by Calculated Risk on 8/31/2007 06:23:00 PM

Friday, August 31, 2007

Honda: U.S. Auto Market Softening

From the WSJ: U.S. Auto Market Shows Signs Of Softening, Honda Official Says (hat tip jg)

The U.S. auto market is showing signs of softening ...A Reuters article puts the Honda estimate at 16 million.

"The initial dealer pulse from across the industry is that mix is a little bit soft," said John Mendel, executive vice president auto operations for Honda motor Co.'s U.S. sales arm.

Mr. Mendel ... said Honda expects U.S. sales for 2007 will range between 15.9 million to 16.3 million light vehicles.

Auto makers sold 16.56 million vehicles in 2006.

Asha Bangalore at Northern Trust suggests (hat tip Steve):

The “timeliest indicators” we think are weekly initial jobless claims, August nonfarm payrolls, August retail sales, the August ISM manufacturing survey, and August industrial production. Each of these reports will be published prior to the September 18 FOMC meeting.

Click on graph for larger image.

Click on graph for larger image.Graph from Northern Trust. Note: Scale doesn't start at zero to change monthly changes.

And Bangalore on auto sales (due Tuesday):

The CEO of AutoNation has indicated that his company’s sales have been suffering. Auto sales have dropped during each of the seven months of the year. The sales tally for August will be published on September 4.

Personal Income and Outlays

by Calculated Risk on 8/31/2007 03:40:00 PM

The BEA released the Personal Income and Outlays report for July this morning. At MarketWatch, Rex Nutting has an overview of the data: Inflation remains moderate in July. It is important to remember this is pre-turmoil data.

I want to focus on how the monthly data contributes to the quarterly BEA report.

You can use the monthly series to exactly calculate the quarterly change in PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next (this is a common misunderstanding). Instead, you have to average real PCE for all three months of a quarter, and then take the change from the average of the data for the three months of the preceding quarter.

So, for Q3, you would average real PCE for July, August and September, then divide by the average real PCE for April, May and June. Of course you need to annualize this rate (take it to the fourth power).

Once we have two months worth of data (after August is released) we can estimate the PCE contribution to the GDP report using the Two Month Method, see Estimating PCE Growth for Q2. The Two Month method is very accurate, and the correlation to the actual quarterly data is high (0.92).

With the release of the July report, we now have the first data point for Q3. To estimate the contribution to the quarterly growth in real PCE, we should look at the growth in real PCE from April to July, not June to July (as is common).

From April to July, the increase in real PCE spending was 1.6% annualized. Still sluggish, but not recessionary. Perhaps real consumer spending will pick up in August and September.

Bush's Subprime Plan

by Anonymous on 8/31/2007 01:14:00 PM

Color me underwhelmed.

According to the Wall Street Journal, the key components of the plan are:

Among the moves will be an administrative change to allow the Federal Housing Administration, which insures mortgages for low- and middle-income borrowers, to guarantee loans for delinquent borrowers. The change is intended to help borrowers who are at least 90 days behind in payments but still living in their homes avoid foreclosure; the guarantees help homeowners by allowing them to refinance at more favorable rates.What this looks like to me:

Mr. Bush also will ask Congress to suspend, for a limited period, an Internal Revenue Service provision that penalizes borrowers who refinance the terms of their mortgage to reduce the size of the loan or who lose their homes to foreclosure. And he will announce an initiative, to be led jointly by the Treasury and Housing and Urban Development departments, to identify people who are in danger of defaulting over the next two years and work with lenders, insurers and others to develop more favorable loan products for those borrowers.

1. Immediate FHA assistance for people who are already 90 days down. Does this mean "up to 90 days down," "at least 90 days down," or what? Waiting to offer refi assistance until borrowers are in the foreclosure process isn't likely to make them want to go find the friendly neighborhood loan officer to do an FHA refinance. And by then, they've got a big chunk of past-due payments (not to mention possibly a prepayment penalty) to roll into the new loan. However,

2. We can't offer more proactive assistance to those who look like they're ready to default but haven't gotten there yet, because apparently after all this time we still need some more task forces. I'm guessing that we're still working on how the "more favorable rates" become available when the FHA insurance premium has to be raised and investors aren't exactly crushing each other in the rush to buy these loans.

3. But if you've already lost your home to foreclosure or short sale, you might get a tax break. This will "keep people in their homes" by making it less expensive for them to give up their homes. Or something.

My view? FHA will be an important part of the process of trying to save as many subprime borrowers who want to keep their homes as we can save. Surprise. FHA is the traditional home of "disaster relief." But this is a bigger disaster than FHA can absorb.

The rest of Bush's plan seems to involve arm-twisting with lenders and Fannie Mae and Freddie Mac. That's already going on all over the place as we write here, and has been for some time. But our fearless leader has used the Friday before a long holiday weekend to make a big "market moving" announcement about it. There's news for you.

Bernanke: Housing, Housing Finance, and Monetary Policy

by Calculated Risk on 8/31/2007 10:00:00 AM

From Fed Chairman Ben Bernanke at Jackson Hole: Housing, Housing Finance, and Monetary Policy.

"It is not the responsibility of the Federal Reserve--nor would it be appropriate--to protect lenders and investors from the consequences of their financial decisions. But developments in financial markets can have broad economic effects felt by many outside the markets, and the Federal Reserve must take those effects into account when determining policy. In a statement issued simultaneously with the discount window announcement, the FOMC indicated that the deterioration in financial market conditions and the tightening of credit since its August 7 meeting had appreciably increased the downside risks to growth. In particular, the further tightening of credit conditions, if sustained, would increase the risk that the current weakness in housing could be deeper or more prolonged than previously expected, with possible adverse effects on consumer spending and the economy more generally.Excerpt on mortgage equity withdrawal and consumption:

The incoming data indicate that the economy continued to expand at a moderate pace into the summer, despite the sharp correction in the housing sector. However, in light of recent financial developments, economic data bearing on past months or quarters may be less useful than usual for our forecasts of economic activity and inflation. Consequently, we will pay particularly close attention to the timeliest indicators, as well as information gleaned from our business and banking contacts around the country. Inevitably, the uncertainty surrounding the outlook will be greater than normal, presenting a challenge to policymakers to manage the risks to their growth and price stability objectives. The Committee continues to monitor the situation and will act as needed to limit the adverse effects on the broader economy that may arise from the disruptions in financial markets."

emphasis added

"... housing may have indirect effects on economic activity, most notably by influencing consumer spending. With regard to household consumption, perhaps the most significant effect of recent developments in mortgage finance is that home equity, which was once a highly illiquid asset, has become instead quite liquid, the result of the development of home equity lines of credit and the relatively low cost of cash-out refinancing. Economic theory suggests that the greater liquidity of home equity should allow households to better smooth consumption over time. This smoothing in turn should reduce the dependence of their spending on current income, which, by limiting the power of conventional multiplier effects, should tend to increase macroeconomic stability and reduce the effects of a given change in the short-term interest rate. These inferences are supported by some empirical evidence.

On the other hand, the increased liquidity of home equity may lead consumer spending to respond more than in past years to changes in the values of their homes; some evidence does suggest that the correlation of consumption and house prices is higher in countries, like the United States, that have more sophisticated mortgage markets (Calza, Monacelli, and Stracca, 2007). Whether the development of home equity loans and easier mortgage refinancing has increased the magnitude of the real estate wealth effect--and if so, by how much--is a much-debated question that I will leave to another occasion."

About GSE Portfolio Caps

by Anonymous on 8/31/2007 08:26:00 AM

This issue of the GSE portfolio caps has been tossed around a lot lately. In the spirit of improving the quality of the discussions, I offer a simple version of what the deal is here. If you're new to UberNerdity, a primer on GSE MBS is here.

The GSEs can "provide liquidity" to the secondary mortgage market in two ways: they can buy loans outright for their own investment portfolios, which means they keep those loans, funded with their own money (raised through debt issues, generally), and earn the interest income from them, taking the credit risk as any investor does. Or, they can buy loans to pool for MBS issues. When they do that, outside investors buy the MBS, fund the loans, and earn the interest income. Because the GSEs guarantee their securities, they charge a guarantee fee to the lenders who sell them the loans, and they have the guarantee obligation left on their books while the MBS is outstanding. Occasionally, the loans that end up in the portfolio are the ones the GSEs bought out of those MBS pools in honor of their guarantee obligation.

Also, the GSEs buy two general types of loans: what we might call "inventory" and "flow." You will usually see the inventory stuff described as "bulk" purchases. That means the GSEs are buying loans, usually in a big chunk (a "bulk" deal), that the lenders already originated, using some guidelines that may not be exactly the same as what the GSEs require in their standard MBS programs. So these deals involve negotiation of pricing. But since the loans have already been originated, you negotiate over the exact pile of loans you have, not over some guidelines that might generate some unknown pile of loans in the future.

The flow business is the forward business. This is a matter of the GSEs publishing guidelines and putting out prices that allow lenders to originate new loans into a forward commitment. Clearly, for the GSEs and the lenders, this stuff is harder to price. You might see reference to "TBA" deals. That means the actual composition of a pool of loans is "to be announced." This is true "rep and warranty" business: the price is established based on the representation that the pool of loans that we end up with will follow all the published guidelines. (The "warranty" means you pay back some or all of that price if your representations were not true.)

As a general rule, the GSEs buy bulk for their portfolios and flow for their MBS programs. There isn't really a law about this, it's just the way they do business most efficiently. If you want to think about it in terms of their "liquidity" functions, they use their portfolios to liquify lender inventory, and their MBS business to liquify lender current production. Small banks and most non-bank mortgage companies don't have the capital to build up "inventory," so all of their business is flow. It's usually the big banks who accumulate "inventory," and either sell it in bulk to the GSEs or securitize it privately or sell it to some insurance company or hold it in their own portfolio, as the market and the bank's investment needs may warrant. Of course, for years now those "inventory" trades generally didn't go to the GSEs, they went into this private security market. A great deal of that ended badly.

It does not have to be that way, and in fact we saw Freddie announcing a few weeks ago that they were shifting some portfolio dollars from bulk to forward on Alt-A purchases. They were more concerned about the liquidity crunch at the level of current production than at the level of inventory. This required them to limit the forward Alt-A purchases to only those lenders from whom they have purchased bulk Alt-A deals in the past, because that offers some kind of reference for a forward commitment. It was a matter of saying, if you originate stuff that is sufficiently like the stuff you have sold us in the past, we will buy it on a forward basis at a predetermined price level. Without some kind of reference point like that, you've got a pig in a poke, and nobody rational can price such a thing in advance.

The portfolio caps for the GSEs are in place in an attempt to control their risk-taking by limiting the dollar amount of loans they can own outright. The caps do not limit what they can buy for their MBS programs: they can buy as much of that as they can 1) find investors for and 2) afford to guarantee.

The assumption has been, in many quarters, that if the GSEs are to provide substantial liquidity to the subprime or near-prime (say, refis of subprime loans that don't quite meet standard guidelines, often because the LTV is so high) markets, they would do so by portfolio purchases. These loans are not uniform and prime-quality like the usual stuff in the MBS program.

And, after all, the problem appears to be a lack of investor appetite for the stuff. If the GSEs bought it for their MBS programs, they would be able to sell the resulting securities only because they were offering that guarantee on those MBS that you don't get in the private issue market. At some level this means the GSEs would have to "price" the risk on loans that the private market has essentially said it cannot or will not price. Most of us are assuming that the GSEs would have to put a pretty steep G-fee on this stuff in order to pull that off. That, in turn, increases the interest rate on the loan, and you do get into that problem of how the new loan can be more affordable to the borrower than the old loan was at a certain point.

The options for the GSEs, then, are to buy for portfolio or buy for MBS. In terms of portfolio purchases, they have some room left to increase holdings up to their caps (they are both under their caps right now), but that's not, most people think, enough in dollar terms to really make headway with the liquidity problem. So one solution is to raise the caps so they can buy more. Another is for them to sell off some of what they have in portfolio to "make room" for these subprime or near-prime purchases.

We just looked yesterday at Freddie's Q02 report, which showed that its portfolio holdings are about 80% prime MBS and 20% "other" (subprime, Alt-A, and other higher-risk loans). As the idea is not to add more subprime or Alt-A paper to the market, you couldn't have them sell off the hinky stuff, so you'd be asking them to sell off some of the 80%.

I'm not sure I follow the logic, necessarily, of leaving the portfolio caps in place to control risk, and then forcing the agencies to rebalance these portfolios so that a higher percentage of their holdings is in the highest-risk classes. Personally, I think the only way this makes much sense is to limit such purchases to that "bulk" or "inventory" part of the business, precisely because it can be more accurately priced. And, of course, because that means originators can share some of the pain here: by "more accurately priced" I mean the GSEs can insist on a reasonable discount. They can free up dollars on lender balance sheets by taking the loans, but they don't have to do so at a profit to the lenders. We're talking liquidity injections here, not transferring bad pricing decisions from private lenders to the GSEs. You will, however, note that this means targeting the big banks and mortgage companies for "relief," not the little community banks and credit unions and so on who don't do bulk deals.

That leaves the flow or current production problem to be solved by the MBS programs, not the portfolios. This is what the GSEs mean when they talk about putting together new mortgage products for these distressed refis, for instance. These new products put a set of standard guidelines or underwriting practices on the table that lenders can originate to in current production. The struggle for everyone will be to put a price on it that makes investors, the GSEs, the lenders, and the borrowers come out ahead.

I will suggest that anyone who thinks the GSEs can do this for free is deluded. In order to fix the mess we're in, someone is going to be subsidizing something somewhere. That does not necessarily mean a direct taxpayer cash subsidy, at least not in immediate terms. But it may mean forcing the GSEs to underprice their risk, and if they do too much of that, the taxpayers will own the problem.

I don't have an answer for that, but I do suggest that those who are really freaked out over the raising of the portfolio cap issue think it through: that isn't necessarily worse than "rebalancing" the portfolios or having the GSEs issue securities at "below market" G-fees. Remember that "rebalancing" the portfolios would require the GSEs to sell off their good stuff into a market that isn't offering top dollar for anything, good, bad, or indifferent.

MMI: It's Official

by Anonymous on 8/31/2007 06:57:00 AM

There's nothing like reading the New York Times' version of an anonymous White House official's version of what Bush is going to say but has not yet said about subprime lending at 6:00 a.m. to really start your day off. Oh, look, there's a white rabbit!

Seriously. Get this:

Administration officials, who asked not to be identified, briefed a handful of news organizations on the proposals to be announced by Mr. Bush at an appearance in the White House Rose Garden on Friday morning.White House flunkies require anonymity to discuss Bush's "announcement on housing"? There could be, like, reprisals if they used their names? They're like, what, bloggers?

The main objective of the package, one senior official said, is not to affect the stock markets but to help low-income homeowners, many of them concentrated in certain neighborhoods in several distressed areas of the country, such as Ohio and Michigan.

“The primary focus is to help individuals who have an opportunity to stay in their homes to stay in their homes,” this official said. “The subprime mortgage situation is having a crushing effect on a lot of communities right now.”

Despite the assertion that affecting the markets is not the goal, one administration official said Thursday evening that concern about Wall Street’s reaction did affect the timing of the briefing. He said there was a fear that if the White House announced in the morning that Mr. Bush would be making an announcement on housing, there could be confusion as buyers and sellers of mortgage securities guessed what the announcement would be.

But secondarily, this official said, helping homeowners keep their homes and refinance or renegotiate the terms of the mortgages could have a stabilizing effect on the financial institutions that have these mortgages in their portfolios, and help them write down the value of the mortgages or sell them off at a loss.

“You can’t solve the problems in the financial markets unless you can make some progress on the retail end of it,” said this official. “This is also a step to get banks to start loaning again.”

It's better for the markets if a muddled version goes out Thursday night than if we just get the actual version during trading hours? Is this really what these people think the "efficient markets" theory means? Are we all really confident that the MBS market won't still be forced to "guess" what this means after the announcement?

And what if this version isn't, actually, muddled? What if Bush really is going to propose a mechanism for lenders to refinance loans that can be sold at a loss? And what if that "stabilizes" things because heretofore banks with lending portfolios have been unable to make refinance loans at a loss, but once the President tells them they can, they'll lend more? This could, like, totally revolutionize Econ 101.

Fortunately, I've already got my diploma, and they can't make me take Econ 101 again. I think I will just wait for the, uh, official announcement before attempting to post anything more on the subject. I wouldn't want to move the MBS market in the wrong direction or anything.

Thursday, August 30, 2007

Moody's president sees unprecedented illiquidity

by Calculated Risk on 8/30/2007 08:45:00 PM

From Reuters: Moody's president sees unprecedented illiquidity (hat tip Viv)

The credit market is experiencing an unprecedented loss of confidence due to the lack of transparency over where exposures lie rather than underlying credit quality problems, Moody's Investors Service President Brian Clarkson said on Thursday.As an aside, watch for layoffs on Wall Street next week:

"I've been in the marketplace for 20 years ... what we're experiencing is an extreme lack of confidence and lack of liquidity. I have never seen this before," Clarkson told Reuters in an interview. "A lot of it has to do with transparency: it's not clear who owns what."

"Everyone in New York is expecting to hear about more job cuts in September. There'll be a wave of them."

Housing Bottoms: Residential Investment vs. Existing Home Prices

by Calculated Risk on 8/30/2007 05:30:00 PM

UPDATE: Changed 2nd graph to make the price change clearer (hopefully). Original 2nd graph is at the bottom. Nominal prices in San Diego fell a cumulative 18% in terms in the early '90s.

In an earlier post, I presented some graphs based on the new Goldman Sachs housing forecast. One of the graphs, reproduced below, showed a possible bottom for residential investment (RI) in Q4 2008. Click on graph for larger image.

Click on graph for larger image.

To this graph, I added a caveat:

NOTE: Please don't confuse a bottom in RI, with a bottom in housing prices. During previous housing busts, existing home prices continued to fall long after residential investment bottomed.To clarify this statement, here is a graph showing prices vs. residential investment for the early '90s housing bust. The prices are based on the S&P/Case-Shiller price indices for the U.S. and San Diego. These are nominal prices; for real prices the time lag between the bottom for RI and existing prices would be even longer.

In the '90s housing bust, residential investment (as a percent of GDP) bottomed in Q1 1991.

In the '90s housing bust, residential investment (as a percent of GDP) bottomed in Q1 1991.The bottom for nominal U.S. house prices was in February 1994, about 3 years after the bottom for RI. In real terms (not shown) the bottom was in 1996.

The bottom for nominal San Diego prices was in March 1996, five years after the bottom in RI.

Note: Original graph.

Note: Original graph.This is the typical pattern for housing busts, and it is because prices tend to be sticky and don't adjust immediately to the market clearing price. It's important to remember that a bottom in RI will probably precede a bottom in existing home prices by a few years.

Freddie Mac Q02 Report

by Anonymous on 8/30/2007 03:50:00 PM

Commercial paper market still shrinking

by Calculated Risk on 8/30/2007 01:28:00 PM

From Rex Nutting at MarketWatch: Commercial paper market still shrinking

Outstanding commercial paper in the U.S. financial system dropped sharply for a third straight week, indicating that a severe credit crunch has not eased in the market that supplies most large companies with operating funds.

Outstanding paper fell by $62.8 billion, or 3.1%, in the week ending Wednesday to $1.98 trillion, bringing the total decline in the past three weeks to $244 billion, or 11%, the Federal Reserve reported Wednesday.

Commercial paper consists of short-term promissory notes issued by corporations to raise cash for their operational needs. Most of the paper has maturities between 30 days and 270 days; anything longer than that requires a registration statement with the Securities and Exchange Commission.

An estimated $1 trillion in commercial paper will mature in the next few months. ...

...

The declines in outstanding paper have been felt strongest in the asset-backed portion of the market, which represents about half of all commercial paper. These securities are backed by assets such as credit-card receivables or mortgages. In the latest week, asset-backed paper fell by $59.4 billion, or 5.6%. In the past three weeks, this kind of paper has fallen by $184.9 billion, or 15.6%.

Comments on Goldman Sachs Housing Forecast

by Calculated Risk on 8/30/2007 12:12:00 PM

Last night, I posted the current Goldman Sachs housing forecast.

A frequently asked question is why starts are forecast to be higher than new home sales. New Home sales come from a subset of housing starts. Housing starts also include owner built units, rental apartments, and other units that would still not be included, if sold, in the New Home sales report.

The new home sales estimate reported by the Census Bureau includes only new single-family residential structures that include both the structure and the land. The Census Bureau defines single-family homes as either fully detached structures or certain attached homes with an unbroken ground-to-roof separating wall. This definition includes some condominiums (side by side units), but does not include condominium units with another unit above or below. Starts for large multi-story condominium projects are included in the housing starts report, but sales and inventory are not included in the New Home sales report.

Just remember that new home sales come from a subset of housing starts. Working through the numbers, the Goldman Sachs forecast for starts to fall to 1.1 million units SAAR, and new home sales to fall to 0.650 million units SAAR is logically consistent, and consistent with historical data.

The following two graphs show the Goldman Sachs forecast for residential investment (RI) and new home sales. Click on graph for larger image.

Click on graph for larger image.

The GS forecast is given as a percent change in RI. This graph converts that forecast into RI as a percent of GDP (with some added assumptions about GDP).

The GS forecast is for another significant downturn in residential investment, and their forecast takes RI as a percent of GDP close to or below 4%, similar to previous housing downturns. GS is currently forecasting RI to bottom in Q4 '08. This is similar to my current view.

NOTE: Please don't confuse a bottom in RI, with a bottom in housing prices. During previous housing busts, existing home prices continued to fall long after residential investment bottomed.  The second graph shows Goldman Sachs' new home sales forecast through 2008. GS shows sales bottoming at 650K in Q1 and Q2 2008, with a very modest increase towards the end of '08.

The second graph shows Goldman Sachs' new home sales forecast through 2008. GS shows sales bottoming at 650K in Q1 and Q2 2008, with a very modest increase towards the end of '08.

No wonder the home builders will be meeting with Bernanke next week. See: Hovnanian CEO says risk of recession heightened. If these forecasts are accurate, these two graphs spell doom for some home builders.

To see the Goldman Sachs forecasts for prices and existing home sales, see table at bottom of Goldman Sachs Housing Forecast.

Loan Modification Data

by Anonymous on 8/30/2007 11:48:00 AM

Credit Suisse's report on the August remittance data for the ABX basket of mortgage securities (no publically available link) includes information, for the first time as far as I know, about loan modifications.

Of the 80 deals surveyed, only 42 include modification information in the remittance reports. That does not necessarily mean there were no mods in the 38 deals; it just means their deal documents do not require that this information be included in the remittance reports. That may change, as more and more servicers are providing this information voluntarily.

For the 42 deals reporting modification activity, 47 loans from 10 different deals were modified. One deal, GSA06HE3, accounted for 21 of the total 47. Of those 21, 20 involved a rate reduction and 11 involved capitalization of principal and interest (past due payments). The average rate reduction was 2.20%. (I note that 2/28 ARMs increase at least 2.00% at their first adjustment.) CS notes that 5 of these loans actually ended up with an increase in the monthly payment (because capitalization offset the rate reduction).

The remaining 9 deals reporting mods involved 4 reporting 1 mod, 1 reporting 2, 2 reporting 3, 1 reporting 5, and 1 reporting 9.

CS does not speculate on why the Goldman deal reports so many more mods than the others. I, on the other hand, speculate that it has to do with the clarity on the subject provided in the prospectus for that deal:

Each servicer will be required to act with respect to mortgage loans serviced by it that are in default, or as to which default is reasonably foreseeable, in accordance with procedures set forth in the applicable servicing agreement. These procedures may, among other things, result in (i) foreclosing on the mortgage loan, (ii) accepting the deed to the related mortgaged property in lieu of foreclosure, (iii) granting the mortgagor under the mortgage loan a modification or forbearance, which may consist of waiving, modifying or varying any term of such mortgage loan (including modifications that would change the mortgage interest rate, forgive the payment of principal or interest, or extend the final maturity date of such mortgage loan) or (iv)accepting payment from the borrower of an amount less than the principal balance of the mortgage loan in final satisfaction of the mortgage loan. These procedures are intended to maximize recoveries on a net present value basis on these mortgage loans.The claim has been bandied about lately that the servicing agreements for these deals just don't permit mods. That is clearly false as a generalization. Some obviously do. I see nothing in this prospectus that limits workouts (any of them listed here) to some stated percent of the deal balance.

However, it is clear that some deals do have language that restricts modifications, or at least is sufficiently ambiguous that servicers are unable to process with them without investor approval of the workout. Therefore, I for one proceed with great caution in looking at reported numbers on modifications for any sort of "trend" or reflection of the broader market of RMBS outside of the ABX buckets. It is likely to be a matter of "those who can, do, and those who can't, don't," and no one to my knowledge has attempted yet to quantify precisely how many can and how many can't. Given that just over half of the ABX deals report on modifications, I'd think it reasonable to speculate that at least half do allow mods, but that is speculation in the absence of digging through all those prospectuses, and I don't actually care about all of this that much.

OFHEO: House Prices Slow

by Calculated Risk on 8/30/2007 10:01:00 AM

OFHEO House Price Index Shows Smallest Quarterly Increase Since 1994

U.S. home prices increased only slightly in the second quarter of 2007 according to the OFHEO House Price Index (HPI). The HPI, which is based on data from sales and refinance transactions, was 0.1 percent higher in the second quarter than in the first quarter of 2007. This is below the revised growth rate of 0.6 percent for the previous quarter and the lowest since the fourth quarter of 1994. Prices in the second quarter of 2007 were 3.2 percent higher than they were in the same quarter of 2006, the lowest annual price change since the 1996-97 period.More later.

OFHEO’s purchase-only index, based solely on purchase price data, indicates less appreciation for U.S. houses over the past year than does the all transactions HPI. The purchase-only index increased 2.6 percent between the second quarter of 2006 and the second quarter of 2007, compared with 3.2 percent for the HPI. However, for the second quarter, the purchase-only index increase was slightly higher at 0.5 percent (seasonally-adjusted).

The figures were released today by OFHEO Director James B. Lockhart as part of OFHEO’s quarterly report analyzing housing price appreciation trends. “House prices were basically flat in the second quarter despite tightening credit policies, rising foreclosure rates, and weakening buyer sentiment,” said Lockhart. “Significant price declines appear localized in areas with weak economies or where price increases were particularly dramatic during the housing boom.”

The data in this release only include price information through June. To the extent that recent mortgage market instability may have affected housing demand and prices, those effects would be evident in OFHEO’s next HPI release.

Stories From the Credit Crunch

by Anonymous on 8/30/2007 09:25:00 AM

The LAT reports: "Sub-prime borrowers not alone" (why they are still hyphenated in the LAT style manual after all these years is not clear):

It's not just sub-prime borrowers who are having trouble getting affordable home loans.I do not wish to be insulting or injurious, but I think it may be a while before non-owner-occupied jumbo IO refis in California get back to that 5.50% thing.

Because mortgage investors stung by growing defaults in the sub-prime sector are shunning all but the most traditional loans, creditworthy borrowers are getting hammered if they want mortgages with payment options or the "jumbo" loans used routinely in Southern California and other high-priced home markets.

If you get such a loan, you'll pay a higher rate than before. And to add insult to injury, it's taking more time for all mortgages to get approved and funded, market experts say.

Rancho Palos Verdes marketing consultant Steve Ammons discovered the new jumbo reality after he began shopping for a mortgage on a Manhattan Beach home that he and his daughter own and rent out.

Ammons and his daughter have credit scores of 750 to 760, he said Wednesday, making them prime borrowers, the most creditworthy. What's more, the house is worth an estimated $1.6 million and has a current $650,000 mortgage, so there is plenty of equity to serve as a cushion for the lender.

Ammons is looking for a 30-year, fixed-rate mortgage, but with a twist -- the option to pay only the interest on the loan during the first 10 years. Such loans have been widely used by landlords seeking to maximize their cash flows. Ammons said a jumbo loan with an interest-only option that he took out just last year on another rental property had an interest rate of 5.5%.

But the story was different this time: A loan officer at Washington Mutual Inc. quoted him a rate of 9.75%, saying that the lender "had to charge such high rates so that they could sell off the loans," said Ammons, who has since put off refinancing.

"It's rough out there," said Doug Duncan, chief economist for the Mortgage Bankers Assn. . . .

San Diego mortgage banker John Robbins, chairman of the national mortgage bankers group, said he saw hope for the jumbo loan market's recovery. But he said borrowers such as Ammons were going to "have to be patient for a month or two."

"This market is going to come back," Robbins said. "For a gentleman like this with a lot of equity in his house, just trying to stabilize his mortgage payments, I don't think help is too far away."

Wednesday, August 29, 2007

Goldman Sachs Housing Forecast

by Calculated Risk on 8/29/2007 08:08:00 PM

The following is excerpted with permission from a Goldman Sachs research note on housing: Home Price Declines: Accelerating and Around for a While

Excerpts:

... we expect housing activity to continue to decline as:The following table shows the GS forecast for key housing indicators - Starts, Prices, New and existing home sales, and change in Residential Investment (RI) - for 2007 and 2008.

Nonconforming mortgage rates are rising and credit is being rationed. Mortgage rates for subprime loans, indeed for all loans that Fannie Mae and Freddie Mac will not purchase, have risen sharply since the beginning of July. Along with this price increase, credit is being rationed as many loans that previously would have occurred are no longer being made. The reduction in credit availability will adversely affect the demand for housing.

Substantial excess supply remains. Perhaps most tellingly, in the second quarter the homeowner vacancy rate was a high 2.6%, far above its long-term average and only slightly below the record level of the first quarter. Furthermore, measures of inventories of new and existing homes remain high, both with nearly 8 months of supply at current sales rates. This excess inventory will require time to be worked off, and while this is occurring will serve as a disincentive to new construction.

Residential investment as a share of GDP is still high. A substantial fall has already occurred, with the share of output devoted to it falling from a peak of 6.3% to 4.9%. But that 4.9% is still above the 4.6% average of the last 30 years and well above lows reached during housing downturns in the early 1980s and 1990s when the share dipped below 3.5%.

Foreclosure rates are increasing. Subprime and Alt-A loans originated over the last several years often called for unrealistic mortgage payments relative to the borrower’s income once mortgage rates reset to higher levels. As these resets have started occurring, delinquency and foreclosure rates on these loans have increased. If even more of these homes enter foreclosure, as appears likely, they will add to the inventory problem outlined above.

Case Shiller | Home Sales | Housing Starts | Real |

| |||

|

| % change, | millions, | millions, | Residential |

| |

|

| end of | annualized | annualized | Investment |

| |

|

| year | New | Existing | Total | % chg |

|

|

|

|

|

|

|

|

|

| 2006 | 3.2 | 1.05 | 6.51 | 1.81 | -4.6 |

|

| 2007 | -7 | 0.81 | 5.77 | 1.40 | -14.7 |

|

| 2008 | -7 | 0.67 | 4.90 | 1.14 | -13.3 |

|

|

|

|

|

|

|

|

|

| 2006Q1 | n.a. | 1.13 | 6.86 | 2.13 | -0.7 |

|

| Q2 | n.a. | 1.09 | 6.63 | 1.86 | -11.7 |

|

| Q3 | n.a. | 0.99 | 6.29 | 1.70 | -20.4 |

|

| Q4 | n.a. | 0.99 | 6.26 | 1.55 | -17.2 |

|

| 2007Q1 | n.a. | 0.85 | 6.42 | 1.46 | -16.3 |

|

| Q2 | n.a. | 0.88 | 5.91 | 1.47 | -9.2 |

|

| Q3 | n.a. | 0.80 | 5.50 | 1.43 | -10.0 |

|

| Q4 | n.a. | 0.70 | 5.25 | 1.25 | -15.0 |

|

| 2008Q1 | n.a. | 0.65 | 5.00 | 1.10 | -20.0 |

|

| Q2 | n.a. | 0.65 | 4.90 | 1.10 | -15.0 |

|

| Q3 | n.a. | 0.68 | 4.80 | 1.15 | -5.0 |

|

| Q4 | n.a. | 0.70 | 4.90 | 1.23 | 0.0 | |

Note: Excerpted with permission.

Notice that GS expects the decline in residential investment to accelerate again. This is exactly what we've been discussing. Also note that GS expects housing starts to decline to 1.1 million seasonally adjusted annual rate (SAAR), existing home sales to fall to 4.8 million SAAR, and New Home sales to 650K (SAAR).

Goldman Sachs on Housing

by Calculated Risk on 8/29/2007 06:53:00 PM

In a research note today (no public link), GS forecast house prices to decline 7% in 2007, and another 7% in 2008 (based on the Case-Shiller index). They believe the OFHEO index will show smaller price declines.

In addition, GS forecasts New Home sales to drop to 650K in Q1 '08, at a seasonally adjusted annual rate (SAAR). This is even below the BofA forecast of 700K for later this year.

For existing homes, GS forecasts 5.25 million SAAR in Q4 '07 and a lower rate in '08.

I'll try to get permission to excerpt from the research note.

Bernanke writes to Schumer

by Calculated Risk on 8/29/2007 03:39:00 PM

Text from the WSJ:

The Honorable Charles E. Schumer

United States Senate

Washington, D.C. 20510

Dear Senator:

Thank you for your recent letters of August 8 and 22, in which you express concern about the potential effects of volatility in financial markets and the tightening of credit conditions on homebuyers, consumers, and the economy as a whole.

I want to assure you that the Federal Reserve, in cooperation with other federal agencies, is closely monitoring developments in financial markets. As you recognized, the Federal Reserve has also taken steps to increase liquidity in the markets. In particular, our changes to our discount window program are designed to assure depositories of the availability of a backstop source of liquidity so that concerns about funding do not constrain them from extending credit and making markets. Also, the Federal Open Market Committee has stated that it is monitoring the situation and is prepared to act as needed to mitigate the adverse effects on the economy arising from the disruptions in financial markets.

I share your concern about the potential impact of scheduled payment resets on homeowners with variable-rate subprime mortgages. Over the next several years, many such homeowners will face significantly higher monthly payments and, consequently, an increased risk of losing their homes to forced sale or foreclosure. The federal banking regulators have encouraged banks and thrifts to work actively with troubled borrowers to modify loans or to refinance as needed to avoid default or foreclosure and have jointly issued guidances to address underwriting and disclosure practices related to subprime mortgage lending.

The twelve Federal Reserve Banks around the country are working closely with community and industry groups dedicated to reducing the risks of foreclosure and financial distress among homebuyers. The Board is also engaged in these issues; for example, Governor Randall Kroszner serves as the Federal Reserve’s representative on the board of directors of NeighborWorks America, which has a program to encourage borrowers facing mortgage payment difficulties to seek help by making early contact with their lenders, servicers, or trusted counselors. And as I noted in my testimony in July, in order to strengthen consumer protections, the Federal Reserve Board is currently undertaking a comprehensive review of the rules regarding loans subject to the Home Owner Equity Protection Act as well as some rules pertaining to mortgage-related disclosures under the Truth in Lending Act.

It might be worth considering at this juncture whether the private and public sectors, separately or in collaboration, could help the situation by developing a broader range of mortgage products which are appropriate for low-and moderate-income borrowers, including those seeking to refinance. Such products could be designed to avoid or mitigate the risk of payment shock and to be more transparent with respect to their terms. They might also contain features to improve affordability, such as variable maturities or shared-appreciation provisions for example. One public agency with considerable experience in providing home financing for low-and moderate-income borrowers is the Federal Housing Administration (FHA). The Congress might wish to consider FHA reforms that allow the agency more flexibility to design new products and to collaborate with the private sector in facilitating the refinancing of creditworthy subprime borrowers facing large resets.

As you note, the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac are currently assisting in subprime refinancings. However, the GSEs’ charters limit their ability to take on higher-risk mortgages and their programs are relevant only to a relatively small share of subprime borrowers. The GSEs should be encouraged to provide products for subprime borrowers to the extent permitted by their charters. The current caps on GSE portfolios–which were imposed for safety and soundness reasons-need not be lifted to allow them to accommodate new borrowers. Currently, the GSE portfolios include substantial holdings of GSE-guaranteed mortgage products, which are easily placed in the private secondary market even under current conditions. Thus, the GSEs could readily sell these securities to make space for new mortgages if they wished to do so. Policymakers may also want to encourage the GSEs to increase their mortgage securitization efforts, which are not constrained by their portfolio caps.

We will continue to keep the Congress informed of developments in the subprime markets and in the credit markets more generally. As you know, Federal Reserve governors and staff have made numerous appearances before the Congress and in other forums on subprime-related issues. Board staff members have continued to brief members of Congressional staffs on these matters. Board staff members are also assisting the Government Accountability Office in the report that they are preparing that will provide a comprehensive review of developments in the subprime mortgage market.

Again, thank you for your interest and please be assured that we are following these issues closely.

Sincerely,

Ben S. Bernanke

Non-Agency Mortgage Market: "Worst Ever"

by Calculated Risk on 8/29/2007 02:06:00 PM

From Bloomberg: Non-Agency Mortgage Market Is the Worst Ever, Wakefield Says (hat tip Brian). A few excerpts:

K. Terrence Wakefield ... comments on the home-loan market. Wakefield is a former Salomon Brothers executive ...These is no returning to the insanity of the last few years.

...

On the market for U.S. mortgages not expected to be packaged into bonds guaranteed by government-chartered companies Fannie Mae and Freddie Mac:

"This is unquestionably the worst it's been. I've never seen a secondary market, since it was founded back in the late 1970s, where you couldn't sell loans. Where there was no bid."

On the future for bonds without guarantees from government-linked entities:

"I'm not suggesting the non-agency mortgage-backed securities market is dead. It will resuscitate but under a very different set of rules, because the rules of the past do not work."

On underwriting:

"All of these practices that are imprudent -- such as stated income loans where you'll lend somebody 95 percent of a property's value without lifting a finger to verify they can pay you back -- that's over. And that was a big piece of the business over the last couple of year."

"I would say 30 to 40 percent of the business done in the last couple of years was done under imprudent lending standards. I just see no circumstance in which those types of practices return."

Effective Fed Funds Rate

by Calculated Risk on 8/29/2007 12:05:00 PM

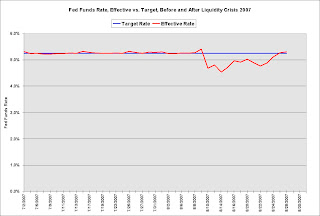

For about two weeks this month, the Fed allowed the effective Fed Funds rate to drift below the target rate. The effective rate is now back to the target rate. Click on graph for larger image.

Click on graph for larger image.

These two graphs compare the effective Fed Funds rate vs. the target rate for the recent liquidity crisis, and for 9/11/2001.

The scales are the same on both graphs (2 months and 0% to 6% on the y-axis). Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Some people have suggested this has been a "stealth" rate cut by the Fed. If it was, it is over.

Note: According to Fed President Poole, the Fed will only cut rates in September if there is clear evidence that the economy is slowing (looking at employment, retail sales and industrial production). Right now the market expectations for a Fed rate cut in September are pretty high (see Cleveland Fed: Fed Funds Rate Predictions).

This does raise the question: Is the worst of the liquidity crisis over? Note: it is important to distinguish between the ongoing credit crunch and the recent liquidity crisis. The credit crunch is far from over.

Weiling About Modifications, Again

by Anonymous on 8/29/2007 11:02:00 AM

Bloomberg's Jonathan Weil is a menace to society.

Last time I bothered to read any of his hysterical Emily Latella-style ravings on the subject, he was completely missing the point about the accounting rules involved in the "modification problem," but making up for his ignorance in inflammatory rhetoric.

He's at it again.

Aug. 29 (Bloomberg) -- It's bad enough when a company's outside auditor is a pushover for management. Equally galling would be for the auditor to try telling management how to run the company. Yet that's what U.S. Senator Charles Schumer has asked the Big Four accounting firms to do at the subprime lenders they audit, pronto.Schumer, just like the SEC, is telling auditors that they should stop telling their clients that accounting rules forbid modifications of defaulting and soon-to-default loans in securitizations, because the SEC and FASB have determined that this does not violate accounting rules.

``One of the most promising solutions to the anticipated foreclosure crisis is the voluntary modification by lenders of existing unsustainable subprime loans,'' Schumer, a New York Democrat, said in an Aug. 23 letter to the firms' top executives.

The chairman of Congress's Joint Economic Committee then called on the firms to ``assist this country's mortgage crisis'' and ``urge your clients to do their part to keep our housing markets afloat, by modifying subprime loans that are at risk of default.''

In so doing, Subprime Chuck made a blithering fool of himself, though he probably doesn't realize why.

Weil then spends much ink assuming that we're talking about lenders' balance sheet loans, and waxing horrified over the idea that an accounting firm might give advice about accounting rules. It all ends up involving apple pie, somehow.

I have no idea why Weil is so spastic on the subject of accounting rules. Maybe he had a mean accounting teacher in the fourth grade who scarred him for life. But of all the criticisms of Schumer I've heard recently, I must say this is the most clearly lunatic.