California had a similar law, but it expired at the end of 2008, leaving Californians who lost their homes in 2009 potentially liable for big state tax bills.

...

Tax experts advise people who lost their homes in 2009 to file for an extension in hopes that California will rectify matters.

However the exemption doesn't apply to those who used the Home ATM for toys or trips ... that debt forgiveness is taxable by both the federal government and the state.

Lender Processing Services put out its Mortgage Monitor report today, and the numbers are really staggering.

Loans delinquent/in foreclosure process: 7.5 million

REO/Post-sale foreclosure: 1 million

Loans that were current 1/1/09 and 60+ days delinquent 1/1/10: 2.5 million

That last one is interesting, because it shows how much faster loans are going bad than are being modified.

...

Tomorrow on CNBC we're going to devote a full day to the current state of the housing market, from what has failed to what is promising on the horizon.

The former president of New York's privately held Park Avenue Bank was arrested and charged on Monday ... A 10-count criminal complaint accused Charles Antonucci of devising "an elaborate round-trip loan transaction" that he told others was his own $6.5 million investment in the bank, misleading state bank regulators and the U.S. Federal Deposit Insurance Corporation (FDIC).

...

"Antonucci is the first person ever to be charged with attempting to defraud the TARP and we expect he will not be the last," Manhattan U.S. Attorney Preet Bharara said at a news conference.

Wednesday, March 10, 2010

More: Short Sales and 2nd liens

by Calculated Risk on 3/10/2010 12:10:00 PM

This is a follow up on the previous post on short sales and 2nd liens. (the previous post had excerpts from the NY Times, Short-Sale Program to Pay Homeowners to Sell at a Loss and WSJ Home-Saving Loans Afoot)

Just to be clear on what subordinate lien holders will receive under a HAFA short sales - from Treasury's HAFA program Short Sale Agreement:

Subordinate Liens. We will allow up to three percent (3%) of the unpaid principal balance of each subordinate lien in order of priority, not to exceed a total of $3,000, to be deducted from the gross sale proceeds to pay subordinate lien holders to release their liens. We require each subordinate lien holder to release you from personal liability for the loans in order for the sale to qualify for this program, but we do not take any responsibility for ensuring that the lien holders do not seek to enforce personal liability against you. Therefore, we recommend that you take steps to satisfy yourself that the subordinate lien holders release you from personal liability.So on a $50,000 2nd lien, the holder of the lien will be offered up to $1,500 to sign off on the deal and release the borrower from personal liability. The HAFA program will reimburse the 1st lien holder one third of that amount, or up to $500.

Investor Reimbursement for Subordinate Lien Releases. The investor will be paid a maximum of $1,000 for allowing a total of up to $3,000 in short-sale proceeds to be distributed to subordinate lien holders, or for allowing payment of up to $3,000 to subordinate lien holders. This reimbursement will be earned on a one-for-three matching basis. For each three dollars an investor pays to secure release of a subordinate lien, the investor will be entitled to one dollar of reimbursement. To receive an incentive, subordinate lien holders must release their liens and waive all future claims against the borrower....I expect that most 1st lien holders will be willing to pay this amount to the 2nd lien holder. But would a $50,000 2nd lien holder be willing to sign off for only $1,500?

It really depends on the financial situation of the borrower, and probably on the likelihood of personal bankruptcy. In most cases the 2nd lien holder can probably do much better by selling the lien to a collection agency.

Although I think the HAFA program will help with short sales (and deed-in-lieu transactions), this will not solve the 2nd lien problem. Foreclosure may still be the servicers' option of choice for borrowers with subordinate liens.

Sunday, March 07, 2010

Short Sales and 2nd Liens

by Calculated Risk on 3/07/2010 11:04:00 PM

A couple of articles tonight that fit together with my earlier post: Housing: A Tale of Boom and Bust and a Puzzle The puzzle is when the banks will start moving ahead with distressed sales (foreclosures and short sales).

First David Streitfeld at the NY Times writes about the Treasury's HAFA program: Short-Sale Program to Pay Homeowners to Sell at a Loss

Taking effect on April 5, the program could encourage hundreds of thousands of delinquent borrowers who have not been rescued by the loan modification program to shed their houses through a process known as a short sale, in which property is sold for less than the balance of the mortgage. Lenders will be compelled to accept that arrangement, forgiving the difference between the market price of the property and what they are owed.Short sales under HAFA are much better than foreclosures for many borrowers because HAFA requires lenders to agree not to pursue a deficiency judgment (one of the key stumbling blocks for eliminating 2nds). And this is also better for the 2nd lien holders too since they get something (note: the program also includes a deed-in-lieu of foreclosure option with similar payments and requirements).

...

Under the new program, the servicing bank, as with all modifications, will get $1,000. Another $1,000 can go toward a second loan, if there is one. And for the first time the government would give money to the distressed homeowners themselves. They will get $1,500 in “relocation assistance.”

Should the incentives prove successful, the short sales program could have multiple benefits. For the investment pools that own many home loans, there is the prospect of getting more money with a sale than with a foreclosure.

For the borrowers, there is the likelihood of suffering less damage to credit ratings. And as part of the transaction, they will get the lender’s assurance that they will not later be sued for an unpaid mortgage balance.

emphasis added

Of course short sale fraud is also a huge concern. Streitfeld quotes economist Tom Lawler:

Short sales are “tailor-made for fraud,” said Mr. Lawler, a former executive at the mortgage finance company Fannie Mae.And from James Hagerty at the WSJ: Home-Saving Loans Afoot

Rep. Frank said banks' reluctance to write down second mortgages is blocking efforts to reduce the first-lien mortgage balances of many borrowers who owe far more on their loans than the current values of their homes. ...As Hagerty notes, the banks are reluctant to write down the 2nd liens because they might still have value even after foreclosure. That is because 2nd liens are recourse, and the lenders could pursue the borrower for a deficiency judgment (or sell the loans to a collector). Frequently the most cost effective course of action for 2nd lien holders is to wait and do nothing. And that is frustrating for the 1st lien holder (commonly Fannie or Freddie).

Many second liens have little value because of the plunge in home prices, Rep. Frank wrote, adding: "Yet because accounting rules allow holders of these seconds to carry the loans at artificially high values, many refuse to acknowledge the losses and write down the loans."

Is $1,000 enough to get 2nd lien holders to sign off and give up the right to a deficiency judgment? I expect that the lenders will pick and choose ... but this should help.

Update: the WSJ has a copy of Barney Frank's letter to the four large banks.

Monday, February 22, 2010

Survey: Short Sales Increase in January

by Calculated Risk on 2/22/2010 02:56:00 PM

From Campbell Surveys: Short Sales See Big Jump in Activity During January

According to the latest Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions, short sales accounted for a substantial 15.9% of home purchase transactions in January. This was well above the share of other distressed property activity – damaged real estate owned or REO (13.4%) and move-in ready REO (13.8%) – and represented a big jump for short sales.

...

“Short sales activity took a temporary dip in November around the expected expiration of the first-time homebuyer tax credit,” reported Thomas Popik, research director for the Campbell/Inside Mortgage Finance survey. “Few first-time homebuyers wanted to take the chance that their short sale transaction wouldn’t be approved by the November 30 deadline. But now that the tax credit has been extended, we see first-time homebuyers once again snapping up attractively priced short sales.”

Survey results showed that short sales typically sell for only 91% of listing price. In contrast, move-in ready REO sells for 99% of listing price, on average.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Source: Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions, Campbell Communications, Jan 2010

This graph, based on data from Campbell Communications, shows the break down of distressed sales of all transactions by three categories: 1) move in ready REOs, 2) damaged REOs (sold mostly to investors), and 3) short sales.

I expect 2010 will be the year of the "short sale" and the percentage of short sales will increase further after the servicers implement the Treasury's HAFA program .

Thursday, February 18, 2010

Short Sales Increasing

by Calculated Risk on 2/18/2010 03:59:00 PM

From Alejandro Lazo at the LA Times: Short sales grow as a cheaper alternative to foreclosure

In a short sale the lender lets a homeowner unload a house for less than what is owed on the mortgage. The transaction recognizes that the home isn't worth what the owner paid for it after more than two years of falling real estate values.There is much more in the article. As Lazo notes, many servicers haven't had adequate staff to handle all the short sale requests. And another reason lenders have been hesitant to approve short sales is because of potential fraud.

Such deals are appealing to struggling homeowners because they escape weighty house debts -- but they don't get away unscathed. Their credit scores will be damaged, perhaps less severely than in foreclosure, but still badly enough to limit for years their ability to borrow money. There may be tax consequences. And any money invested through down payments and renovations will be lost.

Lenders, which can withhold approval of a short sale if they don't like the price, have resisted such sales because they are difficult to execute, particularly when multiple creditors and other parties are involved. And short sales lock in losses that might be reduced if the sale is delayed until the market improves.

But that resistance is softening. With more Americans losing jobs and missing mortgage payments, banks and investors increasingly are agreeing to short sales as a less costly alternative to foreclosure.

Short sales approved by Fannie Mae and Freddie Mac, which own 57% of U.S. mortgages, nearly quadrupled in the first nine months of 2009 compared with the same period in 2008. At the nation's largest mortgage servicers, short sales soared 165% to 74,513 in the first nine months of 2009 from the year-earlier period.

Short sales are still few compared with foreclosures, but policymakers are looking at such sales to shrink the number of bank-owned homes on the market.

The Treasury's HAFA program will probably increase short sale activity significantly.

Under HAFA, the lender settles on an approved price in advance. From the directive a lender must provide "Either a list price approved by the servicer or the acceptable sale proceeds, expressed as a net amount after subtracting allowable costs that the servicer will accept from the transaction." This will help speed up the transaction and minimize short sale fraud.

Also under HAFA, the servicer must "allow a portion of gross sale proceeds to be paid to subordinate lien holders in exchange for release and full satisfaction of their liens." That helps with the 2nd lien problem and is great for the homeowner because there will be no deficiency judgment (also, upon closing, the first mortgage holder has to agree to release the borrower "from all liability for repayment of the first mortgage debt"). This is much better than "walking away"!

HAFA starts on or before April 5, 2010. This is an excellent program, but like HAMP, is limited to homeowners with an unpaid principal balance less than or equal to $729,750.

Tuesday, February 16, 2010

Distressed Sales: Sacramento as an Example

by Calculated Risk on 2/16/2010 02:43:00 PM

This will probably be the year of the "short sale", especially after the Home Affordable Foreclosure Alternatives starts (scheduled for April 5th).

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the January data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. Almost 69 percent of all resales (single family homes and condos) were distressed sales in January.

Note: This data is not seasonally adjusted, and the decline in sales from December to January was about normal. The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs had been declining, and the percent of short sales had been steadily increasing. In January REOs were up to 45% - the highest percent since last September - and the percent short sales declined slightly to 23.6%.

The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs had been declining, and the percent of short sales had been steadily increasing. In January REOs were up to 45% - the highest percent since last September - and the percent short sales declined slightly to 23.6%.

Now that the trial modification period has ended, I expect the REO sales to increase. Also, I expect the percentage of short sales to be higher in 2010 than in 2009 - but probably not as high as foreclosures (it will be interesting to watch).

Also total sales in January were off 23.4% compared to January 2009; the eight month in a row with declining YoY sales.

On financing, over half the sales were either all cash (26.7%) or FHA loans (28.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.