by Calculated Risk on 3/15/2010 10:56:00 AM

Monday, March 15, 2010

Capital One Credit Card Defaults decline, BofA defaults increase

From Reuters: Capital One Credit Card Defaults Fall, but BofA's Rise

Capital One said the annualized net charge-off rate — debts the company believes it will never collect — for U.S. credit cards fell to 10.19 percent in February from 10.41 percent in January. ...

However, Bank of America said its defaults rate rose in February, up from 13.25 percent in January to 13.51 percent.

Click on graph for larger image in new window.

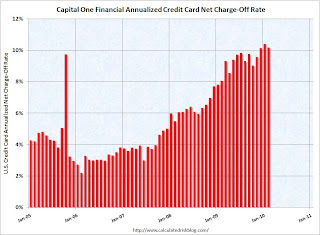

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 - to 9.75% - associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One's credit card annualized net charge-off rate is now at 10.19% - down slightly from January, but still above that spike in 2005!

As Reuters notes, Capital One is usually the first to report monthly credit card charge-offs - so this is the one I track. The other major credit card issuers will report later today.

Tuesday, February 16, 2010

Capital One Credit Card Charge-Offs Increase to 10.41%

by Calculated Risk on 2/16/2010 10:36:00 AM

From Reuters: Capital One credit card defaults rise in January (ht jb)

Capital One Financial Corp's U.S. credit-card defaults rose in January, in a sign that consumers continue to remain under stress, it said in a regulatory filing.

Capital One said the annualized net charge-off rate -- debts the company believes it will never collect -- for U.S. credit cards rose to 10.41 percent in January from 10.14 percent in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One credit card annualized net charge-off rate is now at 10.41% - above the peak in 2005.

As Reuters notes, Capital One is usually the first to report monthly credit card charge-offs. The other major credit card issuers will report later today.

Saturday, February 06, 2010

Paying Credit Cards before Mortgage

by Calculated Risk on 2/06/2010 07:41:00 PM

From Michelle Singletary at the WaPo: Paying your credit card bill before the mortgage

TransUnion ... recently released a report showing that an increasing number of consumers are choosing to pay their credit card bills before their monthly mortgages. ... The percentage of people delinquent on their mortgages but current on credit cards jumped to 6.6 percent in the third quarter of 2009, up from 4.9 percent in the third quarter of 2008.Check out the numbers for California and Florida!

...

The percentage of consumers current on their credit cards but delinquent on their mortgages first surpassed the percentage of consumers up to date on their mortgages but delinquent on their credit cards in the first quarter of 2008, according to TransUnion.

"The implosion of the mortgage industry over the last 24 months, the resetting of adjustable-rate mortgages and the weak job market have all come together to redefine how consumers are managing their finances and meeting or not meeting their credit obligations," said Ezra Becker, director of consulting and strategy in TransUnion's financial services business unit.

This behavior first showed up with subprime borrowers, from Bloomberg in June 2007: Subprime Borrowers More Apt to Pay Card Debt, Ignore Mortgages

The riskiest borrowers in the U.S. are more likely to pay off their credit-card debt than their mortgage, bucking historical trends, a new study shows.Another "subprime" behavior goes mainstream ...

...

Bankers in the past have reasoned that consumers would give up everything else before they risked losing their homes, making mortgages less risky than other forms of lending. The report found borrowers with strong ratings still follow the historic trend of paying their mortgage before their credit-card debt.

The penchant of subprime borrowers to do the opposite may be ``a potential shift in this payment paradigm,'' the study said.

Thursday, December 24, 2009

Credit Card Anger

by Calculated Risk on 12/24/2009 01:15:00 PM

Here is an interesting story in the Denver Post by Bill Johnson: Credit-card squeeze stirs elderly couple's anger

Lawrence Rickman ... is 81 now, seven years his wife's senior. They have had a Bank of America credit card for 20 years. They never once in all that time ... missed a payment.The interest rate increase is outrageous, but also notice that Mr. Rickman was apparently not paying off his credit card balance every month. I suspect he has been running a fairly large balance compared to his income (only Social Security at this time according to the article), and just making the minimum payment on his credit card. Although the 5.9% interest rate was somewhat reasonable, it is still far more than Rickman could earn on any conservative investment.

Rickman slides his December bill across the table, with instructions to read it. ... Look at the interest rate, he says.

Sixteen-point-nine percent, it reads.

"I was paying 5.9 percent, which is what I have paid for years," he says. "I always paid them $500 a month without complaint. Now, they want $1,074 this month. I can't pay it. I won't pay it."

...

"When I got this month's bill," Lawrence Rickman recalls, "I got on the line and told them they were getting out of hand on this interest rate, that I wanted to negotiate."

The conversation, he says, went something like this:

"Lower my rate, or I'll file bankruptcy," he told them.

"But sir, if you do, it will destroy your credit rating."

"So what? I'm almost 82 years old ..."

Credit cards are great if the holder pays off the balance every month - or if the holder infrequently needs to spread an unexpected bill over a few months. But routinely running large credit card balances is hazardous to the holder's financial health. IMO there is something inherently wrong with a business that encourages customers to make bad financial decisions. (I'll get off my soapbox ...)

Tuesday, December 15, 2009

Credit Card Charge-Offs Increase

by Calculated Risk on 12/15/2009 11:28:00 AM

From Reuters: Capital One, Discover credit-card charge-offs rise (ht shill)

Capital One Financial Corp (COF.N) and Discover Financial Services (DFS.N) reported that credit-card charge-offs rose in November -- a sign that consumers remain under stress.

In a regulatory filing on Tuesday, Capital One said the annualized net charge-off rate -- debts the company believes it will never collect -- for U.S. credit cards rose to 9.60 percent in November from 9.04 percent in October.

In another regulatory filing, Discover said its charge-off rate rose to 8.98 percent from 8.54 percent after two months of declines.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One credit card charge-offs hit 9.83% in July (annualized) - above the peak in 2005 - and were near the peak again in November. It is likely that charge-offs will be above 10% soon.

Update: US Credit Card Charge-Offs Rise in November

JPMorgan Chase ... said charge-offs -- loans the company does not expect to be repaid -- rose to 8.81 percent in November from 8.02 percent in October.

...

Bank of America... said its charge-off rate fell for third straight month -- to 13.00 percent in November from 13.22 percent in October. However, it is still the credit card issuer with the highest default and delinquency rates.

Monday, November 23, 2009

Moody’s: Credit Card Delinquencies Rise

by Calculated Risk on 11/23/2009 05:32:00 PM

From Bloomberg: Late Card Payments Rose in October, Moody’s Reports

Loans at least 30 days overdue, a signal of future defaults, rose to 6.12 percent in October from 5.97 percent in September, Moody’s said ... defaults fell last month to 10.04 percent from 10.72 percent in September, reflecting lower delinquency rates earlier in the year.This is the highest delinquency rate since February. At noted in the article, credit card defaults tend to track unemployment, so the default rate will probably continue to rise.

...

Write-offs may peak at 12 percent to 13 percent in 2010, Moody’s analysts Will Black and Jeffrey Hibbs said in the report.

Tuesday, September 15, 2009

Credit Cards: Most Institutions Report higher Write-Offs in August

by Calculated Risk on 9/15/2009 07:42:00 PM

From Bloomberg: U.S. Credit-Card Defaults Resume Ascent as Unemployment Worsens (ht Bob_in_MA)

Bank of America said write-offs rose to 14.54 percent ... That compares with 13.81 percent in July ...As a reminder, the bank stress tests assumed a cumulative two year credit card loss rate of 18% to 20% for the more adverse scenario (only 12% to 17% for the baseline scenario). Right now losses are running worse than the more adverse scenario.

Citigroup’s soured loans rose to 12.14 percent last month, from 10.03 percent, while JPMorgan said write-offs advanced to 8.73 percent from 7.92 percent in July ...

Discover Financial Services ... said charge-offs rose to 9.16 percent from 8.43 percent in July. ...

Capital One Financial Corp. ... said charge-offs improved to 9.32 percent in August, from 9.83 percent.

...

Moody’s Investors Service has said it expects average U.S. charge-offs to peak at 12 percent to 13 percent in 2010.

Also credit card loss rates tend to the track unemployment - so, as the unemployment rate rises into 2010, the credit card charge-offs will probably increase some more.

Monday, August 31, 2009

Fitch: Credit Card Default Chargeoffs decline Slightly in July

by Calculated Risk on 8/31/2009 01:35:00 PM

From Fitch: Consumer 'Signs of Life' Improve U.S. Credit Card Chargeoffs

U.S. consumer credit quality showed signs of life as credit card ABS chargeoffs declined last month, snapping a string of five consecutive record highs, according to the latest Credit Card Index results from Fitch Ratings.As a reminder, the bank stress tests assumed a cumulative two year credit card loss rate of 18% to 20% for the more adverse scenario (only 12% to 17% for the baseline scenario). Right now losses are worse than the more adverse scenario.

...

'We still need to see some measurable improvement in the delinquency and personal bankruptcy figures and the employment situation overall before chargeoffs revert to more historical norms,' said Managing Director Michael Dean. 'For now, we expect chargeoffs to moderate at these elevated levels in the coming months.'

Chargeoffs had risen 45% from February through July and they still remain 63% above year earlier levels. Late stage delinquencies, or receivables more than 60 days past due, have held relatively stable albeit near record highs during the same period following a rapid increase over the prior six months that forewarned the chargeoff run-up.

Fitch's Prime Credit Card Chargeoff Index declined 24 basis points (bps) to 10.55% for the July collection period. ...

Also credit card loss rates tend to the track unemployment - so, as the unemployment rate rises into 2010, the credit card chargeoffs might increase some more.

Sunday, July 26, 2009

Credit Card Debtors "Embracing the Darkness of Default"

by Calculated Risk on 7/26/2009 12:49:00 PM

From David Streitfeld at the NY Times on credit card debt: When Debtors Decide to Default

[T]there is a small but increasingly noticeable group of strapped consumers who ... are deciding they will simply stop paying.Streitfeld is writing about the growing wave of ruthless credit card defaults, but this also raises question about the credit card industry in general. Why aren't consumers being educated on the dangers of not paying off their credit card balance each month? Maybe that will be a good role for the new consumer financial protection agency. And why are transaction costs for retailers still so high with all the innovation and advances in technology?

... They are upset — at the unyielding banks and often at their free-spending selves — and are pre-emptively defaulting. ... “You reach a point where you embrace the darkness of default,” said Adam Levin, chairman of the financial products Web site Credit.com.

The lending industry term for these people is “ruthless defaulters.” In a miserable economy where paychecks, savings and expectations are all diminished, their numbers will surely grow.

“They’ve done the math on their account and they’re very angry,” said Corey Calabrese, a Fordham Law student who is an administrator of the school’s walk-in clinic for debtors at Manhattan Civil Court. Public sentiment is on their side, she added: “For the first time, Americans are no longer blaming the borrower but are looking at the credit card companies.”

Wednesday, June 24, 2009

Report: Record Credit Card Charge-offs

by Calculated Risk on 6/24/2009 03:26:00 PM

From Reuters: US credit card chargeoffs break new record - Moody's

The U.S. monthly credit card chargeoff rate surpassed 10 percent and hit a sixth straight record high in May, Moody's Investors Services said on Wednesday ...Another month, another record.

The chargeoff rate index -- which measures credit card loans the banks do not expect to be repaid -- rose to 10.62 percent in May from 9.97 percent in April.

"We expect the chargeoff rate index to continue to rise in the coming months but at a slower pace, as it peaks at around 12 percent in the second quarter of 2010," Moody's senior vice president William Black said in a statement.

I wouldn't be surprised if Chase sees an increase in chargeoffs after raising the monthly minimum payment from 2% to 5% for some credit card users.

As a reminder, the credit card indicative loss rates for the "more adverse" stress test scenario were 18% to 20% over two years. That might have been a little optimistic. The baseline scenario was 12% to 17% over two years - way too low.

Monday, June 15, 2009

Credit Card Debt: "A line has been crossed"

by Calculated Risk on 6/15/2009 10:59:00 PM

From David Streitfeld at the NY Times: Credit Bailout: Issuers Slashing Card Balances

... Mr. McClelland’s credit card company was calling yet again, wondering when it could expect the next installment on his delinquent account. He proposed paying half of his $5,486 balance and calling the matter even.The story notes that these settlements still damage the borrowers credit. But this appears to be a significant shift.

It’s a deal, the account representative immediately said, not even bothering to check with a supervisor.

As they confront unprecedented numbers of troubled customers, credit card companies are increasingly doing something they have historically scorned: settling delinquent accounts for substantially less than the amount owed.

... many credit card issuers have revised internal guidelines to give front-line employees the power to cut deals with consumers. The workers do not even have to wait for customers to call and ask for a break.

...

An example of how quickly the card companies are shifting their approach is in the behavior of HSBC, a major issuer, toward Mr. McClelland.

He was paying fitfully on his card, which was canceled for delinquency. In April, HSBC offered him full settlement at 20 percent off. He declined. A few weeks later, it agreed to let him pay half.

...a line has been crossed, credit experts say.

“Even in the early stages of delinquency, settlements can be dramatic,” said Carmine Dorio, a longtime industry executive who ran collection departments for Citibank, Bank of America and Washington Mutual.

As an aside: My personal view is that in a financially literate world, almost all borrowers would pay off their credit card balances monthly (there are exceptions).

Record Credit Card Default Rate

by Calculated Risk on 6/15/2009 03:52:00 PM

From CNBC: Credit Card Default Rate Hits Record High

U.S. credit card defaults rose to record highs in May, with a steep deterioration of Bank of America's lending portfolio ...For the stress tests, the indicative two year loss rate for the more adverse scenario was 18% to 20% for credit cards (around 9% per year). That test might have been too lenient.

Bank of America—the largest U.S. bank—said its default rate, those loans the company does not expect to be paid back, soared to 12.50 percent in May from 10.47 percent in April.

In addition, American Express ... said its default rate rose to 10.4 percent from 9.90 ...

Capital One said its credit card default rate rose to 9.41 percent from 8.56 percent, while Discover said its charge-off rate increased to 8.91 percent from 8.26 percent.

JPMorgan Chase ... said its default rate rose to 8.36 percent in May from 8.07 percent in April

Monday, May 18, 2009

Credit Card Changes: Make the Prudent Pay

by Calculated Risk on 5/18/2009 11:42:00 PM

From the NY Times: Overhaul Likely for Credit Cards

Banks are expected to look at reviving annual fees, curtailing cash-back and other rewards programs and charging interest immediately on a purchase instead of allowing a grace period of weeks, according to bank officials and trade groups.This seems unlikely (reviving annual fees, charging immediate interest) because of competition. At least I hope it is unlikely!

“It will be a different business,” said Edward L. Yingling, the chief executive of the American Bankers Association, which has been lobbying Congress for more lenient legislation on behalf of the nation’s biggest banks. “Those that manage their credit well will in some degree subsidize those that have credit problems.”

Friday, May 15, 2009

CNBC: Record Credit Card Defaults in April

by Calculated Risk on 5/15/2009 03:03:00 PM

From CNBC: Credit Card Defaults Reach Record Highs in April

U.S. credit card defaults rose in April to record highs, with Citigroup and Wells Fargo posting double digit loss rates ...

| April | March | |

| Citigroup | 10.21% | 9.66% |

| Wells Fargo | 10.03% | 9.68% |

| JPMorgan Chase | 8.07% | 7.13% |

| Discover Financial Services | 8.26% | 7.39% |

And the beat goes on ...

Tuesday, May 12, 2009

Advanta Halts New Credit-Card Lending

by Calculated Risk on 5/12/2009 09:25:00 AM

From Bloomberg: Advanta Shuts Down Credit-Card Lending Amid Surging Charge-Offs

Advanta Corp., the issuer of credit cards for small businesses, will halt new lending for its 1 million customers next month as the recession causes a surge in loan defaults. ... Advanta said ... charge-offs, or uncollectible debt, reached 20 percent on some cards as of March 31.This is much higher loss rate than for consumer credit cards - the Fed's two year indicative loss rate was 18% to 20% for consumer credit cards - Advanta is seeing that in one year for some cards!

...

“We’ll be shutting down accounts for future transaction activities, but many of the customers will maintain balances and pay us off over time,” [Chief Financial Officer Philip Browne] said yesterday in a telephone interview.

Advanta was the 11th-biggest U.S. credit-card issuer at the end of 2008 with about $5 billion in outstanding balances, and the only major lender focused on small business borrowers ...

Tuesday, April 21, 2009

Capital One: Expect Charge-Off Rates Greater than 10%

by Calculated Risk on 4/21/2009 06:45:00 PM

Conference call notes (ht Brian):

Economic deterioration continued at a rapid pace during the first quarter driving increasing delinquency and charge off rates across most of our lending businesses. U.S. card charge off rate increased to 8.4% for the first quarter, above the 8.1% charge off rate expectation we articulated a quarter ago. Expected seasonal increases in bankruptcies and declining loan balances resulted in higher charge off rates compared to the fourth quarter of 2008. The increase in charge off rates beyond our expectations resulted from several factors related to the pace of economic deterioration in the quarter. Bankruptcies were higher than expected, increasing charge-offs directly without impacting delinquency rates. Recoveries on already charged off debt were lower than expected. We also observed an acceleration of later stage delinquency balances slowing to charge off in the quarter. For context recall that when we articulated our expectations last January the unemployment rate was 7.2% and we assumed it would increase to about 8.7% by the ends of 2009. The unemployment rate has already deteriorated to 8.5% and is expected to move beyond 8.7% well before year end. Even though our U.S. card charge off rate was higher than the expectation we had last quarter delinquencies and charge-offs were a bit better than we would have expected given the actual economic worsening we've seen in the quarter. ...The expected 'greater than 10% charge-off rate' is probably worse than the expected credit card loss rates for the "more adverse" scenario. I'll be curious if the Federal Reserve white paper, to be released on Friday, will mention the expected loss rates by category.

Credit Loss outlook

We expect further increases in U.S. card charge off rate through 2009 as the economy continues to weaken. It is likely that will our U.S. card charge off rate will increase at a faster pace than the broader economy as a result of the denominator effect and our implementation of OCC minimum payment requirements ... We expect monthly U.S. card charge off rates to cross 10% in the next couple of months.

Economic Outlook

I'll update our economic outlook. Unemployment and home prices have been and continue to be the economic variables with the greatest impact on our credit results. We now expect unemployment rate to increase to around 9.6% by the ends of 2009. Our prior assumption for home prices was for the Case Shiller 20 city index to fall by around 37% peak to trough. We now expect a modestly worse peak to trough decline of around 39%. ...

Wednesday, April 15, 2009

Capital One Credit Card Charge-Offs Increase Sharply in March

by Calculated Risk on 4/15/2009 04:01:00 PM

From Zero Hedge blog:

Some very ugly credit card charge-off data just out from Capital One. The February annualized rate of 8.06% has spiked by over 1% month-over-month to the current 9.33%, a very troubling deterioration ...Allow me to add a graph ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Credit card charge-offs in March (annualized) were almost as high as the peak in 2005 (9.33% in March compared to 9.75% in October 2005)

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Wednesday, April 01, 2009

Moody's: Record High Credit Card Charge-Offs

by Calculated Risk on 4/01/2009 05:57:00 PM

From Reuters: Credit card charge-offs hit record high -Moody's (ht Brad)

Credit card write-downs soared to record levels in February, representing an all-time high in the 20-year history of the Moody's Credit Card Index ....Moody's reported the charge-off rate at 5.59% in February 2008, and 4.51% in February 2007.

Credit card charge-offs, the write-down of uncollectable debt, advanced decisively to 8.82 percent in February, marking the sixth consecutive month of increases. The level, is more than 300 basis points higher than a year ago.

...

[Moody's] predicts the charge-off rate index will peak at about 10.5 percent in the first half of 2010, assuming a coincident unemployment rate peak at 10 percent.

Monday, March 16, 2009

Credit Card Defaults at 20 Year-High

by Calculated Risk on 3/16/2009 07:56:00 PM

From Reuters: U.S. credit card defaults rise to 20 year-high

U.S. credit card defaults rose in February to their highest level in at least 20 years, with losses particularly severe at American Express ... and Citigroup ...The Treasury and Federal Reserve haven't publicly released the indicative loss rates for various asset classes associated with the two stress test economic scenarios (baseline and more adverse), but these numbers are probably approaching the "more adverse" scenario range for credit cards.

AmEx ... said its net charge-off rate ... rose to 8.70 percent in February from 8.30 percent in January.

... Citigroup Inc (C.N) ... default rate soared to 9.33 percent in February, from 6.95 percent a month earlier ...

...

Chase ... reported its charge-off rate rose to 6.35 percent in February from 5.94 percent in January. ...

Capital One Financial Corp's ... default rate increased to 8.06 percent in February from 7.82 percent in January.

...

Analysts estimate credit card chargeoffs could climb to between 9 and 10 percent this year from 6 to 7 percent at the end of 2008.

Monday, January 26, 2009

Amex: "Harshest operating environment in decades"

by Calculated Risk on 1/26/2009 04:47:00 PM

From the WSJ: AmEx Earnings Drop 79%

"Our fourth-quarter results reflect an operating environment that was among the harshest we have seen in decades," Chief Executive Kenneth I. Chenault said in a statement. He noted overall cardmember spending fell 10% year-over-year, or 5% excluding the impact of foreign-exchange rates.In other bleak news, regional bank Zions Bancorp reported a loss: Zions, Stung by Crunch, Books Loss

Chenault added that the credit-card issuer remains cautious about the economic outlook through 2009, with expectations for cardmember spending "to remain soft with past-due loans and write-offs rising from current levels."

...

Delinquencies of 90 days or more rose to 3.1% of American Express's managed U.S. lending portfolio, from 1.8% in the prior year. The portfolio's write-off rate climbed to 6.7% from 5.9% in the third quarter and 3.4% in the prior year.

Zions Bancorp swung to a fourth-quarter loss as credit quality continues to sink and the company took a $353.8 million in write-downs on past acquisitions and investments.And more layoffs too, from MarketWatch: Texas Instruments reports a big profit drop, will cut 3,400 . I've lost count, but there have to be well over 50,000 jobs cuts announced today in the U.S.

...

Loss-loan provisions soared to $285.2 million from $156.6 million in the third quarter and $70 million a year earlier. Net loan and lease charge-offs climbed to 1.71% of annualized average loans from 0.91% and 0.28%, respectively. Non-performing assets, loans on the verge of going bad, surged to 2.71% of net loans and leases and other real estate owned from 2.2% and 0.73%.