by Calculated Risk on 11/03/2008 02:34:00 PM

Monday, November 03, 2008

Fed: Lending Standards Tighten, Loan Demand Weakens in October

Note: some readers are being swamped with political ads - especially in California. I'm trying to block the ads ... please accept my apology.

From the Fed: The October 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the current survey, large net fractions of domestic institutions reported having continued to tighten their lending standards and terms on all major loan categories over the previous three months. The net percentages of respondents that reported tightening standards increased relative to the July survey for both C&I and commercial real estate loans, as did the fractions reporting tightening for all price and nonprice terms on C&I loans. Considerable net fractions of foreign institutions also tightened credit standards and terms on loans to businesses over the past three months. Large fractions of domestic banks reported tightening standards on loans to households over the same period. Demand for loans from both businesses and households at domestic institutions continued to weaken, on net, over the past three months.

Click on graph for larger image in new window.

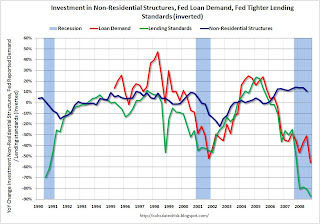

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

Tuesday, October 21, 2008

LIBOR Continues to Decline

by Calculated Risk on 10/21/2008 09:37:00 AM

From the WSJ: Libor's Move Downward Continues

According to data from the British Bankers' Association, three-month U.S. dollar Libor dropped to 3.83375%, the lowest since September 26, from Monday's fixing of 4.05875%. The rate has shed nearly 100 basis points since peaking at 4.81875% on October 10.The TED spread has dropped to 2.61 this morning. This is still above the peaks of the previous waves of the credit crisis: in August 2007 the TED spread peaked at around 2.4, in Dec 2007 at about 2.2, and in March of 2008 at just over 2.0. There is still a long way to go.

The one-month rate fell to 3.5275% Tuesday from Monday's 3.75125%.

...

The three-month BOR/OIS spread narrowed to 271.4 basis points from around 293 basis points Monday as tensions eased.

Also this just shows some loosening in the credit markets - an important step - but the economic data in general suggests the U.S. recession is still getting worse.

Friday, October 17, 2008

Credit Crisis Indicators: More Progress

by Calculated Risk on 10/17/2008 01:03:00 PM

Here are a few indicators I'm watching for progress on the credit crisis.

Here is a list of SFP sales. No announcement today have to wait for progress.

The two year swap spread from Bloomberg: 122.2 down from 138.38 BETTER

I'll add a couple more indicators, but this is progress.

Note: posting will be light today - I'm hiking in Zion. I hiked Angel's Landing this morning - awesome.

Thursday, October 16, 2008

Credit Crisis Indicators: Some Progress

by Calculated Risk on 10/16/2008 01:45:00 PM

This will be a daily post. Here are a few indicators I'm watching for progress on the credit crisis.

Here is a list of SFP sales. Two more $30 billion auctions announced today. NO PROGRESS.

The two year swap spread from Bloomberg: 138.38 slight improvement

Wednesday, October 15, 2008

Credit Crisis Indicators: Worse

by Calculated Risk on 10/15/2008 02:05:00 PM

This will be a daily post. Here are a few indicators I'm watching for progress on the credit crisis.

Here is a list of SFP sales. Two more $30 billion auctions announced today. NO PROGRESS.

Update:

Bob in MA sent me this:

The two year swap spread from Bloomberg: No progress.

Tuesday, October 14, 2008

GMAC Limits Loans to Buyers with 700+ FICO Scores

by Calculated Risk on 10/14/2008 10:38:00 PM

From Bloomberg: GMAC's Lending Limits May Add to GM's U.S. Sales Woes (hat tip Justin)

GMAC said yesterday it's granting financing only to buyers with scores of at least 700, who represent about 58 percent of U.S. consumers. The Detroit-based company, now controlled by Cerberus Capital Management LP, provided 43 percent of GM's second-quarter auto loans.Tighter credit equals fewer sales. This remains me of the old saying (that is true during a credit crunch): Bankers only lend money to people who don't need it.

WSJ: Some Signs of Credit Thaw

by Calculated Risk on 10/14/2008 10:18:00 PM

From the WSJ: Credit Shows Signs of Easing on Bank Rescue

The overnight dollar London interbank offered rate, or Libor, which reflects bank borrowing costs, fell to 2.18% on Tuesday from 2.47% the previous day. But the three-month Libor, a benchmark for many mortgages and corporate loans, remained high at 4.6%.This is a very small improvement.

Data is only available weekly for some of the indicators of credit stress (see Credit Crisis: Watching for Signs of Progress), but the 3-month treasury and TED spread showed only small improvements.

The yield on 3 month treasuries rose slightly to 0.235%. I'm looking for less daily volatility and for the yield to move up closer to the Fed funds rate, or above 1.25%.

The TED spread declined to 4.30 from 4.64 on Friday. This is still far above the highs reached during the previous waves of the credit crisis. I'm looking for the TED spread to decline below 2.0 (0.5 is normal).

Also the Treasury announced another $45 billion Supplementary Financing Program (SPF) auction to support the Fed. If this program slows down borrowing, I think that would be a good sign.

There was some slight improvement today.

Monday, October 13, 2008

Credit Crisis: Watching for Signs of Progress

by Calculated Risk on 10/13/2008 09:30:00 AM

Here are a few indicators I'm watching for progress on the credit crisis.

Click on graph for larger image in new window.

This graph shows the high, low, and the close for the three month treasury bill since the beginning of the year.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the Fed funds rate, or about 1.25%.

Any significant decline would suggest progress, and a decline below 1.0 would indicate this wave of the crisis is over.

Edit: From Econbrowser:

One measure that is being used to summarize the strain in financial markets is the TED spread. This is calculated as the gap between 3-month LIBOR (an average of interest rates offered in the London interbank market for 3-month dollar-denominated loans) and the 3-month Treasury bill rate.Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

Here is a list of SFP sales.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

This is the spread between high and low quality 30 day nonfinancial commercial paper. During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

Added:

In the comments, bond guy writes:

The T-Bill rates will probably take time to settle down. This means that the TED spread will probably be volatile for awhile.

I'd argue that a better indicator will be the 2-year swap spread (spread between 2-year swap rate and 2-year Treasury). If that can come down to 50 bps or so (from over 150), that would mean that the markets would be discounting spread normalization over the coming years.

Friday, October 10, 2008

Credit Spreads: Still Getting Worse

by Calculated Risk on 10/10/2008 02:28:00 PM

The TED spread (the difference between the LIBOR interest rate and the three month T-bill) has increased to a record 4.65 today. Completely off the recent charts! Here is the TED Spread from Bloomberg. Here is a graph via Macroblog that shows a long term view of the TED spread (doesn't include the recent spike to 4.65).

There are a few earlier periods when the TED spread was higher than today (like during the '73-'75 recession).

But 4.65 is pretty close to the all time high.

And the following graph is the A2/P2 spread from the Fed's commercial paper report. The A2/P2 Spread hit 459 bp yesterday.

When the A2/P2 spread spiked to 160 last year that was considered shocking; now that spike looks minor. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

These is still no relief in the credit markets.

Thursday, October 09, 2008

TED Spread at Record

by Calculated Risk on 10/09/2008 09:05:00 AM

Here is the TED Spread from Bloomberg. The TED spread hit a record 4.13 this morning. This is far above the highs reached during the previous waves of the credit crisis.

Note: the TED spread is the difference between the LIBOR interest rate and the three month T-bill. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

From Bloomberg: Libor Dollar Rate Jumps to Highest in Year; Credit Stays Frozen

The cost of borrowing in dollars for three months in London soared to the highest level this year as coordinated interest-rate reductions worldwide failed to revive lending among banks for any longer than a day.The credit markets are still in severe distress.

...

The London interbank offered rate, or Libor, for three-month loans rose to 4.75 percent today, the highest level since Dec. 28. The Libor-OIS spread, a measure of cash scarcity, widened to a record.

Sunday, October 05, 2008

More on the European Financial Crisis

by Calculated Risk on 10/05/2008 03:36:00 PM

Once again Sunday is the new Monday. This week the action is in Europe ...

"Hypo Real Estate has to be stabilized otherwise the damage would be unpredictable."From the NY Times: Germany Moves to Shore Up Confidence in Economy

German Finance Minister Peer Steinbrueck on television, Oct 5, 2008

Germany’s guarantee of its private savings — worth about 500 billion euros, or more than $700 billion— followed the news that a group of banks had pulled out of a deal to provide 35 billion euros, or $48.2 billion, to rescue the large German mortgage lender, Hypo Real Estate.From Bloomberg: German Government Leads Hypo Real Estate Rescue Talks

The Belgian government, meanwhile, scrambled Sunday to engineer a sale of the Belgian units of Fortis before the start of trading on Monday. The Netherlands effectively nationalized the Dutch operations of the bank on Friday after a joint rescue deal with Belgium and Luxembourg broke down.

In Iceland, where the government seized control of a bank last week, officials were considering more sweeping measures to stabilize finances there as well. And the board of UniCredit, which is based in Milan and also operates in Germany and much of Eastern Europe, met to consider a capital increase after being buffeted by a week of speculation about its solvency.

And from the WSJ: Governments Scramble to Find Rescue Plans for Hypo, Fortis

And from The Times: Interest rates to drop to 50-year low

Interest rates in Britain will drop to a new 50-year low in the coming months, economists say, as the Bank of England tries to head off a serious recession. The Bank’s monetary policy committee (MPC) is expected to start the process by cutting rates this week.

Saturday, October 04, 2008

Germany: Hypo Rescue Collapses

by Calculated Risk on 10/04/2008 03:29:00 PM

From Bloomberg: Hypo Real Estate Says Banks Withdrew Support for Rescue Package (hat tip Ryan)

Hypo Real Estate Holding AG, the troubled German property lender, said private banks withdrew their support for a 35 billion-euro ($49 billion) rescue package.Hypo mostly lends to commercial and public projects internationally.

``The intended rescue package involved a liquidity line to be provided by a consortium of several financial institutions,'' Hypo Real Estate said in a statement on the DBF newswire today. ``The consortium has now declined to provide the line. The Group is now in the process of determining the consequences of this'' and ``alternative measures are being investigated.'

Friday, October 03, 2008

Greece Guarantees All Deposits

by Calculated Risk on 10/03/2008 12:16:00 AM

From the Guardian: Greece's deposit guarantee deepens EU financial rift (hat tip Yal)

Greece joined Ireland in offering to guarantee savings in domestic banks.Apparently there was some discussion of a Euro-TARP, but it doesn't appear to be going anywhere.

George Alogoskoufis, the Greek finance minister, said deposits "in all banks that operate in Greece" would be "absolutely guaranteed", amid signs that savers were becoming restless.

The move by a second eurozone country presented a big challenge to European leaders meeting at an emergency summit tomorrow in Paris to hammer out a coordinated response to the threat of meltdown among European banks.

Thursday, October 02, 2008

Credit Stress

by Calculated Risk on 10/02/2008 02:03:00 PM

"The credit window is closed."The TED spread is at a record 3.62.

Jim Press, president of Chrysler LLC

And from Bloomberg: Libor Soars, Commercial Paper Slumps as Credit Freeze Deepens

The Libor- OIS spread, the difference between the three-month dollar rate and the overnight indexed swap rate, widened to a record 260 basis points today. It was 197 basis points a week ago and 79 basis points a month ago.The NY Times quoted Chairman Bernanke as saying on Friday, Sept 19th:

...

The market for commercial paper plummeted $94.9 billion to $1.6 trillion for the week ended Oct. 1 as banks and insurers were unable to find buyers for the short-term debt ...

"If we don’t do this, we may not have an economy on Monday."Well, we still have an economy, but it is clearly in tatters ...

Wednesday, October 01, 2008

Businesses Complain of Credit Market Troubles

by Calculated Risk on 10/01/2008 08:36:00 AM

From the WSJ: Businesses Pressure Congress on Bailout Plan

General Electric Co. and Verizon Communications Inc. ... have begun lobbying drives. And Microsoft Corp., which has relatively limited borrowing needs, "strongly urges" Congress to reconsider a rescue package "that will re-instill confidence and stability in the financial markets," said the company's top lawyer, Brad Smith.The lobbying has really started. The Senate will vote on the bailout bill this evening.

Even Microsoft, which is sitting on a $23 billion hoard of cash, would be tested by a protracted credit crunch, as its chief executive, Steve Ballmer, noted Tuesday. Speaking to reporters in Norway, Mr. Ballmer said, "No company is immune to these issues."

...

[B]usinesses big and small said borrowing was getting harder as the cost of funds rose.

Corporate-bond issuance in the quarter plunged to $76.7 billion from $337.3 billion in the second quarter ... Companies overall were forced to reduce their borrowings on the short-term commercial paper market by $212 billion between the end of February and last Wednesday, as investors continued to back away from the corporate IOUs.

Monday, September 29, 2008

Fed to significantly expand "the capacity to provide U.S. dollar liquidity"

by Calculated Risk on 9/29/2008 10:11:00 AM

From the Fed:

In response to continued strains in short-term funding markets, central banks today are announcing further coordinated actions to expand significantly the capacity to provide U.S. dollar liquidity. Central banks will continue to work together closely and are prepared to take appropriate steps as needed to address funding pressures.Meanwhile the TED Spread from Bloomberg is at a record 3.48! Ouch.

Friday, September 26, 2008

Watching the TED Spread

by Calculated Risk on 9/26/2008 02:22:00 PM

The TED Spread from Bloomberg is still very high at 2.91, although down a little from yesterday.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

This will probably be one of the first indicators to show any benefit from any plan.

Thursday, September 25, 2008

Credit Spreads: Off the Charts

by Calculated Risk on 9/25/2008 10:47:00 AM

We've been tracking the TED spread as a measure of distress in the credit markets (the difference between the LIBOR interest rate and the three month T-bill). Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

The TED spread has increased to 3.27% this morning. Completely off the charts! Here is the TED Spread from Bloomberg.

And the following graph is the A2/P2 spread from the Fed's commercial paper report. The A2/P2 Spread hit 409bp yesterday. This is literally off the chart compared to any previous period.

When the A2/P2 spread spiked to 160 last year that was considered shocking; now that spike looks minor. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for many of these companies the risk of default is close to zero. This is the high quality CP. Lower rated companies also issue CP and this is the A2/P2 rating.

Usually the spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. But right now this shows the credit markets are essentially locked up waiting for The Mother of All Bailouts.

Monday, September 15, 2008

Credit Crisis: The Fourth Wave

by Calculated Risk on 9/15/2008 04:50:00 PM

Here is the TED Spread from Bloomberg (hat tip James, Glenn and others)

The TED spread has increased to 2.01% (from just over 1% last week). This is close to the highs reached in August 2007, late 2007 and in the spring of 2008 (the three previous waves of the credit crisis).

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

Wednesday, September 03, 2008

Ford Sales off 27%

by Calculated Risk on 9/03/2008 01:32:00 PM

"We expect the second half of 2008 will be more challenging than the first half, as weak economic conditions and the consumer credit crunch continues."From the WSJ: Ford Posts 27% Drop In August Sales

Jim Farley, Ford group vice president of marketing and communications.

U.S. auto sales continued their slide in August despite stepped-up incentives to buyers, with Ford Motor Co. posting a 27% drop from a year earlier as sport-utility-vehicle sales plunged 53%.BTW, Boston Fed President Rosengren spoke today on the "Implications of a Credit Crunch”. An excerpt:

Ford also lowered its second-half North American production forecast and revised its overall industry forecast to the low end of its range.

It was hoped that banks with a more national footprint would be less susceptible to regional shocks and thus more able to lend during regional downturns. Unfortunately, many of the largest commercial and investment banks had a significant concentration of their assets in complex securities that have declined in value, had significant exposures to subprime mortgages or so-called “Alt A” mortgages that have declined in value, and also had exposure to construction and residential loans that have suffered from national rather than just regional declines in value.The auto industry has been hit hard by both the change in credit conditions and higher oil prices.

In terms of securitization, the loss of confidence in complex financial instruments and their ratings has dried up the demand for all but the simplest and least-risky securitizations. So rather than serving as a shock absorber for banking problems, it seems that securitization has actually exacerbated the problem. Indeed, a wide variety of loans that were once widely securitized are now not available (e.g., subprime mortgages) or are only available from financial institutions at much higher costs (e.g., jumbo loans).