by Calculated Risk on 3/08/2011 10:11:00 AM

Tuesday, March 08, 2011

CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4

CoreLogic released the Q4 2010 negative equity report today.

CoreLogic ... today released negative equity data showing that 11.1 million, or 23.1 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2010, up from 10.8 million, or 22.5 percent, in the third quarter. The small increase reflects the price declines that occurred during the fourth quarter and led to lower values. An additional 2.4 million borrowers had less than five percent equity, referred to as near-negative equity, in the fourth quarter. Together, negative equity and near-negative equity mortgages accounted for 27.9 percent of all residential properties with a mortgage nationwide....Here are a couple of graphs from the report:

The consensus is that home prices will fall another 5 percent to 10 percent in 2011. If so, the most that negative equity will rise is another 10 percentage points, all else equal. What’s important is not just the share of at-risk loans (i.e., loans with less than 10 percent equity) but current price movements.

...

The aggregate level of negative equity increased to $751 billion in Q4, up from $744 billion last quarter but still below $800 billion a year ago. Over $450 billion of the aggregate negative equity dollars include borrowers who are upside down by more than 50 percent.

...

"Negative equity holds millions of borrowers captive in their homes, unable to move or sell their properties. Until the high level of negative equity begins to recede, the housing and mortgage finance markets will remain very sluggish," said Mark Fleming, chief economist with CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

About 10% of homeowners with mortgages have more than 25% negative equity.

The second graph from CoreLogic shows the aggregate dollar volume by percent of negative equity. Of the $751 billion in negative equity in Q4, over $450 billion of the aggregate negative equity dollars are for borrowers who are upside down by more than 50%. Just under $200 billion more is for borrowers who have 25% to 50% negative equity.

The second graph from CoreLogic shows the aggregate dollar volume by percent of negative equity. Of the $751 billion in negative equity in Q4, over $450 billion of the aggregate negative equity dollars are for borrowers who are upside down by more than 50%. Just under $200 billion more is for borrowers who have 25% to 50% negative equity.All of these borrowers are at high risk for foreclosure.

The third graph shows the break down of equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.In Nevada, over 65% of homeowners with mortgages owe more than their homes are worth. Arizona and Florida are around 50%. Michigan, Georgia and California are all over 30%.

Thursday, August 26, 2010

CoreLogic: 11 Million U.S. Properties with Negative Equity in Q2

by Calculated Risk on 8/26/2010 03:32:00 PM

Note that the slight decline in homeowners with negative equity was mostly due to foreclosures.

First American CoreLogic released the Q2 2010 negative equity report today.

CoreLogic reports that 11 million, or 23 percent, of all residential properties with mortgages were in negative equity at the end of the second quarter of 2010, down from 11.2 million and 24 percent from the first quarter of 2010. Foreclosures, rather than meaningful price appreciation, were the primary driver in the change in negative equity. An additional 2.4 million borrowers had less than five percent equity. Together, negative equity and near negative equity mortgages accounted for nearly 28 percent of all residential properties with a mortgage nationwide.From the report:

...

"Negative equity continues to both drive foreclosures and impede the housing market recovery. With nearly 5 million borrowers currently in severe negative equity, defaults will remain at a high level for an extended period of time," said Mark Fleming, chief economist with CoreLogic.

Negative equity remains concentrated in five states: Nevada, which had the highest percentage negative equity with 68 percent of all of its mortgaged properties underwater, followed by Arizona (50 percent), Florida (46 percent), Michigan (38 percent) and California (33 percent). The declines were primarily due to foreclosures, not the stabilization or small increases in prices in some markets. The largest decrease in negative equity occurred among those with loan-to-value (LTV) ratios in excess of 125 percent, where the number of negative equity borrowers fell to 4.8 million, down from 5 million last quarter.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentage of homeowners underwater, 10 percent or more of homeowners with mortgages in 33 states and the D.C. have negative equity.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA on the graph above.

CoreLogic also released a negative equity report for 164 metro areas (excel file) (with a minimum of 50,000 mortgages). Las Vegas is at the top with 72.8% of homeowners with mortgages in negative equity (another 3.3% are close) - and the top of the list is dominated by Nevada, California, Arizona and Florida - but it is amazing how widespread the problem is!

Even with foreclosures reducing the number of negative equity mortgages, I expect the number of homeowners with negative equity will increase as prices fall later this year.

Saturday, July 31, 2010

Negative Equity Breakdown

by Calculated Risk on 7/31/2010 11:40:00 AM

Here is some data from a recent congressional briefing by Mark Zandi, Chief Economist of Moody's Economy.com, and Yale Professor Robert Shiller. I believe all of this negative equity data was presented by Zandi.

A few key points, as of Q1 2010:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of homeowners with negative equity (dashed line), percent of homeowners with mortgages with negative equity (blue), and the mortgage debt for homes with negative equity - all since Q1 2006.

The good news is the percent of homeowners with negative equity, and the mortgage debt for homes with negative equity, peaked in 2009.

The bad news is the declines have been relatively small even with all the distress sales, minor price increases, and some principal reduction modifications. As prices start to fall later this year (as I expect), the number of homeowners with negative equity will probably increase again (offset by foreclosures, short sales, and some modifications with principal reduction).

The second graph shows the number of homeowners in negative equity, by the percent of negative equity.

The second graph shows the number of homeowners in negative equity, by the percent of negative equity.There are 4.1 million homeowners with more than 50% negative equity, and another 5 million homeowners with 20% to 50% negative equity.

If prices fall 5%, the columns will essentially shift one to the left (ignoring remedies), and there will be 10.2 million homeowners with 20% or more negative equity.

The third graph shows the percent of homeowners with mortgages in negative equity for 33 states and D.C.

The third graph shows the percent of homeowners with mortgages in negative equity for 33 states and D.C.This is shown in three categories: >50%, 20% to 50%, and 0 to 20%.

If you look at Nevada, 17.0% of homeowners (with mortgages) are more than 50% underwater, and another 35.2% are 20% to 50% underwater. These are the homeowners most at risk for foreclosure.

Note: the Q2 CoreLogic negative equity report will be released soon, but that report doesn't provide this level of detail.

Monday, May 10, 2010

Report: 11.2 Million U.S. Properties with Negative Equity in Q1

by Calculated Risk on 5/10/2010 11:23:00 AM

First American CoreLogic released the Q1 2010 negative equity report today.

CoreLogic reported today that more than 11.2 million, or 24 percent, of all residential properties with mortgages, were in negative equity at the end of the f irst quarter of 2010, down slightly from 11.3 million and 24 percent from the fourth quarter of 2009. An additional 2.3 million borrowers had less than five percent equity. Together, negative equity and near-negative equity mortgages accounted for over 28 percent of all residential properties with a mortgage nationwide.From the report:

Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (34 percent). Las Vegas remains the top ranked CBSA with 75% of mortgaged properties being underwater, followed by Stockton (65%), Modesto (62%), Vallejo-Fairfield (60%) and Phoenix (58%). Phoenix had more than 550,000 underwater borrowers, the most households of any metropolitan market in the country. Riverside (463,000), Los Angeles (406,000) Atlanta (399,000) and Chicago (365,000) round out the top five markets.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentage of homeowners underwater, 10 percent or more of homeowners have negative equity in 33 states and the D.C., and over 20% have negative equity or near negative equity in 23 states and D.C. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA on the graph above.

The second graph shows the distribution of homeowners with a mortgage with near or negative equity.

The second graph shows the distribution of homeowners with a mortgage with near or negative equity.The share of borrowers whose mortgage debt exceeds the property value by 25% or more fell slightly to 10.4% or 4.9 million borrowers, down from 10.6% or 5 million borrowers. The aggregate dollar value of negative equity for these deeply underwater borrowers was $656 billion dollars.Research has shown that once negative equity exceeds 25 percent "owners begin to default with the same propensity as investors", and it is these 4.9 million borrowers - with $656 billion in debt - that are most at risk for foreclosure.

Tuesday, February 23, 2010

Q4 Report: 11.3 Million U.S. Properties with Negative Equity

by Calculated Risk on 2/23/2010 05:27:00 PM

First American CoreLogic released the Q4 negative equity report today.

First American CoreLogic reported today that more than 11.3 million, or 24 percent, of all residential properties with mortgages, were in negative equity at the end of the fourth quarter of 2009, up from 10.7 million and 23 percent at the end of the third quarter of 2009. An additional 2.3 million mortgages were approaching negative equity at the end of last year, meaning they had less than five percent equity. Together, negative equity and near‐negative equity mortgages accounted for nearly 29 percent of all residential properties with a mortgage nationwide.From the report:

Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (35 percent). Among the top five states, the average negative equity share was 42 percent, compared to 15 percent for the remaining 45 states. In numerical terms, California (2.4 million) and Florida (2.2 million) had the largest number of negative equity mortgages accounting for 4.6million, or 41 percent, of all negative equity loans.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentgage of homeowners underwater, 10 percent or more of homeowners have negative equity in 33 states, and over 20% have negative equity or near negative equity in 23 states. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.The second graph shows homeowners with severe negative equity for five states.

These homeowners are far more likely to default.

The rise in negative equity is closely tied to increases in pre‐foreclosure activity and is a major factor in changing homeowners’ default behavior. Once negative equity exceeds 25 percent, or the mortgage balance is $70,000 higher than the current property values, owners begin to default with the same propensity as investors.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

This graph fits with figure 2 above and suggests a large number of future defaults in Nevada, Arizona, Florida and California.

Most homeowners with negative equity will probably not default, but this does suggest there are many more foreclosures coming - and more losses.The aggregate dollar value of negative equity was $801 billion, up $55 billion from $746 billion in Q3 2009. The average negative equity for an underwater borrower in Q4 was ‐$70,700, up from ‐$69,700 in Q3 2009. The segment of borrowers that are 25 percent or more in negative equity account for over $660 billion in aggregate negative equity.

Monday, January 18, 2010

Principal Reduction and Walking Away

by Calculated Risk on 1/18/2010 08:46:00 AM

A couple of quotes from an article by James Hagerty in the WSJ: Is Slashing Mortgage Principal the Answer?

... Assistant Treasury Secretary Michael Barr ... suggested that there would be a risk that such a [principal] program would change a lot of borrowers’ behavior. “Most people, most of the time, make their mortgage payments ... even if they’re underwater,” Mr. Barr noted. “You have to be quite careful not to design a program that induces more people to walk away” ...This is a major concern. A couple weeks ago I wrote: New Research on Mortgage Modifications and Principal Reduction

Imagine what would happen to Wells Fargo or Bank of America if their borrowers found out that the banks would substantially reduce their principal if they were 1) underwater (negative equity), and 2) stopped making their payments. The delinquency rate and losses would skyrocket!Because of this risk, a macro principal reduction program is very unlikely.

And another quote from the WSJ:

Tom Capasse, a principal at Waterfall Asset Management LLC, a New York-based investor in mortgages, says it’s too late to prevent a “seismic shift” in borrower behavior ... “There used to be a scarlet D on your forehead if you defaulted,” says Mr. Capasse. “Now it’s a badge of honor.”Not quite a "badge of honor", but the widespread acceptance of "walking away" has been one of the greatest fears of lenders for some time.

Wednesday, January 06, 2010

New Research on Mortgage Modifications and Principal Reduction

by Calculated Risk on 1/06/2010 03:54:00 PM

I've excerpted below from a paper by New York Fed Researchers Andrew Haughwout, Ebiere Okah, and Joseph Tracy: Second Chances: Subprime Mortgage Modification and Re-Default

Although the paper uses subprime data, the general results are applicable to all mortgages. The researchers point out that principal reductions lead to much lower redefault rates (that is obvious, but still worth noting). They also note that principal reductions help mitigate the mobility problem - as I've noted before, the lack of worker mobility slows the potential growth of the economy, leads to lower home maintenance, and possibly "diminished support for local public goods"1.

But the authors don't suggest who should pay for the reductions in principal. If this was a government program, it would be very expensive and unpopular. Diana Olick wrote today at CNBC: Are Principal Writedowns the Answer to Housing Crisis?

I would honestly rather see my home's value go down than see the guy next door ... who made a poor/negligent financial decision get a mulligan at my expense.I think that would be the overwhelming public reaction.

Some people point to Lewis Ranieri's apparent success with principal reductions, from Fortune: Lewie Ranieri wants to fix the mortgage mess

Now Ranieri is championing an inventive solution for fixing the mess he's accused of enabling in the first place. Ranieri has raised $825 million from 31 foundations and corporate and public pension funds, including the South Carolina Retirement Systems, to form the Selene Residential Mortgage Opportunity Fund.This only works because Ranieri bought the distressed mortgages at a deep discount, and his company has no reputation risk. Ranieri wants his borrowers to know that he will reduce their principal.

Selene's mission is simple: to buy delinquent mortgages at a deep discount, work with homeowners to get them paying again, and resell the now stable loans for profit. To get homeowners to do their part, Ranieri is taking the radical step of substantially lowering their mortgage balances.

Imagine what would happen to Wells Fargo or Bank of America if their borrowers found out that the banks would substantially reduce their principal if they were 1) underwater (negative equity), and 2) stopped making their payments. The delinquency rate and losses would skyrocket!

So there is no easy solution. Government supported principal reductions will probably not happen, and private principal reductions - although happening - will not become widespread. This means more foreclosures and short sales (or as I always joke, build a time machine and stop the bubble early - that might be easier!)

And here are some excerpts from the paper:

Our analysis of those modifications in which payments were meaningfully reduced indicates that re-default rates – around 57% in the first year – are distressingly high. Yet the magnitude and form of modifications make a difference. Mortgages that receive larger payment reductions are significantly less likely to redefault, as are those that are modified in such a way as to restore the borrower’s equity position. Of course, these kinds of modifications are not mutually exclusive, since reductions in mortgage balances offer both increased equity and reduced payments.1 Housing Busts and Household Mobility by Fernando Ferreira, Joseph Gyourko (both from Wharton) and Joseph Tracy (New York Fed).

Our findings have potentially important implications for the design of modification programs going forward. The Administration’s HAMP program is focused on increasing borrowers’ ability to make their monthly payments, as measured by the DTI. Under HAMP, reductions in payments are primarily achieved by subsidizing lenders to reduce interest rates and extend mortgage term. While such interventions can reduce re-default rates, an alternative scheme would simultaneously enhance the borrower’s ability and willingness to pay the debt, by writing down principal in order to restore the borrower’s equity position. We estimate that restoring the borrower’s incentive to pay in this way can double the reduction in re-default rates achieved by payment reductions alone.

Another distinction between modifications that reduce the monthly payment by cutting the interest rate as compared to reducing the principal is the likely impact on household mobility. Ferreira et al (2010) using over two decades of data from the American Housing Survey estimate that each $1,000 in subsidized interest to a borrower reduces the two-year mobility rate by 1.4 percentage points. Modifying the interest rate to a below market rate creates an in-place subsidy to the borrower leading to a lock-in effect. .... modification creates an annual subsidy of over $3,000. The results in Ferreira et al (2010) imply that this will lead to on average a reduction in the household two-year mobility rate of over 4.4 percentage points – more than a forty percent reduction in the overall rate. In contrast, reducing the monthly payment through reducing the principal on the mortgage does not create an in-place subsidy and would not lead to a lock-in effect.

emphasis added

Sunday, December 20, 2009

Fed's Flow of Funds now using LoanPerformance Index

by Calculated Risk on 12/20/2009 11:48:00 AM

UPDATE: Originally I thought the Fed switcehed to Case-Shiller. In fact they switched to LoanPerformance, see: Flow of Funds: Change in House Price Index

From a newsletter by John Mauldin:

Frank Veneroso noticed something unusual in the latest Federal Reserve Flow of Funds report. They changed their methodology for analyzing housing prices to a model more like the Case-Shiller index, which most believe to be more accurate. That meant they deducted another $2 trillion from household net worth than in the previous quarter. They just caught up with reality, so no big news there. But there is some big news if you look closely.On the first point the Fed is now using the

About one-third of the homes in the US have no mortgages. Typically, these are nicer homes, as the "rich" have paid off their homes. So you can estimate that to be somewhere between 35-40% of the total value of US homes. Writes Frank:

"So now the flow of funds accounts tell us that the total value of residential real estate is $16.53 trillion. The share owned by households with a mortgage is probably $10 trillion to $11 trillion. Total mortgage household debt now stands at $10.3 trillion. In effect, for all households with a mortgage taken in the aggregate, their loan-to-value ratio is now close to 100% and perhaps close to half of them have a zero to negative equity."

The second point is probably a little inaccurate. According to the most recent American Community Survey, approximately 31.7% of homeowners have no mortgage. Although the "rich" frequently have no mortgage, homeowners without mortgages tend to own less expensive homes than homeowners with mortgages.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is based on the American Community Survey data for homeowners without a mortgage, and for homeowners with mortgages.

The median value (not average) of homes without a mortgage is $148,100, and the median for homes with a mortgage is $214,400.

My estimate is that homeowners without mortgages own about 26% of all household real estate (by value), and this suggests homeowners with mortgages have about 85% loan-to-value in the aggregate. This includes homeowners with 90% equity (almost paid off), and homeowners with substantial negative equity.

Negative equity is a serious problem, but according to First American Core Logic, about 23% of homeowners with mortgages have negative equity - and that is probably closer to the actual number.

Note: here is much more on negative equity with several graphs.

It is interesting the the Fed has switched to

Saturday, December 12, 2009

Refinancing with Negative Equity

by Calculated Risk on 12/12/2009 03:37:00 PM

From David Streitfeld in the NY Times: Rates Are Low, but Banks Balk at Refinancing (ht Dave)

On refinancing with negative equity:

Mark Belvedere bought a condominium in a San Francisco suburb in early 2004 and refinanced it in 2005. He now owes $235,000 on a property that would sell for barely half that today.Unfortunately David Streitfeld doesn't provide any further information on Belvedere's loan. If the loan was held by a bank, then it might make sense for the bank to refinance the loan (this lowers the bank's risk of default). However Belvedere's "lender" might be a servicing company and the loan may have been securitized. Then it is impossible to refinance because the current holders of the note would be paid off, and no new lender would make a loan greater than the value of the collateral.

Mr. Belvedere said he would be willing to live with all that lost equity if he could refinance his loan from a variable rate, which could eventually go as high as 12 percent, into a 30-year fixed term.

His lender said no, citing the diminished value of the property. “It makes no sense and is so frustrating,” Mr. Belvedere said. “I’m ready and willing to pay the mortgage for the next 30 years, but they act like they’d rather have me walk away.”

As Streitfeld notes, the GSEs have a program called Home Affordable Refinance Program (HARP) that will allow lenders to refinance loans upto 125% of the property value. But this is only for loans the GSEs already holds or insures (and because refinancing lowers the risk of default). This wouldn't help Belvedere because he owes almost twice what his property is worth.

Tuesday, November 24, 2009

Negative Equity Report for Q3

by Calculated Risk on 11/24/2009 04:00:00 PM

Here is the Q3 negative equity report from First American CoreLogic mentioned last night. From the report:

Negative equity, often referred to as “underwater” or “upside down,” means that borrowers owe more on their mortgage than their homes are worth.

Data HighlightsNearly 10.7 million, or 23 percent, of all residential properties with mortgages were in negative equity as of September, 2009. An additional 2.3 million mortgages were approaching negative equity, meaning they had less than five percent equity. Together negative equity and near negative equity mortgages account for nearly 28 percent of all residential properties with a mortgage nationwide. The distribution of negative equity is heavily concentrated in five states: Nevada (65 percent), which had the highest percentage negative equity, followed by Arizona (48 percent), Florida (45 percent), Michigan (37 percent) and California (35 percent). Among the top five states, the average negative equity share was 40 percent, compared to 14 percent for the remaining states. In numerical terms, California (2.4 million) and Florida (2.0 million) had the largest number of negative equity mortgages accounting for 4.4 million or 42 percent of all negative equity loans

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentgage of homeowners underwater, a number of other states have 20% or more homeowners with mortgages with little or negative equity.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.The second graph shows homeowners with severe negative equity for five states.

These homeowners are far more likely to default.

The rise in negative equity is closely tied to increases in pre-foreclosure activity. At one end of the spectrum, borrowers with equity tend to have very low default rates. At the other end, investors tend to default on their mortgages once in negative equity more ruthlessly: their default rate is typically two to three percent higher than owner-occupied homes with similar degrees of negative equity. For the highest level of negative equity, investors and owners behave very similarly and default at similar rates (Figure 4). Strategic default on the part of the owner occupier becomes more likely at such high levels of negative equity.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

This graph fits with figure 2 above and suggests a large number of future defaults in Nevada, Arizona, Florida and California.

Note below that negative equity is still a problem for buyers in 2009!

• The bulk of ‘upside down’ borrowers, as a group, share certain characteristics. They:Most homeowners with negative equity will probably not default, but this does show that there could be several hundred billion more in losses coming from residential mortgages.Financed their properties between 2005 and 2008, with 2006 being the peak year where 40 percent of borrowers were in negative equity (Figure 5). Negative equity continues to be a problem even for 2009 originations as evidenced by a negative equity share of 11 percent and another 5 percent near negative equity. Purchased newly built homes that are concentrated in a small number of states. For homes built between 2006 and 2008, the negative equity share is over 40 percent. Relied on adjustable rate mortgages (ARMs) Bought less expensive properties. The average value for all properties with a mortgage is $270,200, but properties in negative equity have an average value of $210,300 or 22 percent less (Figure 8). The average mortgage debt for properties in negative in equity was $280,000 and borrowers that were in a negative equity position were upside down by an average of nearly $70,000. The aggregate property value for loans in a negative equity position was $2.2 trillion, which represents the total property value at risk of default, against which there was a total of $2.9 trillion of mortgage debt outstanding.

Mortgages: 23% of Borrowers have Negative Equity

by Calculated Risk on 11/24/2009 12:43:00 AM

From the WSJ: 1 in 4 Borrowers Under Water

The proportion of U.S. homeowners who owe more on their mortgages than the properties are worth has swelled to about 23% ...The report should be available online soon.

Home prices have fallen so far that 5.3 million U.S. households are tied to mortgages that are at least 20% higher than their home's value ...

[N]egative equity "is an outstanding risk hanging over the mortgage market," said Mark Fleming, chief economist of First American Core Logic. "It lowers homeowners' mobility because they can't sell, even if they want to move to get a new job."

Sunday, September 20, 2009

San Francisco: $30 Billion Option ARM Time Bomb

by Calculated Risk on 9/20/2009 08:49:00 AM

From Carolyn Said at the San Francisco Chronicle: $30 billion home loan time bomb set for 2010

From 2004 to 2008, "one in five people who took out a mortgage loan (for both purchases and refinancing) in the San Francisco metropolitan region ... got an option ARM," said Bob Visini, senior director of marketing in San Francisco at First American CoreLogic, a mortgage research firm. "That's more than twice the national average.The article has much more.

"People think option ARMs (will be) a national crisis," he said. "That's not really true. It's just in higher-cost areas like California where you see their prevalence."

...

First American shows more than 54,000 option ARMs issued here with a value of about $30.9 billion. Fitch shows more than 47,000 option ARMs here with a value of about $28 billion. Both say their data underestimate the totals.

...

Fitch said 94 percent of borrowers elected to make minimum payments only.

...

Unlike subprime loans, which were more commonly used for entry-level homes, option ARMs started out with high balances. In the five-county San Francisco area, option ARMs average about $584,000 and were used to buy homes averaging $823,000, according to an analysis of First American data.

That means they'll spawn foreclosures among upper-end homes.

...

"The average option ARM borrower is significantly underwater, so much that they don't think they'll get out," Sirotic said. On average nationwide, option ARM borrowers ... owe is 126 percent of their home's value, based on depreciation and not including the effects of negative amortization, Sirotic said.

Option ARMs were used as affordability products in mid-to-high priced areas of bubble states like California. Now most of the borrowers are significantly underwater, and this will lead to more foreclosures, and falling prices, in the mid-to-high end areas.

Saturday, September 19, 2009

Report: Strategic Defaults a "Growing Problem"

by Calculated Risk on 9/19/2009 11:55:00 AM

From Kenneth Harney at the LA Times: Homeowners who 'strategically default' on loans a growing problem

National credit bureau Experian teamed with consulting company Oliver Wyman to identify the characteristics and debt management behavior of the growing numbers of homeowners who bail out of their mortgages with none of the expected warning signs, such as nonpayments on other debts.This fits with recent research from Guiso, Sapienza and Zingales: See New Research on Walking Away and here is their paper: Moral and Social Constraints to Strategic Default on Mortgages

...

[Some results:]

...The number of strategic defaults is far beyond most industry estimates -- 588,000 nationwide during 2008, more than double the total in 2007. ... Strategic defaulters often go straight from perfect payment histories to no mortgage payments at all. ... Strategic defaults are heavily concentrated in negative-equity markets ...

Tuesday, September 08, 2009

Fitch on Option ARM Recasts

by Calculated Risk on 9/08/2009 05:58:00 PM

From Fitch: $134B of U.S. Option ARM RMBS To Recast by 2011

Of the $189 billion securitized Option ARM loans outstanding, 88% have yet to experience a recast event ... Of these loans that have not yet recast, 94% have utilized the minimum monthly payment to allow their loans to negatively amortize.Fitch is just looking at securitized Option ARMs, not loans in bank portfolios like Wells Fargo with all the 10 year Pick-a-Pay recast periods.

...

Further evidence of option ARM underperformance in the last year lies in the number of outstanding securitized Option ARMs either 90 days or more delinquent, in foreclosure or real estate-owned proceedings, which has increased from 16% to 37%. Total 30+ day delinquencies are now 46%, despite the fact that only 12% have recast and experienced an associated payment shock. Instead, negative and declining equity has presented a larger problem: due to high concentrations in California, Florida, and other states with rapidly declining home prices, average loan-to-value ratios have increased from 79% at origination to 126% today. 'Negative equity and payment shocks will continue as Option ARM loans recast in large numbers in the coming years,' said Somerville.

The second paragraph is key - many of these borrowers are defaulting before the loans recast! From Bloomberg on a Barclays report in July: Option ARM Defaults Shrink Recast Wave, Barclays Says

The wave of “option” adjustable- rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller “than feared” because many borrowers will default before their bills change, Barclays Capital analysts said.The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast. As Fitch notes, modifications haven't been helpful for Option ARM borrowers because many are too far underwater:

...

About 40 percent of borrowers with option ARMs are already delinquent, and “many” of the others will start missing payments before their obligations change, the Barclays mortgage- bond analysts wrote in a July 24 report. ...

“The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock,” the New York-based analysts including Sandeep Bordian and Jasraj Vaidya wrote.

...

More than $750 billion of option ARMs were originated between 2004 and 2008 ...

To date, 3.5% of the approximately one million 2004-2007 vintage securitized Option ARM loans have been modified, in an attempt to mitigate effects from the payment shock. Modification types have included term extension, conversion to interest only loans, interest rate cuts, and others. These modifications have been somewhat successful, with 24% of modified Option ARM loans being 90+ days delinquent, compared with 37% of the overall Option ARM universe. However ... Fitch expects a high default percentage for modified Option ARM loans.This is a somewhat confusing press release. The recasts will probably lead to higher defaults, but negative equity is the real problem.

Thursday, August 13, 2009

American CoreLogic: More than 15.2 Million Mortgage Holders Underwater

by Calculated Risk on 8/13/2009 06:05:00 PM

The First American CoreLogic Negative Equity Report for June 2009 is available on line. You have to sign up to read the report.

More than 15.2 million U.S. mortgages or 32.2 percent of all mortgaged properties were in negative equity position as of June 30, 2009 according to newly released data from First American CoreLogic. June’s negative equity share was slightly lower than the 32.5 percent as of the end of March 2009 and it reflects the recent flattening of monthly home price changes. As of June 2009, there were an additional 2.5 million mortgaged properties that were approaching negative equity and negative equity and near negative equity mortgages combined account for nearly 38 percent of all residential properties with a mortgage nationwide. The aggregate property value for loans in a negative equity position was $3.4 trillion, which represents the total property value at risk of default. In California, the aggregate value of homes that are in negative equity was $969 billion, followed by Florida ($432 billion), New Jersey ($146 billion), Illinois ($146 billion) and Arizona ($140 billion). Los Angeles had over $310 billion in aggregate property value in a negative equity position, followed by New York ($183 billion), Miami ($152 billion), Washington DC ($149 billion) and Chicago ($134 billion). ... Nevada (66 percent) had the highest percentage with nearly two‐thirds of mortgage borrowers in a negative equity position. In Arizona (51 percent) and Florida (49 percent), half of all mortgage borrowers were in a negative equity position. Michigan (48 percent) and California (42 percent) round out the top five states.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of households with mortgages underwater by state (and near negative equity defined as with less than 5% equity).

UPDATE: States with no data from CoreLogic: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia, Wyoming.

The high population states of California and Florida account for almost 35% of all borrowers underwater, but this graph shows the problem is widespread.

Wednesday, August 05, 2009

Negative Equity: 16 Million Homeowners Underwater

by Calculated Risk on 8/05/2009 03:27:00 PM

Two separate reports ...

From Bloombeg: ‘Underwater’ U.S. Mortgages May Hit 48%, Deutsche Bank Reports

The percentage of properties “underwater” is forecast to rise to 48 percent, or 25 million homes, as property prices drop through the first quarter of 2011, according to [Deutsche Bank] analysts Karen Weaver and Ying Shen.I guess Deutsche Bank didn't get the memo about house prices finding a bottom.

Note: Deutsche Bank estimates 26% of homeowners are currently underwater, matching the data below from Economy.com. And Deutsche Bank sees the next wave hitting prime borrowersm, from the report:

While subprime and Option ARMs are currently the worst cohorts with underwater borrowers, we project that the next phase of the housing decline will have a far greater impact on prime borrowers (conforming and jumbo) ... By Q1 2011, we estimate that 41% of prime conforming borrowers and 46% of prime jumbo borrowers will be underwater, a significant increase over the percentage of these borrowers in Q1 2009. The impact of this is significant given that these markets have the largest share of the total mortgage market outstanding.From the WSJ: More Homeowners ‘Upside Down’ on Mortgages

Some 24% of owner-occupied homes had mortgage debt that exceeded the values of those homes at the end of June, according to data from Equifax and Moody’s Economy.com. That number rises to 32% when looking at the share of homeowners with mortgages that don’t have equity left in their homes.Mods won't help these

Overall, 16 million homeowners are “upside-down” on their mortgages, up from 10 million, or 15% of owner-occupied homes, one year ago.

Nearly 10% of owner-occupied homes now have mortgage debt with loan-to-value ratios of at least 125%, and roughly half of those homes have mortgage debt with loan-to-value ratios of 150% or more.

Although Deutsche Bank may be pessimistic on house prices, both reports suggests about 16 million homeowners are currently underwater, and probably another 5+ million have no equity.

Tuesday, July 28, 2009

Study: Using Home ATM Led to Most Foreclosures in SoCal

by Calculated Risk on 7/28/2009 07:30:00 PM

Nick Timiraos at the WSJ writes: Study Finds Underwater Borrowers Drowned Themselves with Refinancings (ht Jack)

Why are so many homeowners underwater on their mortgages?Here is the study: Follow the Money: A Close Look at Recent Southern California Foreclosures

...

Michael LaCour-Little, a finance professor at California State University at Fullerton, looked at 4,000 foreclosures in Southern California from 2006-08. He found that, at least in Southern California, borrowers who defaulted on their mortgages didn’t purchase their homes at the top of the market. Instead, the average acquisition was made in 2002 and many homes lost to foreclosure were bought in the 1990s. More than half of all borrowers who lost their homes had already refinanced at least once, and four out of five had a second mortgage.

The conventional wisdom is that households who purchased at the top of the market during the recent housing bubble are those most at risk of default due to recent price declines, upward re-sets of adjustable rate mortgage instruments, the economic downturn, and other factors. Here we use public record data to study Southern California borrowers facing foreclosure in late 2006 and 2007. We estimate property values at the time of the scheduled foreclosure sale with the automated valuation model of a major financial institution and then track actual sales prices for those properties that actually sold, either at auction or as later as REO. We find that virtually all of the borrowers had taken large amounts of equity out of the property through refinancing and/or junior lien borrowing with total cash extracted exceeding $300 million. As a result, losses to lenders exceed those of borrowers by a substantial margin, calling into question policies aimed at protecting borrowers.It may seem unfair that these homeowners receive help from the bank (or from the government), but as far as slowing foreclosures it really doesn't matter why the homeowner is underwater. I think the research from the Boston Fed suggesting the costs of foreclosure are less than the costs of modifications is a stronger argument against many mods.

emphasis added

Saturday, July 04, 2009

LA Times: 'Another wave of foreclosures'

by Calculated Risk on 7/04/2009 09:08:00 AM

From Don Lee at the LA Times: Another wave of foreclosures is poised to strike

Just as the nation's housing market has begun showing signs of stabilizing, another wave of foreclosures is poised to strike, possibly as early as this summer, inflicting new punishment on families, communities and the still-troubled national economy.Hoocoodanode? And just wait for the Option ARM recast wave ...

...

Just how big the foreclosure wave will be is unclear. But loan defaults are up sharply. ... rising foreclosures will depress home values, pushing more homeowners underwater. Mark Zandi of Moody's Economy.com estimates that 15.4 million homeowners -- or about 1 in 5 of those with first mortgages -- owe more on their homes than they are worth.

...

"Absolutely," Chase Bank spokesman Tom Kelly said when asked about an impending surge in foreclosures. ... Bank of America spokesman Dan Frahm said the company was projecting a "slow increase" in the number of monthly foreclosures, potentially reaching 30% above previous normal levels.

...

But anecdotal reports indicate that foreclosure sales have started to climb again in the second quarter. And the pipeline is clearly getting fuller.

... just recently, said [Jerry Abbott, a broker and co-owner of Grupe Real Estate in Stockton], there's been a surge of requests for so-called broker price opinions, or appraisals that lenders often ask brokers to provide just before they put a foreclosed property on the market.

"I think it's going to be a very big wave," he said. "Just like what we saw through 2008."

Monday, June 29, 2009

Freddie Mac June Investor Presentation

by Calculated Risk on 6/29/2009 08:48:00 AM

Here are a few graphs from the Freddie Mac June Investor Presentation. Click on graph for large image.

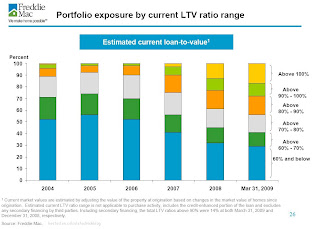

Click on graph for large image.

The first graph shows the average LTV of the Freddie Portfolio (graph doesn't start at zero).

The second graph shows the current breakdown by LTV and credit score.

According to Freddie Mac's estimate, 17% of the mortgages in their portfolio have negative equity. Another 11% of the loans have less than 10% equity.

Another 11% of the loans have less than 10% equity.

According to the Census Bureau, 51.6 million U.S. owner occupied homes had mortgages (end of 2007, see data here)

This would suggest that 8.8 million households have negative equity (51.6 million times 17%), and another 5.7 have 10% or less equity. However, the loans from Freddie Mac were better than most, and this is probably the lower bound for homeowners with negative equity. The third graphs show how the LTV breakdown has shifted over time as house prices have fallen.

The third graphs show how the LTV breakdown has shifted over time as house prices have fallen.

I'm surprised that any loans had negative equity in 2004, but just over 10% of the portfolio appeared to have LTV portfolio risk in 2004. Falling house prices has changed the mix!

Note: I'd consider the Zillow estimate of 20.4 million homeowners with negative equity as the upper bound (and I think their estimate is too high).

About 20.4 million of the 93 million houses, condos and co- ops in the U.S. were worth less than their loans as of March 31, according to Seattle-based real estate data service Zillow.com.There is much more in the Freddie Mac presentation.

Saturday, June 27, 2009

New Research on Walking Away

by Calculated Risk on 6/27/2009 01:42:00 PM

Here is an interesting new paper on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales. (ht Bob_in_MA)

The WSJ Real Time Economics has a summary: When Is It Cheaper to Ditch a Home Than Pay?

The researchers found that homeowners start to default once their negative equity passes 10% of the home’s value. After that, they “walk away massively” after decreases of 15%. About 17% of households would default — even if they could pay the mortgage — when the equity shortfall hits 50% of the house’s value, they found.Walking away (what the researchers call a "strategic default" and the mortgage industry call a "ruthless default") is when the borrower decides to stop paying a mortgage even though they can still afford the payment. This has always been difficult to quantify. Whenever a lender calls a delinquent homeowner - if they can reach the homeowner - the homeowner always tells the lender some sob story about why they can't pay their mortgage (lost job, medical, rate reset, etc.). As the researchers note:

...

“Our research showed there is a multiplication effect, where the social pressure not to default is weakened when homeowners live in areas of high frequency of foreclosures or know others who defaulted strategically,” Zingales said. “The predisposition to default increases with the number of foreclosures in the same ZIP code.”

It is difficult to study the strategic default decision, because it is de facto an unobservable event. While we do observe defaults, we cannot observe whether a default is strategic. Strategic defaulters have all the incentives to disguise themselves as people who cannot afford to pay and so they will appear as non strategic defaulters in all the data.So the researchers conducted a survey to attempt to quantify the percent of strategic defaults. This has drawbacks - the questions are hypothetical and there are no actual monetary consequences - but the results seem somewhat reasonable.

emphasis added

Note: the researchers use Zillow for negative equity numbers, and I think those are overstated. I prefer the research of Mark Zandi at economy.com or estimates from First American CoreLogic.

I think one of the key points in the research are changing social norms - the more people a homeowner knows that he believes "walked away" the more open the homeowner will be to mailing in their keys. This is what I wrote in 2007:

One of the greatest fears for lenders (and investors in mortgage backed securities) is that it will become socially acceptable for upside down middle class Americans to walk away from their homes.This research suggests that this is happening in significant numbers.

This has led many people to suggest principle reductions (as opposed to payment modifications) is the only solution. Tom Petruno at the LA Times has more on this: Is it time for underwater homeowners to be given a get-out-of-debt-free card?

Government and private-lender attempts to stem the home foreclosure crisis so far have mostly focused on loan modifications or refinancing -- giving borrowers a temporary or permanent reduction in their monthly payments.And a final note, the researchers also touch on the recourse vs. non-recourse issue:

But some housing experts say the next wave of help will have to address the core problem for many homeowners: negative equity.

This camp believes that there is no alternative but outright forgiveness of a substantial chunk of mortgage debt for many people who are underwater in their homes and at risk of foreclosure.

While only few states have mandatory non-recourse mortgages (i.e., do not allow creditors to pursue borrowers who walk away from their mortgages for the difference between the amount of the mortgage and the resale value of the house), the cost of legal procedures is sufficiently high that most lenders are unwilling to sue a defaulted borrower unless he has significant wealth besides the home.And that fits with an email Tanta sent me in 2007 on recourse loans:

Back in my day working for a servicer, we never went after a borrower unless we thought the borrower defrauded us, willfully junked the property, or something like that. If it was just a nasty RE downturn, it rarely even made economic sense to do judicial FCs just to get a judgment the borrower was unlikely to able to pay. You could save so much time and money doing a non-judicial FC (if the state allowed it) that it was worth skipping the deficiency.