by Calculated Risk on 1/28/2023 02:11:00 PM

Saturday, January 28, 2023

Real Estate Newsletter Articles this Week: New Home Sales at 616,000 Annual Rate in December; Previous 3 Months Revised Down Sharply

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales at 616,000 Annual Rate in December; Previous 3 Months Revised Down Sharply

• Final Look at Local Housing Markets in December

• 1.51 million Total Housing Completions in 2022 including Manufactured Homes; Most Since 2007

• Has Housing "Bottomed"?

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of January 29, 2023

by Calculated Risk on 1/28/2023 10:11:00 AM

The key reports scheduled for this week are the January employment report and November Case-Shiller house prices.

Other key indicators include January ISM manufacturing and services surveys, and January vehicle sales.

The FOMC meets this week, and the FOMC is expected to announce a 25 bp hike in the Fed Funds rate.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed manufacturing surveys for January.

9:00 AM: FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.

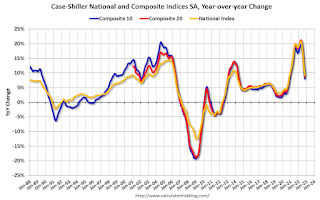

9:00 AM ET: S&P/Case-Shiller House Price Index for November.This graph shows the Year over year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.9% year-over-year increase in the Comp 20 index.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 44.9, down from 45.1 in December.

10:00 AM: The Q4 Housing Vacancies and Homeownership report from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in January, down from 235,000 added in December.

10:00 AM: Construction Spending for December. The consensus is for a 0.1% decrease in construction spending.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

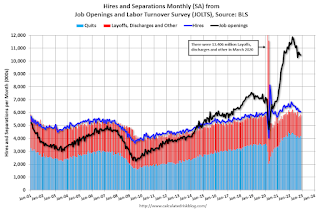

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Job openings decreased in November to 10.458 million from 10.512 million in October

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.0, down from 48.4 in December.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce a 25 bp hike in the Fed Funds rate.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 14.3 million SAAR in January, up from 13.3 million in December (Seasonally Adjusted Annual Rate).

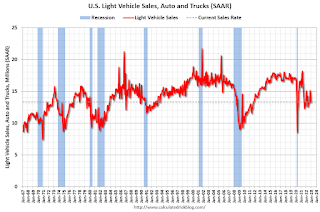

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 14.3 million SAAR in January, up from 13.3 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 186 thousand last week.

8:30 AM: Employment Report for December. The consensus is for 185,000 jobs added, and for the unemployment rate to increase to 3.6%.

8:30 AM: Employment Report for December. The consensus is for 185,000 jobs added, and for the unemployment rate to increase to 3.6%.There were 223,000 jobs added in December, and the unemployment rate was at 3.5%.

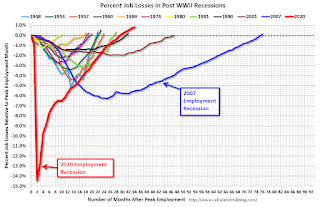

This graph shows the job losses from the start of the employment recession, in percentage terms.

The pandemic employment recession was by far the worst recession since WWII in percentage terms. However, as of August 2022, the total number of jobs had returned and are now 1.24 million above pre-pandemic levels.

10:00 AM: ISM Services Index for January.

Friday, January 27, 2023

COVID Jan 27, 2023: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 1/27/2023 09:58:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 295,140 | 332,606 | ≤35,0001 | |

| Hospitalized2 | 29,411 | 34,723 | ≤3,0001 | |

| Deaths per Week2 | 3,756 | 3,948 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Hotels: Occupancy Rate Down 6.2% Compared to Same Week in 2019

by Calculated Risk on 1/27/2023 04:09:00 PM

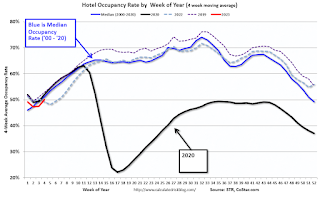

With the Martin Luther King Jr. holiday, U.S. hotel performance came in slightly lower than the previous week, according to STR‘s latest data through Jan. 21.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 15-21, 2023 (percentage change from comparable week in 2019*):

• Occupancy: 54.2% (-6.2%)

• Average daily rate (ADR): $140.16 (+11.3%)

• evenue per available room (RevPAR): $75.97 (+4.4%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019. Year-over-year comparisons will once again become standard after Q1.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Realtor.com Reports Weekly Active Inventory Up 69% YoY; New Listings Down 5% YoY

by Calculated Risk on 1/27/2023 03:12:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Jan 21, 2023. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory growth continued to climb with for-sale homes up 69% above one year ago. In January, the housing market built further on the impressive growth seen in late 2022. But there is still room for more. Even after surging more than 50% in December 2022, the number of homes on the market trailed pre-pandemic counts by nearly 40%.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 5% from one year ago. This marks the twenty-ninth consecutive week of year-over-year declines in homeowners listing their homes for sale, but this week’s decline was not only smaller than dip, the average decline in new listings so far this year is about half what we saw in the fourth quarter of 2022. As mortgage rates rose and the market shifted from a distinct seller’s market to one that might better be described as a nobody’s market, we saw homeowners retrench, and the number of new listings fell. Although the number of new listings is still declining, at the current pace we could see a reversal of that trend or more new listings than one year ago as soon as February.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. In early 2022, inventory was declining rapidly, so the year-over-year change is up sharply.

Has Housing "Bottomed"?

by Calculated Risk on 1/27/2023 12:18:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Has Housing "Bottomed"?

Brief excerpt:

I’ve heard some positive comments from a number of real estate agents in the last week about the existing home market.You can subscribe at https://calculatedrisk.substack.com/.

...

Activity is still down sharply year-over-year (YoY), but the YoY decline is getting smaller.

And some upbeat comments on new home sales ...

Way back in 2009, I pointed out that there are usually two bottoms for housing.There will probably be two bottoms for Residential Real Estate.The first bottom is for activity, and the second is for prices.

The first will be for new home sales, housing starts and residential investment. The second bottom will be for prices. Sometimes these bottoms can happen years apart.

NAR: Pending Home Sales Increased 2.5% in December, Year-over-year Down 33.8%

by Calculated Risk on 1/27/2023 10:03:00 AM

From the NAR: Pending Home Sales Increased 2.5% in December, Ending Six-Month Slide

Pending home sales increased in December for the first time since May 2022 — following six consecutive months of declines — according to the National Association of Realtors®. The Northeast and Midwest recorded month-over-month reductions, while the South and West posted monthly gains. All four U.S. regions saw year-over-year decreases in transactions, with the West experiencing the largest decline at 37.5%.Expectations had been for a 1.0% decline for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

The Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — improved 2.5% to 76.9 in December. Year-over-year, pending transactions dropped by 33.8%. An index of 100 is equal to the level of contract activity in 2001.

“This recent low point in home sales activity is likely over,” said NAR Chief Economist Lawrence Yun. “Mortgage rates are the dominant factor driving home sales, and recent declines in rates are clearly helping to stabilize the market.”

...

The Northeast PHSI dropped 6.5% from last month to 64.7, a decrease of 32.5% from December 2021. The Midwest index shrank 0.3% to 77.6 in December, a decline of 30.1% from one year ago.

The South PHSI rose 6.1% to 94.1 in December, dropping 34.5% from the prior year. The West index advanced 6.4% in December to 58.6, decreasing 37.5% from December 2021.

emphasis added

Personal Income increased 0.2% in December; Spending decreased 0.2%

by Calculated Risk on 1/27/2023 08:41:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $49.5 billion (0.2 percent) in December, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $49.2 billion (0.3 percent) and personal consumption expenditures (PCE) decreased $41.6 billion (0.2 percent).The December PCE price index increased 5.0 percent year-over-year (YoY), down from 5.5 percent YoY in November, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Real DPI increased 0.2 percent in December and Real PCE decreased 0.3 percent; goods decreased 0.9 percent and services were unchanged.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through December 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and the decrease in PCE was slightly below expectations.

Thursday, January 26, 2023

Friday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 1/26/2023 08:49:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.2% increase in personal income, and for a 0.1% decrease in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 5.0% YoY, and core PCE prices up 4.4% YoY.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a -1.0% decrease in the index.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 64.6.

A Few Comments on Q4 GDP and Investment

by Calculated Risk on 1/26/2023 01:47:00 PM

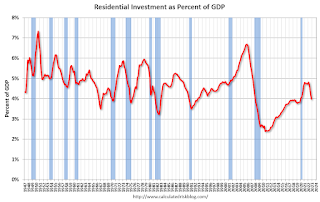

Note: The first two graphs - Investment Contributions and Residential Investment as a percent of GDP - are useful in predicting Fed induced recessions. RI as a percent of GDP usually turns down well in advance of a recession. This is something I'm watching.

Earlier from the BEA: Gross Domestic Product, Fourth Quarter 2022 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent. ...The advance Q4 GDP report, at 2.9% annualized, was above expectations, partly due to a positive impact from an increase in inventories.

The increase in real GDP reflected increases in private inventory investment, consumer spending, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by decreases in residential fixed investment and exports. Imports, which are a subtraction in the calculation of GDP, decreased.

emphasis added

Personal consumption expenditures (PCE) increased at a 2.1% annualized rate in Q4.

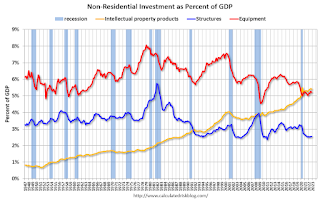

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So, the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern didn't apply.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) decreased at a 26.7% annual rate in Q4. Equipment investment decreased at a 3.7% annual rate, and investment in non-residential structures increased at a 0.4% annual rate.

On a 3-quarter trailing average basis, RI (red) is down, equipment (green) is up, and nonresidential structures (blue) is still down.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP decreased in Q4.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single-family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".