by Calculated Risk on 8/07/2010 11:41:00 AM

Saturday, August 07, 2010

NMHC Quarterly Survey: Apartment Market Conditions Tighten

From the National Multi Housing Council (NMHC): Widespread Improvement Continues for Apartment Industry, According to NMHC Quarterly Survey of Market Conditions

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose from 81 to 83. Fully 69 percent of respondents said markets were tighter (meaning lower vacancies and/or higher rents). This was the sixth straight quarter in which this measure has risen, and is the highest figure since July 2006.

...

“Demand for apartment residences has substantially increased thanks to modest improvements in the jobs market and the continuing decline in homeownership rates. ... Going forward, the near-term outlook for the apartment industry is likely to be tied to the pace of job growth,” [said NMHC Chief Economist Mark Obrinsky]

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

The index has increased for six straight quarters, but only has indicated tighter market conditions for the last two quarters (from very weak conditions).

A reading above 50 suggests the vacancy rate is falling. Based on limited historical data, I think this index will lead reported apartment rents by about 6 months to 1 year.

Also this data is a survey of large apartment owners only. The data released in late July from the Census Bureau showed the rental vacancy rate was steady in Q2 for all rental units in all areas.

A final note: The results of this survey are a little surprising, but it does suggest the rental market might have bottomed - at least for now. I've heard from a couple of sources that effective rents have risen slightly over the first half of 2010 at some large apartment complexes. Just something to be aware of ... (I've posted about this before).

Tuesday, July 27, 2010

Q2 2010: Homeownership Rate Lowest Since 1999

by Calculated Risk on 7/27/2010 10:00:00 AM

The Census Bureau reported the homeownership and vacancy rates for Q2 2010 this morning. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

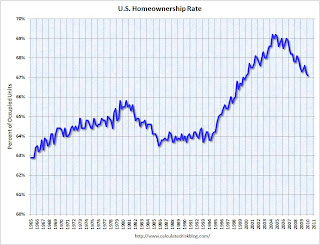

The homeownership rate declined to 66.9%. This is the lowest level since 1999.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

I'll have to revisit this now that the homeownership rate has fallen back to the top of the range I expected!  The homeowner vacancy rate declined to 2.5% in Q2 2010.

The homeowner vacancy rate declined to 2.5% in Q2 2010.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.8% above normal. This data is not perfect, but based on the approximately 75 million homeowner occupied homes, we can estimate that there are close to 500 thousand excess vacant homes.

The rental vacancy rate was steady at 10.6% in Q2 2010.  Other reports have suggested that the rental vacancy rate has declined slightly. This report is nationwide and includes homes for rent.

Other reports have suggested that the rental vacancy rate has declined slightly. This report is nationwide and includes homes for rent.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 41 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, then 2.6% X 41 million units or 1.07 million excess units would have to be absorbed.

This suggests there are still about 1.6 million excess housing units. These excess units will keep pressure on housing starts, rents and house prices for some time.

Wednesday, July 07, 2010

Reis: Apartment Vacancy Rates decline slightly

by Calculated Risk on 7/07/2010 11:59:00 PM

From Nick Timiraos at the WSJ: Apartment Vacancies Fell in Quarter

The national apartment vacancy rate stood at 7.8% at the end of June, according to Reis Inc., a New York real-estate research firm. That was down from the 8% vacancy rate during the first quarter, which was the highest vacancy rate in 30 years. ...This is still near the record vacancy rate set last quarter. This decline fits with the recent survey from the NMHC that showed lower apartment vacancies.

Rents gained by 0.7% during the seasonally strong April-to-June period, the biggest quarterly gain in two years.

Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a near record 10.6% in Q1 2010.

Sunday, June 20, 2010

Apartment owner on rental market: "Worst ever", Charge-offs triple

by Calculated Risk on 6/20/2010 09:42:00 PM

Some landlords think rents have bottomed ... other are not so optimistic ...

From Jon Lansner at the O.C. Register: ‘Worst ever’ market hits O.C. landlords

Veteran Orange County apartment owner and manager Ray Maggi says this the current rental market “is the worst I’ve ever seen” for landlords.

...

Last year, landlords usually offered free months of rent as lures for new tenants. This year, Maggi says, more landlords have simply slashed rents to meet tight-fisted renters who have plenty of choice.

Making matters worse for property owners is that a growing number of tenants aren’t keeping up with payments. Charge-offs have roughly tripled to nearly 3 percent of rents due.

Thursday, June 17, 2010

Have Residential Rents bottomed?

by Calculated Risk on 6/17/2010 01:04:00 PM

There is some evidence that apartment rents have bottomed ... at least temporarily.

The BLS reported this morning:

The shelter index increased for the first time since August 2009, rising 0.1 percent. The rise was mostly due to the index for lodging away from home, which increased 2.5 percent. The indexes for both rent and owners' equivalent rent were unchanged in May.The OER measure was up slightly and tends to lag other measures of rents.

Back in May, the NMHC reported that the market tightness index had increased sharply:

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose sharply from 38 to 81. This was the highest figure in nearly four years.There are some monthly private apartment data providers why say that rents have risen over the first 4 months of the year (on month-to-month basis, rents are still down year-over-year). They are reporting that the occupancy rate has risen slightly too.

...

“We saw a sharp increase in the Market Tightness Index, which fits with the surprisingly strong (for a seasonally weak period) effective rent growth.” [said NMHC Chief Economist Mark Obrinsky]

I spoke with a large apartment owner in Texas who told me they are seeing effective rents rising over the last few months.

I've also heard that the mood really changed at the NMHC meeting in May compared to the January meeting. There is a growing consensus among large apartment owners that rents have bottomed and the industry will rebound in 2011.

And from Dawn Wotapka the WSJ: Apartment Leases, Rents Pick Up

For the first time since the downturn, some of the nation's largest apartment-building landlords are reporting that rent declines have stopped and some are even boasting modest increases. Green Street Advisors, a real-estate research firm, says demand might have struck bottom in the first quarter ... From January through May, rents climbed 2.8% nationwide, according to Axiometrics, which tracks the national apartment market.This seems surprising given that REIS reported a record vacancy rate in Q1: "Nationally, the apartment vacancy rate stayed flat at 8%, the highest level since Reis Inc., a New York research firm, began its tally in 1980" and the Census Bureau reported the rental vacancy rate was at 10.6% in Q1, just below the all time high. Note: Reis is for large cities, the Census Bureau is nationwide.

Just something to be aware of ... rents could start falling again, but it does appear the slide has stopped for now - at least for the large apartment complexes.

Friday, May 07, 2010

NMHC Quarterly Survey: Apartment Market Conditions Tighten

by Calculated Risk on 5/07/2010 04:00:00 PM

From the National Multi Housing Council (NMHC): Apartment Industry Shows Widespread Improvement According to NMHC Quarterly Survey of Market Conditions

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose sharply from 38 to 81. This was the highest figure in nearly four years. Fully 64 percent of respondents said markets were tighter (meaning lower vacancies and/or higher rents). Only two percent reported looser markets. This is the sixth straight increase for this measure.

...

“We saw a sharp increase in the Market Tightness Index, which fits with the surprisingly strong (for a seasonally weak period) effective rent growth. ... Even so, a sustained recovery in the apartment market needs a firm economic and demographic foundation ... in the near-term the industry’s prospects still depend upon a stronger rebound in both the job market and household formation.” [said NMHC Chief Economist Mark Obrinsky]

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading above 50 suggests the vacancy rate is falling. Based on limited historical data, I think this index will lead reported apartment rents by about 6 months to 1 year. Right now I expect BLS reported rents to continue to decline through most of 2010.

This data is a survey of large apartment owners. The data released last week from the Census Bureau showed a 10.6% rental vacancy rate for all rental units.

A final note: at some point the apartment market would start to tighten from the very high vacancy rates (record levels according to the Census Bureau and Reis).

The question asked was:

Q: [O]n balance, apartment market conditions in your markets today are:

Of those surveyed, 64% answered: "Tighter than three months ago" and 34% answered "About unchanged from three months ago". So it appears the bottom in vacancy rates was reached in Q4 2009.

The improvement in the labor market is probably leading to more household formation - and combined with a record low number of new apartment units being completed this year - the apartment market is now starting to tighten. It will take some time for the overall vacancy rate to fall to normal levels, but the excess housing units are now being absorbed. (See Housing Stock and Flow for an analysis of the absorption of excess housing units).

Monday, April 26, 2010

Q1 2010: Homeownership Rate Lowest Since Q1 2000

by Calculated Risk on 4/26/2010 10:00:00 AM

The Census Bureau reported the homeownership and vacancy rates for Q1 2010 this morning. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate declined to 67.1%. This is the lowest level since Q1 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.  The homeowner vacancy rate was 2.6% in Q1 2010.

The homeowner vacancy rate was 2.6% in Q1 2010.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.9% above normal. This data is not perfect, but based on the approximately 75 million homeowner occupied homes, we can estimate that there are close to 675 thousand excess vacant homes.

The rental vacancy rate was 10.6% in Q1 2010.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 41 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 41 million units or over 1 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 41 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 41 million units or over 1 million units absorbed.

This suggests there are still about 1.7 million excess housing units, and these excess units will keep pressure on housing starts, rents and house prices for some time.

Tuesday, April 06, 2010

Apartment Vacancy Rate stays at Record Level, Rents increase Slightly

by Calculated Risk on 4/06/2010 12:07:00 AM

From Nick Timiraos at the WSJ: Apartment Rents Rise as Sector Stabilizes

Nationally, the apartment vacancy rate stayed flat at 8%, the highest level since Reis Inc., a New York research firm, began its tally in 1980.... Nationally, effective rents, which include concessions such as one month of free rent, rose 0.3% during the quarter compared with a 0.7% decline in the fourth quarter of last year and a 1.1% drop in the first quarter of 2009. ...Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a near record 10.7% in Q4 2009.

"Rent reductions are not over yet," said Hessam Nadji, managing director at real-estate firm Marcus & Millichap.

Rents plunged in 2009 by the most in the 30 years Reis has been tracking rents - and with vacancies at record levels, the slight increase in Q1 2010 rents doesn't mean the rent declines are over.

Friday, March 19, 2010

Rents Expected to decline through 2011 in Seattle

by Calculated Risk on 3/19/2010 08:28:00 AM

From Vanessa Ho at Seattlepi.com: Renters, rejoice: Apartments are cheap and the iPod is free (ht Patrick)

"We've done holiday specials -- a one-night stay in a downtown hotel - or an iPod nano," said [Craig Dwyer, vice-president of Seattle-based Pinnacle Family of Companies] residential division. "We've done a microwave. We even did a 32-inch flat panel TV."I'm starting to hear stories about vacancy rates stabilizing in some markets, although rents are probably still falling in most areas. This will keep pressure on CPI and house prices.

After peaking in 2006 and 2007, rents in King, Snohomish and Pierce counties tanked over the course of last year by nearly 4 percent, according to [Mike Scott, whose firm, Dupre + Scott, researches the Puget Sound apartment market]. He expects rents will continue to plummet this year by 5 percent, and again in 2011, but less dramatically.

In Seattle, property managers say that trend has been more pronounced, with some rents dropping as much as 15 to 20 percent last year. ... Bart Flora, co-owner of Cornell & Associates, which manages 6,500 properties in the city, said some, in-city, one-bedroom apartment now rent for $800 to $850, instead of roughly $1,000 two years ago.

"It's the steepest drop I've ever encountered in 25 years, certainly in my career," said Flora. He added that he believed the market - at least in Seattle - appears to have hit bottom and is stabilizing.

Tuesday, February 23, 2010

Shadow Rental Market Pushing down Rents

by Calculated Risk on 2/23/2010 12:57:00 PM

Here is an audio interview from Jon Lansner: Scott Monroe of South Coast Apartment Association visits Jon Lansner of the OC Register

"Rents are down and vacancies are up. Demand is off, and we attribute really to to the fact that here has been a pretty significant erosion of jobs in the Orange County markets. And it is having a trickle down effect. In addition to that, our members are saying that they are competing quite a bit with what historically has not been a competitor for us - that's the gray market or the shadow market - which are condominium rentals and single family home rentals and things of that nature. There is just a lot of product on the market."Monroe says they are seeing much more multi-generational housing, and he expects "doubling up" to last for another 12 months or so.

Scott Monroe, Pres. of South Coast Apartment Association

And this brings up a key point - the supply of rental units has been surging:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (Source: Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.7 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at 10.7% and the apartment vacancy rate is at a record high.

Where did these approximately 4.7 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.6 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

As Scott Monroe noted, this huge surge in rental supply - what he calls the "gray or shadow market" - has pushed down rents, and pushed the rental vacancy rate to record levels. Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply. Eventually many of these "gray market" rentals will be sold as homes again - keeping the existing home supply elevated for years.

Wednesday, February 03, 2010

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 2/03/2010 01:12:00 AM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 38 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous quarter.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Steady; Sales Volume and Equity Financing Improve, According to NMHC Quarterly Survey

The Market Tightness Index’s sub-50 reading of 38 indicates that vacancy and/or rent conditions deteriorated over the last quarter. Thirty percent of respondents said markets were looser, meaning higher vacancies and/or lower rents; only seven percent reported that markets were tighter.

...

“This quarter saw a continued uptick in sales volume and equity financing, which represent another step, albeit a small one, toward a more normal transactions market, after 2009 recorded the lowest number of transactions of the decade,” said NMHC Chief Economist Mark Obrinsky.

“The weakest performing index is the Market Tightness Index,” said Obrinsky, “underscoring the fact that full recovery of occupancy and rents will require job growth to return to the economy. When that happens, and as a large wave of Echo Boomers begins to enter a supply-constrained market, we should see above average rent growth.”

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

This data is for apartment buildings. The data released yesterday from the Census Bureau - showing a 10.7% rental vacancy rate - includes all rental units.

Thursday, January 21, 2010

More on Falling Apartment Rents and Rising Vacancy Rates

by Calculated Risk on 1/21/2010 09:55:00 PM

Kind of a theme ...

From Carolyn Said at the San Francisco Chronicle: Rents, occupancy fall in 4th quarter

Both national and Bay Area rents have fallen steadily for the past five quarters, said apartment data specialist RealFacts of Novato.Oh no, everyone is freaking out!

...

Nationally, the average monthly rent was $933, down from $994 a year earlier, while the occupancy rate is 91.3 percent, compared with 92.2 percent a year ago.

...

The biggest rent declines in the Bay Area were for units that cannot accommodate roommates ... Average rents fell 9.5 percent for studios and 10.9 percent for junior one bedrooms compared with a year ago, RealFacts said.

... about 60 percent of [SoCal] properties are offering concessions, such as a first month's free for new long-term leases, or gifts of iPods or flat-screen TVs.

"Everybody's freaking out and trying to bring in people anyway they can," [Denise Castellucci, a spokeswoman for RealFacts] said.

[The worst areas were] ... Phoenix, where fourth-quarter rents were down 8.7 percent compared with the prior quarter; Las Vegas, down 8.2 percent; Salt Lake City, down 7.3 percent; and Denver, down 6.1 percent.

Note that the rent declines do not include concessions, so effective rents have fallen even further.

This is good news for renters, but this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks - and more bank failures.

And falling rents are already pushing down owners' equivalent rent (OER). OER has declined since August 2009, and will probably continue to decline throughout 2010. Since OER is the largest component of CPI, this will apply downward pressure on CPI all year. And lower rents will also put pressure on house prices, since renting is a competing product.

Rents Fall to 3 1/2 Year Low in Orange County

by Calculated Risk on 1/21/2010 06:31:00 PM

From Jeff Collins at the O.C. Register: O.C. rents fall 6.7% to mid-2006 level

The average rent for a unit in a large Orange County apartment complex fell to $1,473 a month in the fourth quarter of 2009, the fifth straight quarter to see monthly rents drop.Reis reported that the U.S. apartment vacancy rate hit a record high in Q4, and the Census Bureau reported the total rental vacancy rate was at a record 11.1% in Q3 (Q4 numbers will be released in early February).

Apartment tracker RealFacts reports today that numerous empty apartments forced local landlords to cut rent $105 a month on average — 6.7% — vs. the fourth quarter of 2008. And it’s the lowest average rent in 3 1/2 years.

“They’ve come down quite a bit,” observed Hugo Gonsalez, manager for Nextrent.com, a Santa Ana rental listing service. “You see eight empty units (in an apartment complex) where you used to see one.”

The higher vacancy rate is being driven by people doubling up during the recession, and also by the first time home buyer tax credit. This is pushing down rents, and will also put pressure on house prices (since renting is an alternative).

Thursday, January 14, 2010

Manhattan Apartment Rents Decline 9.4%

by Calculated Risk on 1/14/2010 09:22:00 PM

From Bloomberg: Manhattan Apartment Rents Drop 9.4% Amid Job Cuts (ht Brian)

Manhattan apartment rents dropped 9.4 percent in the fourth quarter from a year earlier ... according to a report today by broker Prudential Douglas Elliman Real Estate and appraiser Miller Samuel Inc. A separate tally by broker Citi-Habitats Inc. showed the average apartment price declined 7.3 percent for the year.Just more on falling rents although it sounds like the inventory in Manhattan is down a little , but overall the vacancy rate is at record levels ...

The effective decline in Manhattan apartment costs was likely greater than either broker reported because the figures don’t reflect concessions such as a free month’s rent ...

Last week from Reuters: U.S. apartment vacancy rate hits 30-year high

The Census Bureau will report the overall Q4 vacancy rate on February 2nd, and I expect another new record (above the 11.1% in Q3).

Thursday, December 31, 2009

Renters Win!

by Calculated Risk on 12/31/2009 05:14:00 PM

From USA Today: Apartment renters win as vacancy rate climbs (ht Brian)

Rents fell a record 3.5% in 2009 after factoring in freebies, according to MPF Research. MPF projects prices will fall an additional 2% next year ...Note: Reis reported the apartment vacancy rate at a 23 year high 7.8% at the end of Q3 2009, and the Census Bureau reported the total rental vacancy rate at a record 11.1%.

"I've been at this 35 years, and it's by far the worst I've seen it," says Jeff Cronrod of the American Apartment Owners Association.

Nationwide, apartment vacancy is 7.8%, up from 4.8% at the end of 2007, says MPF Vice President Greg Willett.

The article notes that the supply of rental units is growing as investors buy homes to rent for cash flow and some "homeowners who want to move but can't sell their houses because they're worth less than their mortgages are renting them out instead."

Hey, who does that remind you of? (hint)

Wednesday, December 16, 2009

CPI and Falling Rents

by Calculated Risk on 12/16/2009 11:11:00 AM

From the BLS report on the Consumer Price Index this morning:

The index for all items less food and energy was unchanged in November after rising 0.2 percent in October. The heavily weighted index for shelter, unchanged in October, declined 0.2 percent in November. Within the shelter group, the indexes for rent and owners' equivalent rent both declined 0.1 percent and the lodging away from home index fell 1.5 percent.Owners' equivalent rent (OER) decreased at a 1.5% annualized rate in November, and has decreased at a 1.1% annualized rate over the last three months. OER is the largest component of CPI, and helped keep core CPI unchanged in November. Median CPI from the Cleveland Fed was also unchanged.

Based on reports of falling rents - and a record high vacancy rate, OER will probably continue to fall for some time, keeping core CPI low and possibly negative next year.

Also - falling rents will push up the price-to-rent ratio, and put additional pressure on house prices.

Sunday, November 29, 2009

Apartment Rents Fall 4.9% in SoCal

by Calculated Risk on 11/29/2009 09:23:00 AM

From Alejandro Lazo at the LA Times: Falling rents aid homeowners in mortgage trouble

Southern California rents peaked at $1,501 in the third quarter of 2008 ... Since then, rents have fallen 4.9%, to an average of $1,427 in the third quarter of this year, according to a survey of larger apartment complexes by property research firm RealFacts. The drop came as the occupancy rate of the buildings ticked down 0.8% to 93.7%. The data don't include homes converted into rental units or smaller apartment buildings.Although falling rents and significant concessions are good news for renters, this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks.

...

Job losses and competition from foreclosed homes have made concessions by large landlords common. Thomas Shelton, president of Western National Property Management in Irvine, said he was offering about a month of free rent for every 12-month lease signed.

And falling rents are already pushing down owners' equivalent rent (OER). Since OER is the largest component of CPI, this will apply downward pressure on CPI for some time. And lower rents will also put pressure on house prices, since renting is a competing product.

But renting is a relief to some:

Thomas DeLong walked away from the mortgage on his final home in September and began renting a house for about $1,400 a month, with utilities, in the high-desert area of Perris.

DeLong ... said renting was a relief after years of worry and a financial juggling act that came crashing down all around him.

Wednesday, November 18, 2009

Falling Rents and Minneapolis

by Calculated Risk on 11/18/2009 11:25:00 AM

From the BLS report on the Consumer Price Index this morning:

The rent index decreased 0.1 percent, the index for owners' equivalent rent [OER] was unchanged ...The rent index decreased at a -1.3% annualized rate, and OER declined in three of four ranges (only the Northeast Urban Region saw an increase - see Cleveland Fed).

The rent index and OER will probably continue to fall for some time, keeping CPI and core CPI low.

Most of the reports of falling rents are focused on the coasts, but here is a report from MN Reader in Minneapolis:

The Minneapolis rental market was OK through the end of July. It has deteriorated sharply since then. Internal apartment industry figures show an 8.0% physical vacancy rate as of 8/31/09. The economic vacancy rate, which includes free rent offers, etc, was 11.8% as of that same date. Both figures have gone up significantly since then. All landlords in the market are fighting desperately for residents. Effective asking rents are dropping rapidly.

The vacancy losses seem to be caused by (1) home buying using the $8,000 tax credit; (2) job losses/cutbacks among existing residents; and (3) lack of new jobs for residents who would have rented. Unlike the coasts, there is only a small pool of permanent renters in Minneapolis. Most residents will eventually buy — it is only a question of the rate at which they depart. That rate has definitely picked up this year. [A large part] of the rental market is recent college graduates who rent an apartment after they get their first career job. That hiring and renting has not happened this year.

One difference between Minneapolis and warmer climates is that the rental market is extremely seasonal here. There is very little rental traffic during the winter months. Typically, our movements in and out follow a bell-shaped curve, peaking in the summer months. While in-bound traffic drops in the cold months, the out-bound traffic also typically drops as well. The drop off in out-bound traffic did not occur this year. Resident move-outs stayed very high all fall, as people rushed to beat the 11/30th tax credit deadline. The timing of the scheduled end of the credit could not have been worse for us. The extension until the end of April/June means that the bleeding will go on all winter.

Sunday, November 01, 2009

More on Falling Rents

by Calculated Risk on 11/01/2009 07:08:00 PM

The WSJ has an article on landlords cutting effective rents: Landlords Offer Incentives to Stay Put

... Equity Residential said new tenants in the third quarter paid 9% to 10% less rent than the previous residents. ... Denver-based UDR is offering renewing tenants a flat-screen TV, new carpet, kitchen upgrade or, $300 in cash. ... Some landlords have also become more open-minded about tenants with credit issues involving home foreclosures.Rents are falling because vacancies are at record levels. Reis recently reported that the apartment vacancy rate in cities hit a 23 year high of 7.8 percent in the third quarter, and Reis expects the vacancy rate to reach a record 8 percent soon.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Last week the Census Bureau reported the overall rental vacancy rate hit a record 11.1 percent in Q3 2009.

The higher vacancy rate is pushing down rents and the value of rental units. This is good news for renters, but this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks.

And falling rents are already pushing down owners' equivalent rent (OER). OER just turned negative for the first time 1992. From the BLS:

The increase [in CPI] occurred despite declines in the indexes for rent and owners' equivalent rent, the first decreases in those indexes since 1992.Since OER is the largest component of CPI, this will apply downward pressure on CPI for some time. And lower rents will also put pressure on house prices, since renting is a competing product.

Note: REIT BRE reports tomorrow and their CEO always some interesting comments.

"I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession."

BRE CEO, Aug 5, 2009

Thursday, October 29, 2009

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 10/29/2009 01:48:00 PM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 31 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous quarter.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Improving, Bid-Ask Spread Narrowing

Only one index—the one measuring market tightness (vacancies and rent levels)—remained below 50 (index numbers below 50 indicate worsening conditions), but it also showed improvement over the prior quarter, rising from 20 to 31.

“The broad improvements in sales volume and debt and equity financing suggest the transactions market may finally be thawing,” noted NMHC Chief Economist Mark Obrinsky. “Nearly half (45 percent) of respondents indicated that the gap between what sellers are asking for and what buyers are offering—the bid-ask spread—has narrowed.”

“But the economic headwinds remain strong,” Obrinsky added, “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

...

The Market Tightness Index rose from 20 to 31. Nearly half (49 percent) said markets were looser (with higher vacancies and lower rents), while 11 percent said markets were tighter. This was the ninth straight quarter in which the index remained below 50, but the fourth consecutive quarter in which the index measure has risen. For the year, the Market Tightness Index averaged 20, the lowest on record (since 1999).

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

This data is for apartment buildings. The data released earlier today from the Census Bureau - showing a record rental vacancy rate - includes all rental units.