by Calculated Risk on 1/04/2022 08:27:00 PM

Tuesday, January 04, 2022

Wednesday: ADP Employment

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 413,000, down from 534,000 jobs added in November.

And on COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 206.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 491,652 | 248,571 | ≤5,0002 | |

| Hospitalized3🚩 | 85,423 | 64,152 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,165 | 1,106 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

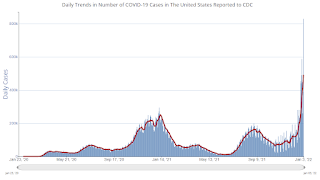

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Will the unprecedented surge in investor purchases of SF homes continue?

by Calculated Risk on 1/04/2022 05:24:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: Will the unprecedented surge in investor purchases of SF homes continue?

Excerpt:

Just some initial thoughts …

Earlier I wrote about housing credit and delinquencies (neither are presently a concern). These are important topics but being overly focused on either is like fighting the last war (the housing bubble).

A new possible risk is all of the investor buying of single-family homes (including build-to-rent).

...

Now demographics are favorable for homebuying, and the concurrent pickup in demand for rental units is a bit of a mystery (see The Household Mystery). It appears we are seeing significant household formation with little population growth. And that would suggest the increase in household formation is not sustainable.

Meanwhile large investors are able to obtain financing at very low rates. ... That is a 105% LTV (loan-to-value) based on BPOs (Broker Price Opinions - not appraisals). With this kind of financing, investors are incentivized to buy at almost any price. The buyers of the security are counting on the cash flow from renting those 3,836 homes. But what if demand for rentals soften?

emphasis added

Question #1 for 2022: How much will the economy grow in 2022?

by Calculated Risk on 1/04/2022 12:58:00 PM

Earlier I posted some questions on my blog: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I posted those in the newsletter (others like GDP and employment will be on my blog).

I'm adding some thoughts, and maybe some predictions for each question.

1) Economic growth: Economic growth was probably around 5.5% in 2021 as the economy rebounded from 2020. There will be a drag from fiscal policy in 2022, and monetary policy will be less accommodative. The FOMC is expecting growth of 3.6% to 4.5% Q4-over-Q4 in 2022. How much will the economy grow in 2022?

Here is a table of the annual change in real GDP since 2005. Prior to the pandemic, economic activity was mostly in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%., although demographics are improving somewhat (more prime age workers).

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2021, I used a 7.0% annual growth rate in Q4 2021 (this gives -2.2% Q4 over Q4 or -3.4% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.0% |

| 2006 | 2.8% | 2.6% |

| 2007 | 2.0% | 2.2% |

| 2008 | 0.1% | -2.5% |

| 2009 | -2.6% | 0.1% |

| 2010 | 2.7% | 2.8% |

| 2011 | 1.5% | 1.5% |

| 2012 | 2.3% | 1.6% |

| 2013 | 1.8% | 2.5% |

| 2014 | 2.3% | 2.6% |

| 2015 | 2.7% | 1.9% |

| 2016 | 1.7% | 2.0% |

| 2017 | 2.3% | 2.7% |

| 2018 | 2.9% | 2.3% |

| 2019 | 2.3% | 2.6% |

| 2020 | -3.4% | -2.3% |

| 20211 | 5.7% | 5.6% |

| 1 2021 estimate based on 7.0% Q4 SAAR annualized real growth rate | ||

The FOMC is projecting real GDP growth of 3.6% to 4.5% in 2022 (Q4 over Q4). Goldman Sachs is forecasting 3.5% growth in 2022.

My sense is growth will slow in 2022 noticeably. Some sectors, like vehicle sales, will pick up since vehicle sales were supply constrained in 2021. Other sectors will continue to recover (like travel related) and service sectors. However, some goods sectors will likely decline, and real estate will likely be mostly flat in 2022. Also, fiscal and monetary supply will give less of a boost in 2022.

Some thoughts:

• Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

• Question #3 for 2022: What will the unemployment rate be in December 2022?

• Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

• Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

• Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

• Question #7 for 2022: How about housing starts and new home sales in 2022?

• Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

• Question #9 for 2022: What will happen with house prices in 2022?

• Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

ISM® Manufacturing index Decreased to 58.7% in December

by Calculated Risk on 1/04/2022 11:13:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in December. The PMI® was at 58.7% in December, down from 61.1% in November. The employment index was at 54.2%, up from 53.3% last month, and the new orders index was at 60.4%, down from 61.5%.

From ISM: Manufacturing PMI® at 58.7%

December 2021 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in December, with the overall economy achieving a 19th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at a slightly slower pace in December than in November.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The December Manufacturing PMI® registered 58.7 percent, a decrease of 2.4 percentage points from the November reading of 61.1 percent. This figure indicates expansion in the overall economy for the 19th month in a row after a contraction in April 2020. The New Orders Index registered 60.4 percent, down 1.1 percentage points compared to the November reading of 61.5 percent. The Production Index registered 59.2 percent, a decrease of 2.3 percentage points compared to the November reading of 61.5 percent. The Prices Index registered 68.2 percent, down 14.2 percentage points compared to the November figure of 82.4 percent. The Backlog of Orders Index registered 62.8 percent, 0.9 percentage point higher than the November reading of 61.9 percent. The Employment Index registered 54.2 percent, 0.9 percentage point higher compared to the November reading of 53.3 percent. The Supplier Deliveries Index registered 64.9 percent, down 7.3 percentage points from the November figure of 72.2 percent. The Inventories Index registered 54.7 percent, 2.1 percentage points lower than the November reading of 56.8 percent. The New Export Orders Index registered 53.6 percent, a decrease of 0.4 percentage point compared to the November reading of 54 percent. The Imports Index registered 53.8 percent, a 1.2-percentage point increase from the November reading of 52.6 percent.”

emphasis added

BLS: Job Openings Decreased to 10.6 million in November

by Calculated Risk on 1/04/2022 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 10.6 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 6.7 million and total separations increased to 6.3 million. Within separations, the quits rate increased to 3.0 percent, matching a series high last seen in September. The layoffs and discharges rate was unchanged at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the employment report on Friday will be for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings decreased in November to 10.6 million from 11.1 million in October.

The number of job openings (yellow) were up 56% year-over-year.

Quits were up 37% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

CoreLogic: House Prices up 18.1% YoY in November

by Calculated Risk on 1/04/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Annual Home Price Appreciation Continues to Accelerate; Up 18.1% in November

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2021.

While 2021 was a record-breaking year for U.S. home price growth, for many prospective buyers the hot housing market will continue to exacerbate ongoing affordability challenges into the new year — and beyond. Though home price growth remains at historic highs, it is projected to slow over the next year. However, economic growth and inflation will most likely lead to increases in mortgage rates, which will further erode affordability.

"Over the past year, we have seen one of the most robust seller's markets in a generation,” said Frank Martell, president and CEO of CoreLogic. “While increased interest rates may help cool down homebuying activity, we expect 2022 to be another strong year with continuing upward price growth."

...

Nationally, home prices increased 18.1% in November 2021, compared to November 2020. On a month-over-month basis, home prices increased by 1.3% compared to October 2021.

...

Home price gains are projected to slow to a 2.8% increase by November 2022.

emphasis added

Tuesday: Corelogic House Prices, Job Openings, ISM Mfg, Vehicle Sales

by Calculated Risk on 1/04/2022 12:03:00 AM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Now Highest in 9 Months

The year is not off to a great start for mortgage rates. At the end of last week, we were already looking at the highest levels in months. The silver lining was that the past few months had seen a very narrow range with rates finally just barely breaking the previous highs. In other words, "highest in months" was a bit of a technicality. ... It's still the case that the "highest rates in 9 months" aren't insanely higher than anything we saw last week. From the lowest rates over the past 2 months, today's are roughly a quarter of a point higher. [30 year fixed 3.29%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS.

• Also, at 10:00 AM, ISM Manufacturing Index for December. The consensus is for the ISM to be at 60.2, down from 61.1 in November.

• All day, Light vehicle sales for December. Sales were at 12.86 million in November (Seasonally Adjusted Annual Rate). Wards Auto is projecting sales of 12.7 million SAAR in December.

Monday, January 03, 2022

Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

by Calculated Risk on 1/03/2022 05:03:00 PM

Earlier I posted some questions on my blog: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I posted those in the newsletter (others like GDP and employment will be on my blog).

I'm adding some thoughts, and maybe some predictions for each question.

2) Employment: Through November 2021, the economy added 6.1 million jobs in 2021. This makes 2021 the best year for job growth ever - by far. However, there are still 3.9 million fewer jobs than in February 2020 (pre-pandemic). Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

| Jobs Added per Month in 2021 | ||

|---|---|---|

| Total nonfarm (000s) | ||

| Jan-21 | 233 | |

| Feb-21 | 536 | |

| Mar-21 | 785 | |

| Apr-21 | 269 | |

| May-21 | 614 | |

| Jun-21 | 962 | |

| Jul-21 | 1,091 | |

| Aug-21 | 483 | |

| Sep-21 | 379 | |

| Oct-21 | 546 | |

| Nov-21 | 210 | |

| Dec-21 | --- | |

The consensus forecast is for 400 thousand jobs added in December.

Unfortunately, it appears this will be another difficult winter with the pandemic, and it seems likely job growth will slow over the next couple of months. Also, given slow population growth it seems likely labor force growth will be sluggish in 2022.

My guess is something like 2.5 to 3.0 million jobs could be added in 2022, but it will depend on the pandemic (and policy). This fits with my view of sluggish labor force growth, an increase in the participation rate, and a decline in the unemployment rate. That would mean there are still fewer jobs at the end of 2022, than before the pandemic.

Some thoughts:

• Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

• Question #3 for 2022: What will the unemployment rate be in December 2022?

• Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

• Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

• Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

• Question #7 for 2022: How about housing starts and new home sales in 2022?

• Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

• Question #9 for 2022: What will happen with house prices in 2022?

• Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

Question #3 for 2022: What will the unemployment rate be in December 2022?

by Calculated Risk on 1/03/2022 03:02:00 PM

Earlier I posted some questions on my blog: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I posted those in the newsletter (others like GDP and employment will be on my blog).

I'm adding some thoughts, and maybe some predictions for each question.

3) Unemployment Rate: The unemployment rate was at 4.2% in November, down 2.5 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.4% to 3.7% range in Q4 2022. What will the unemployment rate be in December 2022?

Here is a graph of the unemployment rate over time:

The unemployment rate decreased in November to 4.2% from 4.6% in October, and down from 6.7% in November 2020.

The unemployment rate is from the household survey (CPS), and the rapid decline in the unemployment rate is due to a combination of job growth and sluggish increase in the participation rate (previous question).

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 20 months after the onset, is now significantly better than the worst of the "Great Recession".

It took several years to recover all the jobs lost following the 2001 and 2007 recessions, and so far, jobs are recovering quicker this time.

The third graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.

The third graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.This data is only available back to 1994, so there is only data for three recessions.

In November, the number of permanent job losers decreased to 1.921 million from 2.126 million in October.

"With labor demand red hot and enhanced unemployment benefits now expired, we expect the unemployment rate to return to the pre-pandemic 50-year low of 3.5% by the end of 2022."

Some thoughts:

• Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

• Question #3 for 2022: What will the unemployment rate be in December 2022?

• Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

• Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

• Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

• Question #7 for 2022: How about housing starts and new home sales in 2022?

• Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

• Question #9 for 2022: What will happen with house prices in 2022?

• Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

by Calculated Risk on 1/03/2022 12:52:00 PM

Earlier I posted some questions on my blog: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I posted those in the newsletter (others like GDP and employment will be on my blog).

I'm adding some thoughts, and maybe some predictions for each question.

4) Participation Rate: In November 2021, the overall participation rate was at 61.8%, up year-over-year from 61.5% in November 2020. Long term, the BLS is projecting the overall participation rate will decline to 60.4% by 2030 due to demographics. Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)? What will be the participation rate in December 2022?

The overall labor force participation rate is the percentage of the working age population (16 + years old) in the labor force. A large portion of the decline in the participation rate since 2000 was due to demographics and long-term trends.

In November 2021, Goldman Sachs economists put out a research note on the labor force participation rate: Why Isn’t Labor Force Participation Recovering?

"While the unemployment rate continues to fall quickly, labor force participation has made no progress since August 2020. ... Most of the 5.0mn persons who have exited the labor force since the start of the pandemic are over age 55 (3.4mn), largely reflecting early (1.5mn) and natural (1mn) retirements that likely won’t reverse. The outlook for prime-age persons who have exited the labor force (1.7mn) is more positive, since very few are discouraged and most still view their exits as temporary."

This data is comparing November 2021 to November 2019, using Not Seasonally Adjusted (NSA) data (I compared to November 2019 to minimize the seasonal impact when using NSA data).

This data is comparing November 2021 to November 2019, using Not Seasonally Adjusted (NSA) data (I compared to November 2019 to minimize the seasonal impact when using NSA data).Almost all of the missing employed workers - by this method - are in the 25 to 29 and in the 45 to 59 age groups.

Note: this is over a 2-year period, and there have been some demographic shifts between cohorts.

This data would suggest most of the missing workers are prime age or took early retirement (the missing workers in their '50s).

My guess, based on the impact of the pandemic easing, is that most of these people will return to the labor force. I don't expect that participation rate to increase to pre-pandemic levels (63.4%), but it seems reasonable the participation rate will increase to the mid 62s by year end, before trending down again later in the decade.

Some thoughts:

• Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

• Question #3 for 2022: What will the unemployment rate be in December 2022?

• Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

• Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

• Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

• Question #7 for 2022: How about housing starts and new home sales in 2022?

• Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

• Question #9 for 2022: What will happen with house prices in 2022?

• Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?