by Calculated Risk on 1/02/2022 03:24:00 PM

Sunday, January 02, 2022

Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

Earlier I posted some questions on my blog: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I posted those in the newsletter (others like GDP and employment will be on my blog).

I'm adding some thoughts, and maybe some predictions for each question.

5) Inflation: Core PCE was up 4.7% YoY through November. This was the highest YoY increase in core PCE since 1989. The FOMC is forecasting the YoY change in core PCE will be in the 2.5% to 3.0% range in Q4 2022. Will the core inflation rate increase or decrease by December 2022?

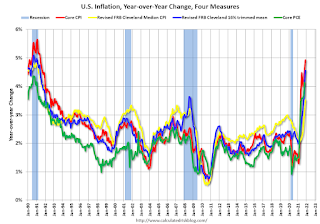

Although there are different measure for inflation, they all show inflation well above the Fed's 2% inflation target.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. The recent spike in inflation is obvious - and will likely get worse over the next few months. Goldman Sachs economists recently wrote:

"The current inflation surge is likely to get worse before it gets better"

by the end of [2022] we expect core PCE inflation to fall to 2.5%. Admittedly, the key driver of our forecast—the partial resolution of supply-demand imbalances in the durable goods sector—is hard to time. But we do not see underlying wage growth or inflation expectations as inconsistent with the Fed’s 2% inflation goal, and therefore expect inflation to begin to come down meaningfully.

Some thoughts:

• Question #2 for 2022: Will the remaining jobs lost in 2020 return in 2022, or will job growth be sluggish?

• Question #3 for 2022: What will the unemployment rate be in December 2022?

• Question #4 for 2022: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020)?

• Question #5 for 2022: Will the core inflation rate increase or decrease by December 2022?

• Question #6 for 2022: Will the Fed raise rates in 2022? If so, how many times?

• Question #7 for 2022: How about housing starts and new home sales in 2022?

• Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

• Question #9 for 2022: What will happen with house prices in 2022?

• Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |