by Calculated Risk on 1/26/2011 08:14:00 AM

Wednesday, January 26, 2011

MBA: Mortgage Purchase Applications lowest since last October

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 15.3 percent from the previous week and reached its lowest level since January 2010. The seasonally adjusted Purchase Index decreased 8.7 percent from one week earlier. The Purchase Index is at its lowest level since October 2010.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.8 percent from 4.77 percent, with points decreasing to 1.19 from 1.20 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

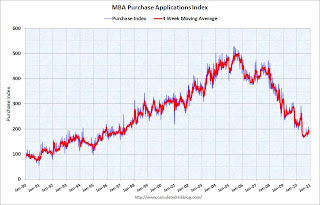

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index suggests weak existing home sales through the first few months of 2011.

Wednesday, January 19, 2011

MBA: Mortgage Purchase Application decline in latest survey

by Calculated Risk on 1/19/2011 07:27:00 AM

The MBA reports: Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 7.7 percent from the previous week. This is the third consecutive weekly increase in refinance applications and is the highest Refinance Index observed since the beginning of December. The seasonally adjusted Purchase Index decreased 1.9 percent from one week earlier.

...

"Mortgage rates have moved somewhat lower since the beginning of the year, as mixed data on the job market continue to cloud the outlook for the economy," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Refinance applications have picked up, as borrowers take advantage of lower rates, but purchase applications remain quite low, indicating that home sales are unlikely to pick up any time soon."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.77 percent from 4.78 percent, with points increasing to 1.20 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

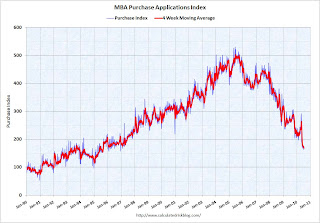

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index suggests weak existing home sales through the first couple months of 2011. As the MBA's Fratantoni noted: "[P]urchase applications remain quite low, indicating that home sales are unlikely to pick up any time soon."

Wednesday, January 05, 2011

MBA: Mortgage Purchase Application activity still low

by Calculated Risk on 1/05/2011 07:20:00 AM

The MBA reports: Mortgage Applications Drop the Week Before Christmas and Increase the Week After

For the week ending December 24, 2010, the Refinance Index decreased 7.2 percent from the previous week and the seasonally adjusted Purchase Index increased 3.1 percent from one week earlier. The following week, the Refinance Index increased 3.9 percent and the seasonally adjusted Purchase Index decreased 0.8 percent.

...

For the week ending December 31, 2010, the average contract interest rate for 30-year fixed-rate mortgages decreased to 4.82 percent with points increasing to 1.11.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is at about the levels of 1997 - and about 17% below the levels of April this year - suggesting weak existing home sales through the first couple months of 2011.

Wednesday, December 01, 2010

MBA: Mortgage Purchase Applications increase slightly last week

by Calculated Risk on 12/01/2010 07:27:00 AM

The MBA reports: Refinance Activity Continues to Decline as Rates Rise in Latest MBA Weekly Survey

The Refinance Index decreased 21.6 percent from the previous week. This is the third weekly decrease for the Refinance Index which reached its lowest level since June 2010. The seasonally adjusted Purchase Index increased 1.1 percent from one week earlier and is at its highest level since the beginning of May 2010.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.56 percent from 4.50 percent, with points increasing to 0.96 from 0.87 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with the increase in applications (seasonally adjusted), the four-week moving average of the purchase index is about 19% below the levels of April 2010 and suggests weak existing home sales through the end of the year.

Thursday, November 18, 2010

MBA National Delinquency Survey: Delinquency rate declines in Q3

by Calculated Risk on 11/18/2010 11:29:00 AM

The MBA reports that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

From the MBA: Delinquencies and Loans in Foreclosure Decrease, but Foreclosure Starts Rise in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 9.13 percent of all loans outstanding as of the end of the third quarter of 2010, a decrease of 72 basis points from the second quarter of 2010, and a decrease of 51 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 9.13% (SA) and 4.39% equals 13.52%.

...

The percentage of loans in the foreclosure process at the end of the third quarter was 4.39 percent, down 18 basis points from the second quarter of 2010 and down eight basis points from one year ago.

Most of the decline in the overall delinquency rate was in the seriously delinquent categories (90+ days or in foreclosure process). Part of the reason is lenders were being more aggressive in foreclosing in Q3 (before the foreclosure pause), and there was a surge in REO inventory (real estate owned). Some of the decline was probably related to modifications too.

The following graph shows the percent of loans delinquent by days past due.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Loans 30 days delinquent decreased to 3.36%. This is slightly below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.44% - the lowest since Q2 2008.

With the foreclosure pause, the 90+ day and in foreclosure rates will probably increase in Q4. The 30 day and 60 day buckets are dependent on jobs and house prices.

More from the press release:

“Mortgage delinquency rates declined over the quarter and over the past year, due primarily to a large decline in the 90+ day delinquency rate. The number of loans in foreclosure also dropped, bringing the serious delinquency rate to its lowest level since the second quarter of 2009. However, the foreclosure starts rate increased for all loan types and the foreclosure starts rate for prime fixed loans set a new record high in the survey, as more loans entered the foreclosure process,” said Michael Fratantoni, MBA’s Vice President of Research and Economics.The MBA also noted that a majority of delinquent loans (and loans in foreclosure) are prime loans. We are all subprime now!

“Most often, homeowners fall behind on their mortgages because their income has dropped due to unemployment or other causes. Although the employment report for October was relatively positive, the job market had improved only marginally through the third quarter, so while there was a small improvement in the delinquency rate, the level of that rate remains quite high. As we anticipate that the unemployment rate will be little changed over the next year, we also expect only modest improvements in the delinquency rate.”

...

“The foreclosure paperwork issues announced by several large servicers in late September and early October are unlikely to have had a large impact on the third quarter numbers, but may well increase the foreclosure inventory numbers in the fourth quarter of 2010 and in early 2011. ... The servicers that halted foreclosure sales temporarily may show higher foreclosure inventory numbers in the fourth quarter of 2010 and in early next year than would otherwise have been the case. ... However, these foreclosed homes are likely to come on the market in the medium term, so it is only a delay rather than a change in the underlying economics.”

Wednesday, November 17, 2010

MBA: Mortgage Purchase Activity decreases as mortgage rates increase

by Calculated Risk on 11/17/2010 07:30:00 AM

The MBA reports: Mortgage Applications Decline as Mortgage Rates Jump in Latest MBA Weekly Survey

The Refinance Index decreased 16.5 percent from the previous week and is at the lowest level observed since July of this year. The seasonally adjusted Purchase Index decreased 5.0 percent from one week earlier, the first decrease after three consecutive weekly increases.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.46 percent from 4.28 percent, with points increasing to 1.13 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year fixed-rate observed in the survey since the week ending September 10, 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is about 30% below the levels of April 2010. This suggests existing home sales will remain weak through at least the end of the year.

Wednesday, November 10, 2010

MBA: Mortgage Purchase Applications Increase slightly last week

by Calculated Risk on 11/10/2010 07:26:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 6.0 percent from the previous week. The seasonally adjusted Purchase Index increased 5.5 percent from one week earlier. This is the third consecutive weekly increase in purchase applications.

...

“The increases in purchase applications we have seen over the past couple of weeks align with the better than expected news from October’s employment report and other data indicating some improvement in the economy’s growth prospects. Refinance applications increased as rates continued to hover near record lows.” [said Michael Fratantoni, MBA’s Vice President of Research and Economics.]

...

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 4.28 percent, with points decreasing to 1.05 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index has increased slightly for three straight weeks, however the index is still about 30% below the levels of April 2010. This suggests existing home sales will remain weak through the end of the year.

Wednesday, November 03, 2010

MBA: Mortgage Purchase Applications Increase slightly last week

by Calculated Risk on 11/03/2010 07:32:00 AM

The MBA reports: Mortgage Purchase Applications Increase, while Refinance Applications Decline in Latest MBA Weekly Survey

The Refinance Index decreased 6.4 percent from the previous week. This is the third straight week the Refinance Index has decreased. The seasonally adjusted Purchase Index increased 1.4 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.28 percent from 4.25 percent, with points increasing to 1.07 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index decreased 2.7% last week, and is about 30% below the levels of April 2010. This suggests existing home sales will remain weak through the end of the year.

Wednesday, October 06, 2010

MBA: Mortgage Purchase Activity increases, FHA applications increase sharply

by Calculated Risk on 10/06/2010 07:32:00 AM

The MBA reports: Sharp Jump in Purchase Activity Led by Applications for FHA Loans in Latest MBA Weekly Survey

The Refinance Index decreased 2.5 percent from the previous week. The seasonally adjusted Purchase Index increased 9.3 percent from one week earlier and is the highest Purchase Index observed in the survey since the week ending May 7, 2010.

...

“The increase in purchase activity was led by a 17.2 percent increase in FHA applications, while conventional purchase applications also increased by 3.6 percent,” said Jay Brinkmann, MBA’s Chief Economist. “This is the second straight weekly increase in purchase applications and the highest Purchase Index level since the expiration of the homebuyer tax credit program. One possible driver of last week’s big increase in FHA applications was a desire by borrowers to get applications in before new FHA requirements took effect October 4th, which included somewhat higher credit score and down payment requirements.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.25 percent from 4.38 percent, with points decreasing to 1.00 from 1.01 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The 30-year contract rate is the lowest recorded in the survey, with the previous low being the rate observed last week.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

This is the highest level of purchase activity since the end of the homebuyer tax credit, however the level is still very low - and much of the increase was driven by FHA applications that may decline next week (because of slightly tighter lending requirements).

Note that the 30 year contract rate is at another record low of 4.25%.

Wednesday, September 22, 2010

MBA: Mortgage Purchase Activity declines slightly

by Calculated Risk on 9/22/2010 07:12:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 0.9 percent from the previous week, which is the third straight weekly decrease. The seasonally adjusted Purchase Index decreased 3.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.44 percent from 4.47 percent, with points decreasing to 0.81 from 1.08 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Purchase applications have declined for two consecutive weeks after rising slightly from the lows in July. Purchase applications are at about the levels of 1996 or 1997, suggesting existing home sales (closed transactions) in August, September and even October, will be weak. (Lawler's estimate is existing home sales will be around 4.1 million SAAR in August - to be reported Thursday)

Wednesday, September 15, 2010

MBA: Mortgage Purchase Activity decreases slightly

by Calculated Risk on 9/15/2010 07:14:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 10.8 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.4 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.47 percent from 4.50 percent, with points increasing to 1.08 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Purchase applications are at about the levels of 1996 or 1997, suggesting existing home sales (closed transactions) in August, September and even October, will only be slightly higher than in July. Note: economist Tom Lawler's "early read" is for August existing home sales of 4.1 million SAAR.

Wednesday, September 08, 2010

MBA: Mortgage Purchase Activity increases slightly

by Calculated Risk on 9/08/2010 07:32:00 AM

The MBA reports: Mortgage Purchase Applications Up, Refinance Applications Fall Slightly in Latest MBA Weekly Survey

The Refinance Index decreased 3.1 percent from the previous week. The seasonally adjusted Purchase Index increased 6.3 percent from one week earlier.

...

“Purchase applications increased last week, reaching the highest level since the end of May. However, purchase activity remains well below levels seen prior to the expiration of the homebuyer tax credit, and is almost 40 percent below the level recorded one year ago,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “On the other hand, refinance volume dropped last week for the first time in six weeks, but the level of applications to refinance remains close to recent highs, as historically low mortgage rates continue to draw borrowers into the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.50 percent from 4.43 percent, with points decreasing to 0.96 from 1.34 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

As the MBA's Fratantoni noted, "purchase activity remains well below levels seen prior to the expiration of the homebuyer tax credit" and this suggests existing home sales in August, September and even October, will only be slightly higher than in July.

Wednesday, September 01, 2010

MBA: Purchase Application activity suggests low level of existing home sales in August and September

by Calculated Risk on 9/01/2010 07:33:00 AM

The MBA reports: Mortgage Applications Increase as Rates Hit New Low in MBA Weekly Survey

The Refinance Index increased 2.8 percent from the previous week and is at its highest level since May 1, 2009. The seasonally adjusted Purchase Index increased 1.8 percent from one week earlier.

...

"Refinancing activity picked up again last week, reaching new 15-month highs, as borrowers took advantage of even lower mortgage rates. The drop in mortgage rates was in line with Treasury rates as the latest data continue to show weak economic growth and an exceptionally weak housing market," said Michael Fratantoni, MBA's Vice President of Research and Economics. "The sharp decline in MBA's Purchase Application index in May had provided a clear leading indicator of the drops in new and existing home sales that were reported for June and July. Despite the slight increase in purchase activity in the past week, the continued low level of purchase applications indicates we are unlikely to see an increase in new home sales reported for August or existing home sales reported for September."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.43 percent from 4.55 percent, with points increasing to 1.34 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate is a new low for this survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Usually I start the graph in January 1990, but this shorter term graph shows that the purchase index has been moving sideways since May of this year.

As the MBA's Fratantoni noted, this suggests existing home sales in August and September will be around the same level as in July.

Thursday, August 26, 2010

MBA Q2 2010: 14.42% of Mortgage Loans Delinquent or in Foreclosure

by Calculated Risk on 8/26/2010 01:30:00 PM

The MBA reports that 14.42 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2010 (seasonally adjusted). This is down slightly from the record 14.69 percent in Q1 2010.

From the MBA: Delinquencies and Foreclosure Starts Decrease in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties dropped to a seasonally adjusted rate of 9.85 percent of all loans outstanding as of the end of the second quarter of 2010, a decrease of 21 basis points from the first quarter of 2010, and an increase of 61 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 9.85% (SA) and 4.57% equals 14.42%.

...

The percentage of loans in the foreclosure process at the end of the second quarter was 4.57 percent, a decrease of six basis points from the first quarter of 2010, but an increase of 27 basis points from one year ago.

Much was made at the end of 2009 about the decline in the 30 day delinquency "bucket" (percent of loans between 30 and 60 days delinquent). Unfortunately the seasonally adjusted 30 day delinquency rate increased again in Q2 2010.

And much was made on the conference call this morning about the declines in the other "buckets", however the total percent of loans delinquent or in the foreclosure process declined only slightly in Q2 from Q1 - and is the second highest on record.

Note: there are some questions about the seasonal adjustment, especially for the 90 day bucket since we've never seen numbers this high before, but the adjustment for the 30 and 60 day periods are probably reasonable.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Loans 30 days delinquent increased to 3.51%, and this is about the same levels as in Q4 2008 (slightly below the peak of 3.77% in Q1 2009).

Delinquent loans decreased in all other buckets - especially in the 90+ day bucket. MBA Chief Economist Jay Brinkmann suggested the decline in the 90+ day bucket was because of some successful modifications - since the lenders reported the loans as delinquent until the modification was made permanent.

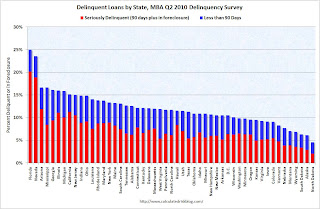

The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days). Clearly Florida and Nevada have a large percentage of loans delinquent or in foreclosure. But the delinquency problem is widespread with 36 states and D.C. all having total delinquency rates above 10%.

When asked if he expected the slight improvements to continue, Brinkmann said "Improvements are more of a hope". He said the problem is jobs, and he is revising down his economic forecasts. He also the improvement in the 90+ day bucket might be because of modifications - and that might not continue.

With house prices falling - and growth slowing - the delinquency rate will probably increase later this year.

Wednesday, August 25, 2010

MBA: Mortgage refinance activity increases, Purchase activity flat

by Calculated Risk on 8/25/2010 07:26:00 AM

The MBA reports: Mortgage Refinance Applications Continue to Increase as Rates Decrease

The Refinance Index increased 5.7 percent from the previous week and is at its highest level since May 1, 2009. The seasonally adjusted Purchase Index increased 0.6 percent from one week earlier.

...

“The volume of refi applications last week was up 26% over their level four weeks ago. Mortgage rates dropped to their lowest level in the survey, going back to 1990, as incoming data continue to indicate that economic growth has slowed,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “We are at a new 15 month high for the Refinance index. With rates this low, many borrowers who refinanced in the past two years may well have an incentive to refinance again, and this is likely increasing refi application activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.55 percent from 4.60 percent, with points decreasing to 0.89 from .92 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This was the lowest 30-year contract rate ever recorded in the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

After falling sharply in May, the purchase index has been moving sideways for three months. The index is 41% below the level of the last week of April (and about 31% below the last week of April using the 4-week average).

This collapse in the purchase index has already shown up as a decline in new home sales (counted when the contract is signed), and existing home sales in July. This suggests little increase in existing home sales in August or September (counted when transactions close).

Wednesday, August 18, 2010

MBA: Mortgage refinance activity increases sharply, Purchase activity declines

by Calculated Risk on 8/18/2010 07:17:00 AM

The MBA reports: Refinance Activity Increases to Highest Level Since May 2009 in Latest MBA Weekly Survey

The Refinance Index increased 17.1 percent from the previous week and was the highest Refinance Index observed in the survey since the week ending May 15, 2009. The seasonally adjusted Purchase Index decreased 3.4 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.60 percent from 4.57 percent, with points increasing to 0.92 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

After falling sharply in May, the purchase index has been moving sideways for about three months. The index is 42% below the level of the last week of April (and about 32% below the last week of April using the 4-week average).

This recent collapse in the purchase index has already shown up as a decline in new home sales (counted when the contract is signed), and will show up in the July and August existing home sales report (July sales to be reported next week).

Wednesday, August 11, 2010

MBA: Mortgage Applications Essentially Unchanged Despite Lowest Rates

by Calculated Risk on 8/11/2010 07:35:00 AM

The MBA reports: Mortgage Applications Essentially Unchanged Despite Lowest Rates

The Refinance Index increased 0.6 percent from the previous week and the seasonally adjusted Purchase Index increased 0.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.57 percent from 4.60 percent, with points decreasing to 0.89 from 0.93 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This was the lowest 30-year contract rate ever recorded in the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has increased slightly for four straight weeks - but is still 40% below the level of the last week of April (and about 32% below the last week of April using the 4-week average).

This recent collapse in the purchase index has already shown up as a decline in new home sales (counted when the contract is signed), and will show up in the July and August existing home sales reports (counted at close of escrow).

Note: Mortgage rates will probably fall to another record low this week too.

Wednesday, August 04, 2010

MBA: Mortgage Purchase Applications increase slightly last week

by Calculated Risk on 8/04/2010 07:24:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 1.3 percent from the previous week. The seasonally adjusted Purchase Index increased 1.5 percent from one week earlier. This third straight weekly increase in the Purchase Index was driven by government purchase applications which increased 3.4 percent from last week, while conventional purchase applications were essentially flat.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.60 percent from 4.69 percent, with points increasing to 0.93 from 0.88 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has increased slightly for three straight weeks - but is still 40% below the level of the last week of April (and about 33% below the last week of April using the 4-week average).

This recent collapse in the purchase index has already shown up as a decline in new home sales (counted when the contract is signed), and will show up in the July and August existing home sales reports (counted at close of escrow).

Wednesday, July 28, 2010

MBA: Mortgage Purchase Applications increase slightly last week

by Calculated Risk on 7/28/2010 07:53:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 5.9 percent from the previous week. The seasonally adjusted Purchase Index increased 2.0 percent from one week earlier and is the highest Purchase Index observed in the survey since the end of June.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.69 percent from 4.59 percent, with points decreasing to 0.88 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Although the weekly applications index increased slightly, the 4-week average is still near the levels of 1996.

This collapse in the mortgage application index has already shown up as a decline in new home sales, and will show up in the July and August existing home sales reports (counted at close of escrow).

Wednesday, July 21, 2010

MBA: Mortgage Purchase Applications increase slightly last week

by Calculated Risk on 7/21/2010 07:43:00 AM

The MBA reports: Interest Rate Drops Spur Refinance Applications in Latest MBA Weekly Survey

The Refinance Index increased 8.6 percent from the previous week and was the highest Refinance Index observed in the survey since the week ending May 15, 2009.

...

The seasonally adjusted Purchase Index increased 3.4 percent from one week earlier, driven by an 8.0 percent increase in government purchase applications.

...

"As rates on 30- and 15-year fixed-rate mortgages declined to the lowest levels recorded in the survey, refinance activity increased last week. The refinance index is up almost 30 percent over the past 4 weeks, but is still well below the peak seen last spring,” said Michael Fratantoni, MBA’s Vice President of Research and Economics.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.59 percent from 4.69 percent, with points increasing to 1.04 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This was the lowest 30-year contract rate ever recorded in the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Although the weekly applications index increased slightly, the four-week moving average is at a 15 year low (lowest since August 1995). The four week average is off 36% since the mini-peak in April (the weekly index is off 42% since the end of April).

This collapse in the mortgage application index has already shown up as a decline in new home sales, and will show up in the July and August existing home sales reports (counted at close of escrow).