by Calculated Risk on 11/11/2022 02:09:00 PM

Friday, November 11, 2022

Early Q4 GDP Tracking

It is early in Q4 ... we will have more estimates next week.

From BofA:

[Forecast 1.0% in Q4] Overall, the data since our last weekly publication pushed down our 3Q GDP tracking estimate from 3.1% q/q saar (seasonally adjusted annual rate) to 3.0% q/q saar. Looking ahead to next week, there are a number of data releases that could affect 3Q tracking, including retail sales on Wednesday, which will also kick-off our 4Q tracking. [Nov 11th estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.0 percent on November 9, up from 3.6 percent on November 3. [Nov 9th estimate]

Current State of the Housing Market; Overview for mid-November

by Calculated Risk on 11/11/2022 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market; Overview for mid-November

A brief excerpt:

Over the last month …There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

1. New listings have declined further year-over-year.

2.Mortgage rates had increased further but declined this week.

3. House prices are declining month-over-month (MoM) as measured by the repeat sales indexes.

...

The next graph shows the month-over-month (MoM) decrease in the seasonally adjusted Case-Shiller index. The MoM decrease in Case-Shiller was at -0.86% seasonally adjusted. This was the second consecutive MoM decrease, and the largest MoM since February 2010. Since this includes closings in June and July, this suggests prices fell sharply for August closings.

...

Next Friday, the NAR will release existing home sales for October. This report will likely show another sharp year-over-year decline in sales for October.

Hotels: Occupancy Rate Down 9.2% Compared to Same Week in 2019

by Calculated Risk on 11/11/2022 08:29:00 AM

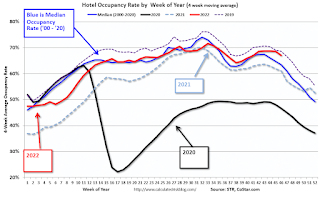

As expected due to the Halloween calendar shift, U.S. hotel performance came in lower than the previous week and showed weakened comparisons to 2019, according to STR‘s latest data through Nov. 5.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Oct. 30 through Nov. 5, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 62.4% (-9.2%)

• Average daily rate (ADR): $147.48 (+11.4%)

• Revenue per available room (RevPAR): $91.99 (+1.1%)

While none of the Top 25 Markets showed an occupancy increase over 2019, Tampa came closest to its pre-pandemic comparable (-1.0% to 72.4%). ...

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Thursday, November 10, 2022

Realtor.com Reports Weekly Active Inventory Up 42% Year-over-year; New Listings Down 20%

by Calculated Risk on 11/10/2022 04:27:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Nov 5, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, increasing 42% above one year ago. Inventory accelerated by a more modest amount this week, but it was still the fourth consecutive week of roughly 2+% inventory gains after a fair amount of stability since July. Inventory growth even in the face of fewer newly listed homes indicates how many buyers have retreated from the housing market rather than navigate higher costs stemming from higher purchase prices and higher mortgage rates.

...

• New listings–a measure of sellers putting homes up for sale–were again down, dropping 20% from one year ago. This marks the eighteenth week of year over year declines in homeowners listing their home for sale, a sign that homeowners are well aware of the market’s reset. This data suggests that many potential sellers may be joining buyers in “wait-and-see” mode.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Housing and Inflation

by Calculated Risk on 11/10/2022 02:02:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing and Inflation

A brief excerpt:

A few key points:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• The Fed has been raising rates to slow inflation. Since housing is a key transmission mechanism for Fed policy, the housing market has slowed dramatically as the Fed raised rates (and mortgage rates increased).

• The CPI report this morning contained some good news on inflation.

• The BLS reported “The index for shelter contributed over half of the monthly all items increase”.

• The BLS measure for shelter is seriously lagged and is likely behind the curve on the sharp slowdown in rents.

...

Both CPI and core CPI were below expectations, and the year-over-year change is declining. Bond yields fell sharply this morning, and the 30-year mortgage rate dropped significantly to 6.67% from 7.25% yesterday (average top tier scenarios with zero points).

...

My current view is inflation will ease quicker than the Fed currently expects.

MBA: "Mortgage Delinquencies Decrease to New Survey Low in the Third Quarter of 2022"

by Calculated Risk on 11/10/2022 11:33:00 AM

From the MBA: Mortgage Delinquencies Decrease to New Survey Low in the Third Quarter of 2022

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.45 percent of all loans outstanding at the end of the third quarter of 2022, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 19 basis points from the second quarter of 2022 and down 143 basis points from one year ago.

“For the second quarter in a row, the mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979 – declining to 3.45 percent. Foreclosure starts and loans in the process of foreclosure also dropped in the third quarter to levels further below their historical averages,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The relatively small number of seriously delinquent homeowners are working with their mortgage servicers to find foreclosure alternatives, including loan workouts that allow for home retention.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q3 to a record low.

From the MBA:

Compared to second-quarter 2022, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding to 3.45 percent, the lowest level in the history of the survey dating back to 1979. By stage, the 30-day delinquency rate remained unchanged at 1.66 percent, the 60-day delinquency rate increased 4 basis points to 0.53 percent, and the 90-day delinquency bucket decreased 22 basis points to 1.27 percent.This sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. For much of the last two years, foreclosure moratoria were in place, which kept these numbers artificially low. ... The percentage of loans in the foreclosure process at the end of the third quarter of 2022 was 0.56 percent, down 3 basis points from the second quarter of 2022, and 10 basis points higher than one year ago.

The percent of loans in the foreclosure process increased year-over-year in Q3 with the end of the foreclosure moratoriums.

Cleveland Fed: Median CPI increased 0.5% and Trimmed-mean CPI increased 0.4% in October

by Calculated Risk on 11/10/2022 11:18:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in October. The 16% trimmed-mean Consumer Price Index increased 0.4% in October. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details here: "Fuel oil and other fuels" increased at a 232% annualized rate in October.

Weekly Initial Unemployment Claims increase to 225,000

by Calculated Risk on 11/10/2022 08:38:00 AM

The DOL reported:

In the week ending November 5, the advance figure for seasonally adjusted initial claims was 225,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 217,000 to 218,000. The 4-week moving average was 218,750, a decrease of 250 from the previous week's revised average. The previous week's average was revised up by 250 from 218,750 to 219,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

The previous week was revised up.

Weekly claims were above the consensus forecast.

BLS: CPI increased 0.4% in October; Core CPI increased 0.3%

by Calculated Risk on 11/10/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in October on a seasonally adjusted basis, the same increase as in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.7 percent before seasonal adjustment.Both CPI and core CPI were below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. The energy index increased 1.8 percent over the month as the gasoline index and the electricity index rose, but the natural gas index decreased. The food index increased 0.6 percent over the month with the food at home index rising 0.4 percent.

The index for all items less food and energy rose 0.3 percent in October, after rising 0.6 percent in September. The indexes for shelter, motor vehicle insurance, recreation, new vehicles, and personal care were among those that increased over the month. Indexes which declined in October included the used cars and trucks, medical care, apparel, and airline fares indexes.

The all items index increased 7.7 percent for the 12 months ending October, this was the smallest 12-month increase since the period ending January 2022. The all items less food and energy index rose 6.3 percent over the last 12 months. The energy index increased 17.6 percent for the 12 months ending October, and the food index increased 10.9 percent over the last year; all of these increases were smaller than for the period ending September.

emphasis added

Wednesday, November 09, 2022

Thursday: CPI, Unemployment Claims

by Calculated Risk on 11/09/2022 09:01:00 PM

Thursday:

• At 8:30 AM ET, The Consumer Price Index for October from the BLS. The consensus is for a 0.7% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 8.0% year-over-year and core CPI to be up 6.6% YoY.

• Also at 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 217 thousand last week.