by Calculated Risk on 1/05/2013 01:27:00 PM

Saturday, January 05, 2013

Summary for Week Ending January 4th

Happy New Year to all!

The key story of the week was the fiscal agreement. Unfortunately the media did an excellent job of confusing most people.

Remember - the "fiscal cliff" was about too much austerity too quickly (about reducing the deficit too quickly). The "fiscal cliff" included expiring tax cuts (income, payroll), expiring spending (unemployment insurance, etc.) and the "sequester" (a combination of defense and other spending cuts). The sequester has been delayed for two months, so we don't know the size of the cuts yet, but it appears the amount of austerity will not be large enough to drag the economy into a new recession. Still, austerity will be a drag in 2013 and that probably means another year of sluggish growth.

I would have argued for a different mix of policies, but reducing the amount of austerity was achieved - and this was a key goal for the fiscal agreement. Long term debt sustainability is still an issue (not part of the "fiscal cliff"), but the deficit is declining right now, and will decline further in 2013. This agreement contained some short term deficit reduction (just the end of the payroll tax cut will reduce the deficit by around $120 billion in 2013 compared to 2012).

The economic data was mixed. The employment report indicated sluggish payroll growth with the unemployment rate still very high at 7.8%. Auto sales were down from November, but still solid. Construction spending was down in November, but residential construction spending was up (non-residential and public spending was down). And the ISM manufacturing and service indexes increased in December, suggesting some improvement.

It appears 2012 ended with sluggish growth. There are reasons for optimism for 2013, but the austerity at the Federal level will be a significant drag all year.

Here is a summary of last week in graphs:

• December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

From the BLS:

Nonfarm payroll employment rose by 155,000 in December, and the unemployment rate was unchanged at 7.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for October was revised from +138,000 to +137,000, and the change for November was revised from +146,000 to +161,000.

Click on graph for larger image.

Click on graph for larger image.The headline number was at expectations of 157,000. Employment for October was revised down slightly, and November payroll growth was revised up.

The second graph shows the unemployment rate.

The unemployment rate was unchanged at 7.8% (The November unemployment rate was revised up from 7.7% as part of the annual household report revision).

The unemployment rate is from the household report and the household report showed only a small increase in employment.

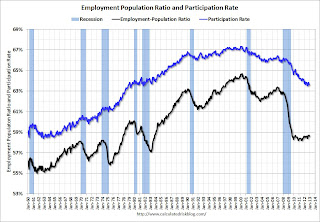

The unemployment rate is from the household report and the household report showed only a small increase in employment.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.6% in December (blue line. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio decreased to 58.6% in December (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Here is a table of the change in payroll employment on an annual basis (before benchmark revisions - the revision through March 2012 will be released next month and will show more jobs added based on the preliminary estimate):

| Annual Change Payroll Employment (000s) | |||

|---|---|---|---|

| Private | Public | Total | |

| 2006 | 1,859 | 209 | 2,068 |

| 2007 | 812 | 288 | 1,100 |

| 2008 | -3,782 | 179 | -3,603 |

| 2009 | -4,984 | -76 | -5,060 |

| 2010 | 1,248 | -221 | 1,027 |

| 2011 | 2,105 | -265 | 1,840 |

| 2012 | 1,903 | -68 | 1,835 |

Employment growth in 2012 was mostly in line with expectations. A little good news - it appears we are near the end of the state and local government layoffs, but the Federal government layoffs are ongoing. Look at the table - four consecutive years of public sector job losses is unprecedented since the Depression.

• U.S. Light Vehicle Sales at 15.3 million annual rate in December

Based on an estimate from WardsAuto, light vehicle sales were at a 15.31 million SAAR in December. That is up 13% from December 2011, and down 1% from the sales rate last month.

Based on an estimate from WardsAuto, light vehicle sales were at a 15.31 million SAAR in December. That is up 13% from December 2011, and down 1% from the sales rate last month.This was above the consensus forecast of 15.1 million SAAR (seasonally adjusted annual rate). Note: Some of the increase in November was a bounce back from Hurricane Sandy that negatively impacted sales at the end of October, and sales might have been boosted slightly in December from some storm related bounce back.

Sales were up over 13% in 2012, and auto sales have been a key contributor to the economy over the last three years. Sales will probably increase in 2013, but not at a double digit rate.

• ISM Manufacturing index increased in December to 50.7

The ISM manufacturing index indicated expansion in December. PMI was at 50.7% in December, up from 49.5% in November. The employment index was at 52.7%, up from 48.4%, and the new orders index was at 50.3%, unchanged from November.

The ISM manufacturing index indicated expansion in December. PMI was at 50.7% in December, up from 49.5% in November. The employment index was at 52.7%, up from 48.4%, and the new orders index was at 50.3%, unchanged from November.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 50.5% and suggests manufacturing expanded in December.

• ISM Non-Manufacturing Index increases in December

The December ISM Non-manufacturing index was at 56.1%, up from 54.7% in November. The employment index increased in December to 56.3%, up sharply from 50.3% in November. Note: Above 50 indicates expansion, below 50 contraction.

The December ISM Non-manufacturing index was at 56.1%, up from 54.7% in November. The employment index increased in December to 56.3%, up sharply from 50.3% in November. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing (Service) index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.5% and indicates faster expansion in December than in November. The internals were strong with both the employment index and new order index up.

• Construction Spending declined in November

The Census Bureau reported that overall construction spending decreased in November:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2012 was estimated at a seasonally adjusted annual rate of $866.0 billion, 0.3 percent below the revised October estimate of $868.2 billion. The November figure is 7.7 percent above the November 2011 estimate of $804.0 billion.

In November 2012, private residential construction spending was the largest category for the first time since 2007 - but spending is still very low (at 1998 levels not adjusted for inflation). Note: Residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected).

In November 2012, private residential construction spending was the largest category for the first time since 2007 - but spending is still very low (at 1998 levels not adjusted for inflation). Note: Residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 56% below the peak in early 2006, and up 33% from the post-bubble low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.

Private residential spending is 56% below the peak in early 2006, and up 33% from the post-bubble low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.Public construction spending is now 15% below the peak in March 2009 and just above the post-bubble low.

The second graph shows the year-over-year change in construction spending.

On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is up 8% year-over-year mostly due to energy spending (power and electric). Public spending is down 3% year-over-year.

• Weekly Initial Unemployment Claims increase to 372,000

The DOL reports:

The DOL reports:In the week ending December 29, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 10,000 from the previous week's revised figure of 362,000.Weekly claims were above the 363,000 consensus forecast.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 360,000.

Weekly claims are very volatile during the holiday season, but the 4-week average finished 2012 near the low for the year.