by Calculated Risk on 6/02/2010 01:56:00 PM

Wednesday, June 02, 2010

Report: BofA acknowledges "foreclosure can be very appealing to customers"

From Diana Olick at CNBC: BofA: Mortgage Walkaways Have Huge Incentive

On the conference call ... this morning, BofA's credit loss mitigation executive, Jack Schakett, said the amount of strategic defaulters ... are "more than we have ever experienced before." He went on to say, "there is a huge incentive for customers to walk away because getting free rent and waiting out foreclosure can be very appealing to customers."This is just acknowledging the obvious - borrowers have "a huge incentive to walk away" and "foreclosure can be very appealing to customers".

Schakett says the foreclosure process is still taking 13 to 14 months ... and so there's over a year of free rent.

emphasis added

On the conference call, BofA announced a new "Principal Reduction Enhancement" program for certain underwater borrowers. Here is the press release via MarketWatch: Qualified Homeowners Who Are Severely Underwater May Earn Forgiveness of Some Principal Over Three or Five Years

NHRP-eligible loans include subprime, Pay-Option ARM and prime-quality two-year hybrid ARM loans originated by Countrywide on or prior to January 1, 2009, if the amount of principal owed exceeds the current property value by at least 20 percent and the loan is 60 days or more past due.This is really targeted at Option ARMs ... and I guess they are asking borrowers to stop paying so they can get a principal reduction.

Tuesday, January 12, 2010

More on Option ARMs

by Calculated Risk on 1/12/2010 07:24:00 PM

From Mark Koba at CNBC: More Homeowners Struggling As Option ARMs Reset Higher

From Diana Olick at CNBC: Walkaways, Pay Option ARMS Hit Banks Bad

And from my earlier post: Option ARM Recast Update

This impact is still being debated, but the Option ARM fallout will hit the mid-to-high end bubble areas because it was used as an affordability product.

UPDATE: As Laurie Goodman at Amherst Securities noted yesterday, Option ARM borrowers were a self selecting group (people stretching to buy homes) and most have negative equity in their homes. The "payment shock" is unclear because of low interest rates and because of modifications. Many lenders will be willing to extend the term, and some lenders like Wells Fargo has reduced principal on a case-by-case basis.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

On negative equity, this graph from Amherst shows the CLTV for various mortgage products. Note that subprime and Alt-A had a somewhat higher percent of borrowers with negative equity than prime - but Option ARMs (red) borrowers are mostly in negative equity!

Option ARM Recast Update

by Calculated Risk on 1/12/2010 01:58:00 PM

Laurie Goodman and others at Amherst Securities released a new research note yesterday: Option ARMs - Performance and Pricing

They make several important points (quoted section are from Amherst):

Click on graph for larger image in new window.

Click on graph for larger image in new window.This chart shows the expected payment shock coming in 2010 and 2011 from Option ARMs. This chart includes projected increases in LIBOR (if LIBOR stays low, the shock will not be as high), and the recast due to reamortizing the loan over the remaining period.

Update: There is question on the size of the payment "shock". The report suggests many payments will double, but other estimate are much lower.

Saturday, December 05, 2009

Moody's: Option ARMs Show "Dismal Performance"

by Calculated Risk on 12/05/2009 10:28:00 AM

From HousingWire: Moody’s Links Option ARM, Subprime Performance Click on graph for larger image in new window.

Via: Housing Wire

"The total count of Option ARMs outstanding are highly concentrated among a few states. (source: Moody's)"

From the article:

[The Option ARM] sector shows “dismal” performance, with more than 40% of borrowers 60 or more days past due on payments. And many of these loans have yet to experience a recast event, when initial minimum monthly payments jump as much as 60%, according to sources interviewed by HousingWire for an upcoming issue.For their borrowers, modifications that lower the interest or extend the term, just delay the inevitable - and really makes the borrowers into renters.

“Even though borrowers with Option ARM loans have the option to make monthly payments typically lower than the accruing interest on the loan, many borrowers are choosing a different option–not making any payment at all.”

...

Negative equity is a key driver of weak performance — as well as a more predictive measure of default than unemployment — particularly among Option ARMs.

...

“There is little hope that most of these [delinquent] borrowers will start making payments again if no principal is forgiven,” Moody’s said. “Forbearance does not eliminate the obligation to repay the loan principal, it only delays it. And many delinquent borrowers are potentially so far underwater that it would take close to a decade for them to attain any positive equity in their home.”

Tuesday, September 22, 2009

A comment on Option ARMs

by Calculated Risk on 9/22/2009 04:11:00 PM

The impact of Option ARM recasts is a huge question mark.

Diana Olick at CNBC writes: ARM Payment Shock a Myth?

We've been talking a lot recently about the "next wave" of foreclosures that would be driven by adjustable rate mortgage resets. In a research note today, FBR's Paul miller is taking an interesting tack: "While we remain very concerned about the impact of continued job losses on default rates, our analysis suggests that payment shock from ARM resets should not be a problem, as long as the Federal Reserve can keep short-term rates at record lows."Stop right there. Resets are not a problem with low interest rates. The potential problems are from loan recasts.

From Tanta on resets and recasts:

"Reset" refers to a rate change. "Recast" refers to a payment change. ... "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.Since a large percentage of ARM borrowers chose the negatively amortizing option, their payments will jump when the loan is reamortized or recast. Of course the interest rate will still be low, and the recast will be at the low rate.

So it is really hard to tell what will happen.

We see cautionary articles all the time:

But I think the exact impact is uncertain. Many Option ARM borrowers are defaulting before the loan recasts, see: $134B of U.S. Option ARM RMBS To Recast by 2011 (note: Fitch is just looking at securitized Option ARMs, not loans in bank portfolios):

Of the $189 billion securitized Option ARM loans outstanding, 88% have yet to experience a recast event ... Of these loans that have not yet recast, 94% have utilized the minimum monthly payment to allow their loans to negatively amortize.For more on defaulting before recast, see: Option ARM Defaults Shrink Recast Wave, Barclays Says .

...

Further evidence of option ARM underperformance in the last year lies in the number of outstanding securitized Option ARMs either 90 days or more delinquent, in foreclosure or real estate-owned proceedings, which has increased from 16% to 37%. Total 30+ day delinquencies are now 46%, despite the fact that only 12% have recast and experienced an associated payment shock. Instead, negative and declining equity has presented a larger problem: due to high concentrations in California, Florida, and other states with rapidly declining home prices, average loan-to-value ratios have increased from 79% at origination to 126% today. 'Negative equity and payment shocks will continue as Option ARM loans recast in large numbers in the coming years,' said Somerville.

emphasis added

And it is important to remember that most of the Option ARM loans in the Wells Fargo portfolio (via Wachovia) recast in ten years, as noted by the Healdsburg Housing Bubble: Reset Chart from Credit Suisse has a Major Error From the Wells Fargo Q2 Conference Call:

[W]hile many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.It is a little confusing. You can't just look at a chart of coming recasts and know when borrowers will default. The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast.

But the recasts will matter too, since many of these borrowers used these mortgages as "affordability products", and bought the most expensive homes they could "afford" (based on monthly payments only). When the recasts arrive, these borrowers will have few options.

Sunday, September 20, 2009

San Francisco: $30 Billion Option ARM Time Bomb

by Calculated Risk on 9/20/2009 08:49:00 AM

From Carolyn Said at the San Francisco Chronicle: $30 billion home loan time bomb set for 2010

From 2004 to 2008, "one in five people who took out a mortgage loan (for both purchases and refinancing) in the San Francisco metropolitan region ... got an option ARM," said Bob Visini, senior director of marketing in San Francisco at First American CoreLogic, a mortgage research firm. "That's more than twice the national average.The article has much more.

"People think option ARMs (will be) a national crisis," he said. "That's not really true. It's just in higher-cost areas like California where you see their prevalence."

...

First American shows more than 54,000 option ARMs issued here with a value of about $30.9 billion. Fitch shows more than 47,000 option ARMs here with a value of about $28 billion. Both say their data underestimate the totals.

...

Fitch said 94 percent of borrowers elected to make minimum payments only.

...

Unlike subprime loans, which were more commonly used for entry-level homes, option ARMs started out with high balances. In the five-county San Francisco area, option ARMs average about $584,000 and were used to buy homes averaging $823,000, according to an analysis of First American data.

That means they'll spawn foreclosures among upper-end homes.

...

"The average option ARM borrower is significantly underwater, so much that they don't think they'll get out," Sirotic said. On average nationwide, option ARM borrowers ... owe is 126 percent of their home's value, based on depreciation and not including the effects of negative amortization, Sirotic said.

Option ARMs were used as affordability products in mid-to-high priced areas of bubble states like California. Now most of the borrowers are significantly underwater, and this will lead to more foreclosures, and falling prices, in the mid-to-high end areas.

Thursday, September 17, 2009

Iowa Attorney General: "Option ARMs are about to explode"

by Calculated Risk on 9/17/2009 10:25:00 PM

From Reuters: "Option" mortgages to explode, officials warn

"Payment option ARMs are about to explode," Iowa Attorney General Tom Miller said after a Thursday meeting with members of President Barack Obama's administration to discuss ways to combat mortgage scams.This was a meeting of state AGs discussing mortgage scams with the Obama Administration, and based on the comments, there was an emphasis on Option ARMs.

...

In Arizona, 128,000 of those mortgages will reset over the the next year and many have started to adjust this month, the state's attorney general, Terry Goddard, told Reuters after the meeting.

"It's the other shoe," he said. "I can't say it's waiting to drop. It's dropping now."

I guess that deserves a Hoocoodanode?

Tuesday, September 08, 2009

Fitch on Option ARM Recasts

by Calculated Risk on 9/08/2009 05:58:00 PM

From Fitch: $134B of U.S. Option ARM RMBS To Recast by 2011

Of the $189 billion securitized Option ARM loans outstanding, 88% have yet to experience a recast event ... Of these loans that have not yet recast, 94% have utilized the minimum monthly payment to allow their loans to negatively amortize.Fitch is just looking at securitized Option ARMs, not loans in bank portfolios like Wells Fargo with all the 10 year Pick-a-Pay recast periods.

...

Further evidence of option ARM underperformance in the last year lies in the number of outstanding securitized Option ARMs either 90 days or more delinquent, in foreclosure or real estate-owned proceedings, which has increased from 16% to 37%. Total 30+ day delinquencies are now 46%, despite the fact that only 12% have recast and experienced an associated payment shock. Instead, negative and declining equity has presented a larger problem: due to high concentrations in California, Florida, and other states with rapidly declining home prices, average loan-to-value ratios have increased from 79% at origination to 126% today. 'Negative equity and payment shocks will continue as Option ARM loans recast in large numbers in the coming years,' said Somerville.

The second paragraph is key - many of these borrowers are defaulting before the loans recast! From Bloomberg on a Barclays report in July: Option ARM Defaults Shrink Recast Wave, Barclays Says

The wave of “option” adjustable- rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller “than feared” because many borrowers will default before their bills change, Barclays Capital analysts said.The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast. As Fitch notes, modifications haven't been helpful for Option ARM borrowers because many are too far underwater:

...

About 40 percent of borrowers with option ARMs are already delinquent, and “many” of the others will start missing payments before their obligations change, the Barclays mortgage- bond analysts wrote in a July 24 report. ...

“The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock,” the New York-based analysts including Sandeep Bordian and Jasraj Vaidya wrote.

...

More than $750 billion of option ARMs were originated between 2004 and 2008 ...

To date, 3.5% of the approximately one million 2004-2007 vintage securitized Option ARM loans have been modified, in an attempt to mitigate effects from the payment shock. Modification types have included term extension, conversion to interest only loans, interest rate cuts, and others. These modifications have been somewhat successful, with 24% of modified Option ARM loans being 90+ days delinquent, compared with 37% of the overall Option ARM universe. However ... Fitch expects a high default percentage for modified Option ARM loans.This is a somewhat confusing press release. The recasts will probably lead to higher defaults, but negative equity is the real problem.

Monday, July 27, 2009

Option ARMs: Good News, Bad News

by Calculated Risk on 7/27/2009 04:04:00 PM

The good news, according to a Barclays Capital report, is not as many Option ARMs will recast in 2011 as forecast earlier by Credit Suisse.

The bad news is borrowers are defaulting en masse before the recast.

From Bloomberg: Option ARM Defaults Shrink Size of Recast Wave, Barclays Says (ht Brian)

The wave of “option” adjustable- rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller “than feared” because many borrowers will default before their bills change, Barclays Capital analysts said.Also some of the loans (mostly Wells Fargo) will probably recast later than the Credit Suisse chart.

...

About 40 percent of borrowers with option ARMs are already delinquent, and “many” of the others will start missing payments before their obligations change, the Barclays mortgage- bond analysts wrote in a July 24 report. ...

“The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock,” the New York-based analysts including Sandeep Bordian and Jasraj Vaidya wrote.

...

More than $750 billion of option ARMs were originated between 2004 and 2008 ...

Also on Option ARMs from the WSJ a couple weeks ago: Pick-a-Pay Loans: Worse Than Subprime

This suggests the recast related problems will happen sooner than the Credit Suisse chart suggests. That is good news in that the problems might not linger as long, and also suggests further price pressure in the short term for the mid-to-high end areas with significant Option ARM activity.

UPDATE on Wells Fargo Option ARM portfolio, from Q2 recorded comments (ht HealdsburgBubble):

The Pick-a-Pay portfolio also performed as expected as we continued to de-risk the portfolio. I want to highlight some key points that are important for every investor to understand about this portfolio:

First, not all option ARM portfolios are alike and we believe we have the best portfolio in the industry. While recently reported industry data, as of April 2009, indicates 37 percent of all industry option ARM loans are at least 60 days past due, our portfolio is performing significantly better with only 18 percent 60 days or more past due as of June 30. Not surprisingly, our non-impaired portfolio is performing significantly better than our impaired portfolio with only 4.7 percent 60 days or more past due. In fact, 92 percent of the non-impaired portfolio is current, compared with 62 percent of the impaired portfolio. In addition, while many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.

emphasis added

Monday, July 13, 2009

Report: Option ARMs Performing Worse than Subprime

by Calculated Risk on 7/13/2009 12:36:00 PM

From the WSJ: Pick-a-Pay Loans: Worse Than Subprime

For the third straight month, option adjustable-rate mortgages are generating proportionally more delinquencies and foreclosures than subprime mortgages ...We knew this day was coming.

As of April, 36.9% of Pick-A-Pay loans were at least 60 days past due, while 19% were in foreclosure, according to data from First American CoreLogic, a unit of Santa Ana, Calif.-based First American Corp. In contrast, 33.9% of subprime loans were delinquent, with 14.5% of those loans in foreclosure, the figures show.

By the way, the Healdsburg Housing Bubble has a nice analysis of the Credit Suisse Reset chart, and makes a strong argument that many of the recasts will be later than the chart indicates: Reset Chart from Credit Suisse has a Major Error

Wells Fargo, who holds more Option-ARMs on its books than any other institution, states in their last 10-Q filing:There is much more in HBB's post, but this suggests that the problem will presist for some time (much longer than shown by the Credit Suisse chart).Based on assumptions of a flat rate environment, if all eligible customers elect the minimum payment option 100% of the time and no balances prepay, we would expect the following balance of loans to recast based on reaching the principal cap: $4 million in the remaining three quarters of 2009, $9 million in 2010, $11 million in 2011 and $32 million in 2012... In addition, we would expect the following balance of ARM loans having a payment change based on the contractual terms of the loan to recast: $20 million in the remaining three quarters of 2009, $51 million in 2010, $70 million in 2011 and $128 million in 2012.In short, Wells expects $56 million in Option ARMs to recast due to the loan balance reaching 125% of the value of the original loan and another $269 million to recast based on the terms of the loan. Given that we’re talking about a portfolio of over $100 BILLION of these loans, this means ESSENTIALLY NO LOANS WILL RECAST due to the negative amortization limits or contractual terms before 2012.

Both assumptions seemed suspect, yet, they are in fact true. Looking at page 55 of the Golden West 10-K from 2005 we read:...most of our loans are scheduled to have a payment change without respect to any annual limit in order to reamortize the loan over its remaining life at the end of the tenth year or when the loan balance reaches 125% of the original amount. We term this reamortization a “recast.” Historically, most loans in our portfolio have paid off before the loan’s payment is recast.History doesn’t look like it will be a good guide going forward but this at least clearly spells out what we are facing. If recasts don’t happen contractually for 10 years this means that the $49 billion of Golden West Option ARMs originated in 2004 will recast in 2014, and the $51 billion originated in 2005 will recast in 2015.

Monday, June 29, 2009

FirstFed and Option ARMs "Last One Standing"

by Calculated Risk on 6/29/2009 03:11:00 PM

Here is an interesting article on FirstFed in the Los Angeles Business Journal: Last One Standing (ht Will)

Since souring option ARMs have taken down a number of big lenders, the big question looms: Will FirstFed, a savings and loan founded in Santa Monica on the eve of the Great Depression, be next?Basically FirstFed is the last of the Option ARM lenders (Wachovia, Countrywide, WaMu, IndyMac are all gone). And on their business:

...

In January, regulators placed the thrift under a cease-and-desist order over concerns that its capital supply was rapidly depleting. Even its auditor expressed doubt about its ability to survive.

Yet the institution is still around ...

FirstFed had been making option ARM loans without incident for more than 20 years. The loans held up well largely because option ARMs tended to be given to borrowers with good credit and proof of income.The average loan balance seems very high. From the Q1 10-Q SEC filing:

...

[By 2005 a] growing number of borrowers began opting for the minimum monthly payment, which sometimes did not even cover the interest rate. ...

[CR Note: by 2005, Option ARMs were being used for "affordability" instead of for cash management]

FirstFed readily admits it made the mistake of dropping its own standards in a misguided attempt to remain competitive. It did that mostly in 2005, a year in which the thrift originated $4.4 billion in single-family loans – primarily option ARMs and most without full verification of income or assets.

But the thrift was also one of the first to pull back. By late 2005 and into 2006, managers made the decision to stop underwriting the riskiest loans and begin requiring proof of income. Within two weeks, their business dropped in half.

[CR Note: Notice the risk layering. Not only were these Option ARMs, they were stated income (liar loan) Option ARMs and even no asset verification!]

...

In late 2007, with a $4.4 billion portfolio of option ARM loans set to recast, FirstFed began working aggressively to modify its at-risk loans.

...

In the past year and a half, FirstFed has modified some 2,000 loans, which constitute $2.8 billion of its option ARM portfolio ... a new effort currently under way could modify all but $400 million of the remaining loans.

At March 31, 2009, 1,511 loans with principal balances totaling $718.5 million had been modified.That is an average loan balance of $475 thousand and far short of the $2.8 in loan mods the article mentions - although FirstFed has probably modified a number of loans in Q2.

FirstFed is a candidate for BFF (or Thursday this week).

Thursday, June 11, 2009

Option ARMs: Paying $98 a month on a $350 Thousand Mortgage

by Calculated Risk on 6/11/2009 10:00:00 AM

From Bloomberg: Option ARMs Threaten U.S. Housing Rebound as 2011 Resets Peak

Shirley Breitmaier took out a $315,000 option ARM to refinance a previous loan on her house.And compare these two comments:

Her payments started at 3/8 of 1 percent, or less than $100 a month ... The 73-year-old widow may see it jump to $3,500 a month in two years ... She’ll be required to start paying principal and interest to amortize the debt when the loan reaches 145 percent of the original amount borrowed.

[CR Note: the 145% recast level is much higher than normal. This is now a GMAC loan]

...

About 1 million option ARMs are estimated to reset higher in the next four years, according to real estate data firm First American CoreLogic of Santa Ana, California. About three quarters of those loans will adjust next year and in 2011, with the peak coming in August 2011 when about 54,000 loans recast, the data show.

[CR Note: recast, not reset. This article uses the two terms interchangeably]

...

“The option ARM recasts will drive up the foreclosure supply, undermining the recovery in the housing market,” [Susan Wachter, a professor of real estate finance at the University of Pennsylvania’s Wharton School in Philadelphia] said in an interview. “The option ARMs will be part of the reason that the path to recovery will be long and slow.”

“This loan is a perfect example front to back, bottom to top, of everything that has gone wrong over the last five to seven years,” [Cameron Pannabecker, the owner of Cal-Pro Mortgage] said. “The consumer had a product pushed on them that they had no hope of understanding.”I agree with Pannabecker.

...

“The problem is, real estate values went down,” [Peter Paul of Paul Financial, the loan orginator] said.

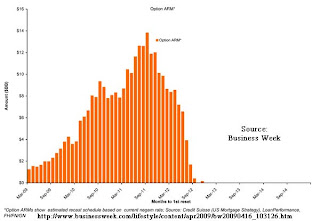

And here is a repeat of the most recent reset / recast chart from Credit Suisse.

Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

As Tanta noted: "Reset" refers to a rate change. "Recast" refers to a payment change.

Resets are not a huge problem as long as interest rates stay low, but recasts could be significant. There are some questions about how the Wells Fargo pick-a-pay portfolio fits into this chart, since Wells Fargo doesn't expect significant recasts until 2012 (see A Bank Is Survived by Its Loans )

Wednesday, May 20, 2009

New Mortgage Loan Reset / Recast Chart

by Calculated Risk on 5/20/2009 09:44:00 AM

Matt Padilla at the O.C. Register presents a new reset / recast chart from Credit Suisse: Loan reset threat looms till 2012 Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

As Tanta noted: "Reset" refers to a rate change. "Recast" refers to a payment change.

Resets are not a huge problem as long as interest rates stay low, but recasts could be significant.

Note that Wells Fargo expects only a small percentage of their $115 billion "pick-a-pay" Option ARM portfolio they acquired via Wachovia (originally from World Savings / Golden West) to recast by 2012 (because Golden West had very generous NegAM terms). I'm not sure how that fits with this chart.

Friday, May 15, 2009

NY Times Norris on Pick-a-pay Loans

by Calculated Risk on 5/15/2009 12:21:00 AM

From Floyd Norris at the NY Times: A Bank Is Survived by Its Loans

World Savings ... did not sell its loans into securitizations, so it knew it stood to lose if a loan went bad. Virtually all of the pick-a-pay loans were for less than 80 percent of the appraised value of the home, and the average was just 71 percent. World said it made loans only to those who could afford the stepped-up monthly payment after the reset, and said it did not lend to subprime borrowers.World Savings appeared to make safe loans, but they were very generous on the cap for when the loans recast. World also used the original appraised value, and there was no reappraisal provision.

...

Most banks forced the borrower to start making much larger monthly payments if the amount owed ... rose to 110 percent of the appraised value of the home when the loan was made. World ... did not force the payments up until the amount owed was 25 percent greater than the original value.

So even though the borrowers originally had substantial "skin in the game", many of the borrowers are deep underwater - and are now really renters.

Note: World was part of Golden West which was bought by Wachovia, and is now owned by Wells Fargo.

The amount owed on such loans at the end of March was $115 billion, which Wells estimates is 107 percent of the current value of the properties underlying the mortgages.At least we don't have to worry about many of these loans blowing up over the next few years!

...

Only $325 million of the loans — less than a third of 1 percent — will reset by the end of 2012.

...

Wells Fargo has written the value of the pick-a-pay portfolio down by about 20 percent, and is offering to restructure some of the loans. But many of the owners may have no reason to seek such a restructuring. ... The result may be perverse: a prolonged foreclosure crisis ...

Note: I think Norris means recast, not reset, "Reset" refers to a rate change. "Recast" refers to a payment change.

Monday, May 11, 2009

Foreclosures in the 'Burbs

by Calculated Risk on 5/11/2009 09:12:00 PM

From Crain's Chicago Business: Foreclosure wave slams suburbia (ht Atrios)

Home foreclosures are surging in Chicago's suburbs just as they level off or decline in many city neighborhoods already ravaged by mortgage defaults.The decline in foreclosures in Chicago might be because of the recent moratorium, but clearly foreclosures are moving into the middle-class areas.

Foreclosure cases filed in the first quarter jumped between 25% and 70% from the fourth quarter in DuPage, Will, McHenry, Lake and Kane counties, according to new data provided to Crain's by the Woodstock Institute, a Chicago-based housing advocacy group. Meanwhile, foreclosures fell 8% in Chicago, the first quarterly decline in a year.

...

The shifting locus of new foreclosures shows how the recession and job losses are supplanting subprime lending as the main driver of mortgage defaults ... While the first wave of foreclosures hit hardest in poorer city neighborhoods ... the latest round is striking middle-class areas where most borrowers qualified for standard-rate mortgages.

We're all subprime now!

And that gives me an excuse to post this ...

Click on drawing for larger image in new window.

Click on drawing for larger image in new window.My friend and co-blogger Tanta originated the phrase "We're all subprime now!" One of her many talents was something she called "Excel Art". This drawing is from December 2007 and is titled "The Adventures of Mortgage Pig, Chapter 4: Hanging Over the Cubicles of the Mod Squad".

The drawing is from an excel file that Tanta used to explain how Option ARM loans recast - see Tanta's UberNerd post: On Option ARMs

Friday, May 08, 2009

Loan Reset / Recast Schedule

by Calculated Risk on 5/08/2009 06:13:00 PM

Before reading, please see Tanta's: Reset Vs. Recast, Or Why Charts Don't Match

"Reset" refers to a rate change. "Recast" refers to a payment change.Here are two Credit Suisse charts:

Click on image for larger graph in new window.

Click on image for larger graph in new window.The first chart is from Business Week in April: Good News: Option ARM Resets Delayed

The reset and recast confusion continues! The x-axis is labeled "months to 1st reset", but the notes to the graph says: "estimated recast schedule".

And here is more from a Credit Suisse research report released in February (no link):

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.Looking at these charts it would be easy to conclude that the recast problem last through 2012. However there is a difference between the original recast date, and the actual recast date - because negatively amortizing loans hit the recast ceiling earlier than the original forecast. I suspect the peak in recasts for Option ARMs will be in 2010.

Wednesday, May 06, 2009

Foreclosures: More movin' on up!

by Calculated Risk on 5/06/2009 10:10:00 AM

From Bloomberg: Rich Americans Default on Luxury Homes Like Subprime Victims (ht Lance)

Chuck Dayton put down a quarter of the $950,000 purchase price when he bought his house in Newport Beach, California, in 2004. ... Dayton, 43, went into default four months ago because he couldn’t afford payments on the three-bedroom home, located within a block of the Pacific Ocean.The next wave of defaults is building ... this time in the mid-to-high range.

...

Dayton said he financed the purchase of his home, 40 miles south of Los Angeles in Orange County, with a payment-option adjustable-rate mortgage now serviced by JPMorgan’s Washington Mutual.

...

Dayton refinanced in February 2007 with a $1 million loan from Washington Mutual ... He also took out two private mortgages and now has a balance of $106,000 on those loans ... Dayton went into default on Jan. 29 and owes $46,584 in delinquent payments and penalties, according to First American CoreLogic ...

The number of U.S. homes valued at more than $729,750, the jumbo-loan limit in the most affluent areas, entering the foreclosure process jumped 127 percent during the first 10 weeks of this year from the same period of 2008, data compiled by RealtyTrac Inc. of Irvine, California, show. The rate rose 72 percent for homes valued at less than $417,000 and 78 percent for all homes

Thursday, January 29, 2009

WSJ: Option ARM Defaults Rising

by Calculated Risk on 1/29/2009 09:17:00 PM

From Ruth Simon at the WSJ: Option ARMs See Rising Defaults (hat tip ShortCourage)

Nearly $750 billion of option adjustable-rate mortgages, or option ARMs, were issued from 2004 to 2007, according to Inside Mortgage Finance ... Rising delinquencies are creating fresh challenges for companies such as Bank of America Corp., J.P. Morgan Chase & Co. and Wells Fargo & Co. that acquired troubled option-ARM lenders.If 61% of the $750 billion in Option ARMs default, and with a 50% loss severity, the losses to lenders will be about $225 billion - far less than for subprime, but still a huge problem.

...

As of December, 28% of option ARMs were delinquent or in foreclosure, according to LPS Applied Analytics ... An additional 7% involve properties that have already been taken back by the lenders. ... Just over half of subprime loans were delinquent, in foreclosure, or related to bank-owned properties as of December. The nearly $750 billion of option ARMs issued from 2004 to 2007 compares with roughly $1.9 trillion each of subprime and jumbo mortgages in that period.

Nearly 61% of option ARMs originated in 2007 will eventually default, according to a recent analysis by Goldman Sachs ...

The key problem with Option ARMs is that they were used as affordability products, mostly in California and Florida, because buyers couldn't qualify for fixed rate mortgages or even regular ARMs. It should have been no surprise that most borrowers chose the negatively amortizing option; it was the only one they could afford!

Wednesday, October 22, 2008

Wachovia $23.7 Billion Loss

by Calculated Risk on 10/22/2008 09:16:00 AM

From Reuters: Wachovia Reports $23.9 Billion Loss for Third Quarter

Wachovia on Wednesday posted a $23.9 billion third-quarter loss, a record for any United States lender in the global credit crisis ... The loss totaled $11.18 per share, and stemmed mostly from an $18.7 billion write-down of good will because asset values declined, as well as a big increase in reserves for soured loans.

...

Much of Wachovia’s troubles stem from a fast-deteriorating $118.7 billion portfolio of “Pick-a-Pay” option adjustable-rate mortgages it largely took on when it bought the California lender Golden West Financial for $24.2 billion in 2006.

Wachovia said it now expects cumulative losses on that 438,000-loan portfolio of $26.1 billion, or 22 percent, up from the 12 percent it had forecast in July.

Tuesday, August 05, 2008

FirstFed and Option ARMs

by Calculated Risk on 8/05/2008 10:32:00 PM

From the WSJ: FirstFed Grapples With Fallout From Payment Option Mortgages

Like many mortgage lenders, FirstFed Financial Corp. is struggling with rising losses. ... Forty percent of its borrowers became at least 30 days delinquent after the payments on their adjustable-rate mortgages were recast. The number of foreclosed homes held by the bank doubled in the second quarter from the first quarter.It seems like Tanta and I have been writing about the coming wave of Option ARM defaults forever, but it's only been since 2005!

But FirstFed isn't another bank grappling with the fallout from subprime mortgages that went to less-creditworthy borrowers. ... [T]he Los Angeles bank is on the front lines of what could be the next big mortgage debacle: payment option mortgages.

Barclays Capital estimates that as many as 45% of option ARMs, as they are often called, originated in 2006 and 2007 could wind up in default. Another analysis, by UBS AG, suggests that defaults on option ARMs originated in 2006 could be as high as 48%, slightly higher than its estimate for defaults on subprime loans.The key here, for the housing market, is that the next wave of defaults will be hitting middle to upper middle class neighborhoods.

We're all subprime now! (a classic Tanta phrase)