by Calculated Risk on 7/04/2022 09:40:00 AM

Monday, July 04, 2022

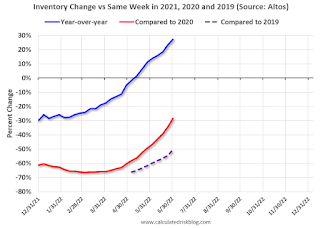

Housing Inventory July 4th Update: Inventory Almost Double from March Low

Inventory is increasing rapidly. Inventory bottomed seasonally at the beginning of March 2022 and is now up 97% since then. Almost double!

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 27.4% according to Altos)

4. Inventory up compared to 2019 (currently down 50.5%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 7/04/2022 08:04:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

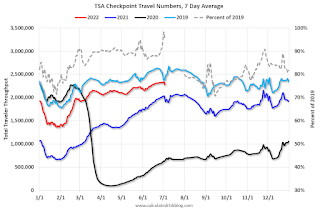

The TSA is providing daily travel numbers.

This data is as of July 3rd.

Click on graph for larger image.

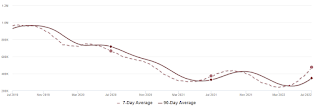

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 5.1% from the same day in 2019 (94.9% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $206 million last week, down about 39% from the median for the week.

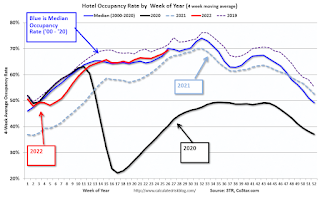

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through June 25th. The occupancy rate was down 4.1% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of June 24th, gasoline supplied was down 5.7% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

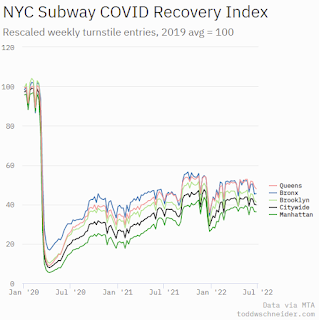

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, July 1st.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, July 03, 2022

Recession Measures and NBER

by Calculated Risk on 7/03/2022 03:18:00 PM

On Business Cycle Dating from NBER:

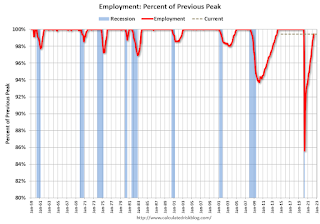

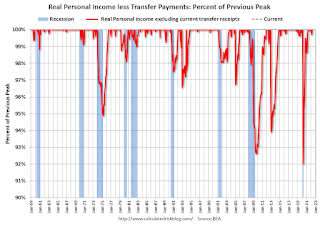

The NBER's definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. In our interpretation of this definition, we treat the three criteria—depth, diffusion, and duration—as somewhat interchangeable. That is, while each criterion needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another. For example, in the case of the February 2020 peak in economic activity, the committee concluded that the subsequent drop in activity had been so great and so widely diffused throughout the economy that, even if it proved to be quite brief, the downturn should be classified as a recession.The following graphs show the two key measures that NBER uses as a percent of the previous peak. (Real personal income less transfers and nonfarm payroll employment).

Because a recession must influence the economy broadly and not be confined to one sector, the committee emphasizes economy-wide measures of economic activity. The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions. In recent decades, the two measures we have put the most weight on are real personal income less transfers and nonfarm payroll employment.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph is for employment through May 2022.

Employment is currently off about 0.5% from the pre-recession peak (dashed line). This is a significant improvement from off 14.4% in April 2020.

Employment is still 822 thousand below pre-pandemic levels.

And the second graph is for real personal income excluding transfer payments through May 2022.

And the second graph is for real personal income excluding transfer payments through May 2022.Real personal income less transfer payments was at an all-time peak in May 2022.

These graphs are useful in trying to identify peaks and troughs in economic activity - and neither are suggesting a recession.

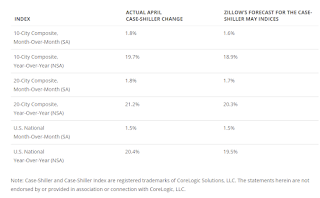

Zillow Case-Shiller Forecast for May: Slowing House Price Growth

by Calculated Risk on 7/03/2022 08:11:00 AM

The Case-Shiller house price indexes for April were released this week. The "April" report is a 3-month average including February, March and April closings. So, this included price increases when mortgage rates were significantly lower than today. This report includes some homes with contracts signed last December (that closed in February)!

Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow Research: April 2022 Case-Shiller Results & Forecast: Putting on the Brakes

With rates continuing their steep ascent and inventory picking up in months since, April is likely the first month of this deceleration as buyers balked at the cost of purchasing a home and pulled out of the market, leading to slower price growth. While inventory is improving, there is still plenty of room to go before it reaches its pre-pandemic trend. Still, coupled with relatively strong demand, that will continue to be a driver for sustained high prices even as sales volume is dropping in response to affordability constraints. As a result, more buyers will take a step to the sidelines in the coming months, which will help inventory to recover and price growth to slow from its peak, leading the market back to a more balanced stable state in the long run and providing more future opportunities for homeownership for those priced out today.

Annual home price growth as reported by Case-Shiller are expected to slow in all three indices. Monthly appreciation in May is expected to decelerate from April in both city indices, and hold in the national index. S&P Dow Jones Indices is expected to release data for the May S&P CoreLogic Case-Shiller Indices on Tuesday, July 26.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be 19.5% in May. This is slightly slower than in February, March and April, but still very strong YoY growth.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be 19.5% in May. This is slightly slower than in February, March and April, but still very strong YoY growth.

Saturday, July 02, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 7/02/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Housing: Inventory will Tell the Tale

• Case-Shiller National Index up 20.4% Year-over-year in April

• Worst Housing Affordability" since 1991 excluding Bubble

• Realtor.com Reports Weekly Inventory Up 25% Year-over-year

• Rent Increases Up Sharply Year-over-year, Pace is slowing

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Vehicles Sales Increased to 13.00 million SAAR in June

by Calculated Risk on 7/02/2022 09:00:00 AM

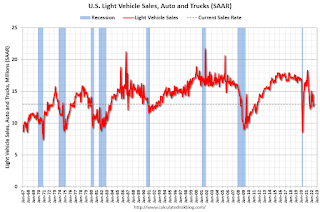

Wards Auto released their estimate of light vehicle sales for June. Wards Auto estimates sales of 13.00 million SAAR in June 2022 (Seasonally Adjusted Annual Rate), up 2.5% from the May sales rate, and down 16.0% from June 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for June (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Schedule for Week of July 3, 2022

by Calculated Risk on 7/02/2022 08:11:00 AM

The key report scheduled for this week is the June employment report to be released on Friday.

Other key reports include Job Openings, the June ISM Service survey and the Trade Deficit for May.

All US markets will be closed in observance of Independence Day

8:00 AM: Corelogic House Price index for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

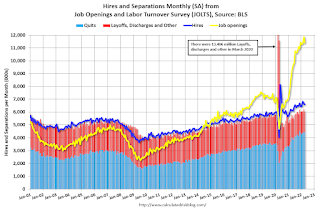

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in April to 11.400 million from 11.855 million in March.

The number of job openings (yellow) were up 23% year-over-year and quits were up 10% year-over-year.

10:00 AM: the ISM Services Index for June. The consensus is for a reading of 54.5, down from 55.9.

2:00 PM: FOMC Minutes, Meeting of June 14-15, 2022

8:15 AM: The ADP Employment Report for June will NOT be released.

"ADP Research Institute (ADPRI) and the Stanford Digital Economy Lab (the "Lab") announced they will retool the ADP National Employment Report (NER) methodology to provide a more robust, high-frequency view of the labor market and trajectory of economic growth. In preparation for the changeover to the new report and methodology, ADPRI will pause issuing the current report and has targeted August 31, 2022 ..."8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand down from 231 thousand last week.

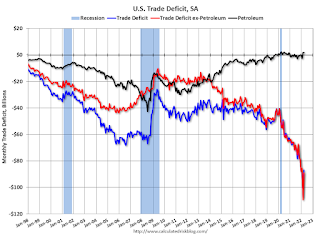

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $84.9 billion. The U.S. trade deficit was at $87.1 billion the previous month.

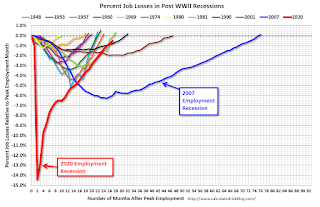

8:30 AM: Employment Report for June. The consensus is for 270,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for June. The consensus is for 270,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 390,000 jobs added in May, and the unemployment rate was at 3.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 26 months after the onset, has recovered quicker than the previous two recessions.

Friday, July 01, 2022

COVID July 1, 2022, Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 7/01/2022 10:11:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.3 | --- | ≥2321 | |

| New Cases per Day3🚩 | 109,944 | 99,245 | ≤5,0002 | |

| Hospitalized3🚩 | 26,896 | 25,227 | ≤3,0002 | |

| Deaths per Day3 | 316 | 319 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q2 GDP Forecasts: Close to Zero

by Calculated Risk on 7/01/2022 03:18:00 PM

From BofA:

With the downward revisions to spending and weak spending data in May, we have revised down our 2Q GDP tracking by from 1.5% qoq saar to 0.0% qoq saar. [July 1 estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +1.9% (qoq ar). [July 1 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -2.1 percent on July 1, down from -1.0 percent on June 30. [July 1 estimate]

Rent Increases Up Sharply Year-over-year, Pace is slowing

by Calculated Risk on 7/01/2022 12:39:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Rent Increases Up Sharply Year-over-year, Pace is slowing

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through April 2022 (Apartment List through June 2022).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

...

The Zillow measure is up 15.9% YoY in May, down from 16.6% YoY in April. This is down from a peak of 17.2% YoY in February.

The ApartmentList measure is up 14.1% YoY as of June, down from 15.4% in May. This is down from the peak of 17.8% YoY last December.

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 5.1% YoY in May, from 4.8% YoY in April - and will likely increase further in the coming months.

My suspicion is rent increases will slow over the coming months as the pace of household formation slows, and more supply comes on the market.