by Calculated Risk on 11/30/2010 08:06:00 PM

Tuesday, November 30, 2010

Hamilton: Europe and China: is this deja vu all over again?

Earlier on house prices:

• Case-Shiller: Broad-based Declines in Home Prices in Q3

• Real House Prices, Q3 2010

Professor Hamilton presents several charts on rising bond yields in Europe, the decline in China's stock market, and the appreciation of the dollar. Hamilton asks: Europe and China: is this deja vu all over again?

If this is deja vu all over again, what might we expect next? What happened last spring was a flight to the dollar as a seemingly safe refuge. And there's been some appreciation of the dollar with the latest events as well, with more to come if history repeats itself.Hamilton didn't mention the U.S. stock market, but as the dollar strengthened against the euro in the spring, and the Shanghai composite sold off about 25% from the peak in mid-April, the S&P 500 also sold off about 15% from the peak in April. Currently the Shanghai is off about 10% from the peak in early November. I don't know if this will be deja vu all over again ...

But this is a slower-moving and broader wave than the first one. And tsunamis pack much more power than a simple crashing breaker.

Europe Update and more

by Calculated Risk on 11/30/2010 04:16:00 PM

On Europe:

• From the WSJ: Fresh Round of 'Stress Tests' Planned for European Banks

The [first stress] tests were largely discredited by revelations that they lacked rigor, including a Wall Street Journal report in September that the tests understated some banks' holdings of potentially risky sovereign bonds. ... "There was some variety in terms of rigor and application of [the initial] tests," European Economic and Monetary Affairs Commissioner Olli Rehn said in Brussels.Oh yeah. Ireland's banks passed the initial stress tests in July! And we know how that worked out.

• From the Financial Times: Trichet hints at more bond purchases. The Financial Times quotes European Central Bank president Jean-Claude Trichet as saying “pundits are under-estimating the determination of governments” and “I don’t think that financial stability in the eurozone, given what I know, could really be called into question.”

• From Bloomberg: Italy-Germany 10-Year Yield Spread Reaches 200 Points, Widest Since 1997. That is just a sample of the headlines on European bonds. And everyone is trying to figure out how to add "B" to PIIGS.

And on a more positive note ...

• The Chicago PMI for November (released this morning) was stronger than expected. Production (at 62.5) "reached its highest level since February 2005", and new orders (67.2) increased "to a level not seen since 2007. The employment index increased to 56.3 from 54.6 in October. This continues the trend of stronger reports recently. I'll have an employment preview on Thursday, and I'll probably take the over again this month (consensus is 145,000 non-farm payroll jobs).

Rumor: WikiLeaks to release BofA documents?

by Calculated Risk on 11/30/2010 02:23:00 PM

From Andy Greenberg at Forbes yesterday: WikiLeaks’ Julian Assange Wants To Spill Your Corporate Secrets (ht Robert)

Early next year, Julian Assange says, a major American bank will suddenly find itself turned inside out. Tens of thousands of its internal documents will be exposed on Wikileaks.org ... The data dump will lay bare the finance firm’s secrets on the Web for every customer, every competitor, every regulator to examine and pass judgment on.And from Andy Greenberg today: Is Bank Of America WikiLeaks’ Next Target?

[A]n eagle-eyed reader has sent me a link to a quote from a Computer World interview with Assange from October of 2009, which, if true, may contain a clue to that bank’s identity:“At the moment, for example, we are sitting on five gigabytes from Bank of America, one of the executive’s hard drives,” he said. “Now how do we present that? It’s a difficult problem. We could just dump it all into one giant Zip file, but we know for a fact that has limited impact. To have impact, it needs to be easy for people to dive in and search it and get something out of it.”

Real House Prices, Q3 2010

by Calculated Risk on 11/30/2010 12:04:00 PM

This morning, S&P reported that there were "broad based" house price declines in Q3. And earlier this month, CoreLogic reported that house prices declined 1.8% in September.

The following graph shows the Case-Shiller National index (quarterly), the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms, all three indexes are back to 2000 / 2001 prices. The real Case-Shiller national index is at a new cycle low, and the real Case-Shiller Composite 20 and real CoreLogic indexes are just above the cycle low (and will be at new lows soon).

A few key points:

• In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

• Even if real prices are still too high, they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• With high levels of inventory, prices will probably fall some more. (My forecast earlier this year was for 5% to 10% additional price declines on the repeat sales indexes).

Case-Shiller: Broad-based Declines in Home Prices in Q3

by Calculated Risk on 11/30/2010 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September (actually a 3 month average of July, August and September).

This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities), and the quarterly national index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Broad-based Declines in Home Prices in the 3rd Quarter of 2010

Data through September 2010, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices ... show that the U.S. National Home Price Index declined 2.0% in the third quarter of 2010, after having risen 4.7% in the second quarter. Nationally, home prices are 1.5% below their year-earlier levels. In September, 18 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down; and only the two composites and five MSAs showed year-over-year gains. While housing prices are still above their spring 2009 lows, the end of the tax incentives and still active foreclosures appear to be weighing down the market.

Click on graph for larger image in new window.

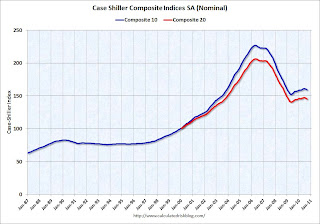

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.8% from the peak, and down 0.7% in September(SA).

The Composite 20 index is off 29.6% from the peak, and down 0.8% in September (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 is up 1.5% compared to September 2009.

The Composite 20 is up 0.5% compared to September 2009.

Case-Shiller reported that nationally home prices are 1.5% below their year-earlier levels. The year-over-year increases in the composite indexes are slowing, and will probably be negative later this year.

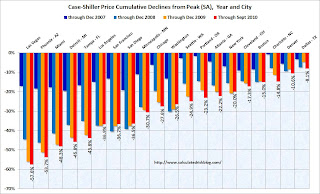

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 1 of the 20 Case-Shiller cities in September seasonally adjusted. Only Wash, D.C. saw a price increase (SA) in September, and that was very small.

Prices increased (SA) in only 1 of the 20 Case-Shiller cities in September seasonally adjusted. Only Wash, D.C. saw a price increase (SA) in September, and that was very small. Prices in Las Vegas are off 57.6% from the peak, and prices in Dallas only off 8.1% from the peak.

Prices are now falling - and falling just about everywhere. And it appears there are more price declines coming (based on inventory levels and anecdotal reports).

Monday, November 29, 2010

Restaurant Performance Index highest in three years

by Calculated Risk on 11/29/2010 10:45:00 PM

This is one of several industry specific indexes I track each month.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

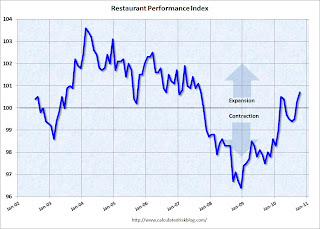

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Performance Index highest in three years

"The National Restaurant Association’s Restaurant Performance Index in October reached 100.7. This is the highest level for the index in over three years, since September 2007, and reflects a strengthening environment of consumer spending at restaurants." said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association.

Restraurants are a discretionary expense, and this expansion suggests consumers are becoming more confident.

DOT: Vehicle miles driven increased in September

by Calculated Risk on 11/29/2010 05:49:00 PM

The Department of Transportation (DOT) reported that vehicle miles driven in September were up 1.5% compared to September 2009:

Travel on all roads and streets changed by +1.5% (3.7 billion vehicle miles) for September 2010 as compared with September 2009.

Cumulative Travel for 2010 changed by +0.5% (11.1 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, vehicle miles driven have only increased slightly from the bottom of the recession.

Miles driven are still 1.6% below the peak in 2007. This is another indicator of a sluggish recovery. And this report was for September when oil prices were in the mid $70s per barrel. Oil prices moved up to the mid $80s today, and that might impact miles driven in December.

Home Sales: Distressing Gap

by Calculated Risk on 11/29/2010 02:12:00 PM

Here is an update to a graph I've been posting for several years. This graph shows existing home sales (left axis) and new home sales (right axis) through October. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the homebuyer tax credits (the initial credit in 2009, followed by the 2nd credit in 2010). There were also two smaller bumps for new home sales related to the tax credits.

Now the gap is mostly because of the continuing flood of distressed sales (both foreclosures and short sales).

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to this historical relationship.

We can guess at the levels: The median turnover for existing homes is just over 6% of all owner occupied homes per year, and with about 75 million owner occupied homes that would suggest close to 5 million sales per year (no one should expect existing home sales to be over 7 million units per year any time soon!). And that would suggest new home sales at just over 800 thousand per year when the market eventually recovers (not 1.2 or 1.3 million per year). This fits with this analysis: The Impact of the Declining Homeownership Rate.

Dallas Fed manufacturing survey shows activity increased in November

by Calculated Risk on 11/29/2010 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Strengthens Further

Texas factory activity increased in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, was positive for the third consecutive month and came in at a reading of 13, up from 7 in October.The following graph compares the regional Fed surveys through November with the ISM manufacturing index through October. The ISM manufacturing index for November will be released on Wednesday, Dec 1st.

All other manufacturing activity indicators also rose, posting their best month since May. The new orders and shipments indexes turned positive after five months of negative readings.

...

Labor market indicators picked up this month. The employment index rose from –4 to 6, reaching its highest level since May, and hours worked increased for the first time in four months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The New York and Philly Fed surveys are averaged together (dashed green, through November), and averaged five Fed surveys (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City.

The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

With the exception of the NY Fed survey (Empire state), all the regional surveys showed a pickup in manufacturing activity in November.

Europe Update

by Calculated Risk on 11/29/2010 08:58:00 AM

Weekly Posts:

• Schedule for Week of Nov 28th

• A Summary for Week ending November 27th

The European markets are off about 1% this morning.

The yield on the Ireland 10-year bond is up to 9.25%.

The yield on the Portugal 10-year bond is up to 7.02%.

The yield on the Spain 10-year bond is up to 5.36%.

Roubini suggests Portugal should seek a bailout: "Go now to the IMF to borrow money now" (in Portugese)

And from Reuters: Greece Gets Loan Repayment Extension to 2021

Greece will have until 2021 to repay its 110 billion euro ($145.7 billion) EU/IMF bailout loan, the country's finance minister said on Monday.Update: from Paul Krugman: Not Waving But Drowning

In return, Greece will have to pay a higher fixed interest rate of about 5.8 percent from 5.5 percent...

It’s as if we’re having the following dialogue:

“Ireland really can’t afford to pay these debts.”

“Here’s a credit line!”

“No, really, we just can’t afford to pay.”

“Here’s a credit line!”

It really is like watching a car wreck.

Sunday Night Futures

by Calculated Risk on 11/29/2010 12:09:00 AM

Earlier the rescue package for Ireland was announced and preliminary agreement on a permanent resolution mechanism was reached (starting in 2013 - if the markets can wait that long).

Not much market reaction. The Asian markets are mixed tonight. And CNBC's Pre-Market Data shows the S&P 500 off about 8 points or less than 1%. Dow futures are off about 80 points.

The Euro is down slightly to 1.32 dollars

It will be interesting to see the reaction in the bond markets for Ireland, Spain and Portugal .

Best to all.

Sunday, November 28, 2010

The recent improvement in economic news

by Calculated Risk on 11/28/2010 07:27:00 PM

Earlier:

• Schedule for Week of Nov 28th

• A Summary for Week ending November 27th

It is worth noting the recent improvement in economic news:

• The October employment report showed a gain of 151,000 nonfarm payroll jobs, the most since April ex-Census. Expectations are for a similar gain in November, although probably not enough jobs added to push down the unemployment rate.

• The BEA estimated real GDP grew at a 2.5% annual rate in Q3. This is still sluggish, but an improvement from the 1.7% growth rate in Q2.

• The Personal Income and Outlays report for October indicated incomes grew at a 0.5% rate (month-to-month), and it appears PCE has grown at about a 3% annualized rate over the last three months. The personal saving rate was 5.7% in October, and although I expect the rate to increase a little more - it appears a majority of the adjustment is behind us (a rising saving rate is a drag on personal consumption).

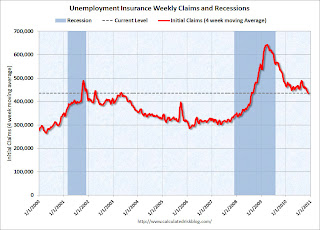

• The 4-week average of initial weekly unemployment claims has declined to 436,000 last week from over 480,000 at the end of August. The weekly reading was 407,000 last week; the lowest since July 2008.

• Most regional manufacturing surveys, with the exception of the NY Fed survey (empire state), has shown a pickup in manufacturing. This suggests the manufacturing sector is still improving (the ISM manufacturing index for November will be released on Wednesday).

• Trucking and rail traffic improved in October, although the Ceridian diesel fuel index was weak.

• The Architecture Billings Index (a leading indicator for commercial real estate) is near flat - suggesting investment in commercial structures such as hotels, offices and malls will stop contracting next year. (addition by subtraction!)

• Even small business optimism has improved slightly.

Most of the reasons for the recent slowdown are still with us - less stimulus spending, the end of the inventory adjustment, problems in Europe and a slowdown in China, and cutbacks at the state and local level - but it appears Residential investment (RI) has bottomed and will most likely add to GDP growth in 2011. I believe the RI drag is now behind us, and RI is usually the best leading indicator for the economy.

The data is still mixed and fits with my general view of a sluggish and choppy recovery (my view since the spring of 2009). Although I don't see a sharp increase in growth, I think the pace of recovery will probably pick up a little bit in 2011, and I'll take the over on the consensus view of 2.5% GDP growth in 2011. My guess is 3%+ GDP growth in 2011 - still not a strong recovery given the amount of slack in the economy, but an improvement over 2010.

Unfortunately there probably will not be enough growth to significantly reduce the unemployment rate in 2011.

Note: I'll add more before the end of the year, but I've been sharing my thoughts with a few analysts and economic commentators and I try to post my views whenever they change - even a little. Right now it looks like the "slowdown, but no double dip call" was correct (it is still early), and now I'm becoming a little more optimistic and taking the "over" on 2011 GDP growth (still no v-shape recovery though).

European Union approves €85 billion rescue of Ireland

by Calculated Risk on 11/28/2010 01:46:00 PM

Update: Here are the details: Announcement of joint EU - IMF Programme for Ireland

From the Irish Times: EU finance ministers agree deal on Irish rescue package

The Irish Times reports that the European Union has approved the €85 billion rescue package for Ireland with an estimated 5.8% average interest rate.

Also, the WSJ reports progress on the "permanent resolution mechanism" (aka default mechanism): EU Outlines Bond Restructuring Plan

Creditors of euro-zone countries that face insolvency after 2013 will see their bond holdings restructured ... [the proposal was] agreed earlier Sunday by German Chancellor Angela Merkel, French President Nicolas Sarkozy, EU President Herman Van Rompuy and European Central Bank chief Jean-Claude Trichet

A Summary for Week ending November 27th

by Calculated Risk on 11/28/2010 09:10:00 AM

Below is a summary of last week mostly in graphs.

Here is the economic schedule for the coming week.

Note: A key story has been the rescue of Ireland. The Irish Times reports that a deal is done, but the details haven't been released.

• New Home Sales declined in October

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

The Census Bureau reported New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 283 thousand. This is down from 308 thousand in September. "This is 8.1 percent below the revised September rate ... and is 28.5 percent below the October 2009 estimate of 396,000."

Months of supply increased to 8.6 in October from 7.9 in September. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply increased to 8.6 in October from 7.9 in September. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

The 283 thousand annual sales rate for October is just above the all time record low in August (275 thousand). This was the weakest October on record and well below the consensus forecast of 314 thousand.

• October Existing Home Sales: 4.43 million SAAR, 10.5 months of supply

The NAR reports: Existing-Home Sales Decline in October Following Two Monthly Gains

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2010 (4.43 million SAAR) were 2.2% lower than last month, and were 25.9% lower than October 2009.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Although inventory decreased from September 2010 to October 2010, inventory increased 8.4% YoY in October. This is the largest YoY increase in inventory since early 2008.

Although inventory decreased from September 2010 to October 2010, inventory increased 8.4% YoY in October. This is the largest YoY increase in inventory since early 2008.

The year-over-year increase in inventory is especially bad news because the reported inventory is very high (3.864 million), and the 10.5 months of supply in October is far above normal.

This graph shows existing home sales Not Seasonally Adjusted (NSA).

This graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2010. Sales for the last four months are significantly below the previous years, and sales will probably be weak for the remainder of 2010.

Existing home sales were weak in October, and will continue to be weak for some time. Inventory is very high - and the significant year-over-year increase in inventory is very concerning. The high level of inventory and months-of-supply will put downward pressure on house prices.

• Moody's: Commercial Real Estate Prices increase in September

Moody's reported that the Moody’s/REAL All Property Type Aggregate Index increased 4.3% in September. This reverses the sharp decline in August. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

This graph is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

This graph is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

• CoreLogic: Total unsold housing inventory increases to 6.3 million units

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic estimates the "shadown inventory" (by this method) at about 2.1 million units.

• Other Economic Stories ...

• Housing Supply: What do all the numbers mean?

• Galleries and more ...

• From the Chicago Fed: Index shows economic activity picked up in October

• From the BEA: Q3 real GDP growth revised up to 2.5% annualized rate

• From the BEA October report: Personal income increased $57.6 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $44.0 billion, or 0.4 percent.

• From the Fed FOMC Minutes: Forecasts revised down again, Disagreement on outlook.

• From LPS Applied Analytics Over 4.3 million loans 90+ days or in foreclosure

• From the American Trucking Association: ATA Truck Tonnage Index Rose 0.8 Percent in October

• Unofficial Problem Bank list increases to 919 Institutions

Best wishes to all!

Saturday, November 27, 2010

Saturday Night Reading

by Calculated Risk on 11/27/2010 11:08:00 PM

• From the NY Times: European Markets in Limbo as Irish Bailout Takes Shape

The package is certain to be complex because aid is expected to come from four sources — two separate European Union funds, the I.M.F. and most likely bilateral loans from Britain and Sweden.The announcement is expected Sunday night.

• From the NY Times: Demonstrators in Ireland Protest Austerity Plan

And a couple of posts from the holidays ...

• Housing Supply: What do all the numbers mean?

• Galleries and more ...

Schedule for Week of Nov 28th

by Calculated Risk on 11/27/2010 05:50:00 PM

The key report for the week will be the November employment report to be released on Friday, Dec 3rd. Other key reports include the Case-Shiller home price index on Tuesday, the ISM manufacturing index on Wednesday, and the ISM non-manufacturing (service) index on Friday.

10:30 AM: Dallas Fed Manufacturing Survey for November. The Texas survey showed a slight expansion last month (at 6.9), and is expected to show expansion again in November. This is the last of the regional surveys for November, and with the exception of the NY Fed (Empire State) survey, all showed improvement in November.

9:00 AM: S&P/Case-Shiller Home Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. The consensus is for prices to decline about 0.4% in September; the third straight month of price declines.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a decline to 60.0 from 60.6 in October.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 52.5 from 50.2 last month.

12:30 PM: Minneapolis Fed President Narayana Kocherlakota speaks on "Monetary Policy Actions and Fiscal Policy Substitutes"

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months - suggesting reported home sales through the end of the year will be very weak.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for +68,000 payroll jobs in November, up from the +43,000 jobs reported in October.

8:30 AM: Productivity and Costs for Q3 (Final). The consensus is for a -0.2% decrease in unit labor costs.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a slight decrease to 56.5 from 56.9 in October.

10:00 AM: Construction Spending for October. The consensus is for a 0.4% decline in construction spending.

2:00 PM: The Fed’s Beige Book for November. This is anecdotal information on current economic conditions.

All day: Light vehicle sales for November. Light vehicle sales are expected to decrease slightly to 12.0 million (Seasonally Adjusted Annual Rate), from 12.3 million in October. Edmunds is forecasting:

Edmunds.com analysts predict that November's Seasonally Adjusted Annualized Rate (SAAR) will be 12.2 million, essentially flat from October 2010.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last several weeks. The consensus is for an increase to 424,000 from 407,000 last week (still high, but much lower than earlier this year).

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1% decrease in contracts signed. It usually takes 45 to 60 days to close, so this will provide an early indication of closings in December.

12:20 PM: Philadelphia Fed President Charles Plosser speaks on the economic outlook

Expected: October Personal Bankruptcy Filings

8:30 AM: Employment Report for November. The consensus is for an increase of 145,000 non-farm payroll jobs in November, about the same as the 151,000 jobs added in October. The consensus is for the unemployment rate to stay steady at 9.6%.

9:10 AM: Fed Vice Chair Janet Yellen speaks on "Fiscal Responsibility and Global Rebalancing"

10:00 AM: Manufacturers' Shipments, Inventories and Orders for October. The consensus is for a 0.7% decrease in orders.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a slight increase to 54.7 from 54.3 in October.

After 4:00 PM: The FDIC will probably have another busy Friday afternoon ...

Ireland: €85 billion bailout expected Sunday

by Calculated Risk on 11/27/2010 01:31:00 PM

The timing is still not clear, but most people expect an announcment Sunday night.

From the Irish Times: Talks on Irish bailout to resume

Irish officials will today resume talks with a delegation from the EU and IMF on the terms of a €85 billion bailout for Ireland, ahead of the likely announcement of an agreement tomorrow.I'll post the details tomorrow night (if it is announced).

Unofficial Problem Bank list increases to 919 Institutions

by Calculated Risk on 11/27/2010 08:37:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 26, 2010.

Changes and comments from surferdude808:

The FDIC released its actions for October, which contributed to a notable increase in the Unofficial Problem Bank List. This week there were 17 additions and one removal leaving the list at 919 institutions with assets of $410.2 billion. Assets declined $9.4 billion during the week, but $11.6 billion, or more than 100 percent of the drop in assets, came from the release of 2010q3 financials. Thus, the net 16 additions this week added $2.2 billion of assets. For the month, a net 25 institutions were added and the list has 376 more institutions than it did a year ago.The Q3 FDIC Quarterly banking profile was released last week and showed 860 problem institutions at the end of Q3 with $379 billion in assets.

The sole removal this week is the termination of an action by the FDIC against Torrey Pines Bank, San Diego, CA ($1.2 billion Ticker: WAL).

Among the 17 additions this week are the Bank of the Orient, San Francisco, CA ($675 million); Town & Country Bank and Trust Company, Bardstown, KY ($454 million Ticker: FHDG); Border State Bank, Greenbush, MN ($347 million); McHenry Savings Bank, McHenry, IL ($271 million); and SouthBank, a Federal Savings Bank, Huntsville, AL ($265 million).

Friday, November 26, 2010

Fannie and Freddie on Foreclosed Homes: Resume all normal sales activity

by Calculated Risk on 11/26/2010 07:34:00 PM

From Kimberly Miller at the Palm Beach Post: Fannie Mae, Freddie Mac give the 'go-ahead' to resume sales of foreclosed homes

Fannie Mae and Freddie Mac gave the go-ahead this week to restart sales of their foreclosed properties ... Brokers received memos Wednesday from the government-sponsored enterprises saying that the homes could once again be marketed and sales finalized on properties already under contract.Fannie and Freddie halted some sales of already foreclosed properties (REO: Real Estate Owned), and they also halted some foreclosures in process. The above story was on sales of REOs.

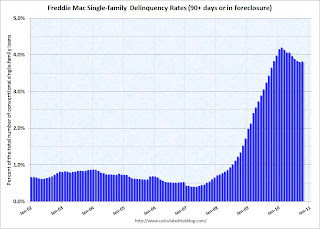

On a related point, Freddie Mac reported that the serious delinquency rate increased to 3.82% in October from 3.80% in September. The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Click on graph for larger image in new window.

Click on graph for larger image in new window.Some of the rapid increase last year was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The increase in October - the first increase since February - is probably related to the new foreclosure moratoriums.

Note: Fannie and Freddie report REO inventory quarterly, but the FHA reported that REO increased sharply in October to 54,609 from 51,487 at the end of September. So even though Fannie and Freddie halted many foreclosures in process, they also halted REO sales - so my guess is their REO inventory probably increased in October and November too (like for the FHA).

Accelerated Timetable for Ireland Bailout Details

by Calculated Risk on 11/26/2010 05:38:00 PM

From the NY Times: Europeans Striving to Calm Nerves in Markets

[T]he team of European Union and International Monetary Fund specialists in Ireland was racing to complete terms of its financing package before markets reopen on Monday.Looks like Sunday will be busy again.

And from the Irish Times: Reports that bailout will attract 6.7% rate rejected

The interest rate for a nine-year EU/IMF loan would be lower than the 6.7 per cent being quoted in some reports today, a source involved in the talks has indicated.University College Dublin professor Karl Whelan earlier estimated an EFSF borrowing rate close to 6%: Borrowing Rates from The EFSF

And more stress tests are coming in Spain (from NY Times article):

In Spain, the central bank ... said it would carry out further stress tests to show ... financial institutions ... could absorb a “problematic exposure” of 180 billion euros, or $238 billion, to the country’s collapsed construction and real estate sectors.

Housing Supply: What do all the numbers mean?

by Calculated Risk on 11/26/2010 01:42:00 PM

We are constantly bombarded with housing supply numbers: 3.86 million existing homes for sale, 10.5 month-of-supply, 2.1 million "pending sales", 7 million mortgages delinquent.

Recently NY Fed president William Dudley said "We estimate that there are roughly 3 million vacant housing units more than usual", and other sources have mentioned there are close to 19 million vacant housing units in the U.S.!

What does it all mean?

The number to start with is the "visible supply" reported monthly from the National Association of Realtors (NAR). At the end of October, the NAR reported there were 3.86 million homes for sale.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows nationwide inventory for existing homes.

Notice that inventory started to increase in the 2nd half of 2005. That was one of the indicators I used to call the top of the housing bubble.

Also notice the seasonal pattern for inventory - inventory increases in the spring, and usually peaks during the summer months, and then falls off sharply in December as homeowners take their homes off the market for the holidays. I expect NAR reported inventory to fall to around 3.5 million of so in December (down from 3.86 million in October, but up from 3.283 in December 2009).

This brings up an interesting point about how the NAR calculates "months-of-supply". The simple formula is months-of-supply = inventory divided by sales. The NAR uses the Seasonally Adjusted Annual Rate (SAAR) of sales, but the Not Seasonally Adjusted (NSA) inventory - even though there is a clear seasonal pattern for inventory.

The NAR formula is: months-of-supply = (inventory (NSA) /sales (SAAR)) * 12 months. (edit: oops, inverted initially, correct above) For October, the NAR reported 4.43 million sales (SAAR), and 3.86 million units of inventory, so that equals 10.5 months of supply.

If inventory drops to 3.5 million in December (normal seasonal decline), but the sales rate stay at 4.43 million, the months-of-supply metric will decline to 9.5 months. Some analysts might report that decline as "good news" even though it is just because of the normal seasonal change in inventory.

A couple more points:

• Historically year end inventory is around 3% to 3.5% of the total number of owner occupied units. Currently there are about 75 million owner occupied units, so a normal level of year end inventory would be around 2.3 to 2.6 million units. So the visible inventory at around 3.5 million would be significantly above the normal level.

• It is the visible inventory that impacts prices. Also important is the level of distressed sales (short sales and foreclosures).

This graph (posted with permission) shows the percentage of short sales and REO (lender Real Estate Ownder) sales since January 2006. From CoreLogic:

Distressed sales fell 10 percent in August to 68,700, the lowest level since May 2008. Although the level of distressed sales declined, it simply reflects the weak demand in the market overall because total sales also declined and the distressed sale share remained stable at 28 percent.So both the level of visible inventory and the percentage of distressed sales is elevated - and that puts downward pressure on house prices.

The next number is the "pending sales" of 2.1 million units. This was reported by CoreLogic this week:

This graph from CoreLogic shows the breakdown of "pending sales" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as a pending sale.

This graph from CoreLogic shows the breakdown of "pending sales" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as a pending sale.CoreLogic estimates the "pending sale" (by this method) at about 2.1 million units. This number is useful - especially the trend - because it suggests that the visible inventory will stay elevated for some time. And also that the number of distressed sales will stay elevated.

Some analyst have called the number of REOs and total delinquent loans as the "shadow inventory". This is incorrect for two reasons: 1) some homes are listed for sale and are visible (CoreLogic removed these homes from their pending sales metric), and 2) some loans will cure from the borrower catching up, the sale of the home, or with a loan modification.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.A fairly large number of 90+ day and in-foreclosure loans are curing too. This is probably because of modifications - and there will probably be a high percentage of redefaults - but this shows why you can't include all delinquent loans as part of the "shadow inventory".

And that brings us to the 7 million delinquent loans. There are two sources for the number of delinquent loans: the Mortgage Bankers Association (MBA) quarterly National Delinquency Survey, and a monthly report from Lender Processing Services (LPS).

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

And from LPS Applied Analytics October Mortgage Performance data:

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.29 percent of mortgages are delinquent, and another 3.92 are in the foreclosure process for a total of 13.20 percent. It breaks down as:

• 2.72 million loans less than 90 days delinquent.

• 2.24 million loans 90+ days delinquent.

• 2.09 million loans in foreclosure process.

For a total of 7.04 million loans delinquent or in foreclosure.

And finally, what about those "3 million excess vacant housing units"?

This number comes from the Census Bureau's quarterly Housing Vacancies and Homeownership. This report shows almost 19 million total vacant housing units, but that number is pretty meaningless and includes 2nd homes, partially constructed new homes, and much more.

The 3 million number is calculated using the homeowner and rental vacancy rates, and estimating the number of excess units above the normal frictional level. There is always some number of vacant homeowner and rental units as people move and for other reasons. So the excess is the number above this frictional level. The NY Fed also added in a part of the increase in "Vacant, held off market, other" to obtain the 3 million estimate.

I think this last portion of the "excess vacant inventory" is less reliable, and I just use the homeowner and rental vacancy rates. My current estimate is about 1.55 million excess vacant units. This is a key number because once the excess is absorbed in an area as new households are formed, then new construction will begin - and that will mean a pickup in economic activity and employment.

The key numbers to follow for the housing market are 1) existing home inventory, 2) number of delinquent loans, and 3) the excess vacant inventory.

Portugal and Spain: More Denials

by Calculated Risk on 11/26/2010 08:23:00 AM

From the previous post excerpting from Michael Pettis:

Its official – Spain and Portugal will need to be bailed out soon. How do I know? In one of my favorite TV shows, Yes Minister, the all-knowing civil servant Sir Humphrey explains to cabinet minister Jim Hacker that you can never be certain that something will happen until the government denies it.From the Financial Times: Portugal denies facing bail-out pressure

Portugal has denied as “totally false” reports that it is under pressure ... to request an international financial bail-out.And from the Financial Times: Spain issues defiant warning to markets

“There is no truth to these reports,” a government spokesman told the Financial Times.

excerpt with permission

José Luis Rodríguez Zapatero, Spanish prime minister, on Friday ruled out any rescue package for the country ... “I should warn those investors who are short selling Spain that they are going to be wrong and will go against their own interests,” Mr Zapatero said

Thursday, November 25, 2010

Pettis: Will Europe face defaults?

by Calculated Risk on 11/25/2010 09:01:00 PM

From Michael Pettis on Europe: Chinese inflation and European defaults

Its official – Spain and Portugal will need to be bailed out soon. How do I know? In one of my favorite TV shows, Yes Minister, the all-knowing civil servant Sir Humphrey explains to cabinet minister Jim Hacker that you can never be certain that something will happen until the government denies it.And Portugal and Spain have just rejected the possibility of a bailout (a joke with a lot of truth).

Pettis offers a few pessimistic predictions including:

Greece will be forced to default and restructure its debt, and the restructuring will come with a significant amount of debt forgiveness. The idea that it can grow its way out of the current debt burden is a fantasy.And ...

Greece will not be the only defaulter. Spain, Portugal, Ireland, Italy, Belgium and much of Eastern Europe will also face severe financial distress and possible default.Best wishes to all.

The Pain would come from Spain

by Calculated Risk on 11/25/2010 03:15:00 PM

First, a great overview from Raphael Minder at the NY Times: A Spanish Bailout Would Test Europe’s Strained Finances

[A]ny bailout of Spain — with an economy twice the size of [Greece, Ireland and Portugal] combined — could severely stress the ability of Europe’s stronger countries to help the financially weaker ones, and spell deep trouble for the euro, Europe’s common currency.There is much more in the article.

...

The looming question is whether Spanish banks are really as healthy as the government and the banks say they are. ... Last July, Spanish banks emerged relatively unscathed from stress tests carried out across Europe ... But the credibility of the stress tests has since been undermined by the collapse of Irish banks.

And from the WSJ: EU Hopes to Double Bailout Fund. Concerns about Spain is the reason for doubling the fund.

Galleries, Europe and more ...

by Calculated Risk on 11/25/2010 09:15:00 AM

A few housekeeping notes for a holiday ...

• Every weekend I post a weekly schedule of economic data for the coming week. The current schedule can be accessed in the menu bar above: "Weekly Schedule".

• Receive blog posts via email. Sign up here for free (No subscription information will be sold or otherwise provided to third parties).

• Follow on Twitter.

• Graph Galleries are now active. You can access the galleries by clicking on a graph, or use "Graph Galleries" in the menu bar above.

The galleries are graphs grouped by category:

1) Employment,

2) New Home sales,

3) Existing home sales,

4) Home prices,

5) Housing (like starts and homeownership rate)

6) Mortgage Delinquency

7) Transportation

8) Manufacturing

9) GDP

10) Commercial Real Estate (CRE)

11) Retail

12) Trade

13) Employment Participation Rate (an analysis)

14) Inflation (CPI)

Two examples:

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph is based on data from MBA's National Delinquency Survey (NDS)and shows the percent of loans delinquent by days past due.

If you click on the graph, the link will take you to the same graph in the "delinquency" gallery.

The title for the graph "MBA Q3 Delinquency Data, Nov 18, 2010" is a link to the related blog post - and the date is when the graph was posted.

Note the "print" link at the bottom. That will display the full size image (The graphs are free to use on websites or for presentations. All I ask is that online sites link to my site, http://www.calculatedriskblog.com/, and printed presentations credit www.calculatedriskblog.com.)

And another example from the existing home sales report this week.

And another example from the existing home sales report this week.

Clicking on the graph will take you to the "existing home" gallery. There are seven related graphs in the gallery (Existing home sales, inventory, months-of-supply, etc). You can click on the thumbnails at the bottom to view each graph.

Enjoy!

And on Europe:

• Ireland 10-year yield is over 9%

• Spanish 10-year bond yields have hit a record 5.2%.

• Portugal 10-year yield is at 7%.

Thanks to all for reading. Have a great Thanksgiving!

Wednesday, November 24, 2010

Music: "The Dollar and Its Diving"

by Calculated Risk on 11/24/2010 10:24:00 PM

A little holiday music ...

ATA: Truck Tonnage Index increases in October

by Calculated Risk on 11/24/2010 07:15:00 PM

Earlier post: New Home Sales decline in October

From the American Trucking Association: ATA Truck Tonnage Index Rose 0.8 Percent in October

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.8 percent in October after increasing a revised 1.8 percent in September. The latest gain put the SA index at 109.7 (2000=100) in October from 108.9 in September.

...

ATA Chief Economist Bob Costello said that truck tonnage changes over the last couple months shows there are some bright spots in the U.S. economy. “October tonnage levels were at the highest level in three months, even after accounting for typical seasonal shipping patterns. These gains fit with reports out of both the manufacturing and retail sectors and show there is a little bit of life in this economic recovery."

Click on map for larger image.

Click on map for larger image.This graph from the ATA shows the Truck Tonnage Index since Jan 2006.

The line is added to show the index has been mostly moving sideways this year.

Comments on October Personal Income and Outlays Report

by Calculated Risk on 11/24/2010 03:28:00 PM

The BEA released the Personal Income and Outlays report for October this morning.

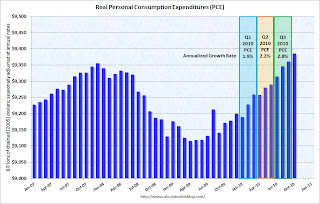

Personal income increased $57.6 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $44.0 billion, or 0.4 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in October, compared with an increaseof 0.2 percent in September.

Click on graph for large image.

Click on graph for large image.The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

Even with no growth in November and December, PCE growth will be close to 2% in Q4, and it will probably be closer to 3% (annualized growth rate).

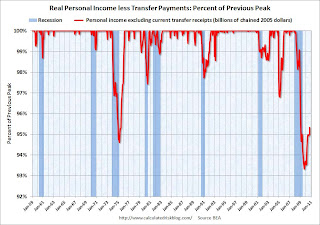

Also personal income less transfer payments increased sharply in October. This increased to $9,285.7 billion (SAAR, 2005 dollars) from $9,252.2 billion in September. This measure had stalled out over the summer.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.7% below the previous peak - but is recovering again.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.7% below the previous peak - but is recovering again. Overall this was a fairly positive report, in line with consensus expectations, and suggests decent (but not robust) growth in October.

Europe Update: Irish Austerity, New Resolution Mechanism, Rising Yields

by Calculated Risk on 11/24/2010 12:43:00 PM

From the Irish Times: 'No group sheltered' as €15 billion savings plan unveiled

[S]pending on social welfare cut by €2.8 billion primarily through cuts in unemployment benefits and child income supports ... new levies on property and a hike in the basic rate of income tax ...And the WSJ reports obtaining a copy of Germany's proposal for a permanent resolution mechanism that would take effect after the EFSF expires in 2013. According to the WSJ, the proposal would create a

"permanent, intergovernmental crisis-management mechanism" in which euro-zone members, private investors and the International Monetary Fund would all play a role.This is the widely discussed "haircut" for bondholders.

Spanish 10-year bond yields have pushed above 5%, the Portugal 10-year yield is at 7%, and Ireland is up to 8.89%.

Note: Right now this is a European problem and I see little impact on the U.S. in the short term.

New Home Sales decline in October

by Calculated Risk on 11/24/2010 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 283 thousand. This is down from 308 thousand in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

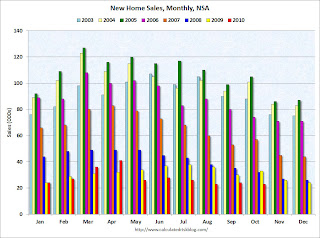

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted or annualized).

Note the Red columns for 2010. In October 2010, 23 thousand new homes were sold (NSA). This is a new record low for October.

The previous record low for the month of October was 29 thousand in 1981; the record high was 105 thousand in October 2005.

The second graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

The second graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

Sales of new single-family houses in October 2010 were at a seasonally adjusted annual rate of 283,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.1 percent (±16.1%)* below the revised September rate of 308,000 and is 28.5 percent (±12.6%) below the October 2009 estimate of 396,000.And another long term graph - this one for New Home Months of Supply.

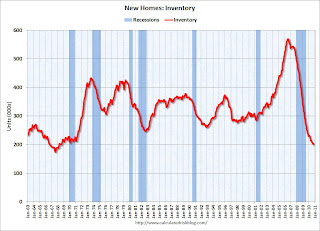

Months of supply increased to 8.6 in October from 7.9 in September. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply increased to 8.6 in October from 7.9 in September. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of October was 202,000. This represents a supply of 8.6 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. The 283 thousand annual sales rate for October is just above the all time record low in August (275 thousand). This was the weakest October on record and well below the consensus forecast of 314 thousand.

This was another very weak report.

Weekly Initial Unemployment Claims decrease sharply

by Calculated Risk on 11/24/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 20, the advance figure for seasonally adjusted initial claims was 407,000, a decrease of 34,000 from the previous week's revised figure of 441,000. The 4-week moving average was 436,000, a decrease of 7,500 from the previous week's revised average of 443,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 7,500 to 436,000.

This is the lowest level for the 4-week moving average since August 2008. This decline is good news.

MBA: Mortgage Purchase Applications Increase, highest level since May

by Calculated Risk on 11/24/2010 07:34:00 AM

The MBA reports: Mortgage Purchase Applications Increase in Latest MBA Weekly Survey

The Refinance Index decreased 1.0 percent from the previous week and is the lowest Refinance Index observed since the end of June. The seasonally adjusted Purchase Index increased 14.4 percent from one week earlier, which included Veterans Day. No adjustment was made for the holiday.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.50 percent from 4.46 percent, with points decreasing to 0.88 from 1.12 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year fixed rate observed in the survey since the week ending September 3, 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with the increase in applications (seasonally adjusted), the four-week moving average of the purchase index is about 22% below the levels of April 2010.

Tuesday, November 23, 2010

Rewind: Irish Banks pass Stress Tests in July 2010

by Calculated Risk on 11/23/2010 11:56:00 PM

Earlier on existing home sales:

The Irish bank stress tests ...

The Central Bank and Financial Regulator CEBS July 2010 Stress Test Results

Allied Irish Banks plc

The exercise was conducted using the scenarios, methodology and key assumptions provided by CEBS. As a result of the assumed shock under the adverse scenario, the estimated consolidated Tier 1 capital ratio would change to 7.2% in 2011 compared to 7.0% as of end of 2009. An additional sovereign risk scenario would have a further impact of 0.70 of a percentage point on the estimated Tier 1 capital ratio, bringing it to 6.5% at the end of 2011, compared with the CRD regulatory minimum of 4%.And The Central Bank and Financial Regulator CEBS July 2010 Stress Test Results

The Governor and Company of the Bank of Ireland

As a result of the assumed shock under the adverse scenario, the estimated consolidated Tier 1 capital ratio would change to 7.6% in 2011 compared to 9.2% as of end of 2009. An additional sovereign risk scenario would have a further impact of 0.50 of a percentage point on the estimated Tier 1 capital ratio, bringing it to 7.1% at the end of 2011, compared with the CRD regulatory minimum of 4%.And today from the Irish Times: Dramatic fall in value of Irish bank stocks

Ooops ...

State Unemployment Rates in October: "Little changed" from September

by Calculated Risk on 11/23/2010 08:06:00 PM

Earlier on existing home sales:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Eight states now have double digit unemployment rates. A number of other states are close.

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in October. Nineteen states and the District of Columbia recorded unemployment rate decreases, 14 states registered rate increases, and 17 states had no rate change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to register the highest unemployment rate among the states, 14.2 percent in October. The states with the next highest rates were Michigan, 12.8 percent, and California, 12.4 percent. North Dakota reported the lowest jobless rate, 3.8 percent, followed by South Dakota and Nebraska, at 4.5 and 4.7 percent, respectively.

...

In October, two states experienced statistically significant unemployment rate changes from September: Maine and Massachusetts (-0.3 percentage point each).

LPS: Over 4.3 million loans 90+ days or in foreclosure

by Calculated Risk on 11/23/2010 04:10:00 PM

LPS Applied Analytics released their October Mortgage Performance data today. According to LPS:

• The average number of days delinquent for loans in foreclosure is a record 492 days

• Over 4.3 million loans are 90 days or more delinquent or in foreclosure

• Foreclosure sales plummeted by 35% in October (as a result of the widespread moratoria)

• Nearly 20% of loans that have been delinquent more than two years are still not in foreclosure

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.29 percent of mortgages are delinquent, and another 3.92 are in the foreclosure process for a total of 13.20 percent. It breaks down as:

• 2.72 million loans less than 90 days delinquent.

• 2.24 million loans 90+ days delinquent.

• 2.09 million loans in foreclosure process.

For a total of 7.04 million loans delinquent or in foreclosure.

This is similar to the quarterly data from the Mortgage Bankers Association.

Note: I've seen some people include these 7+ million delinquent loans as "shadow inventory". This is not correct because 1) some of these loans will cure, and 2) some of these homes are already listed for sale (so they are included in the visible inventory).

FOMC Minutes: Forecasts revised down again, Disagreement on outlook

by Calculated Risk on 11/23/2010 02:00:00 PM

From the November 2-3, 2010 (and conference call held on October 15, 2010) FOMC meeting.

The Fed revised down their forecasts again:

| Economic projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| 2010 | 2011 | 2012 | |

| Change in Real GDP | 2.4 to 2.5% | 3.0 to 3.6% | 3.6 to 4.5% |

| June projections | 3.0% to 3.5% | 3.5% to 4.2% | 3.5% to 4.5% |

| April projections | 3.2% to 3.7% | 3.4% to 4.5% | 3.5% to 4.5% |

| Unemployment Rate | 9.5 to 9.7% | 8.9 to 9.1% | 7.7 to 8.2% |

| June projections | 9.2% to 9.5% | 8.3% to 8.7% | 7.1% to 7.5% |

| April projections | 9.1% to 9.5% | 8.1% to 8.5% | 6.6% to 7.5% |

| PCE Inflation | 1.2 to 1.4% | 1.1 to 1.7% | 1.1 to 1.8% |

| June projections | 1.0% to 1.1% | 1.1% to 1.6% | 1.0% to 1.7% |

| April projection | 1.2% to 1.5% | 1.1% to 1.9% | 1.2% to 2.0% |

There was apparently some significant disagreement:

Participants generally agreed that the most likely economic outcome would be a gradual pickup in growth with slow progress toward maximum employment. They also generally expected that inflation would remain, for some time, below levels the Committee considers most consistent, over the longer run, with maximum employment and price stability. However, participants held a range of views about the risks to that outlook. Most saw the risks to growth as broadly balanced, but many saw the risks as tilted to the downside. Similarly, a majority saw the risks to inflation as balanced; some, however, saw downside risks predominating while a couple saw inflation risks as tilted to the upside. Participants also differed in their assessments of the likely benefits and costs associated with a program of purchasing additional longer-term securities in an effort to provide additional monetary stimulus, though most saw the benefits as exceeding the costs in current circumstances.