by Calculated Risk on 6/02/2012 04:50:00 PM

Saturday, June 02, 2012

Summary for Week Ending June 1st

This was a banner week for economic observers who scream "Miss!" every time an economic report is weaker than expected. The list of disappointing reports is long: a weak employment report, a downward revision to Q1 GDP growth, a disappointing ISM manufacturing index, weaker than expected auto sales, an increase in weekly unemployment claims, house prices at new post-bubble lows, pending home sales were down, and the Chicago PMI was weaker than expected.

Meanwhile the European crisis is grabbing headlines again, and June is another "kick-the-can or break" month for Europe (Usually the saying is "make or break", but there is no "make" on the horizon in Europe).

The weak data is a reminder: Every time the data is better than expected, some observers start predicting robust growth. And every time the data is weak, like last week, other observers start predicting another recession. Both groups have consistently been wrong; this is more of the sluggish and choppy growth that is typical following a financial crisis.

I'll have more on the economic outlook this week (the negatives and a few positives).

Here is a summary of last week in graphs:

• May Employment Report: 69,000 Jobs, 8.2% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

This was a weak month with only 69,000 payroll jobs added. Also the previous two months were revised down.

There appeared to be some additional weather related "payback" in May offsetting the relatively solid job growth during the winter months. As an example, construction employment was down 28,000 (seasonally adjusted), and "leisure and hospitality" declined by 9,000 jobs. Both were up solidly Not Seasonally Adjusted (NSA) in May. Construction was up 169,000 jobs, and leisure and leisure and hospitality increased 312,000 jobs NSA, but this is less than usual in May - probably because of the hiring during the winter - and the seasonally adjusted numbers were down. This weather "payback" is probably over now.

However weather payback probably only accounts for some of the recent slowdown in hiring.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.2% (red line).

The household survey showed a strong increase in employment (422,000 jobs added), but the participation rate increased too from 63.6% to 63.8% (blue line) so that pushed up the unemployment rate. The household survey job gains - and increase in the participation rate - are small positives.

The Employment-Population ratio increased to 58.6% in May from 58.4% in April (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 150,000).

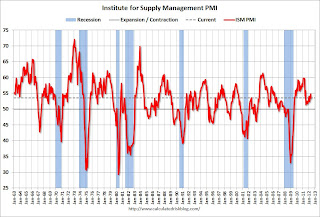

• ISM Manufacturing index declines in May to 53.5

PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.

PMI was at 53.5% in May, down from 54.8% in April. The employment index was at 56.9%, down from 57.3%, and new orders index was at 60.1%, up from 58.2%.From the Institute for Supply Management: May 2012 Manufacturing ISM Report On Business®

Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.0%. This suggests manufacturing expanded at a slower rate in May than in April.

Although this was slightly weaker than expected, new orders were up and prices were down. Not all bad.

• U.S. Light Vehicle Sales at 13.8 million annual rate in May

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.78 million SAAR in May. That is up 17.9% from May 2011, and down 4.1% from the sales rate last month (14.37 million SAAR in April 2012).This was the weakest month this year. The year-over-year increase was large because of the impact of the tsunami and related supply chain issues in May 2011. This was below the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 13.78 million SAAR from Autodata Corp).

• Case Shiller: House Prices fall to new post-bubble lows in March

S&P/Case-Shiller released the monthly Home Price Indices for March (a 3 month average of January, February and March).

S&P/Case-Shiller released the monthly Home Price Indices for March (a 3 month average of January, February and March).The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.1% from the peak, and up 0.2% in March (SA). The Composite 10 is at a new post bubble low Not Seasonally Adjusted.

The Composite 20 index is off 33.8% from the peak, and up 0.2% (SA) from March. The Composite 20 is also at a new post-bubble low NSA.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.8% compared to March 2011.

The Composite 20 SA is down 2.6% compared to March 2011. This was a smaller year-over-year decline for both indexes than in February.

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

Another Update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to January 2000, and the CoreLogic index back to May 1999.

In real terms, all appreciation in the '00s is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to August 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• Weekly Initial Unemployment Claims increase to 383,000

The DOL reports:

The DOL reports:In the week ending May 26, the advance figure for seasonally adjusted initial claims was 383,000, an increase of 10,000 from the previous week's revised figure of 373,000. The 4-week moving average was 374,500, an increase of 3,750 from the previous week's revised average of 370,750.This was above the consensus forecast of 370,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,500.

The average has been between 363,000 and 384,000 all year.

Private residential spending is 62% below the peak in early 2006, and up 14% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 20% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at a new post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit).

• Other Economic Stories ...

• Personal Income increased 0.2% in April, Spending 0.3%

• Fannie Mae Serious Delinquency rate declined in April, Freddie Mac unchanged

• LPS: Foreclosures Sales declined in April, FHA foreclosure starts increased sharply

• Chicago PMI declines to 52.7

• ADP: Private Employment increased 133,000 in May

• NAR: Pending home sales index declined 5.5% in April