by Anonymous on 6/30/2007 12:00:00 PM

Saturday, June 30, 2007

Saturday Rock Blogging: Scenes From a Brookstreet Investors' Meeting

Here are the lyrics, pure and unadulterated. Certainly I don't possess the talent to improve on them:

If you didn't care what happened to me,

And I didn't care for you

We would zig zag our way through the boredom and pain

Occasionally glancing up through the rain

Wondering which of the buggers to blame

And watching for pigs on the wing.

You know that I care what happens to you

And I know that you care for me

So I don't feel alone

Of the weight of the stone

Now that I've found somewhere safe

To bury my bone

And any fool knows a dog needs a home

A shelter from pigs on the wing.

Brookstreet Update III: The Marks Speak

by Anonymous on 6/30/2007 10:46:00 AM

No, no, not the marks to market. The marks to whom Brookstreet sold inverse floaters, according to the OC Register:

"Those investments are pretty involved and sophisticated," said Wayne Willer, a Brookstreet client in Galena, Ill. "And I probably got involved in something I shouldn't have."

"I have no idea what this stuff is," said H.H. Hartmann, a southern Illinois resident who invested $150,000 in Brookstreet CMOs. Nonetheless, when Brookstreet sent him a two-page list of warnings about CMOs this spring, he did what the brokerage asked: He initialed each disclosure and mailed it back.

"(Brokers) kept telling me 'You're going to make money,' " said Gary Stephens, a Brookstreet investor in Missouri. When his monthly statements showed his CMOs declining in value, Stephens said, brokers told him "there was more money there than the (statement) showed."

(risk capital, I'm not sure we can take any more of this today . . . but thanks . . .)

Brookstreet Update II: "A Notional Pricing Disparity"

by Anonymous on 6/30/2007 09:55:00 AM

Lord help us. We're beginning to get some detail on just what Brookstreet's clients were buying. From the OC Register:

The securities, called Collateralized Mortgage Obligations, are backed by pools of residential mortgages. Most CMOs are safe, paying investors principal and interest drawn from thousands of mortgages.

But 30 Brookstreet CMOs reviewed by the Register were more complex than most CMOs. Their structures expose investors to losing or gaining money following tiny fluctuations in interest rates. As such, they are difficult to value. Most are "interest-only strips," which pay investors the interest stream but no principal from mortgages.

Brooks said the accounts collapsed because the clearing firm, a subsidiary of Fidelity Investments, used what are called "notional values" to price the CMOs. Those values plummeted as confidence plunged in mortgage-backed securities to subprime home loans.

"We never had a performance issue," Brooks said of the CMOs. "We had a notional pricing disparity."

These jokers were selling IO strips to retail investors?

For those of you playing along at home, here's a quick definition of the IO strip (and the yin to its yang, the PO strip) from SIFMA:

Principal-Only (PO) Securities.

Some mortgage securities are created so that investors receive only principal payments generated by the underlying collateral. These Principal-Only (PO) securities may be created directly from mortgage pass-through securities, or they may be tranches in a CMO. In purchasing a PO security, investors pay a price deeply discounted from the face value and ultimately receive the entire face value through scheduled payments and prepayments.

The market values of POs are extremely sensitive to prepayment rates and therefore interest rates. If interest rates are falling and prepayments accelerate, the value of the PO will increase. On the other hand, if rates rise and prepayments slow, the value of the PO will drop. A companion tranche structured as a PO is called a “Super PO.”

Interest-Only (IO) Securities.

Separating principal payments to create PO mortgage securities necessarily involves the creation of Interest-Only (IO) securities. CMOs that have PO tranches will therefore also have IO tranches. IO securities are sold at a deep discount to their “notional” principal amount, namely the principal balance used to calculate the amount of interest due. They have no face or par value. As the notional principal amortizes and prepays, the IO cash flow declines.

Unlike POs, IOs increase in value when interest rates rise and prepayment rates slow; consequently, they are often used to “hedge” portfolios against interest rate risk. IO investors should be mindful that if prepayment rates are high, they may actually receive less cash back than they initially invested.

Issue number one: all IOs have a "notional value" by definition. This has exactly jack to do with sinister manipulation of pricing by some nefarious model. The "notional value" of an IO strip will change, just as the face value of a PO strip will change, as payments and prepayments of principal are made on the underlying mortgage loans.

The OC Register story does not tell us what the vintage was of these CMOs, but I'm sure readers of this blog can imagine that IO strips of mortgage-backed securities originated in the period from about 2002 to last quarter had pretty darned fast prepayment speeds. Us insiders call that a "refi boom." A "refi boom" is one of those things in which buying IO strips can bite you in the ass. In any case, while there's a lot of rocket science in the CMO business, calculating the notional balance of an IO strip isn't all that hard: original notional balance minus prepayments of principal equals less notional balance for you to earn interest payments on. Your problem in this circumstance is not that the balance is "notional."

That is why these things are known as sophisticated hedge vehicles and are never, ever sold to retail investors on margin. Unless, apparently, you're Brookstreet. After all, it's probably quite true that they "never had a performance issue." You do not lose your shirt on an IO strip because of principal losses. You lose your shirt because enough of those underlying loans are high-quality enough (or enough refi lenders are low-standard enough) that the damned things prepay.

Brooks said clients who paid the full price for their CMOs – and other financial products – still have money in their accounts, which will accompany his former brokers to whatever new jobs they get.

What?

SEC filings said Brookstreet managed $571 million for 3,644 clients.

Although he served as Brookstreet's president, Brooks said Friday he was not responsible for overseeing the company's trades, which relied on a network of 650 independent brokers nationwide.

In March 2005, the National Association of Securities Dealers suspended Brooks' securities license for two years for inadequate supervision of trades. Last week, Brooks' license was suspended again, this time for 60 days, because of failures in record keeping.

That must be why it's all the clearing firm's fault.

(thanks again, risk capital!)

Brookstreet Update: It Depends On What You Mean By "Lunch"

by Anonymous on 6/30/2007 07:39:00 AM

Remember Brookstreet, the brokerage whose overleveraged retail clients discovered the magic of mark to market a while ago? Evidently the SEC is interested in exactly how that went down. Stories are being, well, not exactly stuck to yet. They're in the works:

[Stanley Brooks] said he is still trying to sort out how the firm imploded. "It's so complicated that the smartest guys in the industry got their lunch handed to them," he said. "It was a perfect storm."

It was also, apparently, a dark and stormy night, during which the Ronco Pocket Cliché Generator began to malfunction. I suppose the industry having its lunch handed to it is better than competitors trying to eat each others' . . . models. Ahem.

Brooks, who founded the family-owned firm in 1990, said the markdowns were executed by its clearing firm, the National Financial unit of Fidelity Investments, the biggest U.S. mutual funds company.

Brooks said "the pricing services [employed by National Financial] issued theoretical pricing [on the CMOs] that apparently wasn't accurate." But he said it was unclear if the firm is planning litigation in the wake of the collapse.

"We are not responsible," Fidelity spokesman Adam Banker said. "While we won't comment on an individual client, I can tell you certain contractual provisions apply when investors borrow on margin purchased securities.

"National Financial has clear margin agreements in place with its clients and uses reputable firms to price securities held in brokerage accounts."

One New York lawyer, who asked not to be named, said he may be retained by one Brookstreet client who lost $1.5 million and is considering litigation.

So Mr. Brooks has settled on the "theoretical pricing" story. One wonders: did Mr. Brooks and his merry band of brokers have any idea that this pricing was "theoretical" before they sold this stuff to clients with 90% borrowed money? Was there some observable market price generated by frequent trades in the asset in question in May that suddenly became "theoretical" in June? Are we to understand that National Financial never marked those positions on the way up?

So now we know: it's "mark to market" during the boom, but it's "mark to model" in the bust. I am eager to find out whether Brookstreet's retail investors get treated with the same contempt certain parties have been heaping on hapless first-time homebuyers who took out 100% toxic loans they didn't understand on the mistaken belief that house prices only go up. I mean, if you want fun, just walk into any group of mortgage-market participants and mention "fiduciary requirements." You will be told in no uncertain terms that your average unsophisticated would-be homeowner carries all the responsibility for doing the due diligence, and that the mortgage brokers are just here to take orders.

If you're an "investor" with $1.5 million to blow? The SEC will get right on it.

(hat tip, risk capital!)

Friday, June 29, 2007

Estimating PCE Growth for Q2

by Calculated Risk on 6/29/2007 05:06:00 PM

The BEA releases Personal Consumption Expenditures monthly (as part of the Personal Income and Outlays report) and quarterly, as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next (several people have asked me about this). Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q2, you would average PCE for April, May and June, then divide by the average for January, February and March. Of course you need to take this to the fourth power (for the annual rate) and subtract one.

Of course June isn't released until after the advance Q2 GDP report. But we can use the change from January to April, and the change from February to May (the Two Month Estimate) to approximate PCE growth for Q2. Click on graph for larger image.

Click on graph for larger image.

This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.92).

Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

But in general, the two month estimate is pretty accurate. Maybe June was exceptionally strong, or maybe April and May will be revised upwards, but the two month estimate suggests real PCE growth in Q2 will be about 1.5%.

For other reasons - like business investment and inventory changes - Q2 growth will probably be stronger than Q1. But the scratching sound you are hearing is from Wall Street firms revising down estimates for Q2 PCE and GDP growth.

BofA RE Agent Survey: Another Leg Down in Traffic

by Calculated Risk on 6/29/2007 04:49:00 PM

Bank of America analysts Daniel Oppenheim, Michael R. Wood, and Michael G. Dahl, released a research note this morning:

BofA Monthly Real Estate Agent Survey

Buyers Take Their Time and Watch Prices Drift Lower

The analysts wrote:

"Another leg down in June as traffic and prices worsen further. Our traffic index fell to 21.9 in June (down 4.5 points from 26.3 in May), the lowest level since we started the survey."This fits my view that housing activity is continuing to decline.

underline emphasis in research note

Excerpted with permission

Personal Income: "Incomes Grew Solidly" in May?

by Calculated Risk on 6/29/2007 02:26:00 PM

If you read this AP article - Consumer Spending Up As Incomes Rebound - you might think that the Personal Income and outlays report showed strong real growth in May. You'd be wrong.

From the AP:

Consumers boosted their spending in May as their incomes grew solidly, an encouraging sign that high gasoline prices haven't killed people's appetite to buy. Inflation moderated.Incomes up "solidly". Spending up. Inflation moderated. What's not to like?

It was the second month in a row that consumer spending went up 0.5 percent, the Commerce Department reported on Friday.

Incomes, the fuel for future spending, rebounded in May, growing 0.4 percent.

From the Census Bureau report on real Disposable Personal Income (DPI):

Real DPI -- DPI adjusted to remove price changes -- decreased 0.1 percent in May.And spending?

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in May.So real disposable income declined in May and real spending barely increased. Oh, and that great 0.1% increase in spending is really 0.06% rounded up. Annualize that!

Federal Financial Regulatory Agencies Issue Final Statement on Subprime Mortgage Lending

by Calculated Risk on 6/29/2007 10:56:00 AM

From the Fed: Federal Financial Regulatory Agencies Issue Final Statement on Subprime Mortgage Lending

The federal financial regulatory agencies today issued a final Statement on Subprime Mortgage Lending to address issues relating to certain adjustable-rate mortgage (ARM) products that can cause payment shock.Here is the Statement on Subprime Mortgage Lending.

May Construction Spending, Part I

by Calculated Risk on 6/29/2007 10:36:00 AM

From the Census Bureau: February 2007 Construction Spending at $1,170.8 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during May 2007 was estimated at a seasonally adjusted annual rate of $1,176.6 billion, 0.9 percent above the revised April estimate of $1,166.0 billion.

...

[Private] Residential construction was at a seasonally adjusted annual rate of $549.0 billion in May, 0.8 percent below the revised April estimate of $553.6 billion.

[Private] Nonresidential construction was at a seasonally adjusted annual rate of $343.1 billion in May, 2.7 percent above the revised April estimate of $334.1 billion.

Click on graph for larger image.

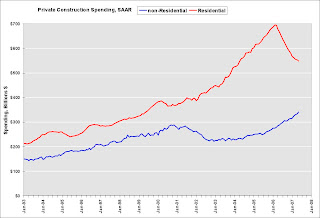

Click on graph for larger image.This graph shows private construction spending for residential and non-residential (SAAR in Billions). While private residential spending has declined significantly, spending for private non-residential construction has been strong.

The second graph shows the YoY change for both categories of private construction spending.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.This will probably be one of the keys for the economy going forward: Will nonresidential construction spending follow residential "off the cliff" (the normal historical pattern)? Or will nonresidential spending stay strong. I'll have some comments on this question later today.

Bloomberg's Numbers

by Anonymous on 6/29/2007 08:50:00 AM

Hat tip to Ministry of Truth for bringing up this startling Bloomberg article, "S&P, Moody's Hide Rising Risk on $200 Billion of Mortgage Bonds." (How much did Fitch pay to get out of the headline?) As our fine commenters have noted, that's an amazingly bearish headline for Bloomberg. It's also a startlingly bald accusation: there's a line between asserting that the rating agencies are not downgrading bonds as fast as some observers think they should, and asserting that they are "hiding rising risk," without the usual "may be" weasel. Bloomberg just stomped right over that line, which suggests to me that tempers have become a bit short:

Standard & Poor's, Moody's Investors Service and Fitch Ratings are masking burgeoning losses in the market for subprime mortgage bonds by failing to cut the credit ratings on about $200 billion of securities backed by home loans.

"Are masking burgeoning losses"? That's even worse than "hiding rising risk." One rather hopes that Bloomberg has its numbers right.

This particular blogger is not sure she understand's Bloomberg's numbers. We get, in order:

- "$200 billion of securities backed by home loans" should have their ratings cut.

- "Almost 65 percent of the bonds in indexes that track subprime mortgage debt don't meet the ratings criteria in place when they were sold"

- "the $800 billion market for securities backed by subprime mortgages"

- "$1 trillion of collateralized debt obligations, the fastest growing part of the financial markets"

- "estimates that collateralized debt obligations . . . will lose $125 billion"

- "25 percent of the face value of CDOs is in jeopardy, or $250 billion"

- "asset-backed bonds, securities that use consumer, commercial and other loans and receivables as collateral . . . which includes mortgage securities, has doubled to about $10 trillion"

- "the $6.65 trillion in outstanding mortgage-backed debt"

- "Investors snapped up $500 million of the securities [CDOs] globally last year"

- "subprime-related debt made up about 45 percent of the collateral backing the $375 billion of CDOs sold in the U.S. in 2006"

- "Of the 300 bonds in ABX indexes, the benchmarks for the subprime mortgage debt market, 190 fail to meet the credit support standard . . . Most of those, representing about $200 billion, are rated below AAA"

OK. So we know right off the bat that item 9 has to be off by an order of magnitude if item 10 is true. If the true size of "the market" of subprime-backed mortgage bonds is $800B, that makes it 80% of the size of the CDO market, 12% of the size of the total MBS market, and 8% of the size of the total ABS market.

If $375B of CDOs were sold in 2006 in the U.S. and 45% of that involved "subprime-related debt," and we assume just for fun that "subprime-related debt" means subprime-backed MBS and that CDOs invest mostly in subordinate tranches (because we aren't sure otherwise where they get enough high-yield to make their numbers work), that suggests that there were at least $169B of low-rated tranches of subprime securitizations available to resecuritize into a CDO last year. That would be just over 20% of this "total market" of $800B. That would imply a pretty thick layer of subordination. I'm thinking that either those CDOs are buying higher-rated paper than we've been led to believe, or else, possibly, "subprime-related debt" includes things like credit default swaps on subprime paper, which implies that brains will explode before we'll be able to line up bond balances on one hand and the notional value of CDO holdings on the other.

Whatever. My brain exploded a good 20 minutes ago. Does anyone else want to take a stab at estimating the potential principal losses that exceed the current estimated principal losses on $200B in subprime ABS, so that we have some idea of how many dollars of losses the rating agencies are "hiding"?

Thursday, June 28, 2007

American Home Mortgage Pulls 2007 Guidance

by Calculated Risk on 6/28/2007 05:27:00 PM

From Reuters: American Home Mortgage pulls outlook on credit losses

American Home Mortgage Investment Corp. on Thursday withdrew its 2007 earnings forecast, and will likely suffer a surprise second-quarter loss as it takes "substantial" charges for credit-related losses.Another "surprise".

Countrywide Subprime Second-Lien ABS Downgraded

by Anonymous on 6/28/2007 05:02:00 PM

And it's only Thursday.

28 Jun 2007 3:08 PM (EDT)

Fitch Ratings-New York-28 June 2007: Fitch Ratings has taken the following actions on classes from Countrywide Asset-Backed Securitizations (CWABS) series 2006-SPS1:

--Class A rated 'AAA', placed on Rating Watch Negative;

--Class M-1 rated at 'AA+', placed on Rating Watch Negative;

--Class M-2 rated at 'AA+', placed on Rating Watch Negative;

--Class M-3 rated at 'AA+', placed on Rating Watch Negative;

--Class M-4 rated at 'AA', placed on Rating Watch Negative;

--Class M-5 rated at 'AA-', placed on Rating Watch Negative;

--Class M-6 downgraded to 'BBB-' from 'A', remains on Rating Watch Negative;

--Class M-7 downgraded to 'BB+' from 'A-', remains on Rating Watch Negative;

--Class M-8 downgraded to 'C' from 'BB+' and assigned a Distressed Recovery (DR) Rating of 'DR6';

--Class M-9 downgraded to 'C' from 'BB' and assigned a Distressed Recovery (DR) Rating of 'DR6';

--Class B downgraded to 'C' from 'BB-' and assigned a Distressed Recovery (DR) Rating of 'DR6'.

The above trust consists entirely of second liens extended to sub-prime borrowers on one- to four-family residential properties and certain other property and assets. CWABS purchased the mortgage loans from CHL and deposited the loans in the trust, which issued the certificates, representing undivided beneficial ownership in the trust.

The negative ratings actions of all classes in the trust reflect the deterioration in the relationship of credit enhancement (CE) to future loss expectations and affect $189.6 million in outstanding certificates.

The impact of the slowdown in the housing market has been particularly evident in highly leveraged subprime borrowers, and delinquency and losses to date for series 2006-SPS1 have been significantly higher than initially expected. After 12 months of seasoning, losses to date as a percentage of the original pool balance are 9.86%. Approximately 14% of the outstanding pool balance is delinquent. Due to the high percentage of losses to date, the cumulative loss trigger will likely fail for the life of the transaction. The failed trigger will generally maintain a sequential allocation of principal with the exception of principal cashflow from the subsequent recoveries of charged-off loans, which may be allocated to subordinate bonds. Fitch expects the amount of principal cashflow from subsequent recoveries to be limited.

While the subordinate classes are expected to incur principal writedowns - as reflected by their distressed ratings - the failed triggers and sequential principal allocation should help mitigate some of the risk of the weak collateral performance for the senior classes. Fitch will closely monitor the delinquency trends and roll rates in the coming months to assess the credit risk of the mezzanine and senior classes.

It Depends On How You Define "Unlucky"

by Anonymous on 6/28/2007 01:35:00 PM

June 28 (Bloomberg) -- Carlyle Group, the buyout firm run by David Rubenstein, postponed a planned $415 million initial public offering of a fund that invests in bonds backed by mortgages after a slump in the U.S. subprime market.

Carlyle is preparing a revised timetable for the sale, it said in a statement today. The Washington-based firm planned to use most of the money from the IPO to buy AAA-rated residential mortgage-backed securities. The fund also targeted loans, high- yield bonds, and collateralized debt obligations. . . .

"Carlyle's fund looked very similar to the Bear Stearns hedge fund," said Toby Nangle, who helps manage $45 billion in assets at Baring Investment Services in London. "They were unlucky with the timing."

I'd say if you're a retail investor you just dodged a bullet. I don't know that I'd call that "unlucky."

Subprime and CDOs II

by Anonymous on 6/28/2007 12:00:00 PM

This is one weird New York Times article on the Bear Hedge Horror of 2007. I'll let you all work out the blog-movie review angle.

When I came across this paragraph, I thought, aha! Exactly what I've been saying all along:

Mr. Cioffi, a longtime bond salesman who had been trading Bear Stearns’s own money for about six months, was brought over to start a hedge fund, the High-Grade Structured Credit Fund. It would invest in bonds and securities backed by subprime mortgages. While some of the mortgage-related securities were easily valued and traded, others, like collateralized debt obligations, or C.D.O.’s, do not trade frequently and can be very difficult to value.

But then I got to this part:

The approach was so successful that the company started a sister fund last summer, the High-Grade Structured Credit Enhanced Leverage Fund, that would use even more leverage.

The timing of that fund, however, could not have been worse; the cooling housing market began to reveal the lax lending standards used by subprime lenders. Last fall, delinquencies and defaults began rising, making the environment for trading and valuing the esoteric securities that are related to those loans much more difficult.

So are the mortgage-related securities the "easily valued and traded ones" or the "esoteric" ones? If the second hedge fund was started right at the time when subprime mortgage investing started to look iffy, how did it get "more difficult" to value the securities? Last fall the deterioration of the housing market and "exotic" mortgage loans was so secret we were having televised hearings on the subject by Congress. Some secret. How, exactly, does that make these puppies "difficult to value"?

(hat tip Walt!)

Subprime and CDOs: Illiquifying the Liquified

by Anonymous on 6/28/2007 10:17:00 AM

Naked Capitalism has another great post up on the Sturm und Drang in the CDO market. It doesn't exactly answer the question that has been nagging at me, namely, to what extent this "CDO valuation" crisis is truly a "direct" consequence of subprime mortgage-backed securities melting down, or whether the latter is just one of a cluster of debt-binge problems that is being amplified by Wall Street's crazy leverage schemes, one that is "easy" for the mainstream press to see and politically palatable for everyone to "blame." Save for the potentially compensatory stories of predatory lending and steering of prime or near-prime borrowers to subprime, which erupt from time to time but never become the main story, the narratives in play today are that subprime borrowers are fraudsters and deadbeats, as are subprime lenders, and this makes the two fine candidates for scapegoating.

What makes me think there might be some scapegoating going on? I'm not claiming that there are no troubles in Subprime City, of course. I am simply having a hard time reconciling the claim that there is a simple and uncomplicated relationship between these hedge funds' CDO asset valuation meltdowns, on the one hand, and deterioration in subprime mortgage performance on the other, when at the very same time this claim is made, we are informed that CDO portfolios are opaque, no one knows what's in them, and what we do know suggests that subprime ABS tranches cannot possibly be the largest share of their holdings:

And there are a few other barriers: you can't get the deal documents. No kidding. The Fed can't even get them because it isn't a "qualified investor." (Should the Fed start a hedge fund so it can study this problem?). From "Where Did the Risk Go? How Misapplied Bond Ratings Cause Mortgage Backed Securities and Collateralized Debt Obligation Market Disruptions," by Joshua Rosner and Joseph Mason (pages 83-4):At present, even financial regulators are hampered by the opacity of over-the-counter CDO and MBS markets, where only “qualified investors” may peruse the deal documents and performance reports. Currently none of the bank regulatory agencies (OCC, Federal Reserve, or FDIC) are deemed “qualified investors.” Even after that designation, however, those regulators must receive permission from each issuer to view their deal performance data and prospectus in order to monitor the sector.

So if regulators can't get the description of the securities, market participants certainly won't. So what good is a price if you aren't really certain what is being traded?

In addition, the discussion in the FT article presupposes the CDOs are passive CDOs, meaning the assets are assembled and the CDO is structured before it is sold to investors. Yet many CDOs are "active" or "managed" CDOs, meaning blind pools. Blind pools that are tranched, often with leverage and often buying other CDOs or "CDO squared" (CDOs of CDOs). That means the investors pony up money before the fund (it is like a convoluted mutual fund) is formed, and the managed gets to trade it over its three to five year life. No CDO manager is going to disclose his holdings (it would put him at a competitive disadvantage) but how can you value it otherwise?

So how do we know these things are chock-full-o'-subprime paper? Well, Yves gives us this, from the Financial Times:

What makes the CDO sector unusual is that it has exploded at such a breakneck pace with bankers packaging bonds, loans and other debts into ever more complex structures. Last year alone, about $1,000bn (£500bn, €745bn) in cash and derivatives CDOs was issued in Europe and the US, according to data from the Bank for International Settlements. More than one-third was composed of asset-backed securities, often including low-grade mortgages.

Let us first note that the term "asset-backed security" or ABS denotes a quite diverse set of instruments; "ABS" is not a synonym for "MBS." ABS issues can be and are backed by commercial loans, student loans, credit cards, auto loans, insurance premiums, aircraft leases, and probably a few dozen other asset types. When an ABS is backed by mortgages, it can, in fact, be backed by "high-grade" mortgages. (Remember the tranche versus pool problem: you can have a low-rated security tranche that is backed by a pool of very high-rated mortgages; the rating on the tranche is due to its subordination in payment priority within the security, not the quality of the collateral, since it's backed by the same collateral as the high-rated tranches.) So BIS tells us that "often" there are low-grade mortgage securities in the one-third of CDO collateral that is ABS. If you wish to claim without reservation that subprime mortgages are driving this dog cart, you're braver than I am. We just got told that not even the regulators get to see the prospectuses.

Of course the fearless reporters of the New York Times and its friends are getting on- or off-the record quotes from industry insiders claiming or implying that the CDOs and hedge funds under pressure right now are the ones heavily invested in subprime. I am only observing that not every industry quote-bot knows what it is talking about and it is quite possible that some participants have an interest in exaggerating the "subprime" part.

The curious part of it all, for me, is this question of "liquidity." Or, more properly, "illiquidity":

As this explosion has occurred, some corners of this universe have already become relatively widely traded and transparent. Every day in the London and New York markets, for example, billions of dollars worth of deals are struck involving indices of derivatives on well-known corporate bonds – making it easy to obtain prices.

However, many other such products are created by bankers directly with their clients and then simply left to sit on the books of an investor. Since such instruments typically last three to five years – and the CDO boom is so recent – many have not come to the end of their life. Nor have they been traded. Christopher Whalen of Institutional Risk Analytics, a consultancy, says: “The lack of a publicly quoted market for CDOs and like assets is exacerbating the liquidity problems for these assets beyond the underlying economics, for example, in subprime real estate.”

As Yves notes, it sounds as if Mr. Whalen is suggesting that the illiquidity of CDOs is exacerbating the illiquidity of CDOs (maybe that's the "squared" part?). But you can see why some mere mortgage punk like me gets puzzled here: was there any asset created in the last five years or so that was more liquid than mortgages? Anyone remember that part about how the investment community was beating our doors down and in fact buying up us mortgage originators as a package in unquenchable thirst for product? How liquid can you get? It wasn't quite as bad as the day-trading thing--you probably didn't get subprime whole loan bid color from cab drivers--but I'm having a hard time remembering the secretive part of the whole thing.

I can't be the only one who suspects that "illiquidity" is in some quarters the new term for "I don't like the bid." Remember all the uproar in March and April about the deterioriation of the whole-loan market for Alt-A and subprime? I can say from personal experience that nobody likes being offered par when your profitability requires you to get bids of 102.50, but that doesn't make the market "illiquid." It does suggest to me that someone has some explaining to do, not about subprime mortgages, but about these CDOs. How did we get "illiquid" securities backed by "liquid" assets? That's some impressive financial magic.

Ponder this, as well:

Some bankers and policymakers argue that this is simply a teething problem that will fade as structured finance becomes more mature. History suggests that most opaque, illiquid markets eventually become more transparent when they grow large enough – and behind the scenes, the Bear Stearns hedge fund problems are prompting bankers and investment managers to re-examine their valuation techniques. . . .

I am not a historian of financial markets, so perhaps it is true that the Whigs always win in this regard. But I would be inclined to think that perhaps it is true that in some cases "opaque, illiquid markets" become large enough to implode spectacularly before they ever get around to becoming "transparent." In fact, I wonder if in certain cases "opacity" is a feature, not a bug.

I do know enough of the history of the mortgage market to be willing to claim that it was, once upon a time, an opaque and illiquid market that did indeed become both very large and highly transparent for quite a while there. You can get an amazing amount of information about one of those nice low-yield boring vanilla GSE MBS, you know, not to mention a price right off the old Bloomberg terminal. Now, you might want to say that in the last few years somehow that famous liquidity and transparency of the residential mortgage market has largely evaporated on us, right at the time that tons of unregulated private money started pouring into it and yields of 12-18% became just not good enough. You might observe that right about the time, historically speaking, when we'd managed to accumulate giant performance databases about mortgage loans, we started offering "low doc, no doc and snow doc" deals with drive-by "appraisals" and automated underwriting and tiny due diligence sampling and every other mechanism we could think of to assure that there was, in fact, no data to be "transparent" about.

So now that we've "innovated" our way into a situation in which nobody has the first bloody idea what's going on with a huge portion of recently-originated mortgage loans, we've noticed that we've innovated our way into a situation in which nobody has the first bloody idea what's going on with the securities they're in or the CDOs that buy the tranches of the securities or the hedge funds that buy the tranches of the CDOs of the securities of the mortgages that were written on a hope and a prayer and a FICO. And this is a "teething" problem? Holy Mastication, Batman, you think this thing will improve if it grows some fangs?

Perhaps certain market participants need to be reminded why we call some of this stuff "nuclear waste." Generating a jillion-gigawatts of power is always a blast. Figuring out what to do with all the leftover plutonium-239 is a drag. How that only just got to be a problem of an "immature market" is beyond me.

And while we're on the subject of revisionist history, note this little gem courtesy of naked capitalism:

See that little footnote? Alt-A is "slightly less risky than subprime"?

Except for Calculated Risk and a few other cantankerous contrarian cranks, do you remember anyone in the last five years describing Alt-A as "slightly less risky than subprime"? My, my. How the worm turns.

KB Home Reports Second Quarter 2007 Loss

by Calculated Risk on 6/28/2007 09:16:00 AM

"Our second quarter results reflect the current oversupply of new and resale housing inventory, a difficult situation compounded by aggressive competition and continued weak demand. Housing affordability challenges and tighter credit conditions in the subprime and near-prime mortgage market have also exacerbated current market dynamics, keeping prospective buyers out of the market, slowing the absorption of excess supply and further delaying a housing market recovery. Pricing pressure intensified in many of our markets during the second quarter, compressing margins and requiring inventory impairment charges in certain of our communities."And for the quarter:

Jeffrey Mezger, president and CEO, KB Home, June 28, 2007 emphasis added.

Housing revenues of $1.30 billion were down 41% from the prior year's second quarter, the result of a 36% year-over-year decline in unit deliveries to 4,776 and an 8% year-over-year decrease in the average selling price to $271,600....

The Company reported a loss from continuing operations of $174.2 million or $2.26 per diluted share in the second quarter of 2007 ...

Wednesday, June 27, 2007

GDP Releases and Revisions

by Calculated Risk on 6/27/2007 07:53:00 PM

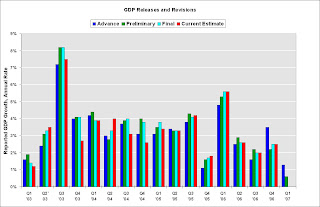

Tomorrow the "final" GDP report will be released for Q1. Of course the Bureau of Economic Analysis (BEA) keeps on revising the estimate for some time, so "final" is just a name for the report.

In the near future, I'd expect the BEA to look into the suggestion by Business Week that offshoring has led to an overstatement of GDP in recent years. Most analysts think that Business Week is correct, but the overstatement is probably less than 0.2% per year.  Click on graph for larger image.

Click on graph for larger image.

The BEA releases three GDP reports per quarter: Advance, Preliminary and Final. This chart shows the release numbers for each release, and also the current estimate for each quarter for the last few years.

Although it seems that the estimates change substantially, they are actually pretty similar from a macro perspective.

For tomorrow, I've seen estimates for the "final" Q1 report ranging from 0.4% to 1.5%. The consensus is 0.8%, mostly because of changes to net imports.

MISC Shelves $750M Bond Offering

by Calculated Risk on 6/27/2007 04:41:00 PM

From the Financial Times: Debt deals pulled as banks feel subprime chill

Companies are pulling financing deals across the globe, in one of the clearest signs yet that investors’ worries about rising interest rates and US subprime mortgages could be infecting other areas of the credit world and driving up the cost of corporate borrowing.UPDATE: Another interesting quote from MarketWatch: Hedge fund CEO: 'day of reckoning to come' in credit market

...

MISC, the world’s biggest owner of liquefied gas tankers on Wednesday shelved its $750m bond offering. The move came a day after US Foodservice, the American division of Ahold, the Dutch supermarket group postponed its $650m bond offering and Arcelor Finance put plans for its euro-denominated benchmark bond issue on hold, citing turbulent market conditions.

The bonds and loan deals were pulled after investors refused to buy them under the proposed terms, demanding higher premiums and more protection.

Stephen Green, chairman of HSBC, on Wednesday fuelled investor concern when he forecast that some large corporate deal was going to “end in tears” because of over-leverage. He warned the losses could be high because the parcelling out of risk to some many parties would make it more difficult to organise a financial reconstruction.

In an interview with the Financial Times, Mr Green admitted that he was “worried by the degree of leverage in some big ticket transactions nowadays” and felt that “something is going to end in tears”.

Eric Mindich, the chief executive of Eton Park Capital Management ... said the "day of reckoning" may be here, in reference to recent problems in the securitized debt markets. "There's dry timber out there," Mindich said at the Wall Street Journal Deals and Deal Makers Conference on Wednesday. "There are people's lives that are going to be changed by what happens."

Blackstone and the Green Shoe

by Calculated Risk on 6/27/2007 12:28:00 PM

Blackstone is now trading below the IPO price of $31.00 per share (last quote was $29.99).

When a deal is sold, the underwriters (the lead underwriters for Blackstone were Morgan Stanley and Citigroup) actually sell more shares than the amount raised by the company. Blackstone sold 133.3 million shares raising $4.13 Billion, and for this deal, the overallotment was 20 million shares, meaning the underwriters raised an additional $620 million - and they put the money in what is called the "Green Shoe".

For most IPOs, the underwriter exercises the overallotment option after some waiting period, and the entire amount in the Green Shoe goes to the company. But if the stock falls below the initial price, the underwriters start buying back stock using the cash in the Green Shoe. This usually sets a floor for the price of the stock, at around the IPO price - just for the overallotment period.

Since the current stock price is below the IPO price, the Green Shoe is probably being spent right now to support the stock price. We will know how much was spent in a couple of months when (if) the overallotment option is exercised.

IMO, the Blackstone IPO probably marks the peak of the PE LBO wave. And if the stock price stays below the IPO price, the company will jokingly be called Blackpebble (or something far worse).

LBO Deals to Watch

by Calculated Risk on 6/27/2007 11:22:00 AM

Following the postponement of the U.S. Foodservice debt offering, the WSJ put together a table titled: Ten Horses of the Buyout Apocalypse?

The course of the great leveraged-buyout and corporate-acquisition boom of the early 21st century will be determined in large part by 10 companies. ... The companies have agreed to be bought and will soon be asking credit investors to finance the deals. It’s part of a $200-billion plus tidal wave of financing needs that will crash ashore in the next six months.The ten companies listed are:

TXU $25.9 Billion

First Data $24B

Alltel $23.2B

Clear Channel $22.1B

Chrylser $20B

Sallie Mae $16.5B

Cablevision $9.2B

Harrah’s Entertainment $9B

Biomet $7B

Alliance Data $6.6B

A nice list of deals to watch.

Distrust, Ridicule, Contempt and Disgrace

by Anonymous on 6/27/2007 09:00:00 AM

Yeah, another mortgage post.

Via the intrepid Housingdoom.com, we see that the forthright, reputable, upstanding and not funny firm eAppraiseIT, LLC is suing a website, mortgagefraudwatchlist.org.

Mortgagefraudblog.com posts a copy of the complaint:

Defendant's false and malicious statements, when considered alone and without innuendo, have (a) negatively impacted Plaintiff's trustworthiness and character, (b) caused Plaintiff to be subjected to distrust, ridicule, contempt and disgrace, and (c) injured Plaintiff's reputation and goodwill in the appraisal management industry.

Of course, it should be noted that Calculated Risk is drawing your attention to this story, alone and without innuendo, merely for the purpose of informing the investment community, which has big boatloads of money at stake in mortgage and housing-related investments, and which often relies on muck-raking blogs for crucial information ignored or garbled by the mainstream media and paid-for analysts, which information has saved them a lot of money over the last few years, that the possibility exists that bloggers may have to form legal defense funds if certain complaints which have nothing to do with the complaint referenced above are filed and are not dismissed on the grounds of distrust, ridicule, contempt and disgrace.

I'm willing to bet that there's not a lot of deep pockets to be picked in blogland. Most blogs are volunteer efforts and the legal costs of nuisance suits would shut them down, pronto. If the eAppraiseIT suit has merit--if the statements made about eAppraiseIT were truly false and defamatory, and I wouldn't know that--then by all means it should proceed, and the blogger in question should make it right. If, on the other hand, those parties who have enabled a disastrous frenzy of fraud and misrepresentation in the mortgage and housing market over the last few years are going to respond to their deserved ridicule with legal harassment, I for one am going to call on the moneyed bagholder community to step up to the plate behind the shoestring blogs. You know who you are and why you read us and what you have to lose.

Tuesday, June 26, 2007

LBO Debt Market Changing

by Calculated Risk on 6/26/2007 11:50:00 PM

From the WSJ: Bonds Becoming a Tougher Sale

Investors issued a resounding 'No' to a leveraged-buyout debt offering yesterday, leaving banks holding the bag for more than $3 billion and raising concerns about the changing economics of the takeover boom.From the NY Times: Delay in Buyout Bond Sale

...

Underwriters pulled a $1.55 billion bond offering by U.S. Foodservice, the nation's second-largest food distributor. The company also postponed plans to sell $2 billion in loans to fund the deal, according to people familiar with the matter. For now, the banks involved in underwriting the deal will have to lend the $3.6 billion directly to U.S. Foodservice, which is being bought from Royal Ahold NV of the Netherlands.

...

The pushback comes at a challenging moment. Investors are looking ahead at $250 billion of new debt coming to market in the coming months. Just this week, Chrysler Group, which is being sold by DaimlerChrysler AG, began marketing a debt fund raising that will total more than $60 billion.

This week, two other buyouts, the $4.7 billion deal for ServiceMaster and the $6.9 billion sale of Dollar General, are expected to price their bonds.It will be interesting to see what happens to these other bond sales. The WSJ noted that ServiceMaster reduced it's "payment in kind" feature, so maybe that sale will be OK.

S&P: Alt A Loans `Disconcerting,' Jumbos Weaker

by Calculated Risk on 6/26/2007 06:52:00 PM

From Bloomberg: Alt A Loans `Disconcerting,' Jumbos Weaker, S&P Says (hat tip risk capital)

U.S. homeowners with good credit are increasingly falling behind on mortgage payments, a sign lenders have been offering ``higher risk'' loans outside the so-called subprime market, Standard & Poor's Corp. said today.Is this the end of the word "contained"?

Rising late payments and defaults on so-called Alt A mortgages made last year are ``disconcerting'' and delinquent borrowers appear to be ``finding it increasingly difficult to refinance'' or catch up on their payments, S&P analysts said today in a statement. ``Serious'' delinquencies, foreclosures and seized property among ``prime jumbo'' mortgages in bonds from 2006 reached the highest among loans of less than 13 months since at least before 2000, S&P said in a separate report.

...

S&P, one of the two largest ratings firms, is now ``examining how the risk profile clearly increased'' in the Alt A market, it said in a statement sent by e-mail today. ``We will communicate our findings to the market,'' S&P said, in language it typically uses ahead of adjusting its rating methodology.

JPMorgan: Planned CDO Sales Dry Up Amid Bailout

by Calculated Risk on 6/26/2007 05:00:00 PM

From Bloomberg: Planned CDO Sales Dry Up Amid Bailout, JPMorgan Says (hat tip Brian)

Planned sales of collateralized debt obligations backed mainly by subprime mortgages are drying up and may shut down amid concerns about the integrity of the market following the near collapse of hedge funds run by Bear Stearns Cos., JPMorgan Chase & Co. said.No wonder Dr. Altig asks: What's That Unpleasant Sound?

The amount of U.S. high-grade, structured finance CDOs that are being offered to investors has plunged to $3 billion, from $20 billion a month ago ...

"We expect events surrounding warehousing liquidations last week to further slow, if not halt entirely, the new issue market," JPMorgan analysts led by Chris Flanagan in New York said in the report.

...

The damage to the $1 trillion CDO market could freeze what has been a large source of liquidity for the credit markets, Tim Backshall, chief strategist at Credit Derivatives Research LLC, said yesterday.

According to Lombard Street Research, it's a credit crunch. From the U.K. Telegraph:Altig is rightly skeptical of the report, but I do think the sector specific credit crunch is definitely getting more severe, and might expand to other sectors (like M&A loans and CRE investments).The United States faces a severe credit crunch as mounting losses on risky forms of debt catch up with the banks and force them to curb lending and call in existing loans, according to a report by Lombard Street Research.

More on May New Home Sales

by Calculated Risk on 6/26/2007 03:32:00 PM

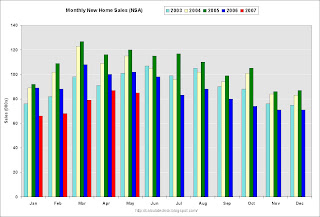

For more graphs, please see my earlier post: May New Home Sales Click on graph for larger image.

Click on graph for larger image.

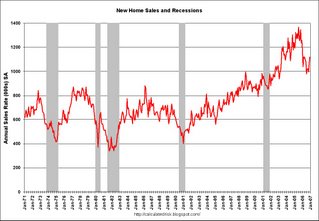

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

For Fun: Here is the same graph after the December 2006 sales were reported just a few months ago. The housing bust was "over". Not! The bounce back was revised away.

Once again, this reminds us to take the "just reported" data with a grain of salt. As reported this morning, much of the surprise "bounce back" in April has already been revised away.

The third graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through April.

Typically, for an average year, about 44% of all new home sales happen before the end of May. At the current pace, new home sales for 2007 will probably be under 900 thousand - about the same level as the late '90s. This is significantly below the forecasts of even many bearish forecasters.

As a final note, this puts total reported inventory at a record 4.967 million units (4.431 existing homes and 0.536 new homes).

Bear Stearns: A Brat Sneers

by Anonymous on 6/26/2007 02:08:00 PM

Instead of writing intellectually-serious posts that provide cogent analyses of financial and economic issues of profound import, I've been playing on the internet. And I found this, the Internet Anagram Server.

So I had to test it by typing in "Bear Stearns."

Bareness Rat. Bean Arrests. Barren Asset. Banes Raters. Absent Rears. Barest Snare. Bases Errant. Barn Teasers. Bars Nearest. Stabs Earner. Baa Nests Err. Bare Ass Rent. Betas An Errs. (I left out all the ones with "breast" and "bra" because this is a family blog.)

Enjoy yourself, from Data Click Rules (a/k/a A Crack Duellist).

BONG HiTS 4 BILL GROSS!

by Anonymous on 6/26/2007 12:00:00 PM

I want some of of what the man is smoking:

Well prudence and rating agency standards change with the times, I suppose. What was chaste and AAA years ago may no longer be the case today. Our prim remembrance of Gidget going to Hawaii and hanging out with the beach boys seems to have been replaced in this case with an image of Heidi Fleiss setting up a floating brothel in Beverly Hills. AAA? You were wooed Mr. Moody’s and Mr. Poor’s by the makeup, those six-inch hooker heels, and a “tramp stamp.” Many of these good looking girls are not high-class assets worth 100 cents on the dollar. And sorry Ben, but derivatives are a two-edged sword. Yes, they diversify risk and direct it away from the banking system into the eventual hands of unknown buyers, but they multiply leverage like the Andromeda strain. When interest rates go up, the Petri dish turns from a benign experiment in financial engineering to a destructive virus because the cost of that leverage ultimately reduces the price of assets. Houses anyone?

If I followed all that, somebody just got called a ho.

But look at it this way: using the current default rate of 7% (3-4% total losses), the holders of some BBB investment grade subprime-based CDOs will lose all of their moolah because of the significant leverage. No need to worry about fictitious 100 cents on the dollar marks here. One hundred percent of nothing equals nothing. If subprime total losses hit 10% then even some single-A tranches face the grim reaper. AAA’s? Folks the point is that there are hundreds of billions of dollars of this toxic waste and whether or not they’re in CDOs or Bear Stearns hedge funds matters only to the extent of the timing of the unwind. To death and taxes you can add this to your list of inevitabilities: the subprime crisis is not an isolated event and it won’t be contained by a few days of headlines in The New York Times.

Wow. Maybe Mr. Gross should take a yoga class. He sounds a little stressed out.

May New Home Sales

by Calculated Risk on 6/26/2007 10:10:00 AM

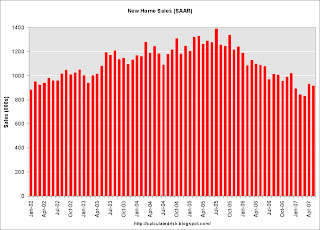

According to the Census Bureau report, New Home Sales in May were at a seasonally adjusted annual rate of 915 thousand. Sales for April were revised down significantly to 930 thousand, from 981 thousand. Numbers for February and March were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in May 2007 were at a seasonally adjusted annual rate of 915,000 ... This is 1.6 percent below the revised April rate of 930,000 and is 15.8 percent below the May 2006 estimate of 1,087,000.

The Not Seasonally Adjusted monthly rate was 85,000 New Homes sold. There were 102,000 New Homes sold in May 2006.

May '07 sales were the lowest May since 2001 (80,000).

The median and average sales prices were up. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in May 2007 was $236,100; the average sales price was $313,000.

The seasonally adjusted estimate of new houses for sale at the end of May was 536,000.

The 536,000 units of inventory is slightly below the levels of the last year. Inventory for the previous months were revised up slightly. For April, the inventory was initially reported at 532,000 (so May would show an increase), but was revised up to 542,000 (so May shows a slight decrease).

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are at record levels. Actual New Home inventories are much higher - some estimate about 20% higher.

This represents a supply of 7.1 months at the current sales rate.

The large downward revision for April removed some of the strength from April's report. It appears we are back to were sales are being revised down every month - probably indicating another downturn in the market - and I expect the trend to continue. More later today on New Home Sales.

BONG HiTS 4 BEAR*

by Anonymous on 6/26/2007 07:55:00 AM

Gretchen Morgenson on the Everquest IPO. Being the vicious nasty blogger with no redeeming social qualities that I am, I must take the opportunity to point out that I have no idea how accurate this reporting on the Everquest deal is, but sentences like this do not raise my confidence level:

The funds that sold the securities to Everquest invested in big pools of loans backed by home mortgages, known as collateralized debt obligations.

"Pools of loans backed by home mortgages"? I'm drinking some good coffee this morning--for which I have our generous tippers to thank--but I don't think there's enough coffee in the continental U.S. to make that sentence mean anything. I believe the linguists call it "word salad."

That doesn't mean that the rest of the reporting is equally confused, of course, but then again it makes me tread cautiously. UberNerds 4 Warned.

*Dear Chief Justice Roberts: the title of this post is not an "incitement to imminent lawless action." It is a "joke." And you people can't throw my sorry little butt out of high school because I've already got my diploma and I don't need you anymore.

Monday, June 25, 2007

NAR Blames Builders for Housing Woes

by Calculated Risk on 6/25/2007 07:46:00 PM

From the WSJ: Existing Home Sales, Prices Decline

"If builders can be disciplined and cut back on production, then overall inventory would begin to diminish,"New home inventory is actually a small portion of the overall inventory. See this post from Saturday: Housing: Total Inventory

Lawrence Yun, senior economist for the Realtors association.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year end inventory levels, since 1982, for new and existing homes. (2007 numbers are for April, I'll update when the New Home numbers are released tomorrow).

Yes, the builders need to cut back on production, but even if the builders stopped building, it would take some time to work through the significant excess supply currently on the housing market.

Alternatively a significant price decline might spur demand; I wonder why the NAR economist doesn't suggest that solution?

BusinessWeek: Bear's Big Loss Arouses SEC Interest

by Calculated Risk on 6/25/2007 04:53:00 PM

From BusinessWeek: Bear's Big Loss Arouses SEC Interest

Bear Stearns (BSC) may have a lot of explaining to do about a big restatement of losses at one of its troubled hedge funds—and not just to its investors. BusinessWeek has learned that the Securities & Exchange Commission recently opened a preliminary inquiry into the near-collapse of Bear Stearns' High-Grade Structured Credit Strategies Enhanced Leveraged Fund. People familiar with the inquiry say regulators are interested in learning how the Wall Street investment firm came to dramatically restate the April losses for the 10-month-old fund ...Your daily dose of BS. (uh, Bear Stearns).

...

Privately, Bear Stearns is spreading the word that the April restatement was prompted by actions by some of their lender banks. People familiar with the matter say the Wall Street firm claims the banks began demanding that the hedge fund put up more collateral for the loans it had taken.

The banks, on their own accord, began marking down the value of the subprime bonds that the hedge fund had invested in, which had the effect of precipitating the current crisis, according to the people familiar with Bear Stearns' account of the events.

UPDATE: BofA Analyst on impact on housing of Bear Stearns Hedge Fund debacle, via Mathew Padilla: Will Bear Stearns' woes lead to higher mortgage rates, lower home prices?

• While these discrepancies may not be revealed in the short term, we believe the object lesson in liquidity would at the very least give CDO investors a reason to require better yields and more likely would result in more restrictive margining requirements by those firms accepting CDOs as collateral. A cascading deleveraging from CDO^2s through CDOs to the non-investment grade tranches of private label securitizations would ultimately produce higher rates to new mortgage borrowers.

• Short-term, private label securitizers (of subprime and Alt-A) should experience weaker gain on sale margins and/or reduced securitization leverage (increased non-investment grade retention). Longer term, it should result in higher coupon rates, reducing mortgage borrowing demand, which the disproportionate impact on subprime and Alt-A would further pressure housing prices by taking out of the market the marginal buyers. Weaker house prices and higher rates would not only increase the pace of foreclosures but more importantly increase loss severities on the foreclosures. The higher losses would in turn create more pressure for higher rates (relative to reference rates) potentially triggering another round of tightening. ...

More on May Existing Home Sales

by Calculated Risk on 6/25/2007 12:43:00 PM

For more existing home sales graphs, please see the previous post: May Existing Home Sales

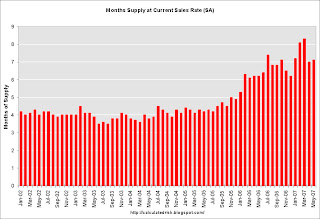

NAR reported that existing home inventories are at record levels today. To put these numbers into perspective, here are the year-end inventory and months of supply numbers, since 1982 (Note: The only data I have is year-end starting in 1982). Click on graph for larger image.

Click on graph for larger image.

The current inventory of 4.431 million units is an all time record. The "months of supply" metric is now above the level of the previous housing slump in the early '90s, but still below the levels of the housing bust in the early '80s.

The "months of supply" is calculated by dividing the total inventory by the seasonally adjusted annual rate (SAAR) of sales, and multiplying by 12. Currently inventory is 4.431 million, SAAR sales are 5.99 million giving 8.9 months of supply.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units (a measure of turnover). See the second graph.  One of the rarely mentioned stories, related to the housing boom, was the increase in turnover of existing homes. This graph shows sales and inventory normalized by the number of owner occupied units.

One of the rarely mentioned stories, related to the housing boom, was the increase in turnover of existing homes. This graph shows sales and inventory normalized by the number of owner occupied units.

Note: all data is year-end except 2007. For 2007, the May sales rate and inventory are used. For owner occupied units, Q1 2007 data from the Census Bureau housing survey was used for May 2007.

This graph shows the extraordinary level of existing home sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.

Some of the sales were for investment and second homes, but normalizing by owner occupied units probably provides a good estimate of normal turnover. A decline in sales to 6% of owner occupied units would result in about 4.6 million sales. If sales fall back to the level of 1998 to 2001 (7.3% of total owner occupied units sold) that would be about 5.6 million units in 2007.

Also look at inventory as a percent of owner occupied units; an all time record of 5.9%! Imagine if sales fell back to the median level for the last 35 years; the months of supply would be ONE YEAR.

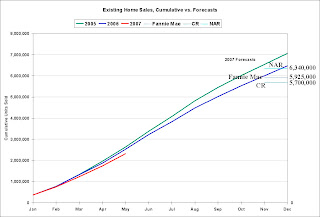

And writing about sales, the followings shows the actual cumulative existing home sales (through May) vs. three annual forecasts for 2007 (NAR's Lereah, Fannie Mae's Berson, and me). My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

NSA sales are 91% of 2006 at this point. If sales maintain that percent of 2006, then total sales will be 5.94 million - about at Fannie Mae's forecast.

To reach the NAR forecast (revised downward on April 11 to 6.34 million units), sales will have to be above 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say the recent NAR forecast is "no longer operative"!

UPDATE: We do requests (occasionally) at CR. The following graph was requested by BrooklynInDaHouse. This graph shows the ACTUAL annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the May inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the ACTUAL annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the May inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

Unfortunately I don't have inventory data prior to 1982. Note that in graph 2 above, sales and inventory are normalized by the number of Owner Occupied Units.

May Existing Home Sales

by Calculated Risk on 6/25/2007 10:12:00 AM

The National Association of Realtors (NAR) reports Home Sales Show Market is Under Performing

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – eased by 0.3 percent to a seasonally adjusted annual rate1 of 5.99 million units in May from an upwardly revised pace of 6.01 million in April, and are 10.3 percent below the 6.68 million-unit level in May 2006.

...

The national median existing-home price2 for all housing types was $223,700 in May, which is 2.1 percent below May 2006 when the median was $228,500.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. For New home sales, March is usually the strongest sales month of the year. For existing homes, the Summer months are more critical.

The second graph shows the months of supply. With the months of supply now over 8 months, we should expect falling prices nationwide. The NAR reports that YoY prices fell again in May.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to a record 4.431 million units in May.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to a record 4.431 million units in May.Total housing inventory rose 5.0 percent at the end of May to 4.43 million existing homes available for sale, which represents an 8.9-month supply at the current sales pace, up from an 8.4-month supply in April.For some reason the NAR forgot to mention this is the all time record for inventory (not months of supply though). More on existing home sales later today.

Sunday, June 24, 2007

Tips for Tanta

by Calculated Risk on 6/24/2007 12:23:00 PM

To celebrate Tanta's six month anniversary as my co-blogger, from now through next Saturday (June 30th), instead of splitting the tips, all the tips will go to Tanta.

This is your chance to tip Tanta without the greedy CR taking half!

I'm sure everyone appreciates that Tanta is an incredible writer with extensive knowledge of the mortgage industry. She is a former bank officer and mortgage lending specialist, on extended medical leave while undergoing treatment for cancer.

Let me be clear: This isn't a cry for sympathy. This isn't charity. And Tanta isn't destitute. Only tip her if you appreciate her work.

These are tips for her virtuoso writing performances - think of it like tipping Billy Joel at the piano - except Tanta is smarter and better looking.

Just tap the Tip Jar on the right, and it will take you to a PayPal payment screen.

I'm doing this without her knowledge or permission.

P.S. A warm thank you to the many generous readers for your previous tips.

Murk to Muddle

by Anonymous on 6/24/2007 08:17:00 AM

naked capitalism has a nice post up this morning that combines all of my favorite themes: models, valuations, risk management, and what the hell is the matter with the New York Times today?

I am not a Times Select subscriber--I get most of my useful business analysis from Opera Weekly--so I don't spend enough time picking on Gretchen Morgenson since she went behind the pay wall.

But Yves is out there doing the heavy lifting:

Back to Morgenson. She got a very important issue wrong:Officials at ratings agencies have said in the past that their ratings reflect their estimates of future performance, not market pricing. So the agencies are also marking to model.

Ratings agencies are not Bloomberg terminals. They provide ratings.

There aren't many people who are more cynical than I am about the rating agencies, but a whole lot of people need to memorize those last two simple sentences. We can argue all day long about whether these bond ratings are sufficiently stress-tested, whether downgrades are too slow, whether the rating agencies conflate "collateral problems" and "structural problems" in their analysis. The whole sorry issue of their fee structure and non-arm's-lenth relationships with the bond underwriters could keep us talking for weeks. But if you want to tell me there's an "observable market rating" to which the agencies should be "marking," you'll have to tell me who writes your prescriptions.

To suggest that the rating agencies are "marking to model" is mind-numbingly dimwitted. This is just like The Great FICO Uproar: everybody wants to get all fired up about whether FICO scores are "inflated" or "manipulated" or what have you, as if FICOs are somehow supposed to be something other than just scores produced by a model.

News flash: There are good models, bad models, and ugly models. There are transparent and opaque models. There are stress-tested and untested models. They're all models. And if they're claiming to model probability of principal loss via default of the underlying collateral, that number you get at the end isn't a dollar price. The number you get at the end could be an input into a pricing model, to be sure. But would you really want to claim that an apparent failure of your pricing model is caused solely by one credit model-generated input failing to correlate to a future market price? If so, you aren't using a "pricing model." I don't doubt that there are some stupid investors out there who have been acting as if a certain credit rating--on a mortgage loan or a CDO tranche--guaranteed a certain market price. But the technical financial-accounting term for those people is "doofuses."

Maybe we could just have a moratorium on anyone using the phrase "mark to _____" for rhetorical flourish until we all get a little clearer on the concept.

Saturday, June 23, 2007

Housing: Total Inventory

by Calculated Risk on 6/23/2007 04:32:00 PM

Floyd Norris at the NY Times writes: Homes Sell. Homes Don’t Sell. Builders Still Build.

And here are the charts from the NY Times story.

THE American housing market, as measured by home-building activity, is falling at the most rapid rate in decades ... [and] the weakness will last while builders seek to sell homes they have already built.However, it isn't just the inventory of new homes for sale that will impact the homebuilders. Existing homes are a competing product for new homes, and the record inventory of existing homes for sale will also pressure home-building activity.

It is unlikely that home starts will turn up significantly until that inventory is significantly reduced.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year end inventory levels, since 1982, for new and existing homes. (2007 numbers are for April).

The second graph shows annual starts vs. total housing inventory (new and existing homes).

Look at the previous housing bust in the early '90s. Starts picked up as inventory fell in '92, and starts continued to increase in '93 and '94 as total inventory fell further.

This time the total inventory is so high that starts will probably not pick up until the total inventory levels have fallen significantly. And, with tighter lending standards, demand will probably continue to fall too. Instead of looking for when home-building activity will pick up, perhaps we should be looking for the next decline in housing starts.

This time the total inventory is so high that starts will probably not pick up until the total inventory levels have fallen significantly. And, with tighter lending standards, demand will probably continue to fall too. Instead of looking for when home-building activity will pick up, perhaps we should be looking for the next decline in housing starts.More data will be available this week, as the existing and new home sales reports for May will be released on Monday and Tuesday, respectively.

Saturday Rock Blogging: I Smell a Rat

by Anonymous on 6/23/2007 04:18:00 PM

Bear, the two of us need look no more

We both found what we were looking for

With a loan to call my own

I won’t pick up the phone

When Merrill Lynch calls me--

You've got a fund in me

(you've got a fund in me)

Bear, you're always losing here and there

Your own bonds aren’t wanted anywhere

If your lenders look behind

And don't like what they find

There's one thing you should know

You've got a fund you owe

(you've got a fund you owe)

I used to say "I" and "me"

Now it's "us,” now it's "we"

I used to say "gains are mine"

Now it's "Bear, loss is thine"

Bear, most lenders would just make me pay

I don't listen to a word they say

They don't see me as you do

They think they’re being screwed

I'm sure they wouldn’t care

If they had a friend like Bear

(a friend) Like Bear

(like Bear) Like Bear

A Tale of Two Hedge Funds

by Anonymous on 6/23/2007 11:24:00 AM

We begin to get some backstory on the Great Bear Hedge Fund Meltdown of 2007, courtesy of the New York Times. The leitmotif, which I prophesy will become the Unshakable Story That Everyone Will Stick To, is that this is all directly and apparently unproblematically related to subprime mortgage loans:

The crisis this week from the near collapse of two hedge funds managed by Bear Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime, credit, leaving many of them struggling to stay in their homes.

Let's leave, for the moment, the question of the incredibly complex and opaque layers of leverage, synthetic structures, derivatives swaps, and mark-to-model valuations that transformed mere commonplace mortgage loan write-downs into 23% losses of $600MM invested equity in approximately 9 months on a fund created because its precursor fund, which had dawdled along for two years or so generating a mere 1.0-1.5% a month return, we are informed, just wasn't good enough for the high rollers who didn't damn well put their money in hedge funds to earn 12-18% a year. This is really all about a bunch of subprime loans.

Notice deployment of the Mozilo Defense:

The first fund, the Bear Stearns High-Grade Structured Credit Fund — the one bailed out yesterday — was started in 2004 and had done well, posting 41 months of positive returns of about 1 percent to 1.5 percent a month. But investors were clamoring for even higher yields, which would require more aggressive bets on riskier mortgage-related securities and significantly higher levels of borrowed money, or leverage, to bolster returns.

So, a bunch of first-time homebuyers with no money made Angelo write a bunch of regrettable loans. Angelo undoubtedly made Bear Stearns buy those loans. A bunch of insane hedge fund investors who aren't happy with 12-18% annual returns from investing in the first loss position on the loans Angelo was forced to make got out their pitchforks and "clamored" until Bear Stearns gave them a new fund that used 10x leverage to sell protection to somebody who is exposed to the losses on the underlying reference securities (you want to bet me that'd be Fund 1?) that were valued by Bear's nifty models to start with.

No, wait. All that stuff is way too complicated for any reader of the Saturday Times to follow. Let's stick with how this "stems directly" from Teh Subprime. Besides the fact that we all know what Teh Subprime is about (don't we?), which makes this story easier to understand, it helps us get away from the implications of printing things like this:

Bear Stearns is bailing one of the funds out because it is worried about the damage to its reputation if it stuck investors and lenders with big losses, said Dick Bove, an analyst with Punk Ziegel & Company.

“If they walked away from it, investors would have lost all their money and lenders would have lost all of the money,” Mr. Bove said. But “if they did that to everyone in the financial community, the financial community would have shut them down.”