by Calculated Risk on 1/25/2023 09:00:00 PM

Wednesday, January 25, 2023

Thursday: GDP, New Home Sales, Durable Goods, Unemployment Claims

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 4th quarter and Year 2022 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q4.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 205 thousand initial claims, up from 190 thousand last week.

• Also at 8:30 AM, Durable Goods Orders for December. The consensus is for a 2.6% increase in durable goods.

• Also at 8:30 AM, Chicago Fed National Activity Index for December. This is a composite index of other data.

• At 10:00 AM, New Home Sales for December from the Census Bureau. The consensus is for 614 thousand SAAR, down from 640 thousand in November.

• At 11:00 AM, the Kansas City Fed manufacturing survey for January.

Freddie Mac: Mortgage Serious Delinquency Rate unchanged in December

by Calculated Risk on 1/25/2023 04:52:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in December was 0.66%, unchanged from 0.66% November. Freddie's rate is down year-over-year from 1.12% in December 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

Vehicle Sales Forecast: Vehicle Sales to Increase in January

by Calculated Risk on 1/25/2023 02:48:00 PM

From WardsAuto: U.S. Light-Vehicle Sales to Rise 5th Straight Month in January; Q1 Forecast for 4% Gain (pay content). Brief excerpt:

The bottom line is raw volume is growing, albeit slowly, with a forecast year-over-year gain in January, as well as the entire first quarter. Because of the chaos of the past three years, January’s upward spike to a 15.6 million-unit seasonally adjusted annual rate from December’s 13.4 million is more a result of disruption to typical year-end seasonal trends than a sudden surge in demand.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for January (Red).

The Wards forecast of 15.6 million SAAR, would be up 17% from last month, and up 3% from a year ago.

Black Knight: Mortgage Delinquency Rate Increased in December; Prepayments at Record Low

by Calculated Risk on 1/25/2023 12:20:00 PM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Closed 2022 Down 9% for the Year, While Prepayments Hit Third Consecutive Record Low

• The national delinquency rate inched up 7 basis points in the month to 3.08%, but finished the year 30 basis points (-9%) below its December 2021 levelAccording to Black Knight's First Look report, the percent of loans delinquent increased 2.3% in December compared to November and decreased 9% year-over-year.

• Prepayment activity fell to 0.39% – with single month mortality (SMM) hitting its third consecutive record low dating back to 2000 when Black Knight began reporting the metric

• Serious delinquencies (90+ days past due) continued to improve nationally despite an 8.7K rise in Florida in the wake of Hurricane Ian, with 44 other states seeing seriously past-due volumes decline in the month

• Borrowers 30 days late increased by 40K, up 4.8%, while 60-day delinquencies stayed flat

• Foreclosure starts increased by 15% in the month to 26,900 – the third consecutive increase, but still 30% below pre-pandemic levels

• Foreclosure was started on 4.9% of serious delinquencies in December, up from November, but still 46% below the start rate seen in December 2019 prior to the pandemic

• Active foreclosure inventory rose by 2.3% in the month, though volumes remained subdued throughout 2022 after the record lows of 2021 due to widespread moratoriums and forbearance protections

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.08% in December, up from 3.01% in November.

The percent of loans in the foreclosure process increased slightly in December to 0.37%, from 0.37% in November.

The number of delinquent properties, but not in foreclosure, is down 146,000 properties year-over-year, and the number of properties in the foreclosure process is up 70,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2022 | Nov 2022 | Dec 2021 | Dec 2020 | |

| Delinquent | 3.08% | 3.01% | 3.38% | 6.08% |

| In Foreclosure | 0.37% | 0.37% | 0.24% | 0.33% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,653,000 | 1,612,000 | 1,799,000 | 3,251,000 |

| Number of properties in foreclosure pre-sale inventory: | 198,000 | 196,000 | 128,000 | 178,000 |

| Total Properties | 1,850,000 | 1,808,000 | 1,927,000 | 3,429,000 |

AIA: Architecture Billings "Continue to Decline" in December

by Calculated Risk on 1/25/2023 10:06:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings continue to decline

Demand for design services from U.S. architecture firms continued to contract in December, according to a new report from the American Institute of Architects (AIA).

The pace of decline during December slowed from November, posting an Architecture Billings Index (ABI) score of 47.5 from 46.6 (any score below 50 indicates a decline in firm billings). Inquiries into new projects posted a positive score of 52.3, however new design contracts remained in negative territory with a score of 49.4.

“Despite strong revenue growth last year, architecture firms have modest expectations regarding business conditions this coming year,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “With ABI scores for the entire fourth quarter of 2022 in negative territory, a slowdown in construction activity is expected later this year, though the depth of the downturn remains unclear.”

...

• Regional averages: Midwest (49.4); South (48.6); Northeast (46.5); West (45.5)

• Sector index breakdown: mixed practice (54.8); institutional (47.3); commercial/industrial (45.2); multi-family residential (44.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 47.5 in December, up from 46.6 in November. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had been positive for 20 consecutive months but indicated a decline the last three months. This index usually leads CRE investment by 9 to 12 months, so this index suggests a pickup in CRE investment in early 2023, but a slowdown in CRE investment later in 2023.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/25/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 20, 2023. This week’s results include an adjustment for the observance of Martin Luther King, Jr. Day.

... The Refinance Index increased 15 percent from the previous week and was 77 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 39 percent lower than the same week one year ago.

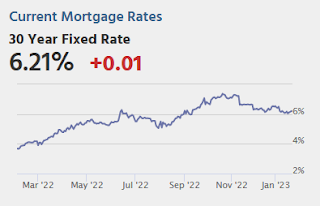

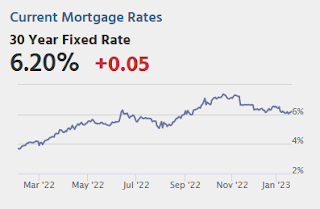

“Mortgage rates declined for the third straight week, which is good news for potential homebuyers looking ahead to the spring homebuying season. Mortgage rates on most loan types decreased last week and the 30-year fixed rate reached its lowest level since September 2022 at 6.2 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Overall applications increased with both gains in purchase and refinance activity, but purchase applications remained almost 39 percent lower than a year ago. Homebuying activity remains tepid, but if rates continue to fall and home prices cool further, we expect to see potential buyers come back into the market. Many have been waiting for affordability challenges to subside.”

Added Kan, “Despite a 15 percent increase in refinances, they were still 77 percent behind last year’s pace, as rates remained more than two percentage points higher, thus providing very little refinance incentive for most borrowers who are locked into lower rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.20 percent from 6.23 percent, with points increasing to 0.69 from 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Tuesday, January 24, 2023

Wednesday: MBA Mortgage Applications, Architecture Billings

by Calculated Risk on 1/24/2023 08:33:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

BLS: Alaska and Pennsylvania Set New Record Series Low Unemployment rates in December

by Calculated Risk on 1/24/2023 11:07:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in December in 7 states, lower in 5 states, and stable in 38 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Thirty-five states and the District had jobless rate decreases from a year earlier, 4 states had increases, and 11 states had little change.Two states set new series record low unemployment rates in December.

...

Utah had the lowest jobless rate in December, 2.2 percent. The next lowest rates were in North Dakota and South Dakota, 2.3 percent each. The rates in Alaska (4.3 percent) and Pennsylvania (3.9 percent) set new series lows. (All state series begin in 1976.) Nevada had the highest unemployment rate, 5.2 percent.

emphasis added

Final Look at Local Housing Markets in December

by Calculated Risk on 1/24/2023 08:48:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in December

A brief excerpt:

The big story for December existing home sales was the sharp year-over-year (YoY) decline in sales. Another key story was that new listings were down further YoY in December as many potential sellers are locked into their current home (low mortgage rate). And active inventory increased sharply YoY.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the final look at local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I update these tables throughout each month as additional data is released.

NOTE: Hopefully I’ll be adding more markets next month!

First, here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely. The NAR reported sales were down 36.3% NSA YoY in December.

...

More local data coming in February for activity in January!

My early expectation is we will see a somewhat smaller YoY sales decline in January, than in December, due to the decrease in mortgage rates in December (January sales are mostly for contracts signed in November and December).

Monday, January 23, 2023

Tuesday: Richmond Fed Mfg

by Calculated Risk on 1/23/2023 09:05:00 PM

After hitting the lowest levels in 4 months at times over the past week, rates have drifted up a bit. There hasn't been much rhyme or reason behind the bounce. ... The week ahead is a bit of a wild card as there are no hotly anticipated events on tap. Some market participants might make a case that the first look at Q4 GDP on Thursday or the PCE inflation on Friday are exceptions to that claim, but they pale in comparison to next week's Fed announcement and Friday's jobs report. [30 year fixed 6.20%]Tuesday:

emphasis added

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for January.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for December 2022.