by Calculated Risk on 6/30/2008 08:00:00 PM

Monday, June 30, 2008

CRL Report on Indymac

Here is a new report from the Center for Responsible Lending IndyMac: What Went Wrong? Here is the PDF file

Ben Butler, an 80-year-old retiree in Savannah, Georgia got an IndyMac loan in 2005 to build a modular house. IndyMac okayed the mortgage based on an application that said Mr. Butler made $3,825 a month in Social Security income.That is just one example. The CRL claims to have "substantial evidence that IndyMac routinely made loans with little regard for their customers' ability to repay the loans."

One problem: The maximum Social Security benefit at the time was barely half that.

Mr. Butler had no idea his income had been inflated by IndyMac or the mortgage broker who arranged the deal, his attorney maintains. Even if IndyMac wasn’t the one that puffed up the dollar figure, the attorney says, it should have easily caught such an obvious lie.

Move aside Countrywide, it looks like Indymac will take a turn at the whipping post.

Indymac: Schumer Caused Minor Bank Run

by Calculated Risk on 6/30/2008 05:36:00 PM

Indymac Responds to Letters Sent by Senator Charles Schumer (hat tip Nemo)

[A]s a result of Sen. Schumer making his letters public and the resulting press coverage, we did experience elevated customer inquiries and withdrawals in our branch network last Friday and on Saturday of roughly $100 million, about ½ of 1% of total deposits. And while branch traffic is somewhat elevated this morning, it is substantially lower than on Saturday, and we are hopeful that this issue appropriately abates soon ...

Update on Oceanside REO

by Calculated Risk on 6/30/2008 04:34:00 PM

Realtor Jim has informed me that they have two firm offers at full price for the REO featured in Oceanside REO: Back to 2002 / 2003 Prices.

These are owner occupied offers. That is what I suspected since the property doesn't make sense for cash flow investors at the current asking price.

The important point here is the difference in market dynamics between the low end (with significant investor activity) and the mid-range markets (most homes will be bought by owner occupants). Investors will probably set the price floor for low end single family homes and condos, but owner occupants will probably be more prevalent in the mid-range - buying at prices above what most investors are willing to pay. Just something to keep in mind ...

Wachovia Waives Refi Fees for Pick-A-Pay, Discontinues NegAm Products

by Calculated Risk on 6/30/2008 02:24:00 PM

Note: Pick-A-Pay is Wachovia's Option ARM (adjustable rate mortgage) product with a NegAm (negative amortization) option.

Press Release: Wachovia Corporation Announces Assistance for Pick-A-Pay Customers

Effectively immediately, Wachovia is waiving all prepayment fees associated with its Pick-A-Pay mortgage to allow customers complete flexibility in their home financing decisions.Obviously Wachovia wants people to refinance out of their current Option ARMs. The NegAm products are really hurting Wachovia.

...

Additionally, for all new loan originations, Wachovia is discontinuing offering products that include payment options resulting in negative amortization.

Unemployment Benefits Extended

by Calculated Risk on 6/30/2008 12:05:00 PM

An extension of unemployment benefits for 13 weeks was included in the war funding bill signed by President Bush today.

This extension covers workers who used all their unemployment benefits between November 2006 and March 2009. As I noted last week, some of these people will reapply for benefits, probably pushing weekly claims over 400K per week once the benefits become available. (Typically an extension of benefits adds about 50K per week for about four weeks).

Extended benefits are not included in continued claims (there is a separate category), however continued claims will probably also get a small boost as some job seekers wait for better opportunities.

Although unemployed workers receive the direct benefit of this extension, this program (like all safety nets) is really aimed at employed workers worried about their jobs. Far more people are worried about losing their jobs than will actually be laid off in this downturn - and if all these people pull back sharply on their spending, then the layoffs might become a self fulfilling prophesy. This program helps reduce the financial fear for these workers.

Oceanside REO: Back to 2002 / 2003 Prices

by Calculated Risk on 6/30/2008 10:43:00 AM

Here is another Countrywide REO in Oceanside offered at $359,900 (from Jim the Realtor). This house sold for $469,000 in early 2004, and is now being offered at late 2002, early 2003 prices. (see graph at bottom of this post)

Unlike the low end home discussed last month, these mid-range homes are not as attractive to cash flow oriented investors. Jim says the rent would be $2000 per month (maybe as high as $2500 per month all fixed up). The cap rate would probably be around 4.5%; too low for most investors.

Hey, where is the shower?

The following graph is the Case-Shiller home price index for San Diego, using the previous sales price of this Oceanside property to scale the price ($469,000 in Feb 2004). NOTE: These prices are not for San Diego and are used just to put this property on the Case-Shiller graph. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although this REO is priced below the current Case-Shiller price - and is being offered at late 2002 / early 2003 prices, this is probably still too high for most investors.

This type of property will probably sell to owner occupied buyers, as opposed to investors, unless the price falls another 20+% (my guess is investors would be interested around $275,000). Although there are many more low end REOs on the market, lenders are starting to price those properties aggressively, and will probably sell many of those properties to investors. These mid-range REOs will probably linger on the market waiting for owner occupied buyers (or even lower prices). Jim did tell me there might be an offer coming in, but he noted: "I'll believe when I see it".

BIS: Economy Near "Tipping Point"

by Calculated Risk on 6/30/2008 08:56:00 AM

From the WSJ: Bank for International Settlements Sees Economy Near 'Tipping Point'

In its annual report, the central bank for central banks said the impact of rising food and energy prices on consumers' incomes, combined with heavy household debts and a pullback in bank lending, may lead to a slowdown in global growth that "could prove to be much greater and longer-lasting than would be required to keep inflation under control."Here is the report.

Meanwhile, from Bloomberg: European Prices Rise More Than Forecast as Oil Surges

The inflation rate in the euro area rose to 4 percent this month, the highest in more than 16 years ...

European retail sales plunged in June with the Bloomberg purchasing managers index falling to 44 from 53.1 in May.

...

``The surge in inflation is the reason why we've seen the economy lurching downwards,'' said Ken Wattret, senior economist at BNP Paribas in London. ``The pipeline pressures are increasing and the news on the wage front has been very alarming.''

Shanghai Cliff Diving

by Calculated Risk on 6/30/2008 02:23:00 AM

The Shanghai SSE composite index is off another 1.9% tonight (most recent quote), and is now below 2700 for the first time since early 2007. The index is off 54% from the peak. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is some serious cliff diving.

And other markets are also selling off, probably because of some combination of a slowing global economy and higher inflation.

As the NY Times notes: Falling Prices Grip Major Stock Markets Around the World

In ... Germany, the benchmark DAX index is off slightly more than 20 percent this year, and the CAC-40 in France is down almost 22 percent. The Euro Stoxx 50, a gauge for the 15-nation euro zone, has declined by about 24 percent. The nearly 15 percent decline in the FTSE 100 in Britain looks tame by comparison.

Emerging market indexes have fared even worse. The Hang Seng in Hong Kong has plunged nearly 21 percent, the Shanghai Composite has lost nearly half its value this year. The Bombay 500 in India lost about 38 percent.

Sunday, June 29, 2008

Lawrence Summers "Most dangerous moment"

by Calculated Risk on 6/29/2008 06:49:00 PM

Lawrence Summers writes in the Financial Times: What we can do in this dangerous moment

It is quite possible that we are now at the most dangerous moment since the American financial crisis began last August.Summers has four recommendations:

First, the much debated housing bill should be passed immediately by Congress and signed into law.I haven't commented very much about this housing bill. Many of the critics have labeled it a $300 billion bailout - it's not. The cost will only be a small fraction of that amount, and the bill will probably be inconsequential. For more on the bill, see the CBO's analysis Federal Housing Finance Regulatory Reform Act of 2008 and Vikas Bajaj's article today in the NY Times: As Housing Bill Evolves, Crisis Grows Deeper.

Second, Congress should move promptly to pass further fiscal measures to respond to our economic difficulties. ... There is now also a case for carefully designed support for infrastructure investment ... There are legitimate questions about how rapidly the impact of infrastructure spending will be felt. ...Yes, it appears the 2nd half recovery has been cancelled and there will be calls for more stimulus packages. Some infrastructure investment - that provides jobs for unemployed construction workers - seems to make sense. Atrios made a similar point this morning.

And from Summers on inflation:

Third, policymakers need to make a clear commitment to addressing the non-monetary factors causing inflation concerns. ... the primary source of inflation concern is increases in the price of oil, food and other commodities. ... Appropriate steps include reform of misguided ethanol subsidies that distort grain markets to minimal environmental benefit, allowing farm land now being conserved to be planted; measures to promote the use of natural gas; and reform of Strategic Petroleum Reserve Policy to encourage swaps at times when the market is indicating short supply. Major importance should be attached to encouraging the reduction or elimination of energy subsidies in the developing world.There seems to be an overwhelming consensus that corn ethanol is misguided - and yet the program persists.

Fourth, it needs to be recognised that in the months ahead there is the real possibility that significant financial institutions will encounter not just liquidity but solvency problems as the economy deteriorates and further writedowns prove necessary.Solvency is the real issue, and I'm not sure about the solution.

Shiller: More Stimulus Needed

by Calculated Risk on 6/29/2008 09:49:00 AM

Robert Shiller writes in the NY Times: One Rebate Isn’t Enough

In January, just before Congress passed the stimulus bill authorizing the rebate checks, Peter R. Orszag, director of the Congressional Budget Office, wrote that, in the current economic situation, there was a risk of “a self-reinforcing spiral (of less lending, lower house prices, more foreclosures, even less lending, and so on) that could further impair economic activity and potentially turn a mild recession into a long and deep recession.”And Shiller goes on to argue that more stimulus is needed:

In his view, there was only a moderate probability that this “self-reinforcing spiral” would take hold. The goal of the rebate checks, he said, would be to lower this probability “to an acceptable value.” He thought that an economic stimulus bill might well make the difference.

...

Has the tax rebate substantially reduced the probability of a downward spiral?

It is too soon to tell, because the Treasury only started to send out rebate checks in late April. Retail sales did rise in May. But the dreaded serious recession still seems very much a possibility.

[W]e should be putting in place another stimulus package like the current one, and stand ready for another after that, and another.With the "2nd half recovery" apparently cancelled, and the immediate effects of the stimulus mostly behind us, it is not surprising that more stimulus is being discussed. But if the stimulus checks go to Saudi Arabia or China, it isn't really helping (there is no multiplier effect).

And it's not clear how a little more consumer spending is supposed to slow the downward spiral of "of less lending, lower house prices, more foreclosures, even less lending, and so on" other than to buy a little time.

Saturday, June 28, 2008

You know Gas is Expensive when Teenagers Stop Cruising!

by Calculated Risk on 6/28/2008 09:14:00 PM

From the NY Times: Cruise Night, Without the Car

For car-loving American teenagers, this is turning out to be the summer the cruising died.

...

From coast to coast, American teenagers appear to be driving less this summer. Police officers who keep watch on weekend cruising zones say fewer youths are spending their time driving around in circles, with more of them hanging out in parking lots, malls or movie theaters.

Apartment Landlords Offering Significant Incentives in Manhattan

by Calculated Risk on 6/28/2008 09:00:00 AM

From the NY Times: Luring Affluent Renters in Manhattan

ONE month’s free rent. Two months’ free rent. No security deposit.Note that this is for some high-end buildings only. It looks like the layoffs in the financial industry are starting to bite ... and it's about to get worse:

How about a year’s worth of storage at Manhattan Mini Storage or an appointment at a doggie day spa for Rover on moving day?

As the rental market in Manhattan has softened in recent months, these are some of the incentives that owners of high-end buildings are offering to lure tenants.

... many of the people laid off by Wall Street firms will not officially become unemployed until their severance pay runs out. For the entire metropolitan area, she said, Moody’s economy.com is projecting a loss of 60,000 jobs by the beginning of 2009, with about 45,000 of those jobs in financial services.

Friday, June 27, 2008

UK: "House prices won't recover until 2015"

by Calculated Risk on 6/27/2008 08:23:00 PM

From Edmund Conway at the Telegraph: House prices won't recover until 2015, ex-MPC expert warns

Families must wait until 2015 for the property market to start booming again, according to Stephen Nickell, who heads up the unit which advises the Prime Minister on housing planning.It's probably too early to be talking about when house prices will return to pre-credit crunch levels, but at least Gordon Brown is hearing that it will take years.

...

"The housing market - in terms of the price of houses - will not look much the same as it did before the credit crunch until after six or seven years."

Also from the Telegraph: British household debt is highest in history

Families in the UK now owe a record 173pc of their incomes in debts, official figures have shown. The ratio of debt to income is higher than any other country in the Group of Seven leading industrialised economies, and is sharply higher than the 129pc of incomes it was five years ago.

...

Michael Saunders of Citigroup warned that - at 173pc of household incomes - the debt burden is higher even than Japan's when it peaked in 1990, before more than a decade of deflation.

"Not only are we the highest in the G7, we are the highest a G7 country has ever seen," he said.

J.D. Power: June Auto Sales at 12.5 million rate

by Calculated Risk on 6/27/2008 03:40:00 PM

From the WSJ: Deep June Car-Sales Slump Seen in J.D. Power Estimate

J.D. Power & Associates sees the market for U.S. light vehicles contracting 15.4% in the month of June compared to a year ago, according to a report released Friday ... The firm expects the closely-watched seasonally adjusted annual rate of sales to fall to 12.5 million vehicle rate, well below the 16.3 million rate set in the same period last year.This is more grim news for the U.S. auto industry.

Bear Markets

by Calculated Risk on 6/27/2008 01:45:00 PM

For those with a round number fetish, the Dow is now off more than 20% from the peak last October. If it closes at or below this level, then this will be considered an official bear market.

Dow closing high on Oct 9, 2007: 14,164.53

20% off would be: 11,331.62 (right now 11,326 so it's close).

The closing high for the S&P 500 was 1565.15 last October 9th and 20% off would be 1252.12 - so we still have a little ways to go for the S&P.

Professor Duy: "This Is Not Good"

by Calculated Risk on 6/27/2008 10:54:00 AM

Tim Duy has another great post on the Fed being caught between inflation and recession: This Is Not Good. Here is his conclusion:

This is a no win situation...which way will the Fed turn? The Fed will hold the current policy in place until policymakers becomes sufficiently distressed by the impact of energy price inflation ... Note that market participants are increasingly aware that the Fed’s default policy for the time being is higher inflation, as evidenced by the rise in 10 year TIPS breakeven levels to 254bp today.

In theory, the best outcome is to find is a sweet spot that allows global growth outside of the US to decelerate while avoiding a free fall in the Dollar. In the absence of such equilibrium, the US economy can hobble along only as long as the following three conditions hold:

1. The Federal Reserve can maintain easy monetary policy.

2. The US government can sustain repeated fiscal stimulus measures.

3. China and the rest of the dollar bloc continue to be willing to accumulate US assets, primarily the Treasury debt needed for fiscal stimulus.

When these conditions no longer hold – such as the Fed needs to tighten to counter energy inflation, or the demand for US debt drops sharply – then I suspect the US economic environment will shift decisively toward higher inflation or significant recession.

Consumer Sentiment: Lowest Since 1980

by Calculated Risk on 6/27/2008 10:18:00 AM

From MarketWatch: Consumers extremely gloomy, UMich survey says.

The consumer sentiment index fell to 56.4 in June from 59.6 in May ... It's the lowest since 1980 and the third-lowest reading in the 56-year history of the survey.A record number of consumers said their own finances had worsened, and inflation expectations are the highest since Feb 1982. (here is the Reuters story with more detail)

Usually consumer sentiment surveys tell you what you already know, and sentiment is heavily impacted by gasoline prices, but these are still pretty stunning numbers.

CNBC: Merrill to Write Down $3 to $5 Billion

by Calculated Risk on 6/27/2008 08:57:00 AM

From CNBC: Merrill Likely to Write Down $3 Billion-$5 Billion

Reuters is reporting: Merrill may take $5.4 bln in Q2 writeoffs: Lehman

Merrill Lynch will likely incur $5.4 billion of write-downs in the second quarter, mainly from its exposure to monolines, said an analyst at Lehman Brothers ...Here comes another round of visits to the confessional!

Thursday, June 26, 2008

Senator Schumer Concerned about IndyMac

by Calculated Risk on 6/26/2008 09:32:00 PM

From the WSJ: Schumer Asks Regulators For Greater IndyMac Scrutiny (Thanks to all!)

Sen. Charles Schumer sent letters to federal regulators asking them to monitor more closely the financial health of IndyMac ...Here is the AP story: Schumer: concerned over IndyMac stability

The New York Democrat wrote that he is "concerned that IndyMac's financial deterioration poses significant risks to both taxpayers and borrowers and that the regulatory community may not be prepared to take measures that would help prevent the collapse of IndyMac or minimize the damage should such a failure occur."

I'm very surprised a letter like this was made public. And I'm surprised a U.S. Senator is mentioning a specific bank. Oh well, anyone with more than the FDIC insured limit deposited with IndyMac has had ample warning.

Credit Markets: "It's never been this bad."

by Calculated Risk on 6/26/2008 06:02:00 PM

From Bill Fleckenstein's Daily Rap today: It's About to Blow! (Here is Fleck's Site for the Daily Rap):

Note: excerpted with permission.

[About midday] I received a phone call from the Lord of the Dark Matter, who began the conversation: "It's about to blow!" He then repeated himself.And I heard confirmation from a bond shop today that "liquidity is getting worse and worse". Here we go again?

He went on to say that behind the scenes, many parts of the credit/mortgage market were "offered only." He said it had nothing to do with month-end or quarter-end. Instead, he believed it had to do with the enormous amount of inventory that would be looking for a home in the next quarter. He believed that the equity market was "miles behind what was occurring in the mortgage-backed/credit markets." Though he noted that he'd said it before, he repeated: "It's never been this bad."

Oil hits $140, Dow Off 300

by Calculated Risk on 6/26/2008 02:53:00 PM

From MarketWatch: Oil prices tops $140

TED spread rising sharply. Is this the 4th wave of the credit crisis?

Alt-A Defaults Rise Sharply

by Calculated Risk on 6/26/2008 12:47:00 PM

Paul Jackson at Housing Wire reports: Alt-A Performance Gets Much Worse in May

A new report released by Clayton Fixed Income Services, Inc. on Wednesday afternoon found that 60+ day delinquency percentages and roll rates increased in every vintage during May among Alt-A loans ... Add in soaring borrower defaults, and the picture doesn’t get much better. Clayton reported that the 2006 vintage saw 60+ day borrower deliquencies among Alt-A first liens reach 21.22 percent in May, up 10.5 percent in a single month; 2007 fared even worse, with 60+ day delinquencies ratcheting up 22 percent to 18.55 percent.Paul notes that the rating agencies will be probably have to increase their loss assumptions:

Those numbers make Standard & Poor’s Ratings Services latest assumption of 35 percent loss severity on Alt-A loans, only one month old, already start to look a little too conservative. ... given the data now available, a ratings cut for any AAA classes deemed at risk one month ago would seem to be a foregone conclusion for most investors.Housing Wire has more details.

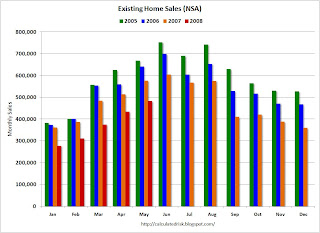

Existing Home Sales: Not Seasonally Adjusted

by Calculated Risk on 6/26/2008 11:52:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are sharply lower in May 2008 compared to the previous three years.

May is an important month for existing home sales, and marks the beginning of the Summer selling season.

Let's compare the NSA pattern for existing home sales to the pattern for new home sales. The second graph shows monthly NSA new home sales.

The second graph shows monthly NSA new home sales.

The first difference is that new home sales peak in the Spring, and existing home sales peak in the Summer. This is because new home sales are reported when the contract is signed, and existing home sales are reported at the close of escrow.

The second obvious difference is there was no Spring selling season for New Home sales, but there has been a pickup (although muted) in Existing Home sales.

The difference in sales activity could partly be because new homes tend to be in more remote locations, and with rising fuel prices, home buyers are buying existing homes closer to their places of work. Another explanation is that existing home sales are being boosted by REO (bank Real Estate Owned) sales. Dataquick reported that in California in May, 38.3 percent of all sales were foreclosure resales!  The third graph compares New Home sales vs. Existing Home sales since January 1994.

The third graph compares New Home sales vs. Existing Home sales since January 1994.

Clearly new home sales have fallen faster than existing home sales.

I suspect REO resales explain some of the difference (as does location).

May Existing Home Sales Graphs

by Calculated Risk on 6/26/2008 11:00:00 AM

Note: for the 2nd month in a row, the NAR didn't release the Existing Home sales data online in a timely manner.

The NAR reports: May Existing-Home Sales Show Modest Gain

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 2.0 percent to a seasonally adjusted annual rate 1 of 4.99 million units in May from a level of 4.89 million in April, but are 15.9 percent below the 5.93 million-unit pace in May 2007.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2008 (4.99 million SAAR) were the weakest May since 1998 (4.77 million SAAR).

It's important to note that a large percentage of these sales are for homes that were foreclosed during the previous year. Dataquick reported that in California in May, 38.3 percent of all sales were foreclosure resales!

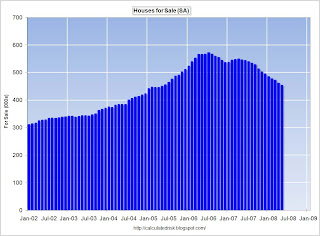

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.49 million homes for sale in May.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.49 million homes for sale in May. Total housing inventory at the end of May fell 1.4 percent to 4.49 million existing homes available for sale, which represents a 10.8-month supply at the current sales pace, down from a 11.2-month supply in April.The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase from March through mid-Summer.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply decreased to 10.8 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year. More later when the raw data is available ...

May Existing Home Sales Increase Slightly

by Calculated Risk on 6/26/2008 10:03:00 AM

From MarketWatch: U.S. May existing-home sales rise 2% as expected

The U.S. home and condo resales inched higher in May as prices continued to fall, the National Association of Realtors reported Thursday. Resales of U.S. houses and condos rose 2% to a seasonally adjusted annualized rate of 4.99 million in May from 4.89 million in April.Graphs soon ... (NAR is slow to release the data online again) Update MarketWatch on inventory:

Inventories of unsold homes on the market fell 1.4% to 4.49 million, a 10.8-month supply at the May sales pace. The inventory figures are not seasonally adjusted. Inventories are up 2.4% in the past year.NAR still hasn't released the data online.

Claims: The Impact of Unemployment Benefits Extension

by Calculated Risk on 6/26/2008 08:30:00 AM

It now appears like that Congress will extend unemployment insurance benefits from 26 weeks to 39 weeks. How will this impact the Weekly Claims data?

First, weekly claims typically get a short term bounce with an unemployment benefit extension as some workers refile for claims. This will probably add 50K per week to claims for several weeks (pushing claims solidly above 400K).

Extended benefits are not included in continued claims (there is a separate category), however continued claims will probably also get a small boost as some job seekers wait for better opportunities.

Just a couple of points to remember when claims get a boost - probably as soon as next month. Of course weekly claims are already rising, even before the extended benefits become available, indicating a weakening labor market.

Here is the current report from the Department of Labor for the week ending June 21, showing initial unemployment claims increased to 384,000, and the 4-week moving average was 378,250. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the continued claims since 1989.

Continued claims increased this week to 3,139,000, an increase of 82,000 from the preceding week.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable). The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Wednesday, June 25, 2008

Credit Crisis: The 4th Wave?

by Calculated Risk on 6/25/2008 11:46:00 PM

The TED spread is starting to rise again and is back above 1.0 for the first time since the beginning of May. Here is the TED Spread from Bloomberg. The spread is still far below the previous three waves, but well above the normal level (below 0.5).

And from the WSJ: European Bank-Lending Anxiety Returns

Tensions in Europe's short-term lending markets are on the rise again, repeating a pattern that central bankers had hoped to end by pumping in hundreds of billions of dollars in recent months.And from the Fed Commercial Paper report, the A2/P2 less AA spread has risen to 82 bps. Note: This is the spread between high and low quality 30 day nonfinancial commercial paper.

The pressure partly reflects an end-of-quarter effect, as banks hoard cash to make sure their finances look healthy when they report second-quarter results.

But it also demonstrates that fears of further write-downs and possible failures aren't going away.

Perhaps it's a little premature to worry about a 4th wave, but these are worrisome signs.

Economic Poll: 75% Blame Bush

by Calculated Risk on 6/25/2008 06:51:00 PM

From the LA Times: Times poll: 75% blame Bush's policies for deteriorating economy

[A]ccording to a Los Angeles Times/Bloomberg poll ... Nine percent of respondents said the country's economic condition has become better off since Bush became president, compared with 75% who said conditions had worsened. Among Republicans, 42% said the country is worse off, while 26% said it is about the same, and only 22% thought economic conditions had improved.This is kind of like blaming the quarterback for a loss; there are many other factors (although I share the view that the Bush administration has done a poor job on economic matters). This is a very high level of pessimism, and is probably related to higher gasoline prices, something that is very visible to every American.

...

All together, 82% of respondents said the economy is doing badly, compared with 71% who felt that way when the question was asked in February. And the pessimism has intensified: 50% of respondents said the economy is doing "very badly," compared to 38% in February.

On energy:

Seventy percent of respondents said the rising cost of fuel had caused hardship for their families and the pain appeared spread across all income groups: 79% of people with incomes of less than $40,000 a year said the higher prices were a hardship, but so did 55% of respondents with incomes above $100,000.In general confidence polls are coincident indicators (they tell you what you already know about spending patterns), so this doesn't suggest anything about future consumer spending. But it's pretty clear that Americans are not happy.

More on Inferior Goods

by Calculated Risk on 6/25/2008 04:25:00 PM

Here is some more evidence of consumers shifting to inferior goods - from Bloomberg via the LA Times: Earnings jump 15% at Kroger, operator of Ralphs.

Consumers bought more store-branded products ...Generic or store-branded products are classic inferior goods. Sales for store-branded products typically increase during tough economic times, and decrease when times are good (as consumers shift back to name brands).

On the same store sales increase of 5.5% - isn't that just related to higher prices for food products?

Fed: No Rate Change

by Calculated Risk on 6/25/2008 02:12:00 PM

From the FOMC:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Recent information indicates that overall economic activity continues to expand, partly reflecting some firming in household spending. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and the rise in energy prices are likely to weigh on economic growth over the next few quarters.

The Committee expects inflation to moderate later this year and next year. However, in light of the continued increases in the prices of energy and some other commodities and the elevated state of some indicators of inflation expectations, uncertainty about the inflation outlook remains high.

The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time. Although downside risks to growth remain, they appear to have diminished somewhat, and the upside risks to inflation and inflation expectations have increased. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.

Quote of the Day: CEO of Dow Chemical on Stagflation

by Calculated Risk on 6/25/2008 12:19:00 PM

"Frankly, there's very few levers left ... [T]his energy crisis is affecting consumers ... People aren't spending. People aren't driving. Really, you need to look at ways to control what's happened in the inflationary world and really take the risk that by raising rates, you may actually cause some demand to go weaker. I think it's back to where Paul Volcker was in the early '80s. There's a real risk here and we've got stagflation. You can only break out of it one way and you better take on inflation head-on."Meanwhile, from the NY Times: Dow Chemical Raises Prices for Second Time in a Month

Andrew Liveris, chairman and CEO of Dow Chemical, June 24, 2008

The Dow Chemical Company said Tuesday that it was raising prices for the second time in a month to offset a “relentless rise” in energy costs, a sign that companies may increasingly have to pass on price increases to their customers.

The increase of as much as 25 percent — the largest in the company’s history — comes after a 20 percent rise last month that the company said did not go far enough given the continuing surge in energy prices.

New Home Sales: Worst Selling Season Ever

by Calculated Risk on 6/25/2008 11:23:00 AM

There was no Spring this year. This year saw the smallest increase in sales from the Winter doldrums, to the Spring selling season, since the Census Bureau started tracking new home sales in 1963.

Note: Please see my earlier post for more on new home sales. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Not Seasonally Adjusted (NSA) new home sales for the last 45 years.

Usually sales increase in the spring - but not this year. The previous worst spring on record was 1982 - in the midst of a severe recession, with 30 year fixed mortgage rates at 17%, and close to double digit unemployment.

In 1982, sales picked up late in the year as interest rates declined sharply (30 year fixed rates fell from 17% to about 13% at the end of the year). The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The Red columns are for 2008. This is the lowest sales for May since the recession of '91.

Once again, the 2008 spring selling season has never really started. And it's probably all downhill from here.

No wonder the home builders are so pessimistic.

May New Home Sales: 512K Annual Rate

by Calculated Risk on 6/25/2008 10:00:00 AM

According to the Census Bureau report, New Home Sales in May were at a seasonally adjusted annual rate of 512 thousand. Sales for April were revised down slightly to 525 thousand (from 526 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for May since the recession of '91.

As the graph indicates, the spring selling season has never really started. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

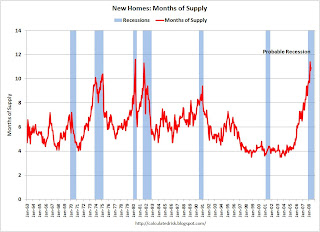

Sales of new one-family houses in May 2008 were at a seasonally adjusted annual rate of 512,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.5 percent below the revised April rate of 525,000 and is 40.3 percent below the May 2007 estimate of 857,000.And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at 10.9 months. Note that this doesn't include cancellations, but that was true for the earlier periods too.

"Months of supply" is at 10.9 months. Note that this doesn't include cancellations, but that was true for the earlier periods too.The all time high for Months of Supply was 11.6 months in April 1980.

Once again, the current recession is "probable" and hasn't been declared by NBER.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of May was 453,000. This represents a supply of 10.9 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations - and cancellations are near record levels. Actual New Home inventories are probably much higher than reported - my estimate is just under 100K higher.

Still, the 453,000 units of inventory is below the levels of the last year, and it appears that even including cancellations, inventory is now falling.

This is another very weak report for New Home sales and I'll have more later.

Illinois Sues Countrywide

by Anonymous on 6/25/2008 08:12:00 AM

As usual, I can't tell if this sounds a little absurd because the complaint is this weak or because all I have to go on is the Gretchen Morgenson Version of the complaint.

The Illinois complaint was derived from 111,000 pages of Countrywide documents and interviews with former employees. It paints a picture of a lending machine that was more concerned with volume of loans than quality.Volume-based compensation structures? There have been volume-based compensation structures in this business since long before Tanta got into it. Does it create perverse incentives? Sure. Do we have to like it? No. Has it operated all these years in plain sight of regulators, investors, and the public? Yes. Is CFC's pay structure all that different from anyone else's? I profoundly doubt it.

For example, former employees told Illinois investigators that Countrywide’s pay structure encouraged them to make as many loans as they could; some reduced-documentation loans took as little as 30 minutes to underwrite, the complaint said.

And if anyone who has ever underwritten a loan in 30 minutes has to go to jail, the jails will be full indeed. I wonder if they'll let me take my new Kindle. Jesus H. Christ on a Process Re-engineering Consultant Binge, folks, anybody who didn't tell the analysts on the conference calls that they'd got their average underwriting time down to 30 minutes was Nobody back in 2000. Not to mention the AUS side of the business where underwriting had gotten down to 30 seconds.

The lawsuit cited Countrywide documents indicating that almost 60 percent of its borrowers in subprime adjustable rate mortgages requiring minimal payments in the early years, known as hybrid A.R.M.’s, would not have qualified at the full payment rate. Countrywide also acknowledged that almost 25 percent of the borrowers would not have qualified for any other mortgage product that it sold.It is now grounds for a lawsuit that you have borrowers in your lowest credit quality product who do not qualify for any alternative product? Um. We used to think that if borrowers in your lowest credit quality product could have qualified for an alternative product, you might be guilty of predatory "steering." Now you're also guilty of predatory lending if indeed the borrowers at the bottom of the pile only qualify there? Every lender has borrowers in, say, its FHA product who could not not qualify for any other mortgage product it sells. Are we going to call that a problem? That'd get pretty interesting pretty fast.

Even more surprising, Ms. Madigan said, was her office’s discovery of e-mail messages automatically sent by Countrywide to its borrowers offering complimentary loan reviews one year after they obtained their mortgages from the company.Lisa Madigan cannot be such a Pangloss as to be bowled over by the idea that lenders solicit their current loan customers for refinances. She can't.

“Happy Anniversary!” the e-mail messages stated. “Many home values skyrocketed over the past year. That means that you may have thousands of dollars of home equity to borrow from at rates much lower than most credit cards.”

Ms. Madigan said, “I was just struck that on the first anniversary of these people’s loans they would get these e-mails luring them into a refinance, into another unaffordable product to generate more fees and originate more loans.”

Nobody has to like any of these business practices. But they have been hiding in plain sight for a long, long time. This ginned-up outraged innocence--all directed at Countrywide, as if everyone else in the industry had never heard of any of this--is truly getting on my nerves.

More on the Decline of the Exurban Lifestyle

by Calculated Risk on 6/25/2008 01:40:00 AM

Peter Goodman at the NY Times writes about an upscale Denver exurb that is getting hit hard by a combination of the housing bust and high oil prices: Rethinking the Country Life as Energy Costs Rise. Here is a great quote:

“Living closer in, in a smaller space, where you don’t have that commute,” [Denver exurbanite Phil Boyle] said. “It’s definitely something we talk about. Before it was ‘we spend too much time driving.’ Now, it’s ‘we spend too much time and money driving.’ ”Michael Corkery at the WSJ writes in the Development blog: Rising Gas Prices Crushing Housing Recovery in Inland Empire

Even though falling prices in California’s Inland Empire are making homes more affordable, rising gasoline prices are crushing hopes of a housing recovery in this area, east of Los Angeles.This is a problem all over the country, see this Bloomberg story on the Washington area: Wealth Evaporates as Gas Prices Clobber McMansions, or this post on Temecula, CA.

...

“Land that was purchased with expanding metro areas in mind has already been hard hit in value,” says [Deutsche Bank analyst Nishu Sood]. ”Sustained higher gas prices could render it effectively worthless.”

As I noted before, any lifestyle dependent on low gas prices - and low gas mileage vehicles - is becoming uneconomical. For those that own a home in a remote location, work in construction, and drive a low gas mileage vehicle, this must feel like a depression.

How bad are things at Wachovia?

by Calculated Risk on 6/25/2008 12:08:00 AM

From MarketWatch: Wachovia hires Goldman to help sort loan portfolio (hat tip Mark)

Wachovia Corp. said Tuesday that it has hired Goldman Sachs Group to review its loan portfolio, another sign that the bank is bracing for further mortgage-related trouble when it reports earnings next month.The key problem for Wachovia is the $120 Billion Pick-a-pay portfolio (Option ARMs) that came with the Golden West acquisition in 2005.

...

Wachovia has written down more than $5 billion in bad investments over the last year ...

Tuesday, June 24, 2008

WaMu Analyst Competition

by Calculated Risk on 6/24/2008 07:45:00 PM

From Matt Padilla at the O.C. Register: How bad are things at WaMu?

Lately equities analysts seem to be competing on who can make the most dire prediction for Washington Mutual’s future loan losses.Wow. $30 billion. That is a huge number. But in the current environment, I'll take the over. Or is that the under when we are talking about losses? See Matt's post for more.

Reuters reports today that WaMu, as the company is known, may set aside as much as $30 billion in credit losses through 2011, predicts Lehman Brothers analyst Bruce Harting.

That tops the $27 billion of losses that UBS analyst Eric Wasserstrom on June 9 said the nation’s largest thrift could face.

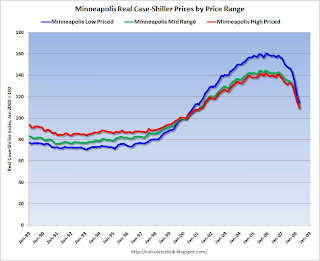

Case-Shiller: Tiered Home Price Indices

by Calculated Risk on 6/24/2008 05:32:00 PM

Here is a look at the Case-Shiller data by price tiers for two cities. See this spread sheet from S&P for tiered pricing for all 20 cities in the Composite 20 index. (note: this is an S&P excel spread sheet, not mine.). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the real Case-Shiller prices for homes in Los Angeles.

The low price range is less than $408,960 (current dollars). Prices in this range have fallen 37.9% from the peak in real terms.

The mid-range is $408,960 to $617,001. Prices have fallen 32.5% in real terms.

The high price range is above $617,001. Prices have fallen 24.1% in real terms. The second graphs show the real Case-Shiller prices for homes in Minneapolis.

The second graphs show the real Case-Shiller prices for homes in Minneapolis.

The low price range is less than $173,578 (current dollars). Prices in this range have fallen 28.8% from the peak in real terms.

The mid-range is $173,578 to $247,371. Prices have fallen 23.1% in real terms.

The high price range is above $247,371. Prices have fallen 23.2% in real terms.

In both of these cities, the low end areas saw the most appreciation, and have seen the fastest price declines.

In a number of previous housing busts, real prices declined for 5 to 7 years before finally hitting bottom. If this bust follows that pattern, we will continue to see real price declines for several more years - but if that happens, the rate of decline will probably slow (imagine somewhat of a bell curve on those graphs).

However, with the record foreclosure activity, prices might adjust quicker than normal (lenders are less prone to sticky prices than ordinary homeowners).

Foreclosure Rage: Take Everything, including the Kitchen Sink

by Calculated Risk on 6/24/2008 03:58:00 PM

This story (2 min 44 secs) starts with that guy in Las Vegas destroying his home. But there is more here - check out the house with all the appliances removed.

Update: Ratio Median House Price to Median Income (2008 Report)

by Calculated Risk on 6/24/2008 02:23:00 PM

A research analyst at Harvard Joint Center for Housing Studies (JCHS) has been kind enough to send me (Thanks!) an update to the median house price to median income ratio I discussed yesterday (see: Ratio: Median Home Price to Median Income)

JCHS didn't post this data because they changed both the data source they use, and their methodology to calculated the ratio - and JCHS analysts felt this would be confusing because the ratios are different from previous releases. However the trends are the same - and therefore useful for us.

Here is some price-to-income data from the 2008 report (data through 2007). Once again I picked a few key cities and plotted the national average (dashed). Note: the new data only goes back to 1989. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Different areas have different price to income ratios. There are several reasons for this (land restrictions, demographics), but on a national basis, the median price to median income ratio rose from around 3.5 in the 1990s, to 4.7 in 2005, and has started to decline since then. This would suggest that a combination of falling prices and rising incomes would need to adjust this ratio by about 25% from peak to trough.

For Los Angeles, it is reasonable to expect the price to income ratio to fall to below 5. This suggests prices at the peak were about twice as high as normal.

Hold on, you say ... the above graph shows the price-to-income ratio for Los Angeles only declined about 3% from 2006 to 2007, but Case-Shiller showed prices in Los Angeles declined 14% in 2007 ... what gives?

Although I don't know the exact methodology used by JCHS, the likely reason for the difference is the JCHS data is based on the annual average, whereas the Case-Shiller data is from the end of 2006 to the end of 2007.

The second graph illustrates this point for Los Angeles. The red line is the JCHS median price to median income ratio for LA.

UPDATE: For Case-Shiller Index, Jan 2000 = 100.

The blue line is the annual average of the mid tier Case-Shiller index (mid tier was used to approximate the median price). The difference between the red and blue lines is that nominal median incomes are increasing. This is exactly what we would expect.

The dashed line is the monthly Case-Shiller mid tier price index. This has fallen off a cliff. It is very likely that the median price to median income ratio (on a monthly basis if it was available) would now be around 7 or lower - well on the way to the historical norm of around 4.7.

GSEs Refuse To Save The Day

by Anonymous on 6/24/2008 12:37:00 PM

The rhetoric of this Bloomberg report has to be read to be believed. Apparently, Fannie and Freddie have power make benefit glorious Nation of Jumbo, and they're blowing it all on people with downpayments in non-bubble markets instead of single-handedly throwing themselves on the grenade to Save the Housing Economy. Really:

June 24 (Bloomberg) -- Three months after Fannie Mae and Freddie Mac won the freedom to step up home-loan purchases, the government-chartered mortgage-finance companies are doing what critics in the Federal Reserve and Congress had predicted. . . .

``They were granted expanded opportunity to help recovery in a troubled housing market and yet have appeared to focus on their own recovery,'' said former U.S. Representative Richard Baker, a critic of the companies who left office earlier this year to run the Managed Funds Association in Washington. . . .

The slowness of Fannie Mae and Freddie Mac in injecting cash for new jumbo loans may have exacerbated the housing slump in markets including California and Florida, where prices have already fallen more than the national average, said Jerry Howard, 53, president of the National Association of Home Builders.

``Had they been quicker into the marketplace, they could have helped slow the downward spiral in housing prices,'' Howard said. . . .

``Fannie and Freddie are catering to low-risk homeowners with high credit scores and a lot of equity in their homes,'' said Dan Green, a loan broker at Mobium Mortgage Group Inc. in Cincinnati and Chicago. ``I'm sure there will be some high-cost areas in the country that will benefit. They just don't happen to be Florida, Michigan, California, Nevada.''

Case-Shiller Home Prices: Selected Cities

by Calculated Risk on 6/24/2008 10:40:00 AM

As noted earlier, S&P reported that the Case-Shiller home price composite indices declined sharply in April. The Case-Shiller composite 20 index (20 large cities) was off 15.3% YoY through April, and off 17.8% from the peak.

Note: the composite 20 index is not the National Price index, but this does suggests the national index will be off sharply in Q2.

However, 8 of the 12 cities in the composite 20 saw month to month price increases. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price changes for several selected cities that I've been following. Prices continue to fall in the 'bubble' cities, like San Diego, Miami, and Las Vegas.

Prices actually rose slightly in areas that saw less appreciation, like Denver and Cleveland. However this could just be seasonal noise, as these cities saw small increases last year at this time too.

Case-Shiller Composite 20 Price Index Off 17.8% from Peak

by Calculated Risk on 6/24/2008 09:36:00 AM

From MarketWatch: Four years of home gains have been wiped out

Home prices in 20 major U.S. cities have dropped a record 15.3% in the past year and are now back to where they were in 2004, according to the Case-Shiller home price index released Tuesday by Standard & Poor's.Note that the Composite 20 is not the national index, but this show prices are still falling in many areas of the country - and still falling quickly (the Composite 20 fell 1.4% in April alone).

Prices in the 20 cities are now down 17.8% from the peak two years ago. The biggest declines were seen in Las Vegas, Miami and Phoenix, with prices falling by 25% or more in the past year. Prices in 10 cities have fallen by more than 10%.

Prices were lower in April than they were a year earlier in all 20 cities tracked by the Case-Shiller index.

More later on individual cities ...

Monday, June 23, 2008

DAPs Will Not Die

by Calculated Risk on 6/23/2008 09:30:00 PM

When I first heard of Down-payment Assistance Programs (DAPs), I knew we would see higher default rates on FHA loans. Heck, the IRS has called DAPs a "scam". The FHA has vowed to eliminate DAPs ... and yet, amazingly, the percent of FHA loans using DAPs is still increasing.

DAPs simply will not die.

To understand DAPs in nerdy detail, see Tanta's DAP for UberNerds.

From the WSJ: Government Mortgage Program Fuels Risks

The offers -- including "100% financing" -- are made possible due to down-payment assistance programs run by nonprofit organizations. These programs are funded largely by home builders and also by private homeowners desperate to sell. The seller-funded groups provide enough down-payment money to buyers that they can qualify for a mortgage backed by the Federal Housing Administration, which requires at least a 3% down payment.These are not real down-payments from disinterested third parties. These programs are designed to have the seller (including home builders) funnel money to the buyer through a "nonprofit" to get around the FHA down-payment requirements. The buyer still has no skin in the game.

The FHA estimates that down payments provided by nonprofit groups account for 34% of all 200,000 loans backed by the FHA so far this year, up from 18% in all of 2003 and less than 2% in 2000. And the agency says that borrowers are two to three times as likely to default on their payments when they receive a down payment from a nonprofit.Here are some previous posts by Tanta and I about DAPs:

D.R. Horton Inc., the nation's largest home builder by volume, is touting "100% financing" for its two- and three-bedroom condominiums near the beach in Maui, Hawaii, which start at $498,000. In the Seattle area, local builder Quadrant Corp. is advertising townhouses that can be purchased with as little as $500 down. "Use your coffee budget to move into a new home," says an online promotion.

FHA Going After DAP Again? Tanta, June 10, 2008

DAP for UberNerds, Tanta, Oct 19, 2007 **** READ this one for nerdy details! ****

FHA to Ban DAPs, CR, Sept 29, 2007

Housing: IRS Raps DAPs, June 2, 2006

More on Housing, CR, Feb 24, 2005

UPS Warns on "anemic" U.S. Economy

by Calculated Risk on 6/23/2008 05:17:00 PM

From Bloomberg: UPS Reduces Outlook on Fuel Costs, Slowing Economy

United Parcel Service ... lowered its second- quarter profit forecast because of rising fuel costs and a slowing U.S. economy.Meanwhile from the WSJ: GM Extends Plant Shutdowns, Offers More Sales Incentives

...

UPS said the ``anemic'' U.S. economy was causing customers to cut back on air shipments, its most profitable offering, and that international packages coming into the U.S. were also declining.

Expanding its efforts to address a steep decline in sales of pickup trucks and sport-utility vehicles, General Motors Corp. plans to extend the summer shutdowns at six plants and to offer more sales incentives to clear its bloated inventory of large vehicles.

Ratio: Median Home Price to Median Income

by Calculated Risk on 6/23/2008 03:48:00 PM

The Harvard Joint Center for Housing Studies report: "The State of the Nation's Housing 2008" is now online. Unfortunately the table I was really hoping they would update is the House Price to Income ratio by metropolitan statistical areas (MSA).

Here is the excel file from the 2007 report: Metropolitan Area House Price-Income Ratio, 1980-2006

Here is some price-to-income data from the 2007 report (data through 2006). I picked a few random cities and plotted the national average (dashed). Check out the excel file for your MSA. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Different areas have different price to income ratios. There are several reasons for this (land restrictions, demographics), but on a national basis, the median price to median income ratio rose from around 3.0 to 4.6 by the end of 2006 (and has probably declined sharply since then). This would suggest that a combination of falling prices and rising incomes would need to adjust this ratio by about 1/3 from peak to trough.

For Los Angeles, it is reasonable to expect the price to income ratio to fall to between 4 and 5 (the historical average). This suggests price at the peak were about twice as high as normal.

Imagine buying a home at 10 times income. With 10% down, and a 6.0% 30 year mortgage, the P&I payments alone (pre-tax) would be about 54% of the homebuyers gross income. Add in taxes, insurance, maintenance and this homeowner is "house poor" from the get go.

And that brings us to table A-7 in the current report. This table shows that 8.8 million owner occupied households dedicate more than 50% of their income to housing in 2006. Another 13.3 million owner occupied households dedicate 30% to 50% of their income to housing.

Of those 8.8 million owner occupied households with housing a severe burden, approximately 3.3 million are in the middle 50% of household incomes - and this is the fastest growing segment - the middle class with housing a severe burden.

Rosenberg on Banks

by Calculated Risk on 6/23/2008 12:57:00 PM

In his daily Market Memo, economist David Rosenberg at Merrill Lynch writes: The bad news on the banks is definitely 'out there' (hat tip Bernie)

The WSJ may have well devoted a whole section to the sector's travails - "Investors Hide as Banks Come Knocking"; "Citi to Slash Investment Banking Jobs World-Wide"; "More Bank Bailouts Ahead?" and "Regional Bank Bargains". links addedWe could add New Crisis Threatens Healthy Banks from the WaPo:

Increasing struggles by consumers and businesses to make payments on a variety of loans, not just mortgages, are setting off a new wave of trouble in the financial sector that is battering even institutions that had steered clear of the subprime-home-loan debacle.Rosenberg makes a similar point as the WaPo noting that "concerns are spreading" from mortgages to other consumer and commercial debt. Rosenberg adds:

Late payments on home-equity loans are at a record high, according to fresh data from the Federal Deposit Insurance Corp. The delinquency rates on loans for cars, small businesses and construction are spiking to levels not seen in a decade or more.

... regional banks which may find it difficult to find suitors since accounting rules require that a takeover target's portfolio is marked to market at the time of acquisition ...And that might just leave FDIC receivership as the only option for many banks. From the WSJ:

There is often only one option left for a capital-starved U.S. bank that can't attract a suitor -- receivership under the auspices of the Federal Deposit Insurance Corp. While hardly ideal, that works fine as long as only a few banks stumble. But if the pressures of the credit crunch cause too many to fail, the FDIC could be overwhelmed. ... No wonder FDIC Chairwoman Sheila Bair has said bank problems are giving her heartburn.

When Bankers Decorate ...

by Calculated Risk on 6/23/2008 11:21:00 AM

"When the bankers are selecting color schemes, you know a project isn't going well"

reader Brian, June 23, 2008

This article from Bloomberg is a good summary of the banks exposure to commercial real estate (CRE): Deutsche Bank Lost in Vegas as Defaults Make Lenders Decorators

Workers building the $3.5 billion Cosmopolitan Resort & Casino on the Las Vegas strip are getting used to their financiers from Deutsche Bank AG. Lately, the weekly visitors from 60 Wall Street have been critiquing plans that called for a black-and-white decor.

``They are considering changing the color palettes and finishes,'' said Travis Burton, a vice president for lead contractor Perini Corp., who outfits the bankers with safety vests and hard hats before touring the site.

...

Deutsche Bank ... is one of a dozen investment banks that rode a five-year boom in commercial real estate by financing developers and landlords while profiting by packaging loans into securities. Then credit markets seized up in 2007, sticking banks and brokerage firms with commercial mortgages and bonds. The amount for large U.S. banks alone: $169 billion ... The resolution may take more than providing advice on drapes as the economy falters and mall vacancies increase.

Harvard: Bleak Outlook for Housing

by Calculated Risk on 6/23/2008 09:02:00 AM

Note: Dean Baker comments on the Joint Center for Housing Studies at Harvard University. As I noted below, the JCHS outlook sections always seem too optimistic, but the report does provide some excellent data.

Hat tip Ben Zipperer in Baker's comments:

When America's housing boom finally ends, don't expect a loud pop.

"It's not going to be a big dramatic event," says William Apgar, senior scholar at Harvard University's Joint Center for Housing Studies.

From the WSJ in August 2005: How Will Home Boom End?

"But comparing the [sudden price declines in the] stock market and the housing market is misleading at best. Because people live as well as invest in their homes, many owners stay put when prices first show signs of softening. This reduces the number of houses on the market and helps bring supply and demand back into balance, forestalling faster and sharper price declines."From the San Diego Union: Harvard report: Housing outlook remains bleak

-- from a 2005 Joint Center report

"With the slowdown in the entire residential construction sector, the home improvement market has downshifted to a more sustainable rate of growth... The dip in spending should, however, be both mild and short-lived. The fundamentals of remodeling demand remain positive, and the backlog of under-improved homes ensures a ready market for upgrades in the near term. And with home equity still at record levels, owners have the means as well as the motivation to continue to invest in their properties over the coming years."

-- from a 2007 Joint Center report

In a grim report on the weakened state of the housing industry, Harvard University says the United States is caught in a real estate market downturn “that is shaping up to be the worst in a generation.”Hopefully the report will be available online soon (check here). The annual Harvard report is a great source of data, however for the last few years I've noted that the report seemed too optimistic.

The decline in housing construction and home sales “already rivals the worst downturns in the post World War II era,” said the report out today from Harvard's Joint Center for Housing Studies. Price drops and mortgage failures “are the worst on records that date back to the 1960s and 1970s.”

Despite the “State of the Nation's Housing” report's somber tone, some analysts said it might be understating the problem.

“We have never had anything like this happen,” said Christopher Thornberg, an economist with the Beacon Economics research firm in Los Angeles. “It's a bloodbath. Prices are falling because they are too high. You would have to have prices in California fall 40 percent in order to get back to an historical level of affordability relative to incomes.”

...

“I think it is going to take another year nationwide for us to work through all of our problems in the housing market, at least to make a significant dent,” [Mark Zandi, chief economist for Moody's Economy.com] said. “In some parts of the country, the market will remain depressed well into the next decade. It is going to be a slog.”

Krugman: Home Not-So-Sweet Home

by Calculated Risk on 6/23/2008 01:23:00 AM

From the NY Times: Home Not-So-Sweet Home

Listening to politicians, you’d think that every family should own its home — in fact, that you’re not a real American unless you’re a homeowner. ... Even Democrats seem to share the sense that Americans who don’t own houses are second-class citizens.Krugman lists three disadvantages to owning that we've discussed:

...

And the belief that you’re nothing if you don’t own a home is reflected in U.S. policy. Because the I.R.S. lets you deduct mortgage interest from your taxable income but doesn’t let you deduct rent, the federal tax system provides an enormous subsidy to owner-occupied housing.

...

In effect, U.S. policy is based on the premise that everyone should be a homeowner. But here’s the thing: There are some real disadvantages to homeownership.

Krugman concludes:

All I’m suggesting is that we drop the obsession with ownership, and try to level the playing field that, at the moment, is hugely tilted against renting.Hear, hear!

And while we’re at it, let’s try to open our minds to the possibility that those who choose to rent rather than buy can still share in the American dream — and still have a stake in the nation’s future.

Sunday, June 22, 2008

Report: Citi to Cut 10% of Investment Banking Jobs

by Calculated Risk on 6/22/2008 07:14:00 PM

The WSJ is reporting: Citi to Slash Investment Banking Jobs World-Wide

Citigroup ... will dismiss thousands of investment-banking employees world-wide as part of a plan to cut the roughly 65,000-employee group by 10% ...According to the WSJ the cuts will probably happen tomorrow, with entire trading desks eliminated in New York and other cities.

Update: from the Financial Times: Job fears mount as Goldman sheds staff (hat tip crispy&cole)

... it emerged that Goldman Sachs ... cut staff at its investment banking division last week.The FT article ends with:

The Wall Street bank is now expected to cut up to 10 per cent of staff in the division that handles mergers and acquisition advice and corporate fundraisings over the course of 2008 ...

“Any bank that says it’s not cutting is lying,” said one industry insider on Sunday. “It’s getting to halfway through the year and everyone can see that business hasn’t picked up.”It is becoming more clear that the '2nd half recovery' was a mirage - not only for the financial industry, but for the economy in general.

Property Taxes Falling

by Calculated Risk on 6/22/2008 05:13:00 PM

From the LA Times: Tax cushion for falling property values

Assessors in the five-county Los Angeles area are now in the process of cutting property taxes on more than half a million homes because of plunging home values. ...In California, the assessed value is set to the sales price (in most cases), and then the assessed value is limited to a maximum increase of 2% per year. Property taxes are 1% of the assessed value.

Although savings will vary widely, the average annual property tax reduction in Los Angeles County is expected to be about $750. In Riverside County, it'll be around $1,200.

Homeowners who bought years ago will still see their property taxes increase 2% per year (since the assessed value is still below the market value). However for recent home buyers, with falling prices, the market value will likely be below the purchase price. These homeowners can appeal the assessment value - or as in this case, the assessors office may reduce the assessed value automatically.

A decline of $1,200 per year in Riverside suggests assessed values have fallen $120,000 on average.

Those tax breaks will go only to selected homeowners who bought their homes around the market's peak in 2005 and 2006. The Los Angeles County Assessor's office, for example, reviewed only properties purchased since July 1, 2004, and will be lowering taxes on 128,000 out of the 318,000 examined.This is both good news and bad news for homeowners. Imagine opening a letter from the assessors office saying your property taxes have decreased $1,200 per year - but that the value of your home has declined $120,000. Ouch!

Assessors in Orange, Riverside, San Bernardino and Ventura counties reviewed sales since Jan. 1, 2004, and say they expect to reduce taxes on about two-thirds of those homes.

My guess is the assessors office will have to review sales back to 2003 or even 2002 next year.

Saudi Arabia Plans to Increase Oil Production

by Calculated Risk on 6/22/2008 10:53:00 AM

Here is a story from Bloomberg on the "Oil Summit" in Saudi Arabia: Saudi Arabia Boosts Oil Supply, May Pump More Later

``Saudi Arabia is prepared and willing to produce additional barrels of crude above and beyond the 9.7 million barrels per day, which we plan to produce during the month of July, if demand for such quantities materializes and our customers tell us they are needed,'' [Saudi Oil Minister Ali al- Naimi] said.

Saudi Arabia's capacity will be 12.5 million barrels a day by the end of 2009 and may rise to 15 million after that if necessary, he said.

UK Housing: Starts Off 56%

by Calculated Risk on 6/22/2008 01:13:00 AM

From The Guardian: Number of new houses being built plummets nearly 60%

The National House Building Council, which has 20,000 registered house builders on its books, said there were 6,890 new starts in the private sector in May, compared with 15,713 this time last year. This represents a drop of 56%.And on house prices in the UK: HBOS predicts 9% fall in house prices and sales to halve

..

This news came on the same day as Halifax, the UK's biggest mortgage lender, announced that it would be raising its fixed rates on loans by half a percentage-point from today ... Homeowners who have more than 25% equity in their houses now face an increase on a two-year fixed-rate mortgage from 6.49 to 6.99%.

House prices will fall 9% this year, HBOS warned yesterday in its gloomiest prediction for the housing market since 1989.Just a reminder that the housing bust is

Saturday, June 21, 2008

Foreclosure Rage

by Calculated Risk on 6/21/2008 08:08:00 PM

I wonder if he has a demolition permit? (30 secs) Be careful what you buy!

BofA and the Dodd Bailout Bill

by Calculated Risk on 6/21/2008 08:07:00 PM

Peter Viles at the LA Times (L.A. Land blog) has the story: Did Bank of America write the Dodd bailout bill?

Update: I don't like the system, but I don't see a scandal here. Bank of America employees have given to almost all candidates, and almost legislation is written by lobbyists.

Non-Residential Investment: Multimerchandise shopping

by Calculated Risk on 6/21/2008 10:08:00 AM

The previous post discussed the incentives being offered by mall owners to marginal retailers. Move in incentives are common in retail (and frequently in commercial too), but according to the WSJ in the case of Steve & Barry's the incentives were essential:

Without these payments, the stores are barely profitable, if at all ...That shows the desperation of mall owners with vacancy rates rising rapidly.

Just like for residential, there was substantial overbuilding in multimerchandise shopping space in recent years.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows investment in multimerchandise shopping space starting in 1997 in current dollars (inflation adjusted Q1 2008). The circle shows the probable period of overinvestment.

It appears that $20 billion per year or so would be a normal level of investment. However, with the recent over investment, non-residential investment in multimerchandise shopping structures will probably fall below $20 billion per year for a few years.

Unfortunately the investment data for multimerchandise shopping is only available starting in 1997.