by Calculated Risk on 2/28/2009 11:59:00 PM

Saturday, February 28, 2009

Late Night Comments

Just a few comments on comments ...

I'm working with JS-Kit. They have moved all the old comments over to the new database.

Hopefully we can have the default be "flat". And we can add a refresh (that takes the user to the bottom).

JS-Kit will also be adding the following features:

Best to all. And thanks for your patience.

HSBC to take £17bn Bad Loan Provision

by Calculated Risk on 2/28/2009 05:08:00 PM

From The Times: HSBC takes £17bn hit on bad loans

HSBC is to own up to the full horror of its American sub-prime business, Household, when it unveils a £7 billion goodwill write-off in addition to a £17 billion provision against rising bad loans.Oh, the horror! The confessional remains busy, and AIG will be dropping by on Monday.

The provisions will be announced tomorrow alongside a heavily discounted £12 billion rights issue – the biggest ever held in Britain – and a dividend cut ...

The fundraising will make HSBC the strongest bank in the world that has not received a cash injection from the state. Its tier-one ratio, a key measure of financial strength, will rise from 8.5% to 10.5%. Analysts say it will provide a $40 billion (£28 billion) buffer against further bad debts.

February Economic Summary in Graphs

by Calculated Risk on 2/28/2009 09:59:00 AM

Here is a collection of 20 real estate and economic graphs from February ...

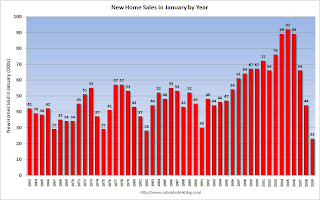

New Home Sales in January

New Home Sales in JanuaryThe first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for January 2009. This is the lowest sales for January since the Census Bureau started tracking sales in 1963. (NSA, 23 thousand new homes were sold in January 2009).

From: Record Low New Home Sales in January

Housing Starts in January

Housing Starts in JanuaryTotal housing starts were at 464 thousand (SAAR) in January, by far the lowest level since the Census Bureau began tracking housing starts in 1959.

Single-family starts were at 347 thousand in January; also the lowest level ever recorded (since 1959).

From: Housing Starts at Another Record Low

Construction Spending in December

Construction Spending in DecemberThis graph shows private residential and nonresidential construction spending since 1993.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months.

From: Construction Spending: Private Nonresidential has Peaked

January Employment Report

January Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 598,00 in January, and the annual revision reduced employment by another 311,000 in 2008. The economy has lost almost 2.5 million jobs over the last 5 months!

The unemployment rate rose to 7.6 percent; the highest level since June 1992.

Year over year employment is now strongly negative (there were 3.5 million fewer Americans employed in Jan 2008 than in Jan 2007).

From: January Employment Report: 598,000 Jobs Lost, Unemployment Rate 7.6%

January Retail Sales

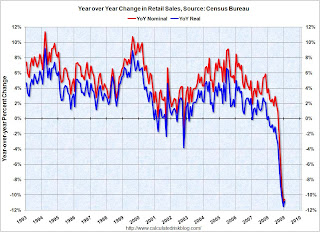

January Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

Although the Census Bureau reported that nominal retail sales decreased 10.6% year-over-year (retail and food services decreased 9.7%), real retail sales declined by 10.9% (on a YoY basis). The YoY change decreased slightly from last month.

From: Retail Sales Increase Slightly in January

LA Port Traffic in January

LA Port Traffic in JanuaryThis graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Inbound traffic was 14% below last January. This slowdown in imports (inbound traffic to the U.S.) is hitting Asian countries hard. There was a slight increase from December to January, but that appears to be mostly seasonal (the data is NSA).

For the LA area ports, outbound traffic continued to decline in January, and was 28% below the level of January 2008. Export traffic is now at about the same level as in 2005.

From: LA Area Ports: Exports Decline in January

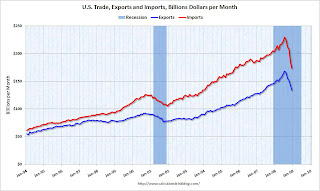

U.S. Imports and Exports Through December

U.S. Imports and Exports Through DecemberThe first graph shows the monthly U.S. exports and imports in dollars through December 2008. The recent rapid decline in foreign trade continued in December. Note that a large portion of the decline in imports is related to the fall in oil prices - but not all.

From: U.S. Trade: Exports and Imports Decline Sharply

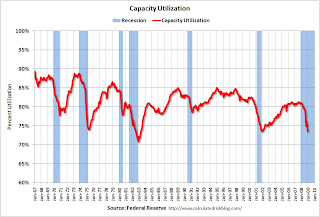

January Capacity Utilization

January Capacity UtilizationThe Federal Reserve reported that industrial production fell 1.8 percent in January, and output in January was 10.0% below January 2008. The capacity utilization rate for total industry fell to 72.0%, the lowest level since 1983.

The significant decline in capacity utilization suggests less investment in non-residential structures for some time.

From: Capacity Utilization and Industrial Production Cliff Diving

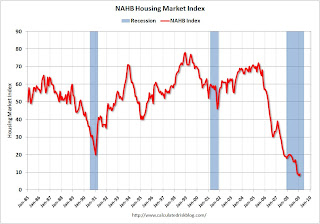

NAHB Builder Confidence Index in February

NAHB Builder Confidence Index in FebruaryThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased slightly to 9 in February from the record low of 8 set in January.

From: NAHB Housing Market Index Near Record Low

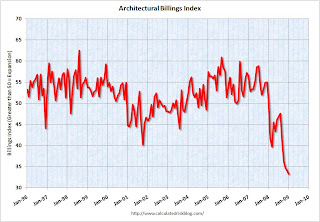

Architecture Billings Index for January

Architecture Billings Index for JanuaryThe American Institute of Architects (AIA) reported the January ABI rating was 33.3, down from the 34.1 mark in December (any score above 50 indicates an increase in billings).

From: Architecture Billings Index Hits Another Record Low

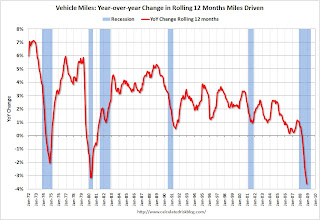

Vehicle Miles driven in December

Vehicle Miles driven in DecemberThis graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in December 2008 were 1.6% less than December 2007, so the YoY change in the rolling average may start to increase.

From: U.S. Vehicle Miles Driven Off 3.6% in 2008

Existing Home Sales in January

Existing Home Sales in January This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January 2009 (4.49 million SAAR) were 5.4% lower than last month, and were 8.6% lower than January 2008 (4.91 million SAAR).

From: More on Existing Home Sales (and Graphs)

Existing Home Inventory

Existing Home InventoryThis graph shows inventory by month starting in 2004. Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle.

From: More on Existing Home Sales (and Graphs)

Case Shiller House Prices for December

Case Shiller House Prices for DecemberThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 28.3% from the peak.

The Composite 20 index is off 27.0% from the peak.

From: Case-Shiller: House Prices Decline Sharply in December

Price-to-Rent Ratio for Q4

Price-to-Rent Ratio for Q4This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 75% to 85% complete as of Q4 2008 on a national basis. This ratio will probably continue to decline.

However it now appears rents are falling too (although this is not showing up in the OER measure yet) and this will impact the price-to-rent ratio.

From: House Prices: Real Prices, Price-to-Rent, and Price-to-Income

Unemployment Claims

Unemployment ClaimsThis graph shows weekly claims and continued claims since 1971.

The four week moving average is at 639,000 the highest since 1982.

Continued claims are now at 5.11 million - another new record (not adjusted for population) - above the previous all time peak of 4.71 million in 1982.

From: Weekly Claims: Continued Claims Over 5 Million

Restaurant Performance Index for January

Restaurant Performance Index for January"The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.4 in January, up 1.0 percent from December’s record low level of 96.4."

From: Restaurant Performance Index Rebounds Slightly

New Home Sales

New Home SalesThis graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

From: Record Low New Home Sales in January

Q4 Homeownership Rate

Q4 Homeownership RateThe homeownership rate decreased slightly to 67.5% and is now back to the levels of late 2000.

Note: graph starts at 60% to better show the change.

From: Q4: Homeownership Rate Declines to 2000 Level

New Home Months of Supply

New Home Months of SupplyThe months of supply is at an all time record 13.3 months in January.

From: Record Low New Home Sales in January

Buffett's Letter to Shareholders

by Calculated Risk on 2/28/2009 08:27:00 AM

Here is Buffett's Letter to Shareholders

There are several interesting sections, but for housing I think the section on Clayton Homes (Buffett's manufactured home division) is especially interesting. Here is a brief excerpt (starts on page 10). First Buffett describes the lending debacle in the manufactured home industry in the 1997 to 2000 period:

Clayton is the largest company in the manufactured home industry, delivering 27,499 units last year. This came to about 34% of the industry’s 81,889 total. Our share will likely grow in 2009, partly because much of the rest of the industry is in acute distress.And now Buffett draws a parallel to the national housing bubble:

...

[In 1998] much of the industry employed sales practices that were atrocious. Writing about the period somewhat later, I described it as involving “borrowers who shouldn’t have borrowed being financed by lenders who shouldn’t have lent.”

To begin with, the need for meaningful down payments was frequently ignored. Sometimes fakery was involved. ... Moreover, impossible-to-meet monthly payments were being agreed to by borrowers who signed up because they had nothing to lose. The resulting mortgages were usually packaged (“securitized”) and sold by Wall Street firms to unsuspecting investors. This chain of folly had to end badly, and it did.

... industry losses were staggering. And the hangover continues to this day. This 1997-2000 fiasco should have served as a canary-in-the-coal-mine warning for the far-larger conventional housing market. But investors, government and rating agencies learned exactly nothing from the manufactured-home debacle.

[I]n an eerie rerun of that disaster, the same mistakes were repeated with conventional homes in the 2004-07 period: Lenders happily made loans that borrowers couldn’t repay out of their incomes, and borrowers just as happily signed up to meet those payments. Both parties counted on “house-price appreciation” to make this otherwise impossible arrangement work. ... The consequences of this behavior are now reverberating through every corner of our economy.

Clayton’s 198,888 borrowers, however, have continued to pay normally throughout the housing crash ... This is not because these borrowers are unusually creditworthy ... Why are our borrowers – characteristically people with modest incomes and far-from-great credit scores – performing so well? The answer is elementary, going right back to Lending 101. Our borrowers simply looked at how full-bore mortgage payments would compare with their actual – not hoped-for – income and then decided whether they could live with that commitment. Simply put, they took out a mortgage with the intention of paying it off, whatever the course of home prices.

Just as important is what our borrowers did not do. They did not count on making their loan payments by means of refinancing. They did not sign up for “teaser” rates that upon reset were outsized relative to their income. And they did not assume that they could always sell their home at a profit if their mortgage payments became onerous. Jimmy Stewart would have loved these folks.

...

Homeowners who have made a meaningful down-payment – derived from savings and not from other borrowing – seldom walk away from a primary residence simply because its value today is less than the mortgage. Instead, they walk when they can’t make the monthly payments.

...

The present housing debacle should teach home buyers, lenders, brokers and government some simple lessons that will ensure stability in the future. Home purchases should involve an honest-to-God down payment of at least 10% and monthly payments that can be comfortably handled by the borrower’s income. That income

should be carefully verified.

Putting people into homes, though a desirable goal, shouldn’t be our country’s primary objective. Keeping them in their homes should be the ambition.

UK: 500,000 Lloyds Borrowers have Negative Equity

by Calculated Risk on 2/28/2009 01:07:00 AM

From The Times: Lloyds counts cost of HBOS takeover and property slump as 500,000 customers slip into negative equity

HBOS, Britain’s biggest mortgage lender, revealed that 381,669 customers, about 16.8 per cent of its mortgage book, owed more than the value of their homes. At Lloyds TSB, 162,000 homeowners, 15 per cent of its mortgage book, were in the same position.Also on comments: Haloscan crashed hard, so I switched to JS-Kit. I'll try to improve the JS-Kit interface, and hopefully Ken (CR Companion) will be able to provide some help. Thanks to everyone for your patience.

These figures compare with only 0.1 per cent of customers of each bank – a total of less than 4,000 households – being in negative equity at the end of 2007.

...

Michael Saunders, chief economist at Citigroup, said last month that the bank estimated homeowners with negative equity was up to about 1.2 million, from 100,000 a year ago, out of a total of between 11 million and 12 million mortgages. “There is no sign that the decline in house prices – and hence the surge in negative equity – is yet close to ending,” he said.

He said in December that about one owner in four could be in negative equity if prices fell by a total of 30 per cent by 2010, as many analysts expect.

Friday, February 27, 2009

High on the Hill

by Calculated Risk on 2/27/2009 09:31:00 PM

Tomorrow morning at 8AM ET, the Buffett letter to investors will be released, and later I'll post a February Economic Summary in Graphs.

The AIG deal might be announced Sunday evening or Monday morning.

Today real GDP growth was revised down to minus 6.2% (annualized), the Citi deal was announced, two banks failed (Heritage Community Bank, Glenwood, Illinois and Security Savings Bank, Henderson, Nevada), and the S&P 500 is back to 1996 prices.

Also, the Restaurant Performance Index for January was released, and here is a look at Investment Contributions to GDP.

If you need a laugh after reading that news, Jim the Realtor showcases an investment opportunity in San Diego - enjoy!

Bank Failure #16 in 2009: Security Savings Bank, Henderson, Nevada

by Calculated Risk on 2/27/2009 07:45:00 PM

From the FDIC: Bank of Nevada, Las Vegas, Nevada Assumes All of the Deposits of Security Savings Bank, Henderson, Nevada

Security Savings Bank, Henderson, Nevada was closed today by the Nevada Financial Institutions Division, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes two today! Update ... by Soylent Green Is People

As of December 31, 2008, Security Savings Bank had total assets of approximately $238.3 million and total deposits of $175.2 million. Bank of Nevada did not pay a premium to acquire the deposits of Security Savings Bank.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $59.1 million. The Bank of Nevada's acquisition of all the deposits of Security Saving Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Security Savings Bank is the sixteenth bank to fail in the nation this year.

Security is toast as well

Yes, Friday is here.

Bank Failure #15 in 2009: Heritage Community Bank, Glenwood, Illinois

by Calculated Risk on 2/27/2009 07:27:00 PM

From the FDIC: MB Financial Bank, N.A., Chicago, Illinois, Assumes All of the Deposits of Heritage Community Bank, Glenwood, Illinois

Heritage Community Bank, Glenwood, Illinois, was closed today by the Illinois Department of Financial Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday ... oh wait, there is another one too!

As of December 5, 2008, Heritage Community Bank had total assets of $232.9 million and total deposits of $218.6 million. ...

The FDIC and MB Financial Bank entered into a loss-share transaction. MB Financial Bank will share in the losses on approximately $181 million in assets covered under the agreement. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $41.6 million. MB Financial Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Heritage Community Bank is the fifteenth FDIC-insured institution to fail in the nation this year and the third in the state.

A comment on comments ...

by Calculated Risk on 2/27/2009 06:09:00 PM

The old comment system went down today. I switched over to the JS-Kit system and this is probably a permanent switch. The Haloscan system was no longer being improved, and JS-Kit has a number of new features in development.

There is a control feature at the bottom for threaded or flat comments. I'm still trying to figure everything out! Suggestions welcome ...

Now back to waiting for the FDIC.

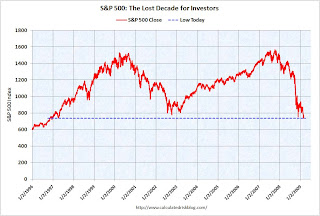

Party Like It's ... 1996

by Calculated Risk on 2/27/2009 03:59:00 PM

The S&P 500 closed at 735 or so. The low in 1997 was 737.01.

Note: the S&P 500 was at 744 when Greenspan spoke of "irrational exuberance"! Click on graph for larger image in new window.

Click on graph for larger image in new window.

DOW off 1.6%

S&P 500 off 2.3%

NASDAQ off 1.0%

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (Doug should update soon)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

California Unemployment Rate Hits Double Digits

by Calculated Risk on 2/27/2009 03:17:00 PM

From the LA Times: California unemployment rate reaches 10.1%

More than 1 in 10 California workers were unemployed in January ...Ouch.

The 10.1% jobless rate is the highest since June 1983 and not far below the 11% record set in November 1982 at the worst point of a severe recession ... Job losses escalated in January, with the state's unemployment rate jumping by 1.4 percentage points from a revised 8.7% for December.

Investment Contributions to GDP

by Calculated Risk on 2/27/2009 02:00:00 PM

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag is getting smaller, and the drag on GDP will be significantly less in 2009, than in 2007 and 2008.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

The REALLY bad news is nonresidential investment (blue) is about to fall off a cliff. Nonresidential investment subtracted -0.24% (SAAR) from GDP in Q4, and will decline sharply in 2009 based on the Fed's Senior Loan Officer Survey, the Architecture Billings Index, and many many other reports and stories. In previous downturns the economy recovered long before nonresidential investment - and that will probably be true again this time.

As always, residential investment is the investment area to follow - it is the best predictor of future economic activity.

GE Cuts Dividend

by Calculated Risk on 2/27/2009 01:49:00 PM

This is a big story because it shows how quickly the economy has changed. Just last November, GE once again promised not to cut the dividend through the end of 2009.

From MarketWatch: GE to cut dividend to 10 cents from 31 cents: WSJ

General Electric will cut its quarterly dividend to 10 cents from 31 cents, the Wall Street Journal reported on its Web site Friday.And from GE last November: An update on the GE dividend

On Sept. 25, GE stated that its Board of Directors had approved management’s plan to maintain GE’s quarterly dividend of $0.31 per share, totaling $1.24 per share annually, through the end of 2009. That plan is unchanged.This dividend cut was inevitable. But hoocoodanode? Apparently not GE management.

The Stress Test Schedule

by Calculated Risk on 2/27/2009 12:05:00 PM

It has been widely reported that the stress tests will be completed "no later than the end of April", based on this FAQ:

Q10: When will the process be completed?Just to let everyone know, I've heard the banks have been told to submit their stress test results by Wednesday March 11th. Too bad the results will not be made public.

A: The Federal supervisory agencies will conclude their work as soon as possible, but no later than the end of April.

UPDATE: Questions from a reader:

Just to repeat the first question: With all that is happening in Asia and Europe (especially the exposure to Eastern Europe and other emerging markets), what are the macro assumptions for these markets? I'm sure other readers have excellent questions too.The Fed published macroeconomic assumptions for the US. What about international markets? Should the banks assume mark-to-market accounting will stay or will be repealed? Should the banks still assume that in 2010 they will have to bring off-balance sheet exposures back on their books?

Restaurant Performance Index Rebounds Slightly

by Calculated Risk on 2/27/2009 10:57:00 AM

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved Somewhat in January as Restaurant Performance Index Rebounded From December’s Record Low

The outlook for the restaurant industry improved somewhat in January, as the National Restaurant Association’s comprehensive index of restaurant activity bounced back from December’s record low. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.4 in January, up 1.0 percent from December’s record low level of 96.4.

“Despite the encouraging January gain, the RPI remained below 100 for the 15th consecutive month, which signifies contraction in the key industry indicators,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Same-store sales and customer traffic remained negative in January, and only one out of four operators expect to have stronger sales in six months.”

...

Restaurant operators reported negative customer traffic levels for the 17th consecutive month in January.

...

Along with soft sales and traffic levels, capital spending activity remained dampened in recent months. Thirty-four percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, matching the proportion who reported similarly last month and tied for the lowest level on record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007. Also note the record low business investment by restaurant operators - this is happening in most industries, and is showing up as a significant decline in equipment and software investment in the GDP report (-28.8% annualized in the Q4 report!)

Citi Deal Details

by Calculated Risk on 2/27/2009 09:13:00 AM

From the NY Times: U.S. Agrees to Raise Its Stake in Citigroup

[T]he government will increase its stake in the company to 36 percent from 8 percent.From MarketWatch: Citi CEO says latest deal should end nationalization fear

...

Under the deal, Citibank said that it would offer to exchange common stock for up to $27.5 billion of its existing preferred securities and trust preferred securities at a conversion price of $3.25 a share, a 32 percent premium over Thursday’s closing price.

The government will match this exchange up to a maximum of $25 billion of its preferred stock at the same price. In its statement, the Treasury Department said the dollar-for-dollar match was intended to strengthen Citigroup’s capital base.

The government of Singapore Investment Corporation, Saudi Prince Walid bin Talal, Capital Research Global Investors and Capital World Investors have already agreed to participate in the exchange, Citibank said in a statement. Existing shareholders will own about 26 percent of the outstanding shares.

...

The bank will also suspend dividends on its preferred shares and its common stock.

"[F]or those people who have a concern about nationalization, this announcement should put those concerns to rest," Pandit said.Here is the Treasury statement: Treasury Announces Participation in Citigroup's Exchange Offering

GDP Revision: Q4 GDP Declined at 6.2%

by Calculated Risk on 2/27/2009 09:00:00 AM

From the WSJ: GDP Shrank 6.2% in 4th Quarter, Deeper Than First Thought

The U.S. recession deepened a lot more in late 2008 than first reported, according to government data showing a big revision down because businesses cut supplies to adjust for shriveling demand.I'll have more on investment, but this is more in line with expectations in Q4.

...

The sharply lower revision to a decline of 6.2% reflected adjustments downward of inventory investment, exports and consumer spending.

The report showed businesses inventories shrank $19.9 billion in the fourth quarter, instead of rising by $6.2 billion as Commerce originally estimated.

...

Fourth-quarter investment in structures decreased 5.9%. Equipment and software plunged 28.8%.

Report: Citi and U.S. Government Reach Agreement

by Calculated Risk on 2/27/2009 12:07:00 AM

From the WSJ: Citi, U.S. Reach Deal on Government Stake

... expected to be announced Friday morning ... the Treasury has agreed to convert some of its current holdings of preferred Citigroup shares into common stock ... The government will convert its stake only to the extent that Citigroup can persuade private investors such as sovereign wealth funds do so as well ... The Treasury will match private investors' conversions dollar-for-dollar up to $25 billion.MarketWatch has some details.

The size of the government's new stake will hinge on how many preferred shares private investors agree to convert into common stock. The Treasury's stake is expected to rise to up to 40% of Citigroup, the people said.

Thursday, February 26, 2009

Summary Post: New Home Sales at Record Low

by Calculated Risk on 2/26/2009 08:34:00 PM

Another summary post and open thread (for discussion).

New home sales in January 2009 (309 thousand SAAR) were 10.2% lower than last month, and were 48% lower than January 2008 (597 million SAAR). See link for graphs of sales and inventory.

There was some discussion that the seasonal adjustment might be distorting the sales number. The following graph of the January sales numbers (no adjustment) shows this decline in sales wasn't a seasonal issue.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows the Census Bureau reported sales for every January since 1963. The label is the sales for the month (in thousands).

Clearly January 2009 was the worst ever - and this wasn't adjusted for changes in population either, and the U.S. population has grown substantially since 1963.

Initial unemployment claims hit 667,000 last week (highest since 1982) and continued claims were over 5 million for the first time ever. The numbers aren't quite as bad when adjusted by covered employment (see graphs)

Here was an analysis on the impact of falling rents: What If Rents Cliff Dive?

Fannie Mae reported a loss of $25.2 billion, the U.S. may backstop AIG CDS losses (likely to be announced Sunday or Monday morning), and oh yeah, we are still waiting for the Citi deal!

Scroll down for more ... and there will probably be more tonight. Best to all.

Obama Proposes to Cap Mortgage Interest Deduction for Higher Income Taxpayers

by Calculated Risk on 2/26/2009 07:19:00 PM

Jon Lansner at the O.C. Register has more including responses from the NAR and the NAHB: Obama plans mortgage-deduction cut (ht John and Tom)

From the WSJ: $318 Billion Tax Hit Proposed

The tax increases would ... [reduce] the value of such longstanding deductions as mortgage interest ... for people in the highest tax brackets. Households paying income taxes at the 33% and 35% rates can currently claim deductions at those rates. Under the Obama proposal, they could deduct only 28% of the value of those payments.The mortgage interest deduction is capped to $1 million in mortgage debt.

The changes would be phased in gradually over the next few years. For the 2009 tax year, the 33% tax bracket starts with couples with taxable earnings of $208,850, when adjusted for personal exemptions and various deductible expenses. A taxpayer in the top bracket paying $1,000 of mortgage interest, for example, would see a tax break worth $350 reduced to $280.

Fannie Mae: $25.2 Billion Loss

by Calculated Risk on 2/26/2009 06:11:00 PM

From Fannie Mae:

Fannie Mae reported a loss of $25.2 billion ... in the fourth quarter of 2008, compared with a third-quarter 2008 loss of $29.0 billion ...The confessional is very busy ...

On February 25, 2009, the Director of FHFA submitted a request for $15.2 billion from the U.S. Department of the Treasury on our behalf under the terms of the Senior Preferred Stock Purchase Agreement in order to eliminate our net worth deficit as of December 31, 2008. FHFA has requested that Treasury provide the funds on or prior to March 31, 2009.

...

We expect the market conditions that contributed to our net loss for each quarter of 2008 to continue and possibly worsen in 2009, which is likely to cause further reductions in our net worth.

S&P May Downgrade $140 Billion in Prime Jumbos

by Calculated Risk on 2/26/2009 05:58:00 PM

From Reuters: S&P may cut $140 bln of prime jumbo mortgage deals (ht Brian)

Standard & Poor's said on Thursday it may downgrade 3,279 prime tranches of jumbo residential mortgage-backed deals with a market value of around $140 billion, after increasing its loss expectations for deals issued in 2006 and 2007.More details from S&P (no link):

Standard & Poor's Ratings Services today placed its ratings on 3,279 classes from 209 U.S. first-lien prime jumbo residential mortgage-backed securities (RMBS) transactions issued in 2006 and 2007 on CreditWatch with negative implications. The affected classes totaled approximately $172.02 billion of original par amount, and have a current principal balance of $139.96 billion.Just more downgrades coming ...

...

The CreditWatch placements reflect an increase in projected losses for prime jumbo transactions from these vintage years ... Our revised loss projections reflect an increase in our loss severity assumption to 40% from 30% for prime jumbo transactions issued in 2006 and 2007. This change is based on our belief that the influence of continued foreclosures, distressed sales, an increase in carrying costs for properties in inventory, costs associated with foreclosures, and more declines in home sales will depress prices further and lead loss severities higher than we had previously assumed. Additionally, there has been a persistent rise in the level of delinquencies among the prime mortgage loans supporting these transactions. ...

We anticipate reviewing and resolving these CreditWatch actions over the next several weeks.

What If Rents Cliff Dive?

by Calculated Risk on 2/26/2009 04:22:00 PM

Yesterday I posted two graphs based on the Capital Assistance Program house price scenarios. The first graph was the change in nominal house prices, and the second was a house price-to-rent ratio (assuming rents are flat for the next two years).

But what if rents decline?

Here is a story from the Guardian in the UK: Steep fall in rents as unsold homes flood the market

A glut of unsold properties hitting the lettings market since the beginning of the year has pushed rents down by as much as 25% across Britain.Rents are declining in the U.S. too, although this hasn't shown up in the BLS' Owners Equivalent Rent.

...

Average rents dropped to £795 a month in February compared to £950 in May last year, a fall of 16.3%, according to property search engine Globrix ...

It estimates that the number of new properties for let has jumped by 88% over the past year, with the biggest increase occurring since the start of 2009.

... FindaProperty said that the number of rental properties advertised on its site almost doubled between September 2008 and February 2009 ... average rental prices fell from £872 a month last year to £830 in February this year, and that landlords are offering lures such as free satellite TV and free weekly cleaner in a desperate attempt to secure new tenants.

Here is a graph that shows the price-to-rent ratio under three rent scenarios (using the "more severe" economic scenario). House prices are based on the Composite 10 index (used by Treasury) and are assumed to decline 22% in 2009 and 7% in 2010 under the "more severe" scenario.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This shows three scenarios for rents in the U.S. over the next two years: Flat, a 10% decline in rents, and a 25% decline in rents.

As I noted yesterday, with the "more severe" scenario and flat rents, the price-to-rent ratio will be slightly below the normal range. If rents fall 10%, this metric would be in the normal range, and with a 25% decline in rents house prices would be too high.

With the largest bubble in history, I'd expect house prices to overshoot and the price-to-rent ratio to decline to the bottom of the normal range. This suggests even a 10% decline in rents would make the "more severe" scenario too mild.

FDIC: Number of Problem Banks Increases Sharply in Q4

by Calculated Risk on 2/26/2009 03:25:00 PM

The FDIC released the Quarterly Banking Profile for Q4 today. Here is an excerpt from the FDIC press release:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported a net loss of $26.2 billion in the fourth quarter of 2008, a decline of $27.8 billion from the $575 million that the industry earned in the fourth quarter of 2007 and the first quarterly loss since 1990. Rising loan-loss provisions, losses from trading activities and goodwill write-downs all contributed to the quarterly net loss as banks continue to repair their balance sheets in order to return to profitability in future periods.It is going to be a busy year for the FDIC.

...

The FDIC's "Problem List" grew during the quarter from 171 to 252 institutions, the largest number since the middle of 1995. Total assets of problem institutions increased from $115.6 billion to $159 billion.

emphasis added

U.S. May Backstop AIG CDS

by Calculated Risk on 2/26/2009 02:37:00 PM

From Bloomberg: AIG Rescue May Include Credit-Default Swap Backstop

American International Group Inc. may get a backstop from the U.S. to protect against further losses on credit-default swaps, according to a person familiar with the matter.There you have it.

The federal guarantees may be included in New York-based AIG’s restructured bailout ...

This will probably be announced Sunday night or Monday morning.

Obama Budget: $250 Billion for TARP II

by Calculated Risk on 2/26/2009 12:59:00 PM

From CNBC: Troubled Banks Could Get $250 Billion More in Budget

President Barack Obama penciled into his budget on Thursday the possibility that he may request an additional $250 billion to help fix the troubled U.S. financial system.What a surprise ...

The figure, described as a "placeholder" and not a specific funding request, would support asset purchases of $750 billion via government financial stabilization programs, administration officials said.

Any additional request to Congress would come on top of the $700 billion financial bailout program enacted last year ...

"Additional action is likely to be necessary to stabilize the financial system and thereby facilitate economic growth," the White House said in budget documents released on Thursday.

Banks: Fear and Despair

by Calculated Risk on 2/26/2009 11:59:00 AM

I'm not talking about Cape Fear Bank, although they just entered into a written agreement with the Fed. Another bank to watch for on Friday afternoons ...

I'm more concerned with the stress tests, and I fear they will be inadequate.

Bloomberg reported today: Moody’s May Downgrade More Subprime-Mortgage Debt

Moody’s Investors Service said it’s reviewing all 2005, 2006 and 2007 subprime-mortgage bonds for credit-rating downgrades, covering debt with $680 billion in original balances.This is extremely timely.

The review reflects an increase in Moody’s expected losses on the underlying loan pools, the New York-based company said in a statement today. Losses for such mortgages backing 2006 securities will probably reach 28 percent to 32 percent, up from a previous projection of 22 percent, Moody’s said.

The ratings firm said that it boosted expected losses based on “the continued deterioration in home prices, rising loss severities on liquidated loans, persistent elevated default rates, and progressively diminishing prepayment rates.”

I can understand Krugman's Feelings of despair

... Obama and Geithner say things like,If you underestimate the problem; if you do too little, too late; if you don’t move aggressively enough; if you are not open and honest in trying to assess the true cost of this; then you will face a deeper, long lasting crisis.But what they’re actually doing is underestimating the problem, doing too little too late, and not being open and honest in trying to assess the true cost.

FDIC: $1.45 Billion in Distressed Loans Sold

by Calculated Risk on 2/26/2009 11:24:00 AM

From the FDIC: FDIC Closes on a $1.45 Billion Structured Sale of Distressed Loans

The Federal Deposit Insurance Corporation (FDIC) today announced the conclusion of the sale of $1.45 billion of performing and nonperforming residential and commercial construction loans in distressed markets through the use of two private/public partnership transactions. ...Although this press release doesn't provide all the details, there is clearly a market for these assets (the FDIC received 30 bids) - so these bids could help value assets at the 19 largest banks. Unfortunately I doubt they will use these prices ...

In the two recent transactions, the FDIC placed the loans, which were exclusively from the failed First National Bank of Nevada, into a limited liability corporation (LLC). The FDIC retained an 80 percent interest in the assets with the winning bidder picking up an initial 20 percent stake. Once certain performance thresholds are met, the FDIC's interest drops to 60 percent. The future expenses and income will be shared on the percentage ownership of the purchaser and the FDIC.

...

The successful bidders on the two transactions were Diversified Business Strategies and Stearns Bank NA. ...

The closure of this sale brings the total amount of assets sold utilizing private/public partnership transactions to approximately $3.2 billion over the last year, in five separate transactions.

Record Low New Home Sales in January

by Calculated Risk on 2/26/2009 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate of 309 thousand. This is the lowest sales rate the Census Bureau has ever recorded (starting in 1963).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for January 2009. This is the lowest sales for January since the Census Bureau started tracking sales in 1963. (NSA, 23 thousand new homes were sold in January 2009).

As the graph indicates, sales in January 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in January 2009 were at a seasonally adjusted annual rate of 309,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 10.2 percent (±15.4%)* below the revised December rate of 344,000 and is 48.2 percent (±6.8%) below the January 2008 estimate of 597,000.

The months of supply is at an ALL TIME RECORD 13.3 months in January (this is seasonally adjusted)!

The months of supply is at an ALL TIME RECORD 13.3 months in January (this is seasonally adjusted)!The seasonally adjusted estimate of new houses for sale at the end of January was 342,000. This represents a supply of 13.3 months at the current sales rate.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly - since starts have fallen off a cliff.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly - since starts have fallen off a cliff.Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another extremely weak report. Record low sales. Record high months of supply. More Cliff Diving. I'll have more on new home sales later today ...

GM Expects 'Going Concern' Notice

by Calculated Risk on 2/26/2009 09:10:00 AM

Another step towards a second bailout or bankruptcy ...

From the WSJ: GM Posts $9.6 Billion Loss, Burns Through $6.2 Billion in Cash

GM's revenue fell as the worsening economic malaise drove most of GM's four regions into the red. The company burned through $6.2 billion in cash in the quarter, less than the $6.9 billion in the three months to Sept. 30.

...

The nation's biggest domestic auto maker said Thursday it lost $30.9 billion for the full year and expects an opinion from its auditors as to whether the company remains a "going concern" when its annual report is issued in March.

...

GM has lost more than $70 billion since 2005 ... The company has relied heavily in emerging markets, especially Latin America, Eastern Europe and Asia, to offset losses at home. But as the economic troubles that began with the mortgage meltdown and banking crisis in the U.S. spread around the globe, GM's is facing losses most everywhere it operates.

Weekly Claims: Continued Claims Over 5 Million

by Calculated Risk on 2/26/2009 08:37:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 21, the advance figure for seasonally adjusted initial claims was 667,000, an increase of 36,000 from the previous week's revised figure of 631,000. The 4-week moving average was 639,000, an increase of 19,000 from the previous week's revised average of 620,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 14 was 5,112,000, an increase of 114,000 from the preceding week's revised level of 4,998,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 639,000 the highest since 1982.

Continued claims are now at 5.11 million - another new record - above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

Another weak unemployment claims report ...

Report: AIG Discussing "Radical Restructuring"

by Calculated Risk on 2/26/2009 01:09:00 AM

From the Financial Times: AIG considers break-up in bid to stay afloat

AIG and the US authorities are in advanced discussions over a radical restructuring that would split the stricken insurer into at least three government-controlled divisions in an attempt to keep it afloat...Citi and AIG are keeping us waiting.

Under the plan, the government would swap its current 80 per cent holding in the insurer for large stakes in three units – AIG’s Asian operations, its international life insurance business and the US personal lines business. A fourth unit, comprised of AIG’s other businesses and troubled assets, could also be formed.

In return, the authorities would relax the terms, or even cancel a large portion, of a $60bn five-year loan to AIG and convert $40bn-worth of preferred stock into shares...

AIG was on track to announce the overhaul on Monday, when it is expected to report a $60bn loss with its fourth-quarter results. The board is due to meet on Sunday.

Wednesday, February 25, 2009

Summary: Another Busy Day

by Calculated Risk on 2/25/2009 11:06:00 PM

Another summary post and open thread (for discussion).

Existing home sales in January 2009 (4.49 million SAAR) were 5.4% lower than last month, and were 8.6% lower than January 2008 (4.91 million SAAR). See link for graphs of sales and inventory.

The Treasury announced the Capital Assistance Program today. The detail can be found on the Treasury site: http://www.financialstability.gov/. This included the stress test economic scenarios. Here is the table of the scenarios and graphs of what this means in terms of house prices.

Bernanke testified before the House Financial Services Committee today. Basically he repeated his Senate testimony, but he did argue that progress has been made. Here are some Credit Crisis indicators that suggest that is correct.

And oh yeah, the WSJ is reporting the Citi Deal Is Imminent.

WSJ: Citi Deal Is Imminent

by Calculated Risk on 2/25/2009 08:49:00 PM

Here is our daily "Citi deal is imminent" story.

From the WSJ: Citi Is Near Deal to Boost U.S.'s Stake by Up to 40%

Citigroup Inc. is closing in on an agreement to boost the federal government's stake in the company to as much as 40%, according to people familiar with the situation. A deal could be announced as soon as Thursday.This could raise some interesting problems in foreign countries:

For example, a Mexican law bars any institution that is more than 10%-owned by a foreign government from running a bank in that country. As a result, some Citigroup executives are worried that an increased U.S. stake might subject the bank to pressure to relinquish some or all of its ownership of Grupo Financiero Banamex ...UPDATE: This happened twice today. One government release says one thing, another says something different. I noted that the Treasury White Paper on the Capital Assistance Program said:

These shares can convert at the firm’s discretion (with the approval of their regulator) into common equity if needed to preserve lending in worse-than-expected economic environment at a conversion price set at a 10% discount from the prevailing level of the institution’s stock price as of February 9, 2009.Nemo notes that the Term Sheet says:

Conversion price is 90% of the average closing price for the common stock for the 20 trading day period ending February 9, 2009, subject to customary anti-dilution adjustments.One release from the FDIC called the program the "Capital Assessment Program" (and I labeled a couple of charts with that name), but the real name is the "Capital Assistance Program".

BofA's Lewis: Merrill, Countrywide Are ‘Stars’

by Calculated Risk on 2/25/2009 06:15:00 PM

Form Bloomberg: Lewis Says Merrill, Countrywide Are ‘Stars’ This Year

Bank of America Corp. Chief Executive Officer Kenneth Lewis said Merrill Lynch & Co. and Countrywide Financial Corp., the acquisitions that some analysts say helped push down the bank’s share price, have been “stars” so far this year.At first glance this seems absurd. One analyst is quoted in the story saying "I almost fell off my chair". However if you separate the acquired toxic assets from the ongoing performance, I can understand Lewis' comments. Countrywide is benefiting from the refinance boom. Most (if not all) of these loans are being sold to Fannie and Freddie (or guaranteed by them).

The key question is how toxic are the toxic assets BofA acquired with Merrill and Countrywide? Oh well, the Capital Assistance Program is here to help.

Stress Test House Price Scenarios

by Calculated Risk on 2/25/2009 03:59:00 PM

Here are a couple of graphs to illustrate the Capital Assistance Program house price scenarios. (see previous post) Note: the FDIC called it Capital Assessment Program (so the graph titles are incorrect!)  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For whatever reason the Treasury is using the Case-Shiller Composite 10 index (I'd prefer the National Index). This graph shows nominal house prices under the two scenarios: baseline, and more severe.

Under the baseline scenario, nominal prices in the Composite 10 cities would return to mid-2002 prices. Under the more severe scenario, prices would return to early 2001 prices. The second graph shows what this would mean for the price-to-rent ratio.

The second graph shows what this would mean for the price-to-rent ratio.

Note: this is price-to-rent for the Composite 10 index and Jan 2000 is set to 1.0.

This assumes rents stay flat for the next two years (recent reports suggest rents are falling - and that would mean prices would have to fall further).

This metric suggests that the severe price declines would bring the price-to-rent ratio below the normal range. Note: this requires the above assumption on rents.

NOTE: This is based on the Composite 10 index, and that index will most likely decline more than the national index. Even in these 10 cities, some areas will probably see larger price declines (as an example areas with significant Option ARM loans) and other areas less.

Repeating this table of the scenarios:

Stress Test Economic Scenarios

by Calculated Risk on 2/25/2009 02:42:00 PM

According to the Supervisory Capital Assessment Program FAQs, the Stress Tests will be completed "as soon as possible" but no later than the end of April.

Here are the economic scenarios for the stress tests:

The more severe case is a 22% decline in house prices in 2009 and a 7% decline in 2010 (using the Case-Shiller Composite 10). I'll put up a graph with these projections soon.

Treasury Releases Terms of Capital Assistance Program

by Calculated Risk on 2/25/2009 02:18:00 PM

From the U.S. Treasury: Terms of Capital Assistance Program

To view the White Paper, Term Sheet and FAQ, visit www.FinancialStability.gov.Update: From the Treasury White Paper on Capital Assistance Program (see previous post):

TermsCapital provided under the CAP will be in the form of a preferred security that is convertible into common equity at a 10 percent discount to the price prevailing prior to February 9th. CAP securities will carry a 9 percent dividend yield and would be convertible at the issuer's option (subject to the approval of their regulator). After 7 years, the security would automatically convert into common equity if not redeemed or converted before that date. The instrument is designed to give banks the incentive to replace USG-provided capital with private capital or to redeem the USG capital when conditions permit. With supervisory approval, banks will be able to request capital under the CAP in addition to their existing CPP preferred stock. With supervisory approval, banks will also be allowed to apply to exchange the existing CPP preferred stock for the new CAP instrument.

ConditionsRecipients of capital under the CAP will be subject to the executive compensation requirements in line with the Emergency Economic Stabilization Act of 2008, as recently amended. The Treasury will shortly be releasing rules to implement these amendments. As part of the application process, banks must submit a plan for how they intend to use this capital to preserve and strengthen their lending capacity – specifically, to increase lending above levels relative to what would have been possible without government support. The Treasury Department will make these plans public when the bank receives the capital under the CAP. Taxpayers will be able to monitor the performance of banks receiving capital under the CAP. Banks receiving capital will be required to submit to Treasury monthly reports on their lending broken out by category. These will be posted on www.FinancialStability.gov. Recipients will also be subject to restrictions on paying quarterly common stock dividends, repurchasing shares, and pursuing cash acquisitions.

These shares can convert at the firm’s discretion (with the approval of their regulator) into common equity if needed to preserve lending in worse-than-expected economic environment at a conversion price set at a 10% discount from the prevailing level of the institution’s stock price as of February 9, 2009.Guess the date Citi's stock price peaked in February (closed at $3.95 on Feb 9th)

New and Existing Home Sales: The "Distressing" Gap

by Calculated Risk on 2/25/2009 01:10:00 PM

Real Time Economics at the WSJ excerpts some analyst comments about the existing home sales report: Economists React: ‘So Much for Signs of Stability’ in Housing. A few comments from analysts:

"So much for signs of stability."I wouldn't look at existing home sales for signs of stability.

"The drop back in the number of existing U.S. home sales in January dashes hopes that housing activity had found a floor."

"Overall, the longer housing activity remains in the doldrums, the less likely it is that the economy will see a decent recovery in 2010 as Fed Chairman Ben Bernanke hopes."

"The rate of decline in existing home sales over the last three months suggests that the market has not yet entered a bottoming phase and housing remains under considerable pressure."

A large percentage of existing home sales (45% according to the NAR) are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis through January) and new home sales (right axis through December).

Update (Feb 26, 2009): The graph is updated through January now (and right axis label corrected).

For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

If we are looking for the first "signs of stability" in the housing market, I think we should look for declining inventory, a bottom in new home sales, and the gap between new and existing home sales closing.

Note: Existing home inventory might be declining, see the 5th graph here. However this might be misleading (see caveats in post).

Credit Crisis Indicators

by Calculated Risk on 2/25/2009 12:23:00 PM

As Bernanke said today, some progress has been made ...

| Although a normal spread is around 0.5, this is still a significant improvement. |

This is a significant improvement from the high of 5.86 after Thanksgiving. The A2P2 spread is at the lowest level since the latest wave of the crisis started in Sept 2008. However this is still fairly high - look at those previous small peaks - those were considered serious at the time.

Note: This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Federal Reserve released the Factors Affecting Reserve Balances last Thursday. Total assets increased $72.2 billion to $1.92 trillion. The increase was mostly due to the Federal Reserve buying $57.9 billion in mortgage-backed securities (MBS) guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae.

The Federal Reserve released the Factors Affecting Reserve Balances last Thursday. Total assets increased $72.2 billion to $1.92 trillion. The increase was mostly due to the Federal Reserve buying $57.9 billion in mortgage-backed securities (MBS) guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae.After spiking last year to $2.31 trillion the week of Dec 18th, the Federal Reserve assets have declined somewhat. Now it looks like the Federal Reserve is starting to expand their balance sheet again.

Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

These indicators do indicate some progress ...