by Calculated Risk on 1/21/2022 09:23:00 PM

Friday, January 21, 2022

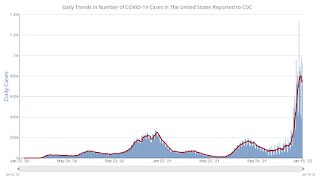

COVID Update January 21, 2022: New Cases Declining

Another COVID update. Hopefully this wave declines soon. Best to all.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 210.0 | --- | ≥2321 | |

| New Cases per Day3 | 726,870 | 797,694 | ≤5,0002 | |

| Hospitalized3🚩 | 144,636 | 133,297 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,843 | 1,754 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

1.44 million Total Housing Completions in 2021 including Manufactured Homes; Most since 2007

by Calculated Risk on 1/21/2022 03:04:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: 1.44 million Total Housing Completions in 2021 including Manufactured Homes

Excerpt:

This graph shows total housing completions and placements since 1968. The net additional to the housing stock is less because of demolitions and destruction of older housing units.There is more in the post. You can subscribe at https://calculatedrisk.substack.com/

Even though there were significant construction delays in 2021 - and there are currently the most housing units under construction since 1973 - there were 1.444 million total completions in 2021, the most since 2007.

Hotels: Occupancy Rate Down 16% Compared to Same Week in 2019

by Calculated Risk on 1/21/2022 11:59:00 AM

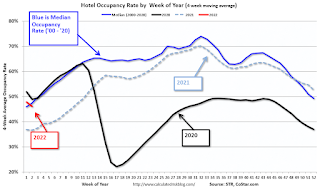

U.S. weekly hotel occupancy worsened in comparison with pre-pandemic levels, according to STR‘s latest data through Jan. 15.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

January 9-15, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 48.8% (-16.3%)

• Average daily rate (ADR): $122.12 (-1.6%)

• Revenue per available room (RevPAR): $54.47 (-19.0%)

On an absolute basis, occupancy was higher than the previous week, but the gap to 2019 levels widened, pointing to a larger impact from the omicron variant. ADR and RevPAR were up week over week and when indexed to 2019. ...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Q4 GDP Forecasts: 5% to 6%

by Calculated Risk on 1/21/2022 10:16:00 AM

The advance estimate of Q4 GDP will be released on Thursday, January 27th. The consensus estimate is for 6.0% real GDP growth (seasonally adjusted annual rate).

From BofA:

We expect the advance estimate of 4Q GDP to show a pickup in growth to 5.0% qoq saar. [January 21 estimate]From Goldman Sachs:

emphasis added

We left our Q4 GDP tracking estimate unchanged at +6.5% (qoq ar). [January 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 5.1 percent on January 19, up from 5.0 percent on January 14. [January 19 estimate]

Black Knight: National Mortgage Delinquency Rate Decreased in December; Foreclosures at Record Low

by Calculated Risk on 1/21/2022 08:29:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: 2021 Ends With Foreclosures at All-Time Low and Near Record-Low Delinquency Rate; Serious Delinquencies Still More than 2X Pre-Pandemic Levels

• At 3.38% entering January, the national delinquency rate sits just 0.1% above February 2020’s near record-low of 3.28%, just prior to the onset of the pandemicAccording to Black Knight's First Look report, the percent of loans delinquent decreased 5.9% in December compared to November and decreased 44% year-over-year.

• However, over half a million excess serious delinquencies remain – borrowers 90 or more days past due on their mortgages, including those in active forbearance – more than twice pre-pandemic levels

• Just 0.24% of loans are in active foreclosure in December – an all-time low – with the month’s 4,100 foreclosure starts some 90% below December 2019 levels

• While roughly twice as many foreclosure sales (completions) occurred in the month as compared to December 2020, there were only one-third as many as in pre-pandemic December 2019

• Given the volume of borrowers who’ve exited forbearance protections in recent months, the industry must keep a very close eye on foreclosure metrics moving forward in 2022

• Prepayment activity fell by more than 7% in December and is poised to fall even further as rising rates continue to erode refinance incentive

emphasis added

The percent of loans in the foreclosure process decreased 3.8% in December and were down 28% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.38% in December, down from 3.59% in November.

The percent of loans in the foreclosure process decreased in December to 0.24%, from 0.25% in November.

The number of delinquent properties, but not in foreclosure, is down 1,452,000 properties year-over-year, and the number of properties in the foreclosure process is down 50,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2021 | Nov 2021 | Dec 2020 | Dec 2019 | |

| Delinquent | 3.38% | 3.59% | 6.08% | 3.40% |

| In Foreclosure | 0.24% | 0.25% | 0.33% | 0.46% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,799,000 | 1,906,000 | 3,251,000 | 1,803,000 |

| Number of properties in foreclosure pre-sale inventory: | 128,000 | 132,000 | 178,000 | 245,000 |

| Total Properties | 1,927,000 | 2,039,000 | 3,429,000 | 2,047,000 |

Thursday, January 20, 2022

COVID Update, January 20, 2022

by Calculated Risk on 1/20/2022 08:54:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 209.8 | --- | ≥2321 | |

| New Cases per Day3 | 744,615 | 783,922 | ≤5,0002 | |

| Hospitalized3🚩 | 143,874 | 129,442 | ≤3,0002 | |

| Deaths per Day3 | 1,749 | 1,754 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Second Home Market: South Lake Tahoe in December

by Calculated Risk on 1/20/2022 03:33:00 PM

With the pandemic, there was a surge in 2nd home buying. In response, Fannie made some lending changes, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through December 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low - above the record low set in March 2021, but down YoY - and prices are up sharply YoY.

More Analysis on December Existing Home Sales

by Calculated Risk on 1/20/2022 10:40:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Existing-Home Sales Decreased to 6.18 million in December

Excerpt:

This graph shows existing home sales by month for 2020 and 2021.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

This was the fifth consecutive month with sales down year-over-year. Sales will likely be down YoY in January 2022 too since were exceptionally strong last Winter.

...

[and on inventory] According to the NAR, inventory decreased to 0.92 million in December from 1.11 million in November. Inventory usually declines significantly in November and December as potential sellers remove their homes from the market for the holidays. Inventory is now at a record low.

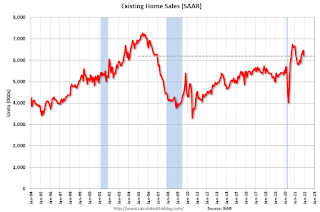

NAR: Existing-Home Sales Decreased to 6.18 million in December

by Calculated Risk on 1/20/2022 10:18:00 AM

From the NAR: Annual Existing-Home Sales Hit Highest Mark Since 2006

Existing-home sales declined in December, snapping a streak of three straight months of gains, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed sales fall in December from both a month-over-month and a year-over-year basis. Despite the drop, overall sales for 2021 increased 8.5%.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 4.6% from November to a seasonally adjusted annual rate of 6.18 million in December. From a year-over-year perspective, sales waned 7.1% (6.65 million in December 2020).

...

Total housing inventory at the end of December amounted to 910,000 units, down 18.0% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December (6.18 million SAAR) were down 4.6% from last month and were 7.1% below the December 2020 sales rate.

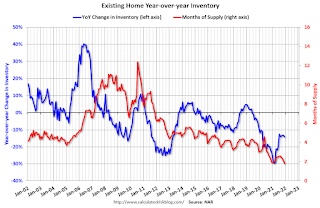

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 0.91 million in December from 1.11 million in November.

According to the NAR, inventory decreased to 0.91 million in December from 1.11 million in November.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 14.2% year-over-year in December compared to December 2020.

Inventory was down 14.2% year-over-year in December compared to December 2020. Months of supply declined to 1.8 months in December from 2.1 months in November.

This was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Increase to 286,000

by Calculated Risk on 1/20/2022 08:34:00 AM

Note: This report is for the BLS January reference week.

The DOL reported:

In the week ending January 15, the advance figure for seasonally adjusted initial claims was 286,000, an increase of 55,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 230,000 to 231,000. The 4-week moving average was 231,000, an increase of 20,000 from the previous week's revised average. The previous week's average was revised up by 250 from 210,750 to 211,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,000.

The previous week was revised up.

Weekly claims were well above the consensus forecast, likely due to the current COVID wave.