by Calculated Risk on 5/13/2024 08:10:00 PM

Monday, May 13, 2024

Tuesday: PPI, Fed Chair Powell, Q1 Quarterly Report on Household Debt and Credit

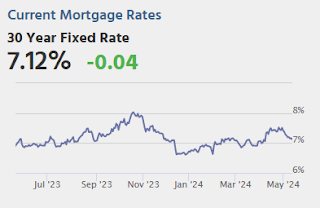

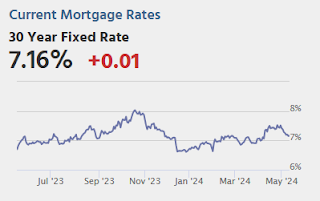

With essentially nothing on the event calendar to start the new week, it was fair to expect a continuation of the same sideways drift that characterized last week. It's not the future can ever be predicted when it comes to markets, but we can say the flat trajectory is the least surprising outcome for Monday. That same trajectory will be increasingly surprising over the next 2 days, with a special focus on Wednesday (CPI day). Even Tuesday deserves some respect with the Producer Price Index and a moderated discussion from a European banking conference with Fed Chair Powell. Today's Fed-speak wasn't worth any volatility, but the NY Fed's consumer survey showed an uptick in inflation expectations and made for a modest intraday bump at 11am ET. [30 year fixed 7.12%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

• At 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM: Discussion, Fed Chair Jerome H. Powell, Moderated Discussion with Chair Powell and De Nederlandsche Bank (DNB) President Klaas Knot, At the Annual General Meeting, Foreign Bankers’ Association, Amsterdam

• At 11:00 AM, NY Fed: Q1 Quarterly Report on Household Debt and Credit

Heavy Truck Sales Increased in April

by Calculated Risk on 5/13/2024 01:53:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the April 2024 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

2nd Look at Local Housing Markets in April

by Calculated Risk on 5/13/2024 11:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in April

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to April 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the second look at local markets in April. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in April were mostly for contracts signed in February and March when 30-year mortgage rates averaged 6.78% and 6.82%, respectively (Freddie Mac PMMS). This is down from the 7%+ mortgage rates in the August through November period (although rates are now back above 7% again)..

...

In April, sales in these markets were up 6.7% YoY. In March, these same markets were down 9.5% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down compared to January 2019. Sales in Grand Rapids and Nashville are up compared to 2019.

...

This is a year-over-year increase NSA for these markets. However, there were two more working days in April 2024 compared to April 2023, so sales Seasonally Adjusted will be lower year-over-year than Not Seasonally Adjusted sales.

...

Many more local markets to come!

Housing May 13th Weekly Update: Inventory up 1.6% Week-over-week, Up 35.0% Year-over-year

by Calculated Risk on 5/13/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 12, 2024

Sunday Night Futures

by Calculated Risk on 5/12/2024 08:09:00 PM

Weekend:

• Schedule for Week of May 12, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $78.26 per barrel and Brent at $82.79 per barrel. A year ago, WTI was at $70, and Brent was at $75 - so WTI oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.60 per gallon. A year ago, prices were at $3.53 per gallon, so gasoline prices are up $0.07 year-over-year.

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 5/12/2024 08:21:00 AM

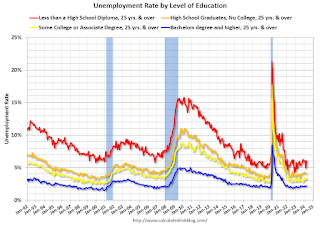

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through April 2024. Note: This is an update to a post from a few years ago.

Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.2% in April, and highest for those without a high school degree at 6.0% in April.

All four groups were generally trending down prior to the pandemic, and all are close to pre-pandemic levels now.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up (although flattened a little recently). "Some college", "high school" and "less than high school" have been trending down.

Based on recent trends, probably half the labor force will have at least a bachelor's degree sometime next decade (2030s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, rising educational attainment is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in lower weekly claims.

A more educated labor force is a positive for the future.

Saturday, May 11, 2024

Real Estate Newsletter Articles this Week: Housing Starts: Record Average Length of Time from Start to Completion in 2023

by Calculated Risk on 5/11/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Housing Starts: Record Average Length of Time from Start to Completion in 2023

• Part 1: Current State of the Housing Market; Overview for mid-May 2024

• 1st Look at Local Housing Markets in April

• Asking Rents Mostly Unchanged Year-over-year

• ICE Mortgage Monitor: Annual home price growth eased in March

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 12, 2024

by Calculated Risk on 5/11/2024 08:11:00 AM

The key reports this week are April CPI, Retail Sales and Housing Starts.

For manufacturing, April Industrial Production, and the May NY and Philly Fed manufacturing surveys will be released.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for April.

8:30 AM: The Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: Discussion, Fed Chair Jerome H. Powell, Moderated Discussion with Chair Powell and De Nederlandsche Bank (DNB) President Klaas Knot, At the Annual General Meeting, Foreign Bankers’ Association, Amsterdam

11:00 AM: NY Fed: Q1 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for April from the BLS. The consensus is for 0.3% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.6% YoY).

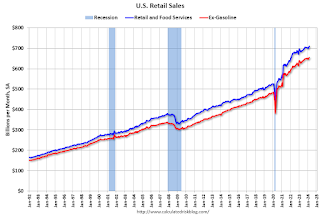

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 0.4% increase in retail sales.

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 0.4% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of -10.8, up from -14.3.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 51 unchanged from 51 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM ET: Housing Starts for April.

8:30 AM ET: Housing Starts for April. This graph shows single and total housing starts since 2000.

The consensus is for 1.410 million SAAR, up from 1.321 million SAAR in March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, down from 231 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 8.0, down from 15.5.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.4%.

10:00 AM: State Employment and Unemployment (Monthly) for April 2023

Friday, May 10, 2024

May 10th COVID Update: Weekly Deaths Continue to Decline

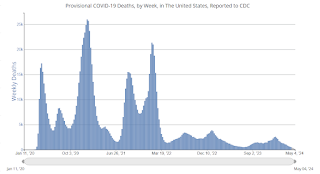

by Calculated Risk on 5/10/2024 07:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 512 | 582 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

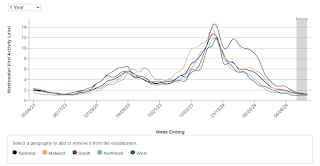

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Part 1: Current State of the Housing Market; Overview for mid-May 2024

by Calculated Risk on 5/10/2024 12:37:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-May 2024

A brief excerpt:

This 2-part overview for mid-May provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

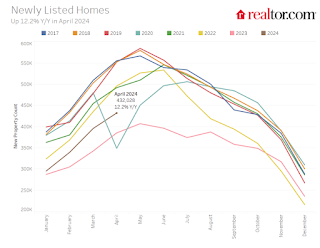

Here is a graph of new listing from Realtor.com’s April 2024 Monthly Housing Market Trends Report showing new listings were 12.2% year-over-year in April. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, which has been a drag on sales the past couple of years, sellers turned out in higher numbers this April as newly listed homes were 12.2% above last year’s levels, matching last month’s growth rate. This marked the sixth month of increasing listing activity after a 17-month streak of declines.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but still below normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be above 7%.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.