by Calculated Risk on 3/14/2023 04:47:00 PM

Tuesday, March 14, 2023

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023. However, this would NOT lead to a surge in foreclosures and significantly impact house prices (as happened following the housing bubble) since lending has been solid and most homeowners have substantial equity in their homes.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Last week, CoreLogic reported on homeowner equity: US Annual Home Equity Gains Cool Again in Q4 2022, CoreLogic ReportsThe report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 7.3% year over year, representing a collective gain of $1 trillion, for an average of $14,300 per borrower, since the fourth quarter of 2021.With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

...

Here is some data on REOs through Q4 2022 …

...

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased from $818 million in Q3 2022 to $829 million in Q4 2022. This is increasing, but still very low.

...

The bottom line is there will be an increase in foreclosures in 2023 (from record low levels), but it will not be a huge wave of foreclosures as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.

2nd Look at Local Housing Markets in February

by Calculated Risk on 3/14/2023 11:42:00 AM

Today, in the Calculated Risk Real Estate Newsletter:

2nd Look at Local Housing Markets in February

A brief excerpt:

This is the second look at local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

In February, sales in these markets were down 23.1%. In January, these same markets were down 33.8% YoY Not Seasonally Adjusted (NSA).

This is a significantly smaller YoY decline NSA than in January for these early reporting markets.

The early data suggests NAR reported sales will rebound in February. This will still be a significant YoY decline, and the 18th consecutive month with a YoY decline.

...

Many more local markets to come!

Cleveland Fed: Median CPI increased 0.6% and Trimmed-mean CPI increased 0.5% in February

by Calculated Risk on 3/14/2023 11:23:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI:

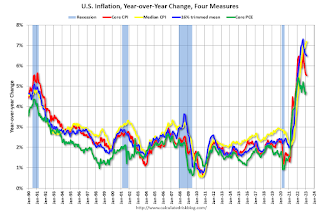

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in February. The 16% trimmed-mean Consumer Price Index increased 0.5% in February. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Fuel oil and other fuels" decreased at a 55% annualized rate in February, and "Used Cars" decreased at a 29% annualized rate.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 3/14/2023 09:07:00 AM

Here a few measures of inflation:

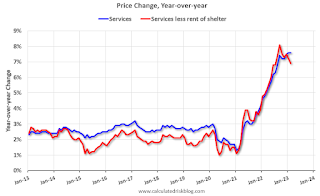

The first graph is the one Fed Chair Powell has been mentioning.

This graph shows the YoY price change for Services and Services less rent of shelter through February 2023.

Services less rent of shelter was up 6.9% YoY in February, down from 7.2% YoY in January.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were up 1.0% YoY in February, down from 1.3% YoY in January.

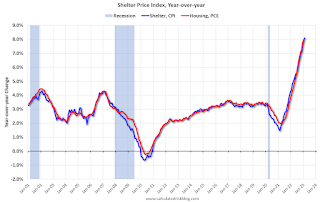

Here is a graph of the year-over-year change in shelter from the CPI report (through February) and housing from the PCE report (through January 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through February) and housing from the PCE report (through January 2023)Shelter was up 8.1% year-over-year in February, up from 7.9% in January. Housing (PCE) was up 8.0% YoY in January.

The BLS noted this morning: "The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase [in CPI]".

BLS: CPI increased 0.4% in February; Core CPI increased 0.5%

by Calculated Risk on 3/14/2023 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in February on a seasonally adjusted basis, after increasing 0.5 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.0 percent before seasonal adjustment.Both CPI and core CPI were close to expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase, with the indexes for food, recreation, and household furnishings and operations also contributing. The food index increased 0.4 percent over the month with the food at home index rising 0.3 percent. The energy index decreased 0.6 percent over the month as the natural gas and fuel oil indexes both declined.

The index for all items less food and energy rose 0.5 percent in February, after rising 0.4 percent in January. Categories which increased in February include shelter, recreation, household furnishings and operations, and airline fares. The index for used cars and trucks and the index for medical care were among those that decreased over the month.

The all items index increased 6.0 percent for the 12 months ending February; this was the smallest 12-month increase since the period ending September 2021. The all items less food and energy index rose 5.5 percent over the last 12 months, its smallest 12-month increase since December 2021. The energy index increased 5.2 percent for the 12 months ending February, and the food index increased 9.5 percent over the last year.

emphasis added

Monday, March 13, 2023

Tuesday: CPI

by Calculated Risk on 3/13/2023 08:43:00 PM

If you're just getting caught up or otherwise haven't heard, the biggest news in financial markets since last Friday has been the precipitous failure of Silicon Valley Bank. While not necessarily a household name, SVB was the 16th largest bank in terms of assets and the 2nd biggest bank failure in history behind Washington Mutual 15 years ago.Tuesday:

Combine that with the fact that the 3rd largest bank failure in history (Signature Bank) occurred 2 days later and it's no surprise that there's some panic in financial markets about systemic risk (aka, a domino effect resulting in additional turmoil).

...

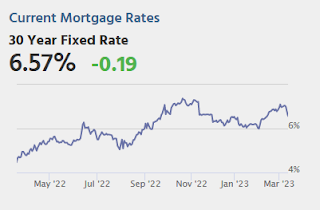

If the market is calmer, then why are rates still so much lower? This has to do with the market shifting its expectations for Fed rate hikes in the rest of 2023. Specifically, the market now sees the Fed hitting a ceiling rate that's more than 1.5% lower than it was at the beginning of last week! [30 year fixed 6.57%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for February.

• At 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.4% increase in core CPI. The consensus is for CPI to be up 6.0% Year-over-year (YoY), and core CPI to be up 5.5% YoY.

Bank Failure #2 in 2023: Silicon Valley Bank

by Calculated Risk on 3/13/2023 04:43:00 PM

Note: There were over 500 bank failures during and immediately following the GFC, and almost 300 in just 2009 and 2010. That was mostly due to default risk (poor performing MBS). I don't expect a large wave of failures now.

From the FDIC: FDIC Establishes Signature Bridge Bank, N.A., as Successor to Signature Bank, New York, NY

Signature Bank, New York, NY, was closed today by the New York State Department of Financial Services, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC transferred all the deposits and substantially all of the assets of Signature Bank to Signature Bridge Bank, N.A., a full-service bank that will be operated by the FDIC as it markets the institution to potential bidders. ... Signature Bank had total assets of $110.4 billion and total deposits of $88.6 billion as of December 31, 2022. As receiver, the FDIC will operate Signature Bridge Bank, N.A. to maximize the value of the institution for a future sale and to maintain banking services in the communities formerly served by Signature Bank.

Pandemic Economics, Housing and Monetary Policy: Part II

by Calculated Risk on 3/13/2023 10:32:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Pandemic Economics, Housing and Monetary Policy: Part 2

A brief excerpt:

Special Note: This was mostly written prior to the failure of Silicon Valley Bank. Now it appears the Fed might pause in March. Goldman Sachs economists wrote last night: “we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22 (vs. our previous expectation of a 25bp hike)”, although BofA economists wrote this morning “After the latest developments around Silicon Valley Bank and the Fed, we retain our outlook for a 25bp hike in March.”There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

In Part 1 of Pandemic Economics, Housing and Monetary Policy I noted that pandemic economic outcomes were frequently largely unexpected. And that this has been especially true for housing.

Housing is the key transmission mechanism for monetary policy. And we need to be on the lookout for pandemic distortions to normal economic patterns - especially in housing - and hope that the Federal Open Market Committee (FOMC) will adjust monetary policy accordingly.

Many analysts are puzzled about why the economy hasn’t slowed quicker given the rapid increase in the Fed Funds rate over the last year. Some analysts are even concerned about “premature reacceleration”. Some analysts are even concerned about “premature reacceleration”. Goldman Sachs economists wrote last week:“In recent months we have argued that the drag on GDP growth from last year’s fiscal and monetary policy tightening is fading, not growing, and that this means that the key risk for the economy is a premature reacceleration, not an imminent recession.”When I read some of the recent comments from FOMC members, I’m reminded of a great scene from the movie China Syndrome where a stuck indicator almost led to catastrophic failure.

emphasis added

Housing March 13th Weekly Update: Inventory Decreased 1.5% Week-over-week

by Calculated Risk on 3/13/2023 08:47:00 AM

Click on graph for larger image.

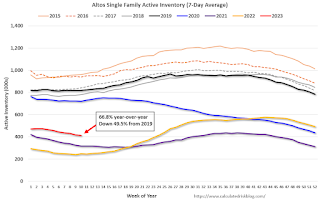

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday, March 12, 2023

Sunday Night Futures

by Calculated Risk on 3/12/2023 06:12:00 PM

Weekend:

• Schedule for Week of March 12, 2023

Monday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for January 2023

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 8 and DOW futures are up 40 (fair value).

Oil prices were up over the last week with WTI futures at $76.68 per barrel and Brent at $82.78 per barrel. A year ago, WTI was at $109, and Brent was at $118 - so WTI oil prices are DOWN 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.43 per gallon. A year ago, prices were at $4.29 per gallon, so gasoline prices are down $0.86 per gallon year-over-year.