by Calculated Risk on 7/14/2022 01:59:00 PM

Thursday, July 14, 2022

Current State of the Housing Market

Today, in the Calculated Risk Real Estate Newsletter: Current State of the Housing Market

A brief excerpt:

This is a market overview for mid-July.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a graph using the Altos inventory data of the trend comparing to 2020 and 2019. The dotted red line is the recent trend compared to 2020 - and at the current pace, inventory will be up compared to 2020 in late August. The dashed grey line is comparing to 2019, and based on the current trend, it is possible inventory will be back to 2019 levels by the beginning of 2023.

...We are seeing a clear slowing in the housing market, with more price reductions, more inventory, and fewer sales. It will take some time to see the impact on house price growth, but that is coming too.

Next week, existing home sales will likely show a sharp year-over-year decline in sales for June, and housing starts will probably show further declines (and still a record number of homes under construction).

It is important to remember that housing is a key transmission mechanism for Federal Open Market Committee (FOMC) policy. As long as inflation remains elevated, the Fed will keep raising rates - and that will impact the housing market (although mortgage rates have already jumped in anticipation of the FOMC actions).

Hotels: Occupancy Rate Down 14.5% Compared to Same Week in 2019

by Calculated Risk on 7/14/2022 12:57:00 PM

As expected on the negative side of a holiday calendar shift, U.S. hotel performance came in lower than the previous week, according to STR‘s latest data through July 9.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

July 3-9 2022 (percentage change from comparable week in 2019*):

• Occupancy: 63.3% (-14.5%)

• Average daily rate (ADR): $153.71 (+15.7%)

• Revenue per available room (RevPAR): $97.37 (-1.1%)

Whereas the previous week’s percentage changes were elevated on the favorable side of the calendar shift, the most recent week was skewed downward due to a comparison with a non-holiday week in 2019. After two consecutive weeks of lower demand around the Fourth of July holiday, the metrics are expected to strengthen for the remaining weeks of July.

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

LA Port Traffic: Mostly Steady in June

by Calculated Risk on 7/14/2022 10:17:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 0.4% in June compared to the rolling 12 months ending in May. Outbound traffic was down 0.1% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Weekly Initial Unemployment Claims Increase to 244,000

by Calculated Risk on 7/14/2022 08:33:00 AM

The DOL reported:

In the week ending July 9, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 9,000 from the previous week's unrevised level of 235,000. The 4-week moving average was 235,750, an increase of 3,250 from the previous week's unrevised average of 232,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 235,750.

The previous week was unrevised.

Weekly claims were higher than the consensus forecast

Wednesday, July 13, 2022

Thursday: Unemployment Claims, PPI

by Calculated Risk on 7/13/2022 08:52:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 230 thousand down from 235 thousand last week.

• Also, at 8:30 AM, The Producer Price Index for June from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.5% increase in core PPI.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 123,365 | 108,028 | ≤5,0001 | |

| Hospitalized2🚩 | 31,993 | 28,720 | ≤3,0001 | |

| Deaths per Day2🚩 | 342 | 311 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fed's Beige Book: "Housing demand weakened noticeably"

by Calculated Risk on 7/13/2022 02:09:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Atlanta based on information collected on or before July 13, 2022."

Economic activity expanded at a modest pace, on balance, since mid-May; however, several Districts reported growing signs of a slowdown in demand, and contacts in five Districts noted concerns over an increased risk of a recession. Most Districts reported that consumer spending moderated as higher food and gas prices diminished households' discretionary income. Due to continued low inventory levels, new auto sales remained sluggish across most Districts. Hospitality and tourism contacts cited healthy leisure travel activity with some noting an uptick in business and group travel. Manufacturing activity was mixed, and many Districts reported that supply chain disruptions and labor shortages continued to hamper production. Non-financial services firms experienced stable to slightly higher demand, and some firms reported that revenues exceeded expectations. Housing demand weakened noticeably as growing concerns about affordability contributed to non-seasonal declines in sales, resulting in a slight increase in inventory and more moderate price appreciation. Commercial real estate conditions slowed. Loan demand was mixed across most Districts; some financial institutions reported increased customer usage of revolving credit lines, while others reported weakening residential loan demand amid higher mortgage interest rates. Demand for transportation services was mixed and reports on agriculture conditions across reporting Districts varied. While demand for energy products was robust and oil and gas drilling activity picked up, production remained constrained by labor availability and supply chain bottlenecks for critical components. Similar to the previous report, the outlook for future economic growth was mostly negative among reporting Districts, with contacts noting expectations for further weakening of demand over the next six to twelve months.

emphasis added

Lawler on Demographics: Observations and Updated Population Projections

by Calculated Risk on 7/13/2022 12:55:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler on Demographics: Observations and Updated Population Projections

A brief excerpt:

CR Note: This is a technical post, but the key take away for housing is: “the “demographics” are not nearly as positive over the next several years as the Census 2017 projections would have suggested.”There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Way back in 2015, I projected a surge in homebuying in the 2020s based on demographics. The surge has happened, but the demographics are not as positive as originally predicted. Many analysts are repeating my earlier analysis without adjusting for less net international migration (NIM), and more deaths.

From housing economist Tom Lawler:

Analysts who rely on US population projections (total and by characteristics) to project other economic variables (including those housing related) have been frustrated by the lack of any credible official projections. The last official intermediate and long term population projections from Census was done in 2017, and (which I’ve written about before) those projections significantly over-predicted US births, significantly under-predicted deaths, and significantly over-predicted net international migration (NIM). On the latter score it’s not clear the extent of the over-prediction of NIM in the Census 2017 projections, as Census has not released updated NIM estimates for the 2010-2020 period. The last such NIM estimates were in the “Vintage 2020” population estimates, which did NOT incorporate the Census 2020 results, and the Vintage 2020 population estimate for April 1, 2020 was about 2.05 million below the Census 2020 tally. Presumably most of the Vintage 2020 “miss” reflected higher NIM over the past decade than that shown in the Vintage 2020 estimates, though the yearly differences in NIM are unknown, and Census has not yet released updated intercensal population estimates for the 2010-2020 period that are consistent with the Census 2020 results.

... some analysts like to look at projections of the number of 30 to 39 year olds, as that age group would likely include a large number of potential first-time home buyers. The Census 2017 Projections predicted that from July 1, 2020 to July 1, 2025 the number of 30-39 year olds would increase by 2,571,433, with a 697,200 increase in 2021. This updated projection has the number of 30-39 year olds increasing by only a third of that amount (864,670), with a 291,209 increase (from Vintage 2021) in 2021. The reasons for the big differences are (1) a different starting age distribution; (2) significantly higher deaths; and (3) significantly lower NIM. Obviously, the “demographics” are not nearly as positive over the next several years as the Census 2017 projections would have suggested.

Cleveland Fed: Median CPI increased 0.7% and Trimmed-mean CPI increased 0.8% in June

by Calculated Risk on 7/13/2022 11:41:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

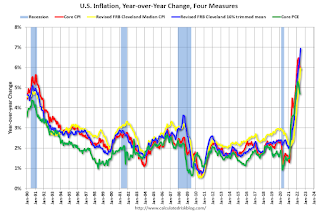

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.7% in June. The 16% trimmed-mean Consumer Price Index increased 0.8% in June. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Motor Fuel" increased at 251% annualized rate in June!

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Early Look at 2023 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/13/2022 09:14:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 9.8 percent over the last 12 months to an index level of 292.542 (1982-84=100). For the month, the index rose 1.6 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2021, the Q3 average of CPI-W was 268.421.

The 2021 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 9.8% year-over-year in June, and although this is very early - we need the data for July, August and September - my very early guess is COLA will probably be over 9% this year - and COLA could be double digits - the largest increase since 11.2% in 1981.

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2021 yet, but wages probably increased again in 2021. If wages increased 4% in 2021, then the contribution base next year will increase to around $153,000 in 2023, from the current $147,000.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

BLS: CPI increased 1.3% in June; Core CPI increased 0.7%

by Calculated Risk on 7/13/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.3 percent in June on a seasonally adjusted basis after rising 1.0 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 9.1 percent before seasonal adjustment.The consensus was for 1.1% increase in CPI, and a 0.6% increase in core CPI. Both were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The increase was broad-based, with the indexes for gasoline, shelter, and food being the largest contributors. The energy index rose 7.5 percent over the month and contributed nearly half of the all items increase, with the gasoline index rising 11.2 percent and the other major component indexes also rising. The food index rose 1.0 percent in June, as did the food at home index.

The index for all items less food and energy rose 0.7 percent in June, after increasing 0.6 percent in the preceding two months. While almost all major component indexes increased over the month, the largest contributors were the indexes for shelter, used cars and trucks, medical care, motor vehicle insurance, and new vehicles. The indexes for motor vehicle repair, apparel, household furnishings and operations, and recreation also increased in June. Among the few major component indexes to decline in June were lodging away from home and airline fares.

The all items index increased 9.1 percent for the 12 months ending June, the largest 12-month increase since the period ending November 1981. The all items less food and energy index rose 5.9 percent over the last 12 months. The energy index rose 41.6 percent over the last year, the largest 12-month increase since the period ending April 1980. The food index increased 10.4 percent for the 12-months ending June, the largest 12-month increase since the period ending February 1981.

emphasis added